Queens New York Assignment to Living Trust

Description

How to fill out New York Assignment To Living Trust?

If you have previously utilized our service, sign in to your account and download the Queens New York Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward instructions to obtain your document.

You have continuous access to all documents you have acquired: you can find them in your profile within the My documents section whenever you need to use them again. Utilize the US Legal Forms service to easily search for and save any template for your personal or professional requirements!

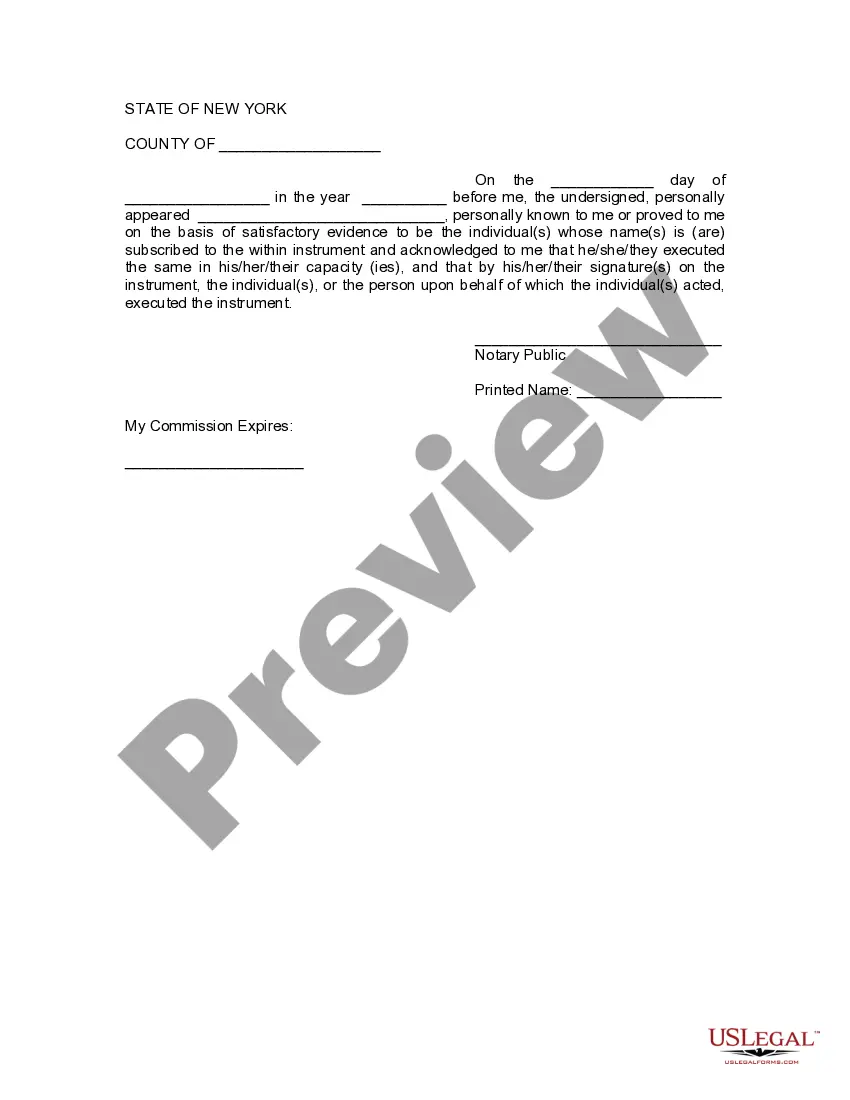

- Ensure you have identified an appropriate document. Browse through the description and use the Preview feature, if available, to determine if it satisfies your needs. If it does not fit your requirements, use the Search option above to locate the suitable one.

- Purchase the template. Hit the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process your payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Queens New York Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

One downside of a living trust is that it may not provide protection against creditors. Unlike a will, a living trust does not go through probate, which can minimize delays and costs. However, it is still important to note that a Queens New York Assignment to Living Trust may not cover certain legal matters, such as Medicaid eligibility. Therefore, consulting with a professional can help clarify how a living trust fits your unique needs.

To transfer your property into a trust in New York, you must create a trust document that outlines your wishes. Next, you will execute a property deed transferring ownership from you to the trust. It’s essential to record this deed with the county clerk’s office where the property is located. This process ensures a smooth Queens New York Assignment to Living Trust, helping you manage your assets efficiently.

One significant mistake some parents encounter is failing to update the trust as circumstances change. Life events like births, deaths, and financial shifts can alter the effectiveness of a trust fund. It’s critical that parents keep their Queens New York Assignment to Living Trust aligned with their current family situation and intentions. Regular reviews can help avoid complications down the road.

This decision deserves careful thought. A trust can protect assets from probate and provide tax benefits, but it also requires thoughtful planning and maintenance. If your parents are considering a Queens New York Assignment to Living Trust, consulting with a legal professional is wise to ensure that it aligns with their needs.

Putting assets in a trust can present several downsides. For one, the assets become less accessible in emergencies, as they must be managed according to trust guidelines. You might also face limitations on how income from the trust is used. If you're thinking about a Queens New York Assignment to Living Trust, understanding these downsides is essential.

Trust funds can come with challenges that you should not ignore. For example, they often require ongoing management and can incur additional taxes. Moreover, trust funds may create a sense of entitlement among beneficiaries, which can lead to strained family dynamics. When evaluating a Queens New York Assignment to Living Trust, it's wise to consider these potential pitfalls.

A family trust can have drawbacks that you should consider. For instance, creating and maintaining a trust requires time, effort, and costs like legal fees. Additionally, a trust may limit the immediate access that family members have to assets. When contemplating a Queens New York Assignment to Living Trust, it's crucial to weigh these factors.

To file a living trust in New York, start by drafting the trust document with clear terms outlining how your assets will be managed and distributed. Next, you will need to transfer your assets into the trust, which may include real estate, bank accounts, and investments. In Queens, New York, an Assignment to Living Trust can be filed to formally designate those assets to the trust. Consider using the US Legal Forms platform for templates and guidance, ensuring your living trust meets all legal requirements.