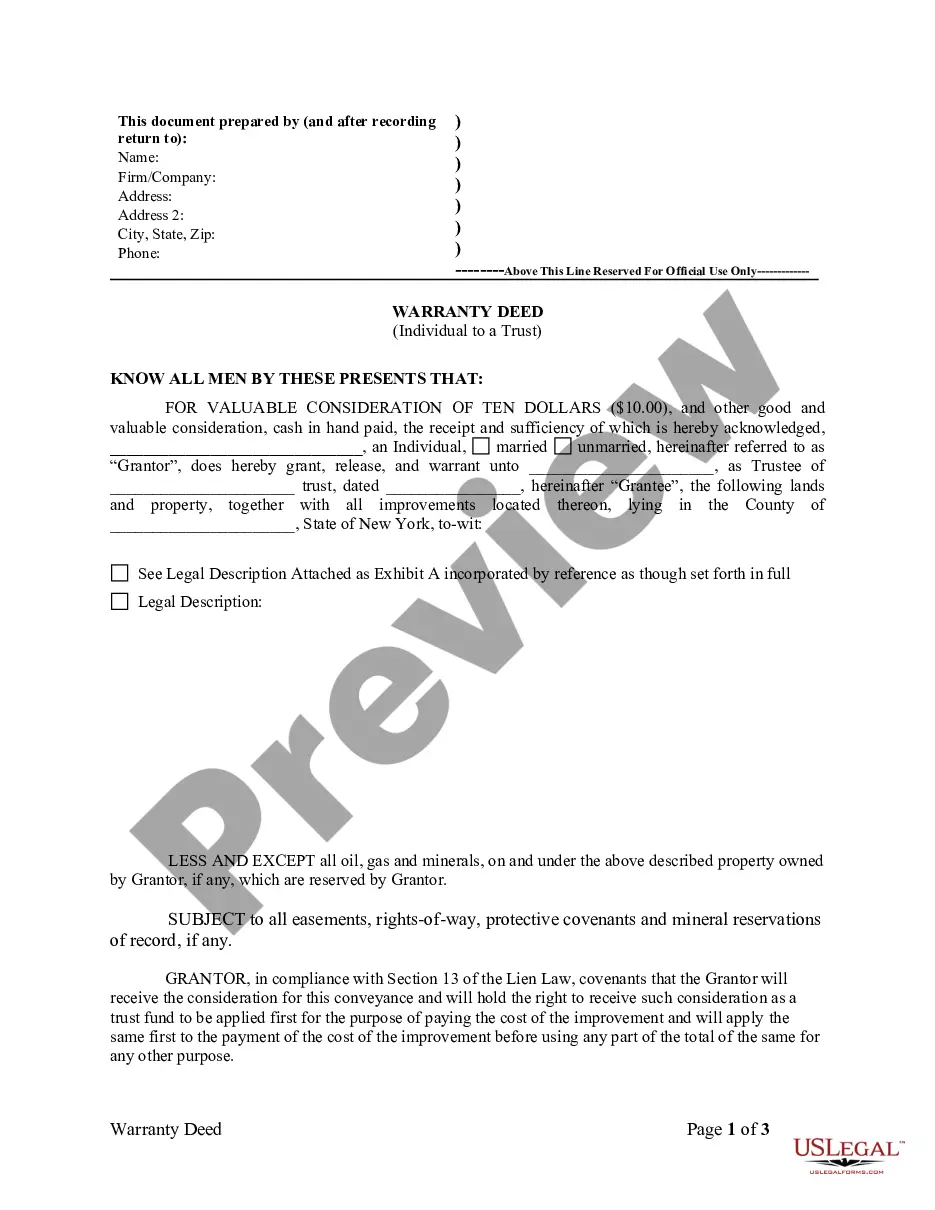

Yonkers New York Warranty Deed from Individual to a Trust

Description

How to fill out New York Warranty Deed From Individual To A Trust?

If you are looking for a legitimate document, it’s remarkably challenging to find a more suitable site than the US Legal Forms portal – one of the most extensive collections on the web.

Here you can discover a vast quantity of templates for commercial and personal uses categorized by types and regions, or keywords.

