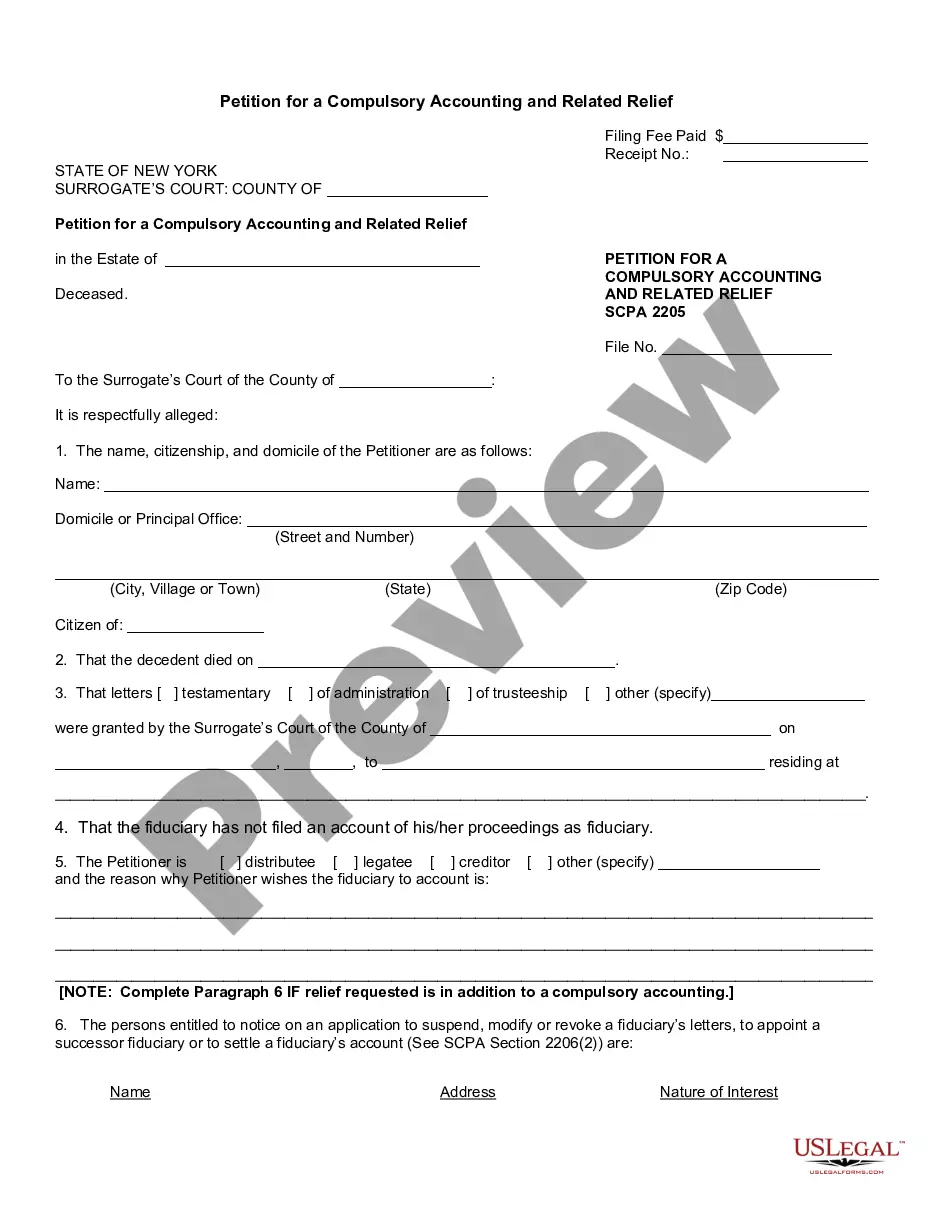

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

Queens New York Petition for a Compulsory Accounting and Related Relief

Description

How to fill out New York Petition For A Compulsory Accounting And Related Relief?

Take advantage of the US Legal Forms and gain instant access to any form template you need.

Our advantageous website with thousands of documents enables you to locate and acquire nearly any document sample you desire.

You can save, complete, and validate the Queens New York Petition for a Compulsory Accounting and Related Relief in just a few minutes, rather than spending hours online looking for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submissions. Our knowledgeable attorneys frequently examine all the documents to ensure that the forms are pertinent for a specific state and adhere to new laws and regulations.

