Clark Nevada Notice of Assignment to Living Trust

Description

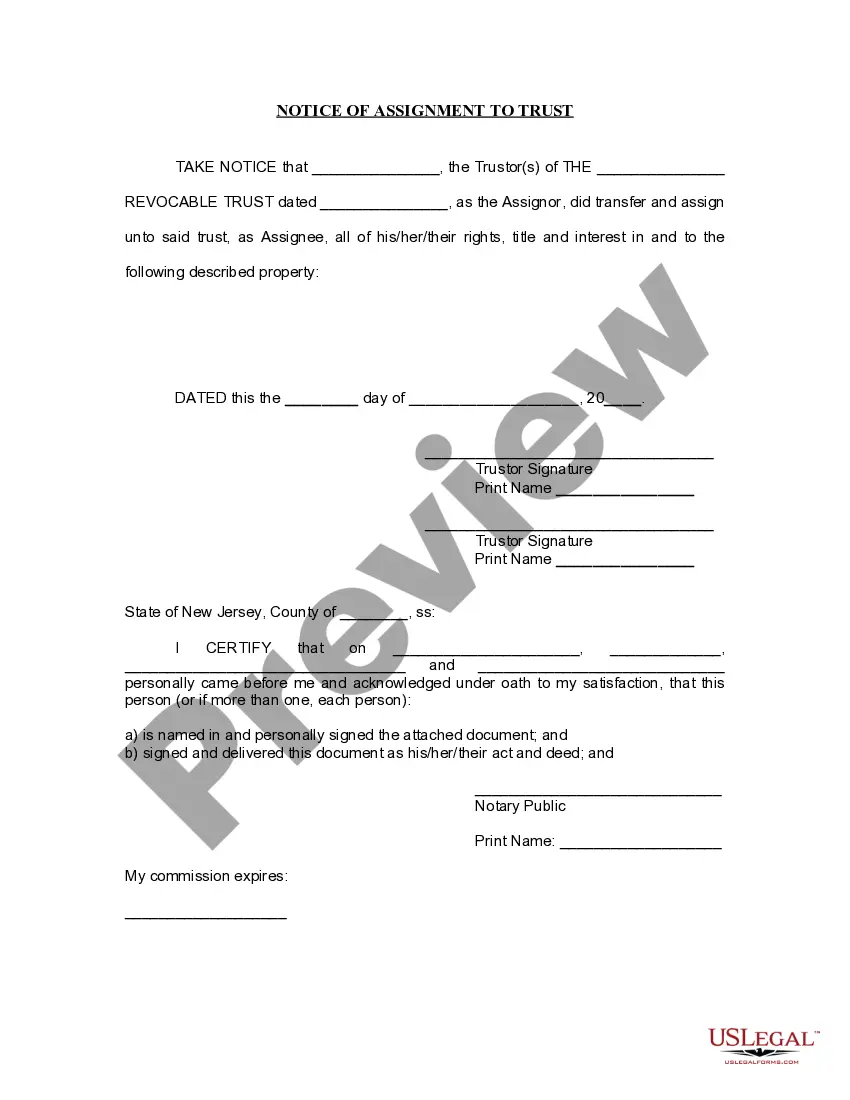

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Nevada Notice Of Assignment To Living Trust?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our supportive website featuring a vast array of documents enables you to locate and acquire nearly any document sample you require.

You can store, fill out, and sign the Clark Nevada Notice of Assignment to Living Trust in just a few minutes instead of spending hours online searching for a suitable template.

Using our catalog is an excellent way to enhance the security of your form submissions.

Locate the form you need. Make sure it is the correct form: check its title and description, and use the Preview option if available. If not, use the Search bar to find the required one.

Initiate the downloading process. Click Buy Now and select the pricing option that suits you. Then, set up an account and complete your order using a credit card or PayPal. Download the document. Choose the format to receive the Clark Nevada Notice of Assignment to Living Trust and modify and complete it, or sign it as per your needs. US Legal Forms is one of the most extensive and dependable form libraries on the internet. We are always pleased to support you in nearly any legal matter, even if it’s merely downloading the Clark Nevada Notice of Assignment to Living Trust. Feel free to fully utilize our form catalog and make your document experience as seamless as possible!

- Our qualified legal experts routinely examine all documents to guarantee that the forms are applicable for a specific region and adhere to new laws and regulations.

- How can you obtain the Clark Nevada Notice of Assignment to Living Trust.

- If you already have an account, simply Log In to your profile. The Download button will be visible on all the templates you review.

- Additionally, you can access all your previously saved documents in the My documents section.

- If you do not have an account yet, follow the steps below.

Form popularity

FAQ

In Nevada, trusts generally remain private and are not part of the public record. This means that the details of your Clark Nevada Notice of Assignment to Living Trust stay confidential, protecting your family's financial information. Only certain situations, such as probate or litigation, may require disclosure of trust details. Therefore, many prefer trusts for their privacy and asset protection benefits.

One major mistake parents often make is not clearly defining the terms of the trust fund. Without clear instructions, beneficiaries may face confusion or conflict, undermining your intentions. A Clark Nevada Notice of Assignment to Living Trust can help you specify your wishes and ensure that each beneficiary understands their role. It is vital to communicate openly about the trust's goals and processes.

To execute a quit claim deed in Nevada, start by preparing the deed document, which must identify the grantor and grantee as well as the exact property description. Once completed, you will need to sign the document before a notary. Finally, submit the quit claim deed to the county recorder’s office. This process lets you smoothly transfer property to your trust, such as in a Clark Nevada Notice of Assignment to Living Trust.

In Nevada, a trust generally does not need to be filed with any court. This means that when you establish a trust, such as a Clark Nevada Notice of Assignment to Living Trust, you retain privacy over its details. However, it's important to follow legal protocols for documenting the trust, particularly when your assets transfer to it. This helps ensure that your wishes are honored without the need for public disclosure.

To determine if you possess a quitclaim deed, check your property records at the local county recorder’s office. They can provide necessary documentation and confirm ownership transfers. If you're exploring your options for managing your living trust documentation, remember that services like US Legal Forms can assist with processes like the Clark Nevada Notice of Assignment to Living Trust.

In Nevada, a living trust does not need to be recorded to be effective. However, it may be beneficial to provide a notice of assignment to ensure clarity about asset ownership. Utilizing services like US Legal Forms can help simplify the process for establishing or managing your living trust, including handling the Clark Nevada Notice of Assignment to Living Trust.

A quitclaim deed is permanent as it conveys ownership of the property from one party to another, without any warranties. Once executed and recorded, it remains valid for all future interests in the property. Knowing how this affects living trusts is important, especially concerning the Clark Nevada Notice of Assignment to Living Trust.

You can get a copy of your quit claim deed by accessing the local county recorder's office either in person or online. Many offices now offer digital copies for convenience. For assistance with obtaining various legal documents, consider using platforms like US Legal Forms to facilitate your needs, including the Clark Nevada Notice of Assignment to Living Trust.

To access a copy of your property deed in Arizona, you should contact the county recorder's office where your property is located. They can provide a certified copy upon request, often via their online portal. Additionally, resources like US Legal Forms can help you navigate property documentation needs, including the Clark Nevada Notice of Assignment to Living Trust.

To obtain a copy of a quit claim deed, you can visit your local county recorder's office or its website. In many cases, these documents are available publicly, enabling you to request a copy directly. Alternatively, using services like US Legal Forms can streamline the process of obtaining important legal documents, including the Clark Nevada Notice of Assignment to Living Trust.