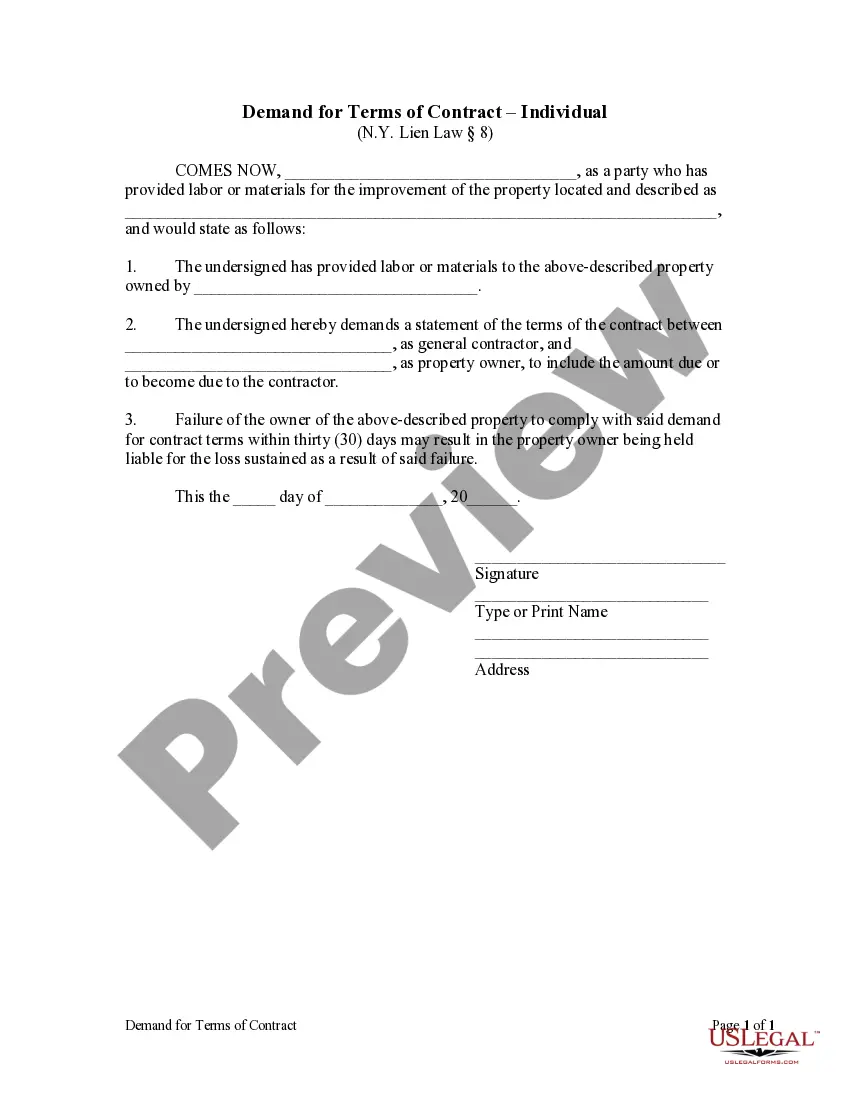

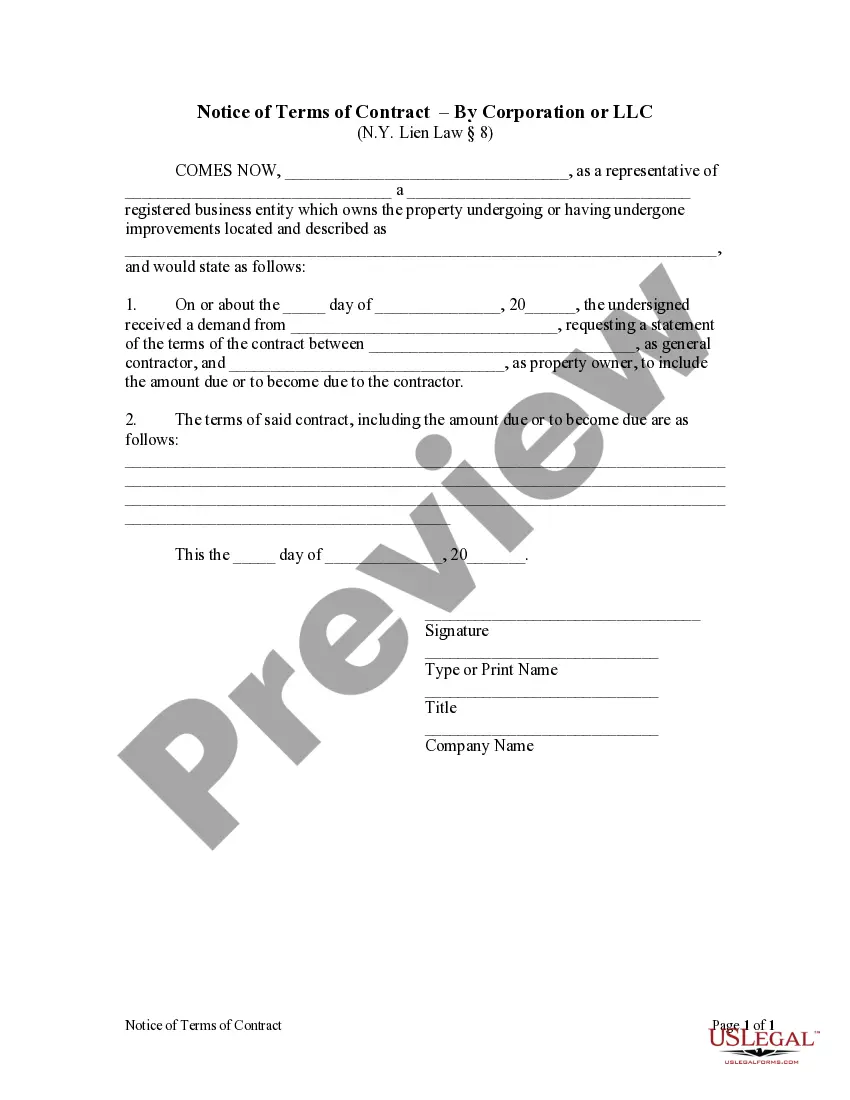

