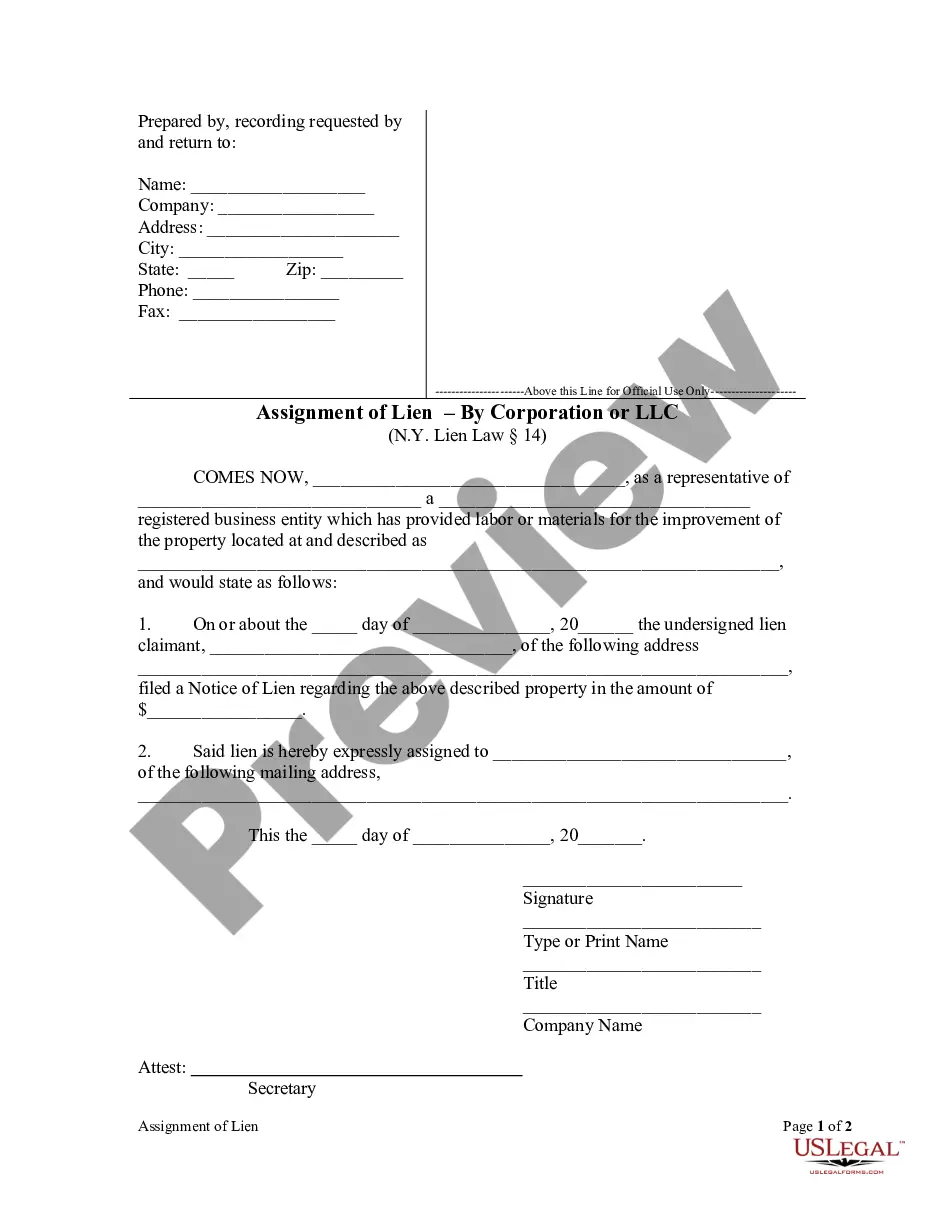

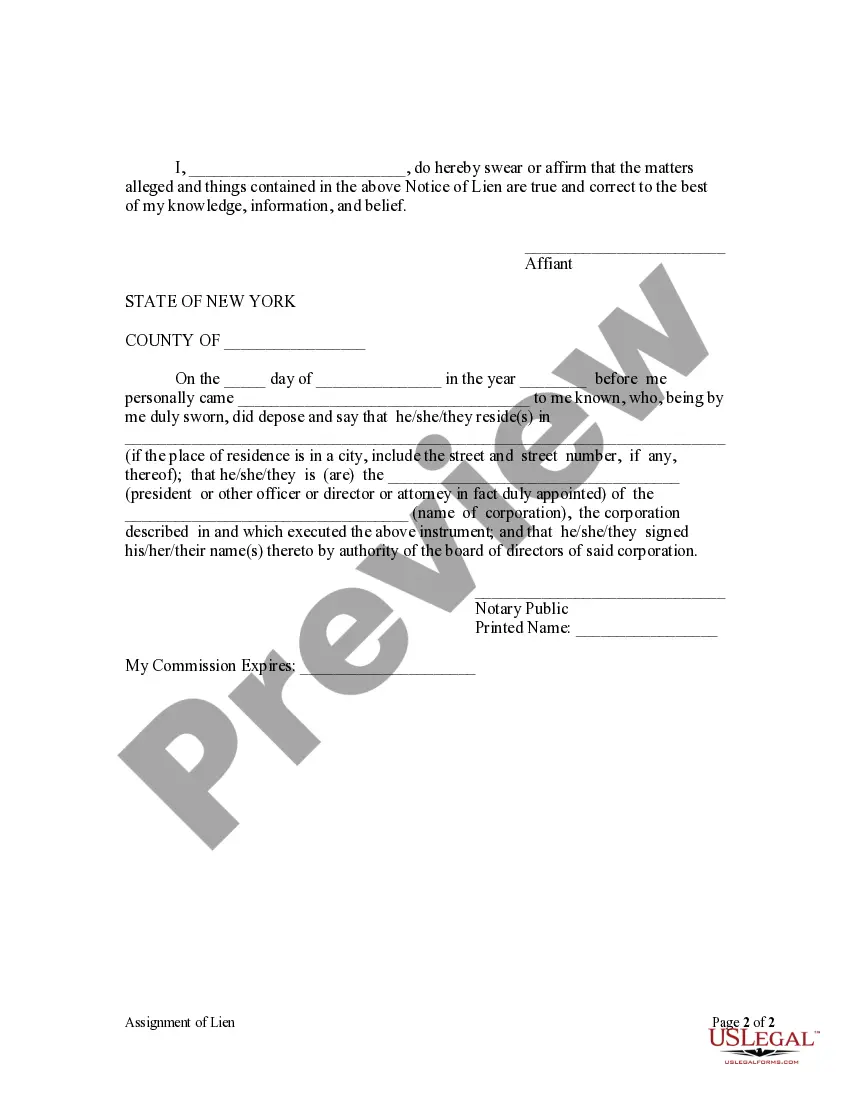

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

Rochester New York Assignment of Lien by Corporation

Description

How to fill out New York Assignment Of Lien By Corporation?

Are you searching for a dependable and cost-effective provider of legal forms to obtain the Rochester New York Assignment of Lien by Corporation or LLC.

US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your divorce proceedings through the court, we have you covered.

Our platform offers more than 85,000 current legal document templates for both personal and business use.

Verify if the Rochester New York Assignment of Lien by Corporation or LLC adheres to the laws of your state and local jurisdiction.

Review the form's description (if provided) to learn who and what the document is designed for.

- All templates we provide are not generic and are tailored based on the needs of individual states and regions.

- To download the document, you'll need to Log In to your account, locate the needed template, and click the Download button adjacent to it.

- Please note that you can download your previously acquired form templates anytime from the My documents section.

- Are you a newcomer to our platform? Don't worry.

- You can set up an account in minutes, but ensure you do the following first.

Form popularity

FAQ

To obtain a copy of your deed in Rochester, NY, visit the county clerk's office or access their online database. You will need to provide necessary information such as your property's address or the parcel number. Having this documentation is crucial for transactions and can help clarify any liens connected to your property, including a Rochester New York Assignment of Lien by Corporation. Consider using uslegalforms to streamline the request process.

