Queens New York Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

Are you seeking a reliable and cost-effective provider of legal forms to purchase the Queens New York Renunciation And Disclaimer of Property received through Intestate Succession? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish rules for living together with your partner or a set of documents to facilitate your divorce in court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business needs. All templates we provide access to are not generic and tailored based on the requirements of individual states and counties.

To download the document, you must Log In to your account, locate the needed template, and click the Download button next to it. Please note that you can download your previously acquired document templates anytime in the My documents section.

Are you a newcomer to our website? No problem. You can set up an account in a few minutes, but before doing that, ensure to follow these steps.

Now you can register your account. Then select the subscription option and proceed with the payment. Once the payment is complete, download the Queens New York Renunciation And Disclaimer of Property received through Intestate Succession in any available file format. You can revisit the website at any time and redownload the document without any additional fees.

Finding current legal documents has never been more straightforward. Try US Legal Forms today, and eliminate the need to spend hours understanding legal paperwork online for good.

- Verify if the Queens New York Renunciation And Disclaimer of Property received via Intestate Succession adheres to your state and local regulations.

- Review the form’s details (if available) to determine who and what the document is suitable for.

- Restart the search if the template is not appropriate for your particular situation.

Form popularity

FAQ

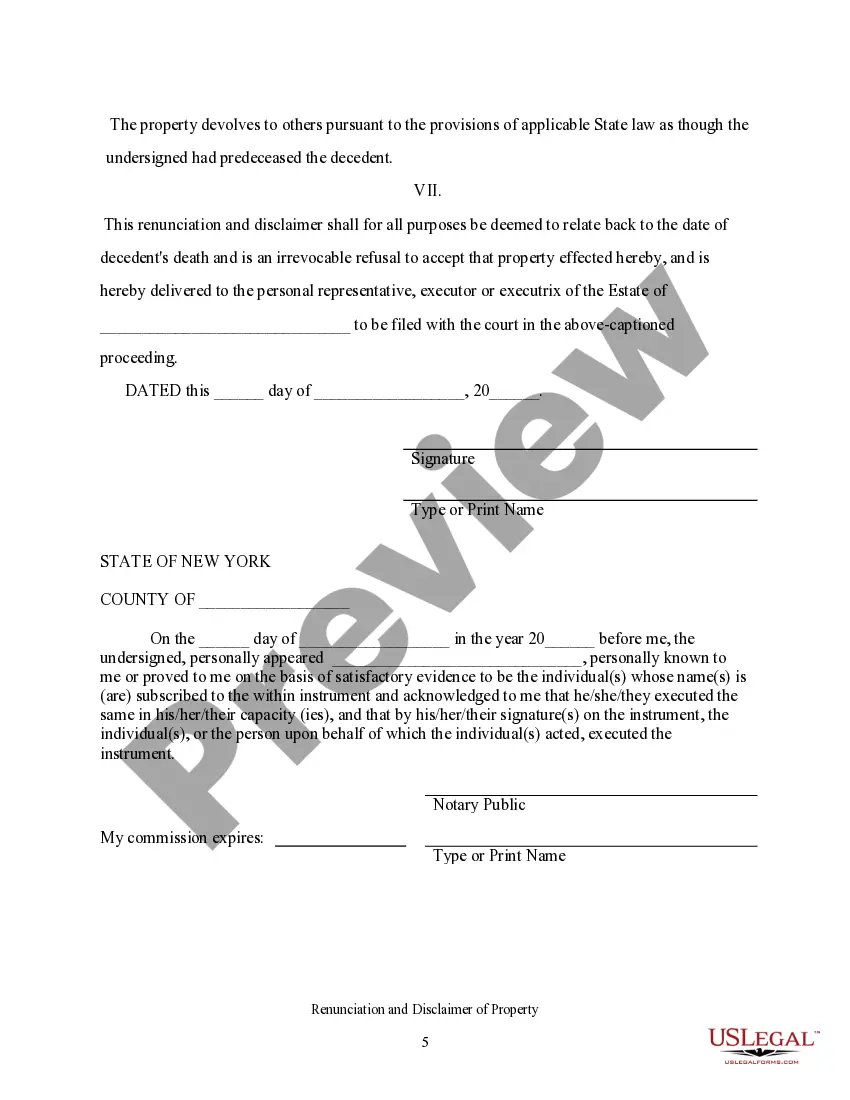

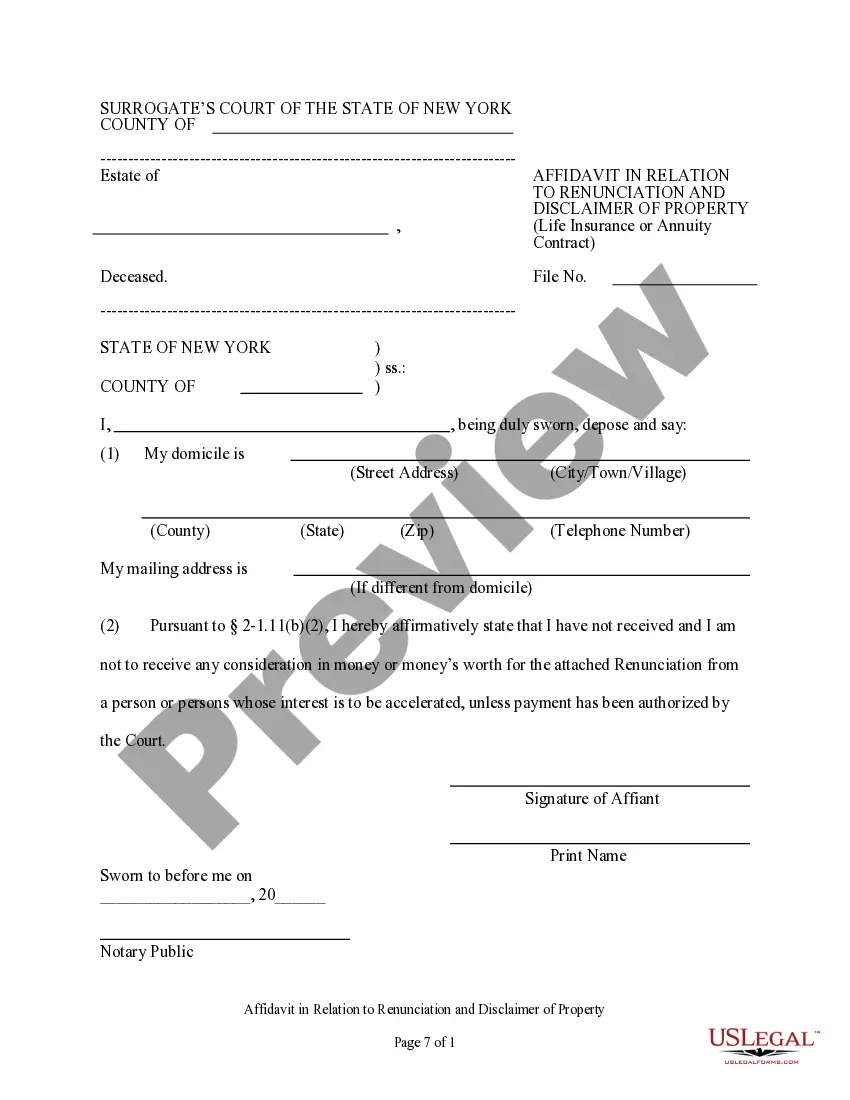

An affidavit of renunciation of inheritance is a formal declaration made by an heir who chooses to give up their rights to inherited property. This document states your intention to renounce the inheritance and follows the rules of the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. It is important to have this affidavit prepared according to state laws and properly filed.