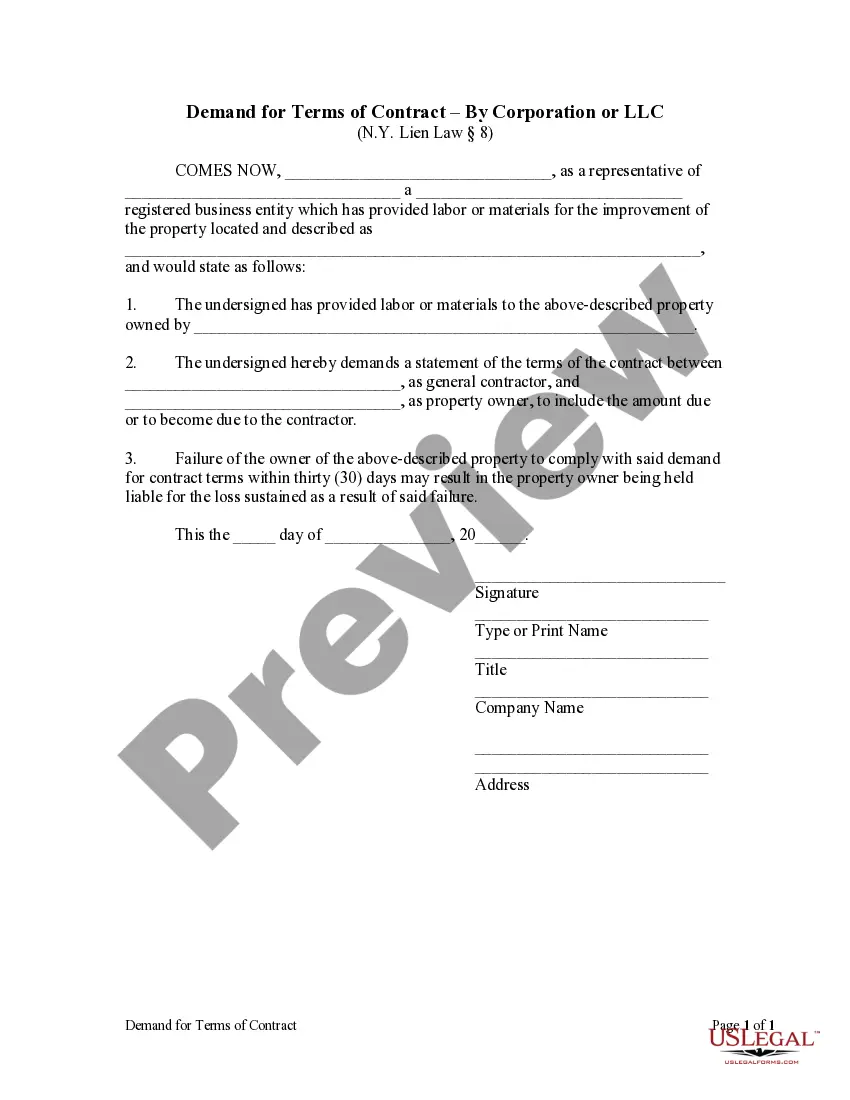

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result.