If you haven't created an account yet, follow the steps below.

Access the page with the form you need. Ensure that it is the form you were looking for: check its title and description, and utilize the Preview feature if available. Otherwise, use the Search box to find the required one.

- How can you obtain the Queens New York Petition for a Compulsory Accounting and Related Relief.

- If you possess a subscription, simply Log In to your account. The Download button will be activated on all the samples you review.

- Additionally, you can find all the previously saved documents in the My documents section.

Form popularity

FAQ

Yes, executors are generally required to provide an accounting to beneficiaries detailing how estate assets have been managed. This responsibility ensures transparency and builds trust between the executor and beneficiaries. In cases where an executor withholds information, a Queens New York Petition for a Compulsory Accounting and Related Relief can be filed to enforce this obligation.

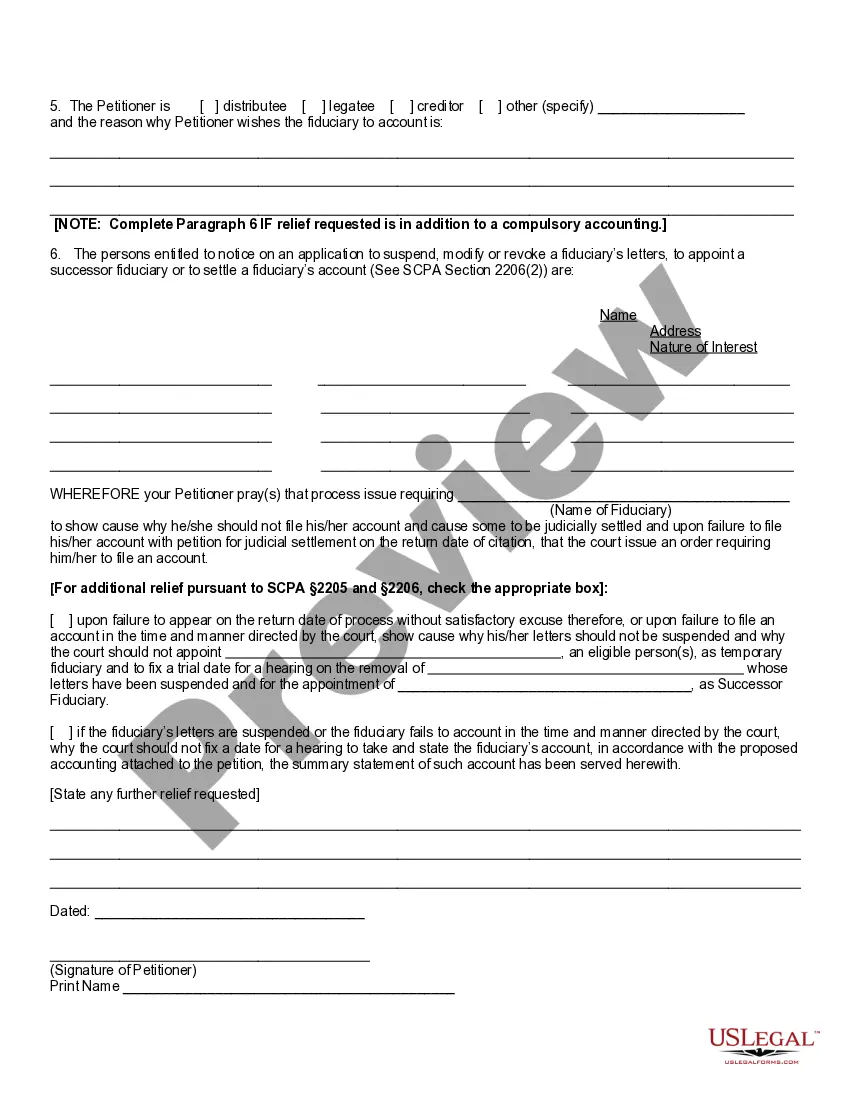

Judicial settlement of accounts refers to a process where a court reviews and approves the financial transactions of a trustee or executor. This settlement provides official validation for how funds were handled, ensuring all parties involved are held accountable. By utilizing a Queens New York Petition for a Compulsory Accounting and Related Relief, beneficiaries can seek this judicial oversight and protect their rights.

To compel an accounting means to legally force a trustee or executor to present a detailed report of financial transactions. This action is crucial when beneficiaries suspect mismanagement or if the fiduciary fails to communicate effectively. Using a Queens New York Petition for a Compulsory Accounting and Related Relief can initiate this process and promote transparency.