To place a lien on a business in New York, you must file the appropriate paperwork with the county clerk's office. This usually includes a lien form and details about the owed amount. It is crucial to follow the legal steps correctly to ensure the lien is valid and enforceable, especially if you are focusing on a Rochester New York Assignment of Lien by Corporation. Legal resources like USLegalForms can guide you through this process.

A notice of intent to lien in New York is a document that alerts a property owner that a lien may be filed against their property due to unpaid debts. This notice provides the property owner an opportunity to resolve the debt before a lien is officially recorded. Understanding this process is vital when dealing with the Rochester New York Assignment of Lien by Corporation, as it establishes your intent and informs the affected parties.

To perform a lien search in New York, you can start by visiting the county clerk’s office where the property is located. There, you will find public records that list all recorded liens. Additionally, online databases and legal platforms like USLegalForms provide resources for searching liens efficiently. Utilizing these tools can help you understand the status of a property regarding the Rochester New York Assignment of Lien by Corporation.

Writing a letter of lien requires clear and concise language. Begin by including your company's name, address, and contact information. Then, state the specifics of the debt or obligation, ensuring you mention the 'Rochester New York Assignment of Lien by Corporation' to emphasize jurisdiction and context. Finally, sign the letter and consider sending it via certified mail to maintain a record of your communication.

In most cases, UCC liens expire after five years, although the lender can file to renew your lien. If you pay the lien off before the five years are up, you can ask the lender to terminate the lien.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

UCC Financing Statement Amendment (Form UCC3) Uniform Commercial Code Financing Statement Amendment is for used for the termination, continuation, and/or transfer changes to Financing Statement.