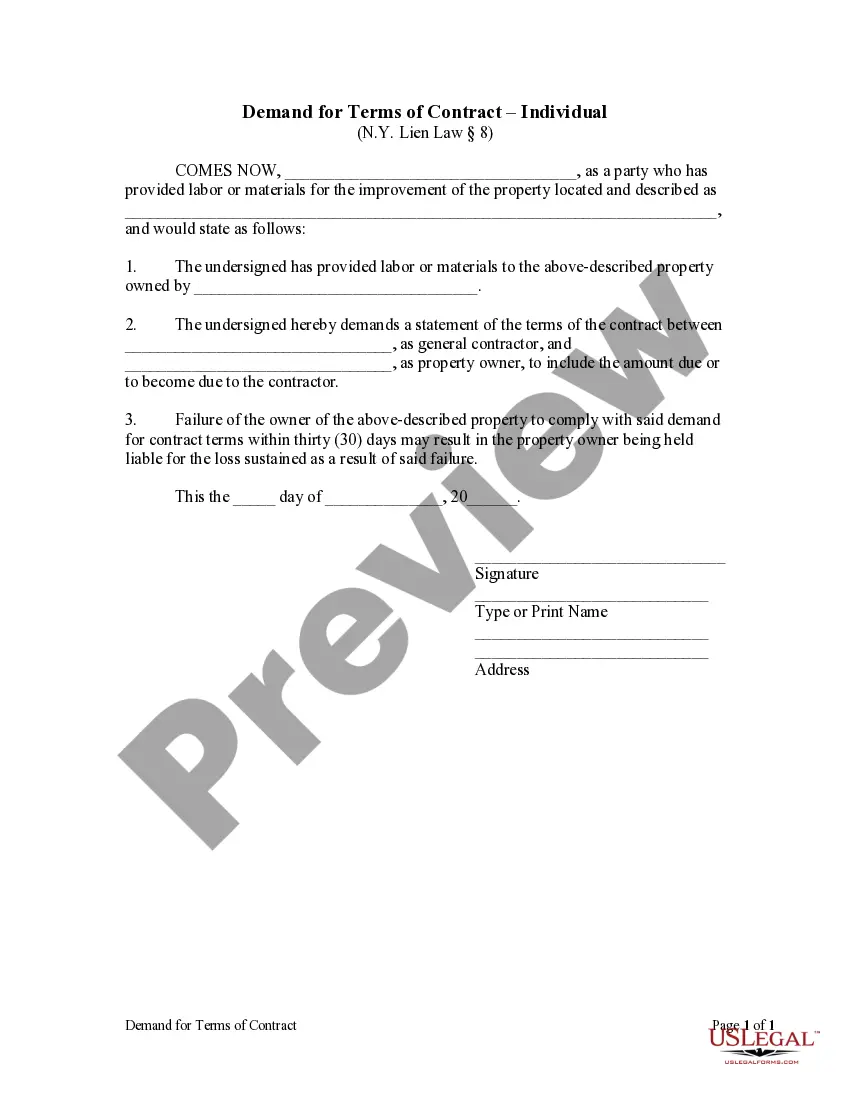

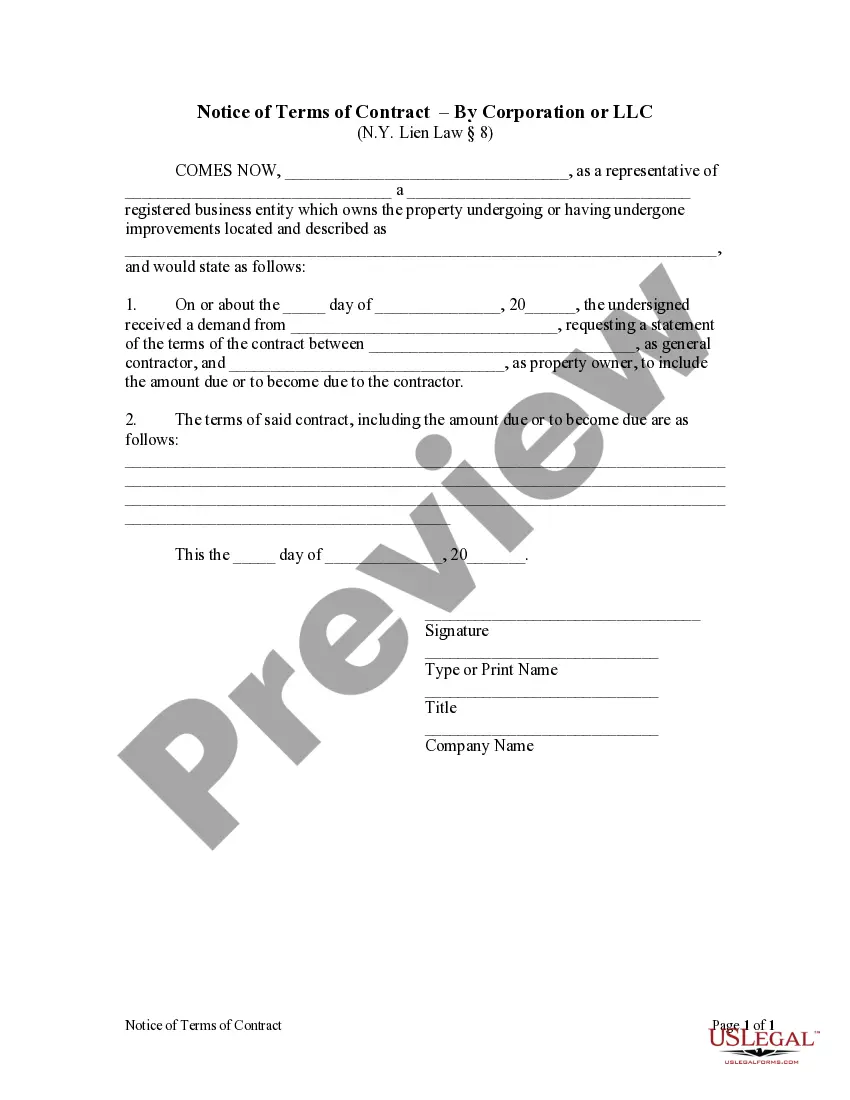