When a trustee refuses to provide an accounting, beneficiaries may consider filing a Queens New York Petition for a Compulsory Accounting and Related Relief. This legal action compels the trustee to present a full report of their financial activities. It helps protect the interests of the beneficiaries and ensures that the trustee fulfills their fiduciary duties.

A petition for accounting is a legal request made to a court to disclose the financial dealings of a trustee, executor, or any fiduciary. This process ensures that all transactions related to an estate or trust are transparent and justifiable. In situations involving a Queens New York Petition for a Compulsory Accounting and Related Relief, this petition allows beneficiaries to review how their assets are being managed.

To obtain a letter of administration without a will, you must file a petition in the Surrogate's Court in the county where the deceased person lived. In Queens, New York, this involves completing the necessary forms, including the Queens New York Petition for a Compulsory Accounting and Related Relief. Once your petition is filed, the court will assess your request and issue the letter if all legal requirements are satisfied. Utilizing a platform like USLegalForms can simplify this process, providing the necessary forms and guidance.

To request an accounting of an estate, you typically must file a petition with the probate court. This petition should specify the reasons for the request and possibly include additional documentation to support your claim. It is essential to detail your interest in the estate for the court to consider your request. If you're uncertain about the process, the Queens New York Petition for a Compulsory Accounting and Related Relief can assist you in navigating this step.

Anyone who has a legitimate interest in the deceased's estate, typically family members or close friends, can petition for Letters of Administration in New York. This includes individuals who stand to inherit assets upon the passing of the decedent. The petition must demonstrate their relationship to the deceased and the need for administration. Consider exploring the Queens New York Petition for a Compulsory Accounting and Related Relief for more information.

The timeframe for being appointed as an administrator of an estate in New York can vary based on several factors, including court processing times and potential disputes among heirs. Typically, the initial application can take several weeks to months to be reviewed and approved. It is important to ensure all documents are correctly submitted to avoid delays. For a smoother experience, utilize resources like the Queens New York Petition for a Compulsory Accounting and Related Relief.