Yonkers New York Demand for Terms of Contract by Corporation

Description

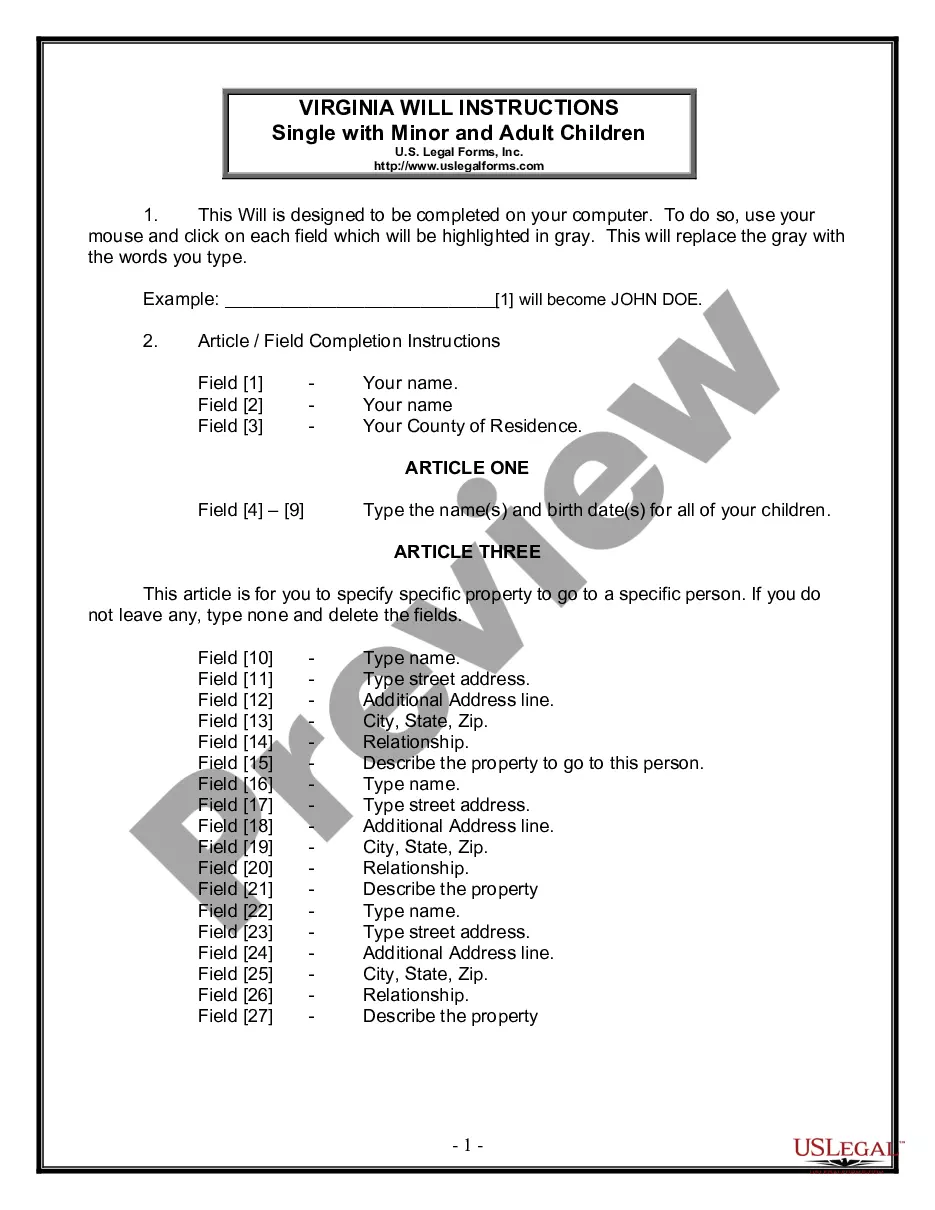

How to fill out New York Demand For Terms Of Contract By Corporation?

We consistently aim to minimize or evade legal repercussions when handling delicate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite costly.

Nevertheless, not every legal concern is equally intricate.

The majority can be managed independently.

Utilize US Legal Forms whenever you require to obtain and download the Yonkers New York Demand for Terms of Contract by Corporation or LLC or any other form promptly and securely.

- US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our service enables you to take charge of your matters without engaging a lawyer's assistance.

- We provide access to legal form templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Individuals with Yonkers income If you are not a Yonkers resident, you must file Form Y-203, City of Yonkers Nonresident Earnings Tax Return, if you: earned wages or carried on a trade or business within the city of Yonkers, or are a member of a partnership that carried on a trade or business there; and.

But every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York State sources, must file a return on Form IT-204, regardless of the amount of its income (see Specific instructions on page

Supplemental Wage Tax Rate Increases Effective July 1, 2021, the New York supplemental wage tax rate increased to 13.78% (previously 9.62%) and the Yonkers resident supplemental wage tax rate increased to 2.30815% (previously 1.61135%). The Yonkers nonresident supplemental wage tax rate remains 0.5%.