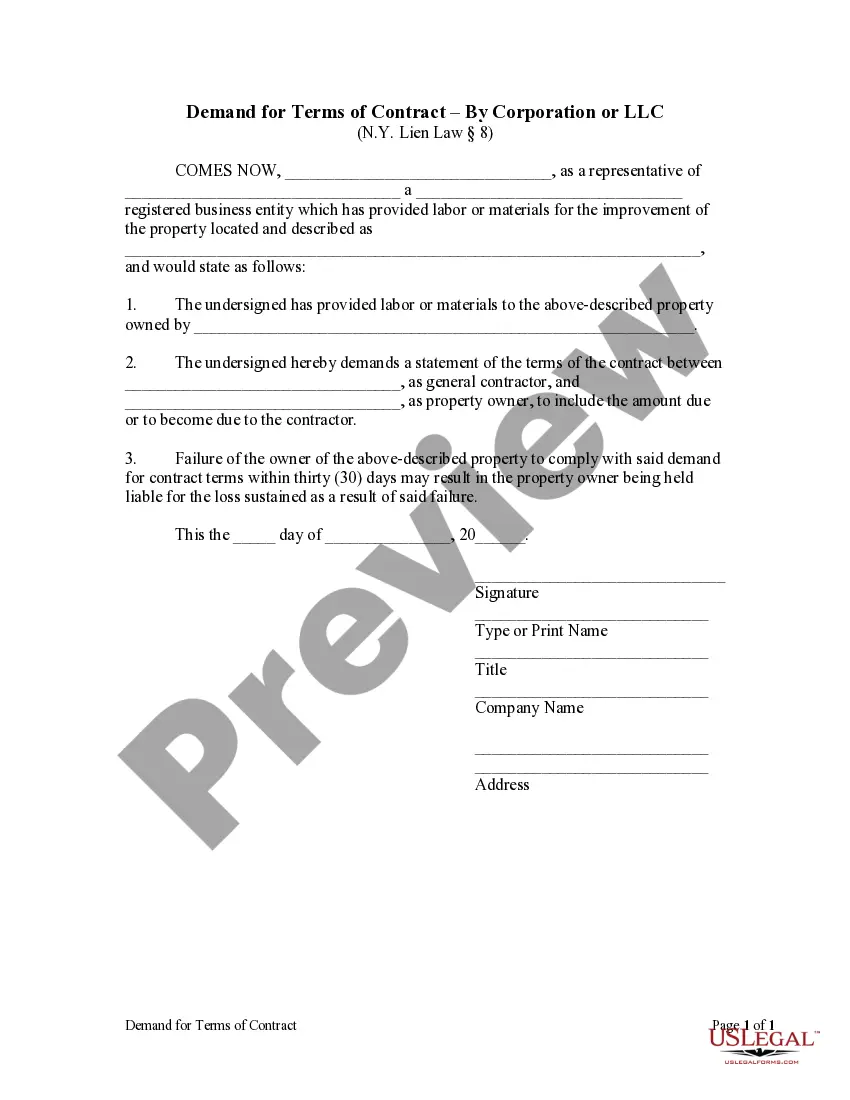

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result.