With our sophisticated search feature, locating the latest Yonkers New York Warranty Deed from Individual to a Trust is as simple as 1-2-3.

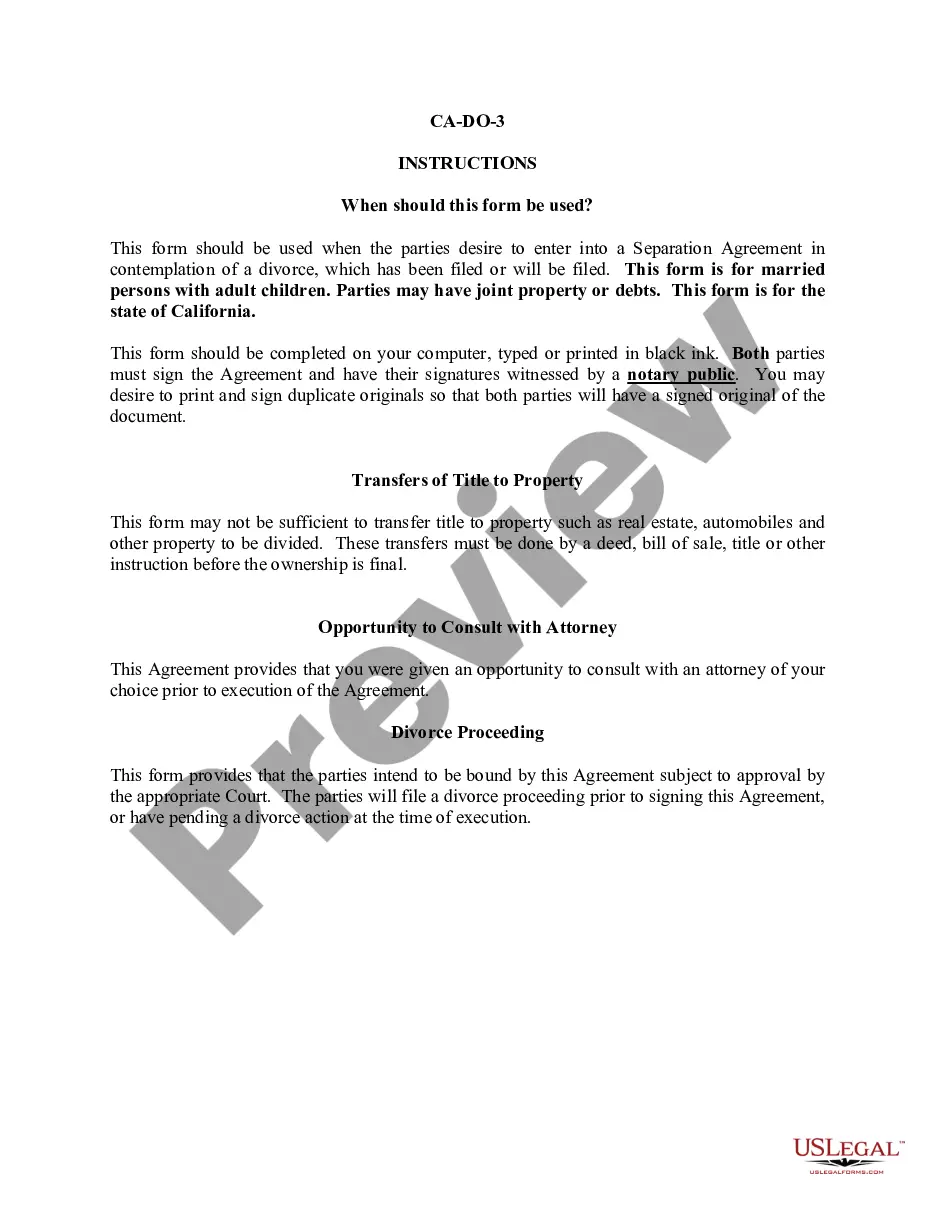

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the document. Choose the format and save it to your device.

- Moreover, the relevance of each document is verified by a team of experienced attorneys who routinely review the templates on our site and refresh them according to the most recent state and county requirements.

- If you are already familiar with our platform and have an active account, all you need to obtain the Yonkers New York Warranty Deed from Individual to a Trust is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the directions listed below.

