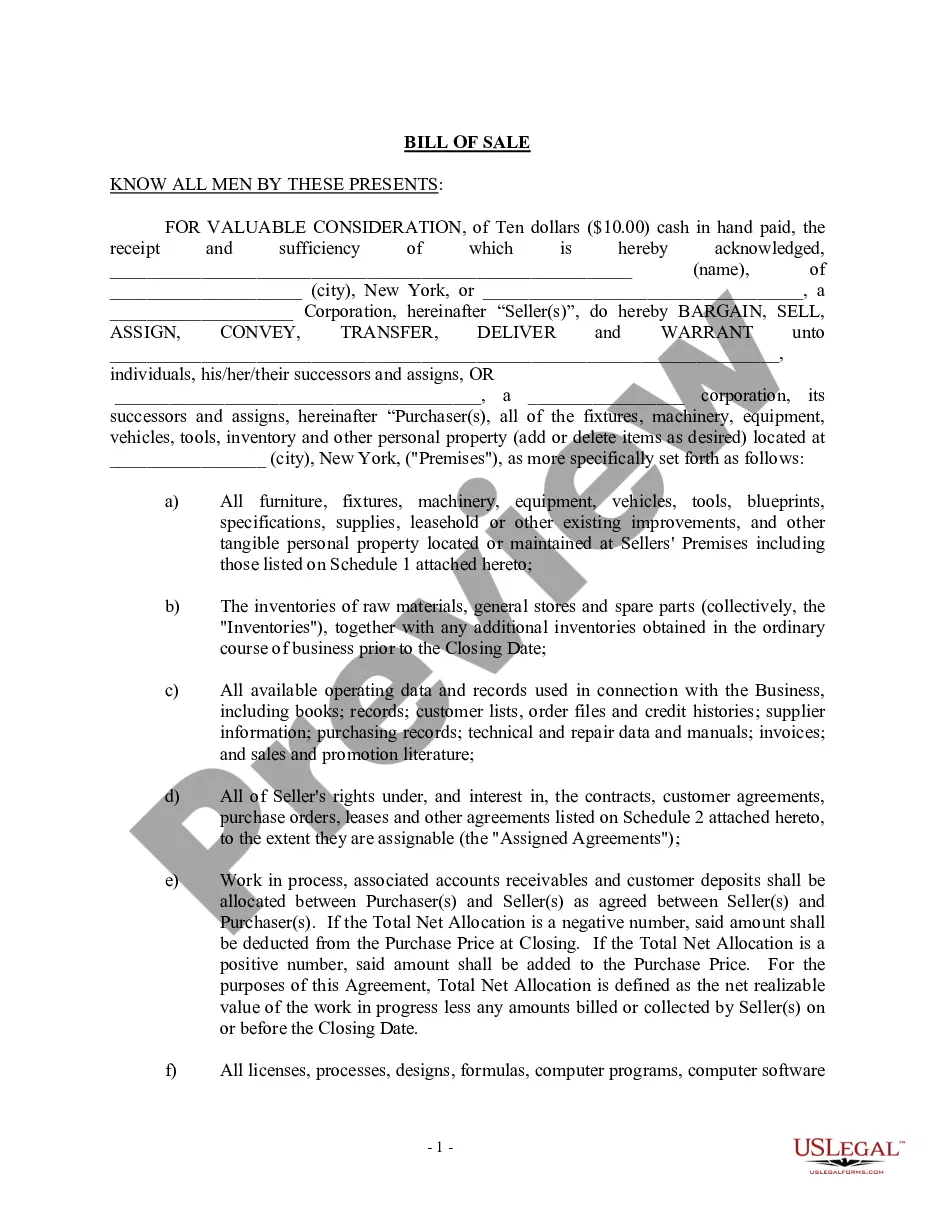

Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

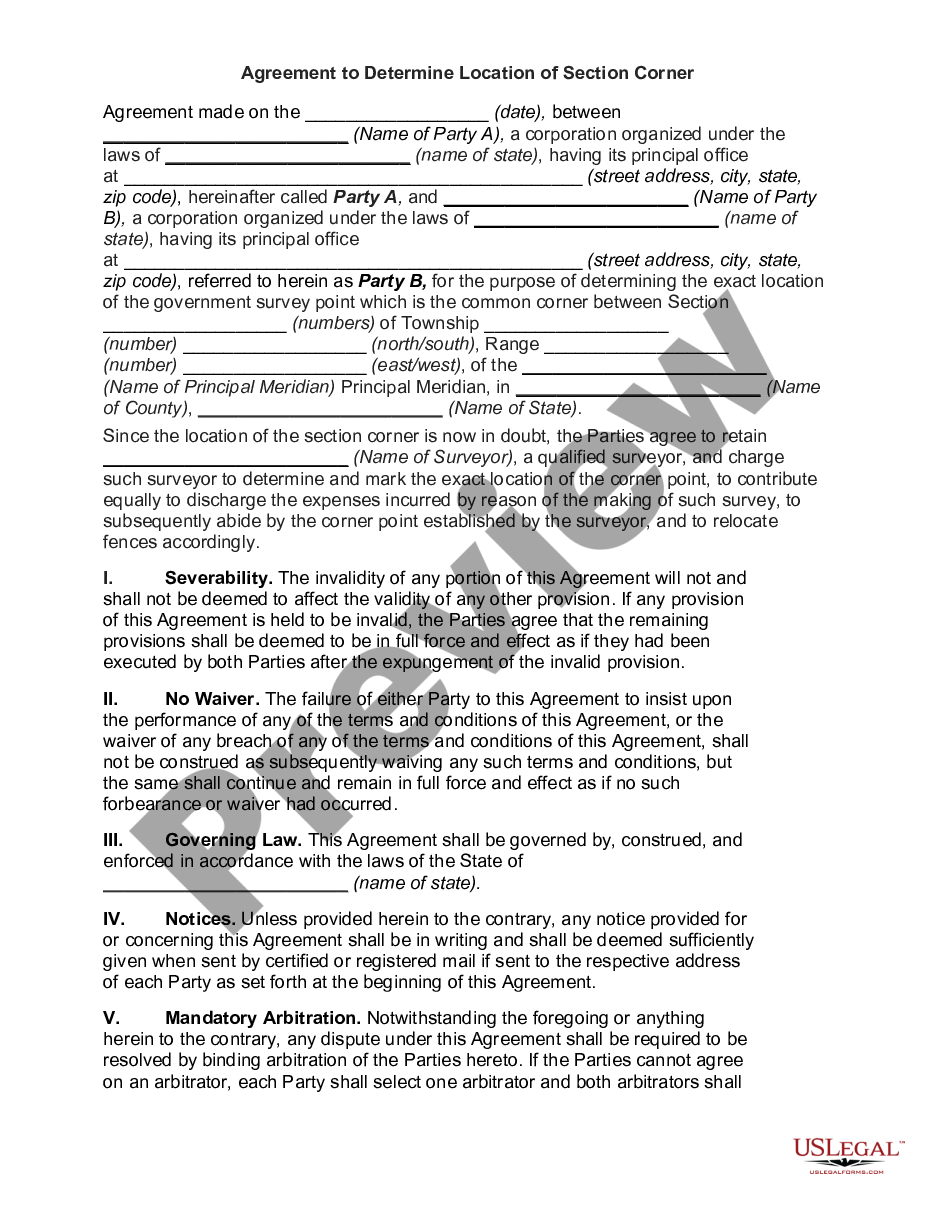

How to fill out New York Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Irrespective of social or occupational rank, finalizing legal documents is a regrettable requirement in today's society.

Frequently, it’s nearly unfeasible for someone lacking a legal background to produce this type of documentation from the ground up, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms becomes advantageous.

Verify that the form you have selected is tailored to your area, as the laws of one state or county do not apply to another state or county.

Examine the form and review a brief summary (if available) of the contexts in which the document can be utilized.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific forms applicable to virtually any legal situation.

- US Legal Forms also acts as an excellent tool for associates or legal advisors who wish to enhance their efficiency with our DIY papers.

- Regardless of whether you need the Yonkers New York Bill of Sale related to the Sale of Business by Individual or Corporate Seller or any other documents that are suitable in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to swiftly acquire the Yonkers New York Bill of Sale associated with the Sale of Business by Individual or Corporate Seller using our reliable service.

- If you are already a member, you can proceed to Log In to your account to download the required form.

- However, if you are unfamiliar with our platform, be sure to follow these guidelines before securing the Yonkers New York Bill of Sale linked to the Sale of Business by Individual or Corporate Seller.

Form popularity

FAQ

Filling out a New York State resale certificate involves including your business name and address, the seller’s details, and stating the reason for purchasing without tax. You also need to provide your tax ID number, ensuring accuracy throughout. Utilizing this certificate effectively supports your financial activities, particularly in the context of a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Yes, you need a seller permit to sell online in New York if you are selling goods and services that are taxable. This permit ensures that you comply with state sales tax regulations. When conducting a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, having your seller permit in hand is essential.

Several items are exempt from sales tax in New York, including most food products, prescription medications, and certain types of clothing. It's beneficial to know these exemptions, especially when drafting a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to avoid unnecessary tax payments.