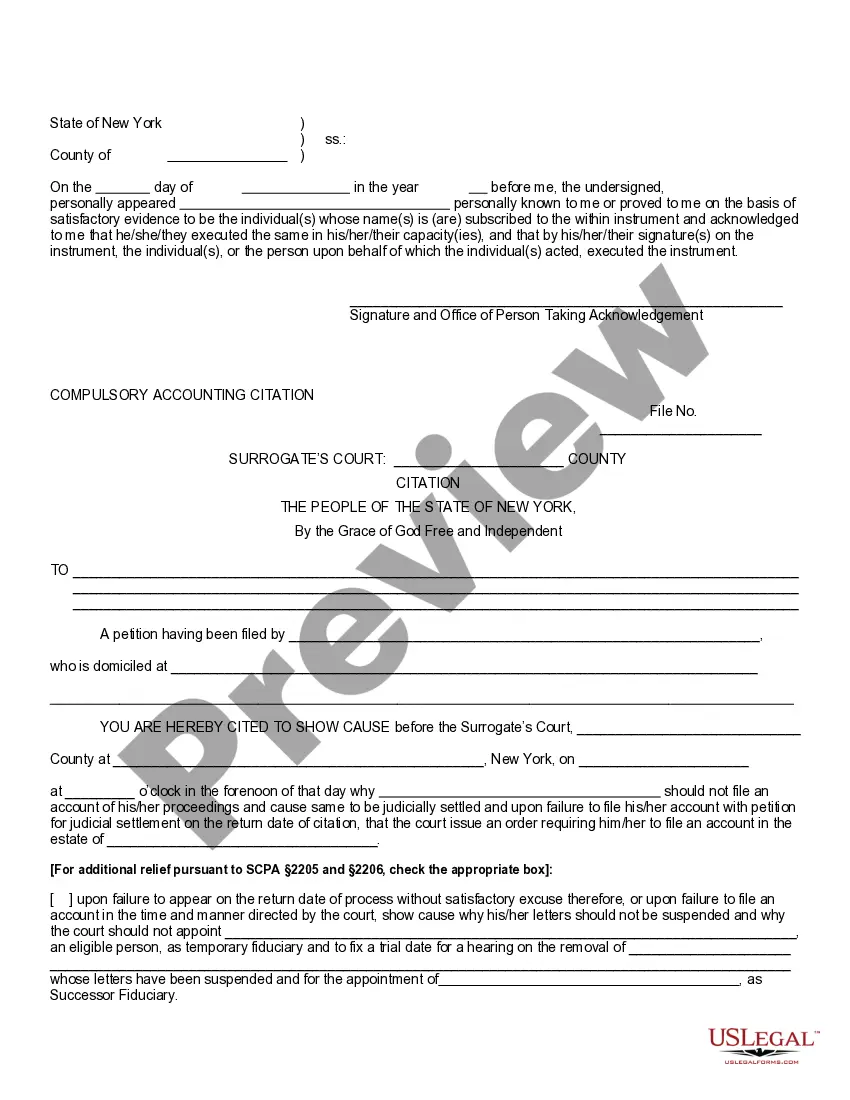

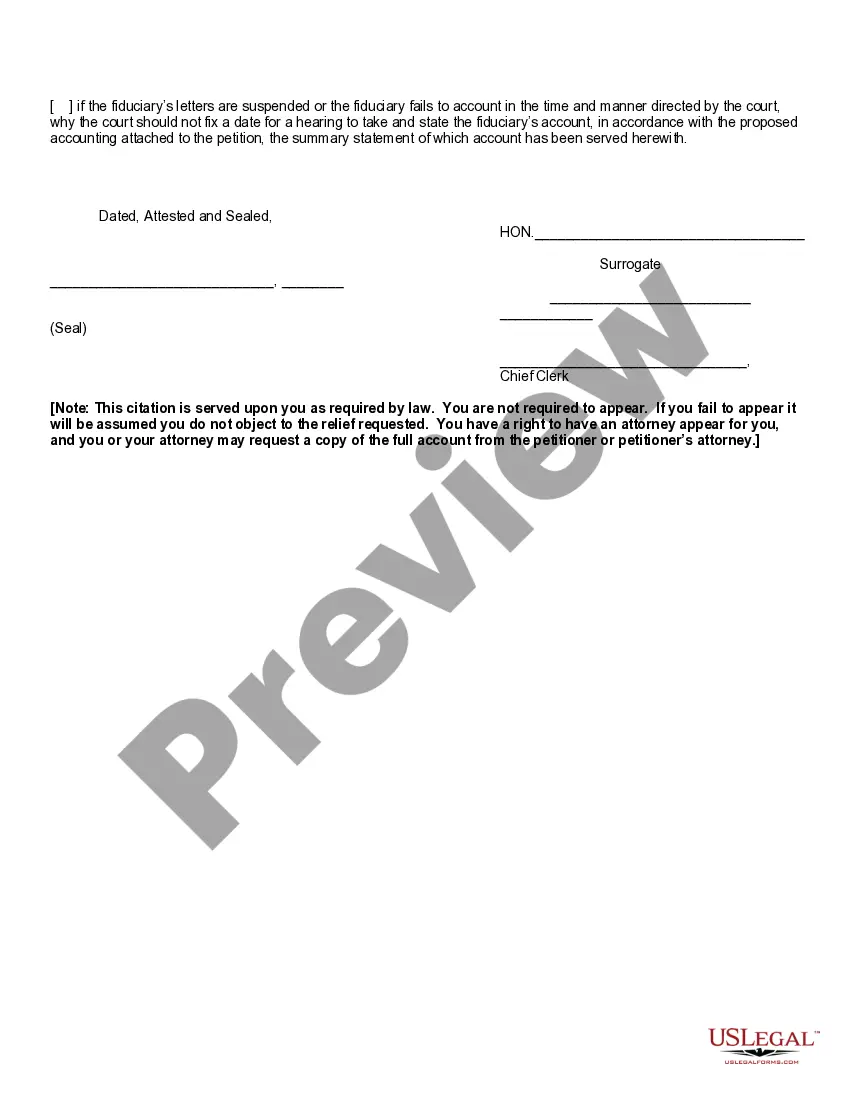

A compulsory accounting citation is a legal document that requires an executor or administrator to provide an accounting of the estate's financial activities to the court. This citation is often issued during disputes among heirs or when beneficiaries question the handling of funds. It acts as a tool for enforcing transparency and accountability. If you're facing issues regarding estate management, the Queens New York Petition for a Compulsory Accounting and Related Relief can guide you.