Suffolk New York Demand for Terms of Contract by Corporation

Description

How to fill out New York Demand For Terms Of Contract By Corporation?

If you have previously used our service, Log In to your account and store the Suffolk New York Demand for Terms of Contract by Corporation or LLC on your device by clicking the Download button. Ensure your subscription is active. If it's not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have lifetime access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

- Ensure you’ve found a relevant document. Review the description and utilize the Preview feature, if available, to determine if it fits your requirements. If it’s unsuitable, employ the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Suffolk New York Demand for Terms of Contract by Corporation or LLC. Choose the file format for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

The budget for Suffolk County in 2025 is projected to allocate funds toward various essential services, infrastructure, and community development projects. This budget will play a significant role in supporting local corporations, including those addressing Suffolk New York Demand for Terms of Contract by Corporation. Staying informed about the budget can help businesses plan their operations and comply with contractual terms effectively.

Yes, the statute of limitations for contracts in New York State is six years. This means that if a corporation wants to enforce a contract, they must file their claim within this timeframe. Understanding this limit is crucial for any Suffolk New York Demand for Terms of Contract by Corporation. If you need assistance navigating this legal timeline, our platform offers resources to help you.

To take someone to Small Claims Court in New York, you need to determine if your claim meets the guidelines of Small Claims Court. Gather all necessary documentation that supports your claim, especially any related to a Suffolk New York Demand for Terms of Contract by Corporation. After preparing your case, file the claim at your local court and follow through with the scheduled hearing.

In Suffolk County, the limit for Small Claims Court is $5,000 for claims filed by individuals. However, corporations can pursue claims up to $10,000. This capability is essential for those using the Suffolk New York Demand for Terms of Contract by Corporation, ensuring that businesses can seek resolution efficiently.

Filling out an agreement requires clear identification of all parties and a comprehensive description of the contract's purpose. Next, include the key terms such as payment, duties, timelines, and any contingencies. Finally, review the document for completeness and accuracy before signing. For guidance, consider using uslegalforms, especially if you're dealing with Suffolk New York Demand for Terms of Contract by Corporation.

To fill out a contractor agreement, begin by entering the names and contact details of all parties involved. Next, specify the scope of work, payment terms, and any legal obligations. Ensure you read the agreement thoroughly before signing. Utilizing a platform like uslegalforms can streamline this process and help you align with the Suffolk New York Demand for Terms of Contract by Corporation.

The 2-year contractor rule generally refers to the requirement that contractors must retain certain records and documentation for two years post-project completion. This ensures that there is accountability and transparency in the construction industry. For companies in Suffolk New York, adhering to this rule aligns with the Suffolk New York Demand for Terms of Contract by Corporation, promoting best practices.

Writing a construction contract agreement involves detailing the project scope, timeline, and payment terms. Clearly outline responsibilities for both the contractor and the client, ensuring all materials and labor costs are included. Also, state any penalties for delays or breaches in contract. By addressing these matters, you can better handle complications related to Suffolk New York Demand for Terms of Contract by Corporation.

The Suffolk County 2025 contract is a strategic agreement that outlines various initiatives and projects that the county aims to implement by 2025. This contract focuses on improvements in infrastructure, community services, and economic development. Understanding its terms can help corporations align their services with county objectives. Thus, if your corporation has a stake in Suffolk New York Demand for Terms of Contract by Corporation, familiarizing yourself with this contract can be beneficial.

To write a simple contract agreement, start by clearly defining the parties involved. Specify the terms of the agreement, including obligations and responsibilities. Additionally, include details about payment, delivery dates, and any conditions that need to be met. Remember, if you're navigating a Suffolk New York Demand for Terms of Contract by Corporation, it's crucial to follow local laws to ensure compliance.