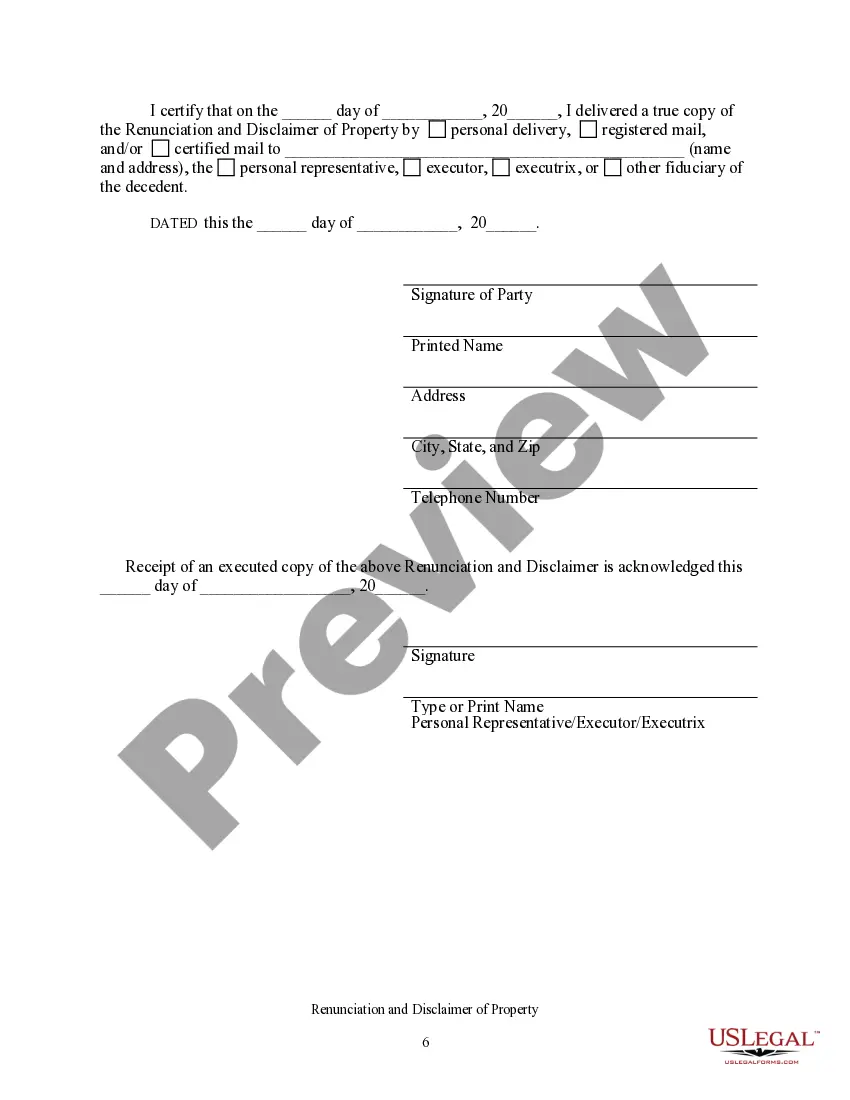

To disclaim an inherited property, you should draft a written disclaimer that specifies your refusal of that property. Make sure to reference the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. After signing the disclaimer, file it with the appropriate probate court to finalize your decision legally.

In New York State, there are generally no inheritance taxes, however, estate taxes may apply if the estate exceeds a certain threshold. Currently, this threshold is set at $6.11 million. Understanding the nuances of the law around estate taxes can help you make informed decisions regarding the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession.

Disclaiming an inheritance in New York involves preparing a formal disclaimer that states your decision not to accept the inheritance. You will need to file this document with the probate court handling the estate, under the guidelines of the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. Adhering to legal procedures helps protect your interests.

To disclaim an inheritance in New York, you need to submit a written disclaimer stating your intent to renounce the property. This disclaimer should be filed with the appropriate court, referencing the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. It is advisable to consult legal assistance to ensure compliance with state regulations and proper documentation.

The process to disclaim an inheritance begins with preparing a written disclaimer that conforms to New York's laws regarding the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. You must file the disclaimer with the probate court that has jurisdiction over the estate. Remember, this action must be taken typically within nine months after the decedent's death to follow legal timelines.

To write a disclaimer of inheritance sample, you should start with your identification, including your name and relationship to the deceased. Next, clearly state that you are disclaiming any rights to the property under the Queens New York Renunciation And Disclaimer of Property received by Intestate Succession. It is also important to include the specific property you wish to disclaim, and ensure you sign the document to validate your intention.

The renunciation of the right of succession is a legal action where an individual formally refuses an inheritance designated to them under intestate laws. This process allows individuals to avoid accepting debts attached to the inheritance and can help in redistributing assets among other heirs. In Queens, New York, understanding this process is crucial, and platforms like US Legal Forms can provide valuable support to navigate it effectively.

Renouncing an inheritance requires you to prepare a legal document expressing your intent not to accept the property. This document must be filed with the relevant authorities in Queens, New York. The process can be nuanced, especially concerning timing and language, so it is advisable to consult with legal resources like US Legal Forms for assistance in crafting a valid renunciation.

Disclaiming an inheritance in New York involves submitting a written disclaimer to the executor of the estate or the court handling the estate. You must ensure that this disclaimer is clear and within state guidelines, which include specific wording and deadlines. In Queens, New York, engaging with US Legal Forms can help simplify the process and ensure that your disclaimer is legally valid.