- Ensure you have selected the document you require. Review its details and use the Preview feature to examine its content. If it doesn’t satisfy your requirements, utilize the Search option at the top of the page to find the appropriate file.

- Confirm your choice. Click the Buy now button. Then, select your preferred pricing plan and provide information to create an account.

Form popularity

FAQ

The least desirable deed is widely considered to be the quitclaim deed. This type of deed provides no warranties and leaves the buyer exposed to potential title issues. If you want a reliable and secure transfer of property, choosing a Yonkers New York Warranty Deed from Individual to a Trust guarantees that you are protected against future claims on the title.

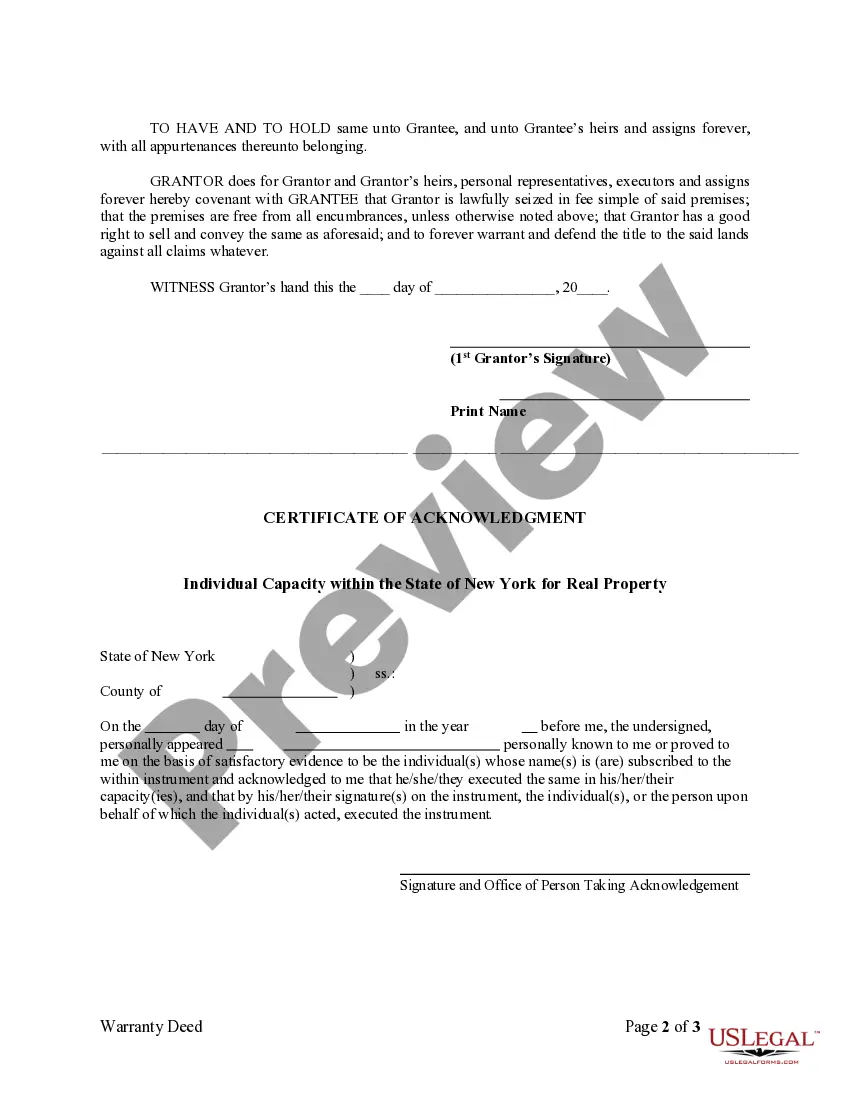

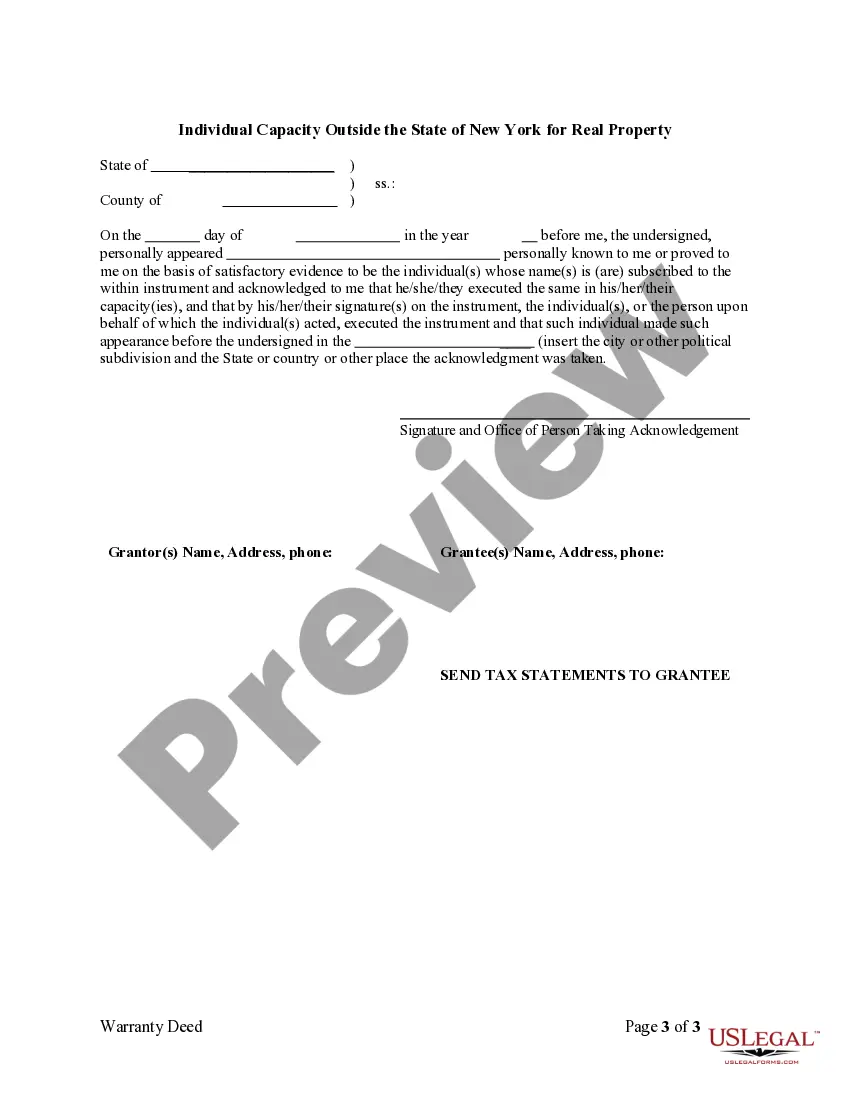

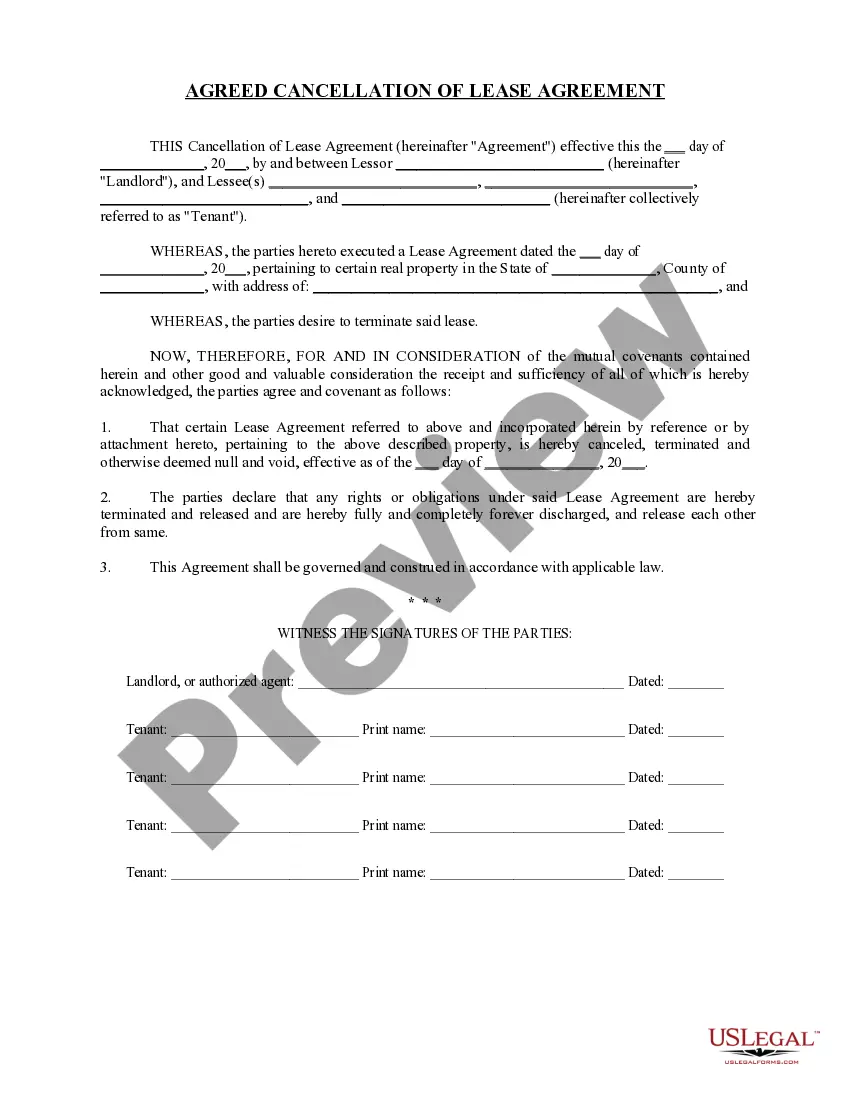

To transfer a deed in New York, you must prepare a new deed and sign it in front of a notary. Once the deed is executed, it should be filed with the County Clerk’s office. If you are considering a Yonkers New York Warranty Deed from Individual to a Trust, you need to ensure you have the proper paperwork to protect your interests during the transfer.