Mail your return to: STATE PROCESSING CENTER, PO BOX 15198, ALBANY NY 12212-5198.

Effective July 1, 2021, the New York supplemental wage tax rate increased to 13.78% (previously 9.62%) and the Yonkers resident supplemental wage tax rate increased to 2.30815% (previously 1.61135%). The Yonkers nonresident supplemental wage tax rate remains 0.5%.

Or New York S Corporation Estimated Tax. Paid on Behalf of Nonresident Individual. Partners and Shareholders.

Individuals with Yonkers income If you are not a Yonkers resident, you must file Form Y-203, City of Yonkers Nonresident Earnings Tax Return, if you: earned wages or carried on a trade or business within the city of Yonkers, or are a member of a partnership that carried on a trade or business there; and.

Residents of Yonkers are subject to the Yonkers Resident Withholding Tax. This tax must be included in paychecks for all employees who live in Yonkers. This tax applies to any services performed or employment in New York City or elsewhere in New York State.

If you maintain a permanent place of abode in Yonkers and spend 184 days or more in Yonkers, you are considered a Yonkers resident. The rules regarding Yonkers domicile are also the same as for New York State domicile.

Yonkers taxes you if you live or work in Yonkers, but NYC only taxes you if you live there (you are not taxed in NYC for your work performed there). If you live in Yonkers and work in NYC, you will be taxed by Yonkers on your NY State return for your Yonkers residency.