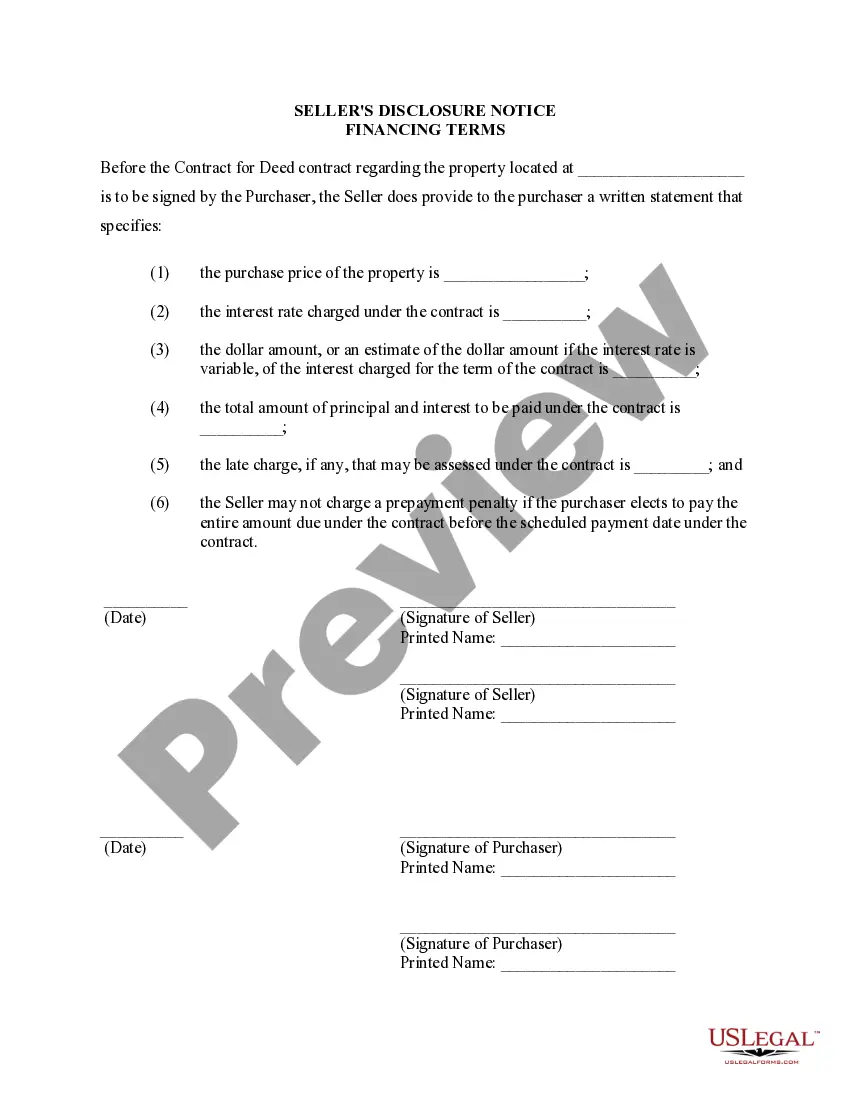

The Syracuse New York Seller's Disclosure of Financing Terms for Residential Property is a crucial document that outlines the specific terms and conditions related to the financing aspect of a real estate transaction. It provides vital information to potential buyers regarding the financial arrangement and obligations associated with purchasing a property through a Contract or Agreement for Deed, commonly referred to as a Land Contract. A Land Contract is a type of financing arrangement where the seller acts as the lender, allowing the buyer to make installment payments directly to the seller over an agreed-upon period of time. This alternative method of financing can be particularly beneficial for buyers who may have difficulty obtaining traditional mortgage loans due to various factors such as credit history, low income, or lack of a substantial down payment. The Syracuse New York Seller's Disclosure of Financing Terms includes several important terms and conditions that both parties must fully understand before entering into the agreement. Some key elements covered in the document may include: 1. Purchase Price: The total amount agreed upon as the selling price of the property. 2. Down Payment: The initial lump sum paid by the buyer at the start of the contract. This is often a smaller percentage of the purchase price compared to traditional mortgages. 3. Installment Payments: The periodic payments made towards the purchase price, typically on a monthly basis, until the full amount is paid off. 4. Interest Rate: The interest rate imposed by the seller on the outstanding balance. This rate may be fixed or variable, depending on the terms agreed upon. 5. Duration of the Contract: The agreed-upon length of time over which the buyer will make payments, also known as the term of the contract. 6. Late Payment Penalties: Any additional fees or penalties that may be charged if the buyer fails to make timely payments. 7. Property Insurance and Taxes: Clarification on whether the buyer or seller is responsible for maintaining insurance coverage and paying property taxes. 8. Maintenance and Repairs: Indication of who bears the responsibility for repairs and upkeep of the property during the contract term. Different variations of Syracuse New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may exist depending on specific clauses or provisions included by either party. These variations may address additional concerns such as early payment options, default consequences, or the possibility of transferring the contract to another party. Overall, the Syracuse New York Seller's Disclosure of Financing Terms for Residential Property acts as a transparent and legally binding document that protects the interests of both the buyer and seller throughout the duration of the Land Contract. It ensures that all parties involved have a clear understanding of their financial obligations and helps facilitate a smooth and successful real estate transaction.

Syracuse New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Syracuse New York Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you’ve already utilized our service before, log in to your account and download the Syracuse New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Syracuse New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!