Among statutory deed forms, the quitclaim deed is often viewed as the weakest. It offers no guarantees about the title and may leave the buyer vulnerable to future claims. For those looking to secure property through a Yonkers New York Warranty Deed from Individual to a Trust, opting for a warranty deed ensures you receive a well-protected title.

The weakest type of deed is the quitclaim deed. Unlike a warranty deed, a quitclaim deed does not provide any warranties about the title. Using a Yonkers New York Warranty Deed from Individual to a Trust can significantly reduce risks since it guarantees that the title is clear and protected against future claims.

The weakest form of deed is generally considered to be the quitclaim deed. This type of deed transfers whatever interest the seller may have without any warranties about the title. If you require a Yonkers New York Warranty Deed from Individual to a Trust, it is advisable to choose a warranty deed to ensure maximum protection and avoid potential issues.

A warranty deed and a bargain and sale deed are not the same in New York. A warranty deed offers guarantees regarding the ownership and title of the property, while a bargain and sale deed typically does not include these protections. If you're considering a Yonkers New York Warranty Deed from Individual to a Trust, you benefit from the seller's assurance of a clear title and future protection.

The strongest type of deed is the warranty deed. It provides the highest level of protection to the buyer, ensuring that the seller guarantees clear title to the property. When dealing with a Yonkers New York Warranty Deed from Individual to a Trust, this deed assures that no other claims or defects will arise in the future.

Transferring property to a trust in New York typically involves executing a deed that designates the trust as the new owner. A Yonkers New York Warranty Deed from Individual to a Trust serves this purpose well. It's advisable to consult with legal professionals to ensure the process is completed correctly and meets all legal requirements.

To transfer a deed in New York State, you'll need to prepare a new deed that outlines the transfer. For effective property transfer, it’s recommended to use a Yonkers New York Warranty Deed, as it offers assurance against potential claims. Don’t forget to file this deed with the county clerk where the property resides to secure the transaction legally.

One significant mistake parents make when setting up a trust fund is failing to fund the trust properly. They may create the trust but forget to transfer assets, rendering it ineffective. To avoid this, ensure you utilize a Yonkers New York Warranty Deed from Individual to a Trust to properly convey your property into the trust, thereby achieving your estate planning goals.