Obtaining a certificate of authority in New York typically takes about 2-4 weeks, depending on the processing times. This certificate allows you to collect sales tax legally and engage in business activities. To streamline this process, especially for those involved in transactions requiring a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it's beneficial to use services like uslegalforms that guide you through the required steps.

The Yonkers nonresident tax is generally 1.5% of your taxable income sourced from Yonkers. This tax requires careful consideration, especially for businesses operating in the city. By documenting your transactions accurately with a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, you can streamline the tax process and avoid unnecessary complications.

Yes, if you are selling taxable goods or services in New York, you need a seller's permit. This permit is required even for online sales, regardless of your location. Including the relevant details in your Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller ensures that your sales comply with local regulations and enhances your business's credibility.

The sales tax rate in Yonkers, New York, is 8.875%. This rate applies to many types of sales, including goods and certain services. When conducting a transaction that involves a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it is vital to calculate and include this sales tax to ensure compliance with state regulations.

Selling in New York typically requires a business license, depending on the nature of your sales. This license helps ensure that your business operates within the legal framework. If your transaction involves the transfer of ownership through a sale, consider using the Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to formalize the agreement.

Yes, in most cases, you need a vendor license to sell goods in New York City legally. This license ensures that you comply with local laws and regulations governing sales. Whether you're selling goods independently or through a corporate entity, having a Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can provide assurance and legal clarity in your transactions.

Becoming a vendor in New York City requires submitting your application to the Department of Consumer and Worker Protection. You'll need to meet specific criteria, such as having the right permits and licenses. If your business involves a sale, consider utilizing the Yonkers New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to help establish a legal record of your transactions.