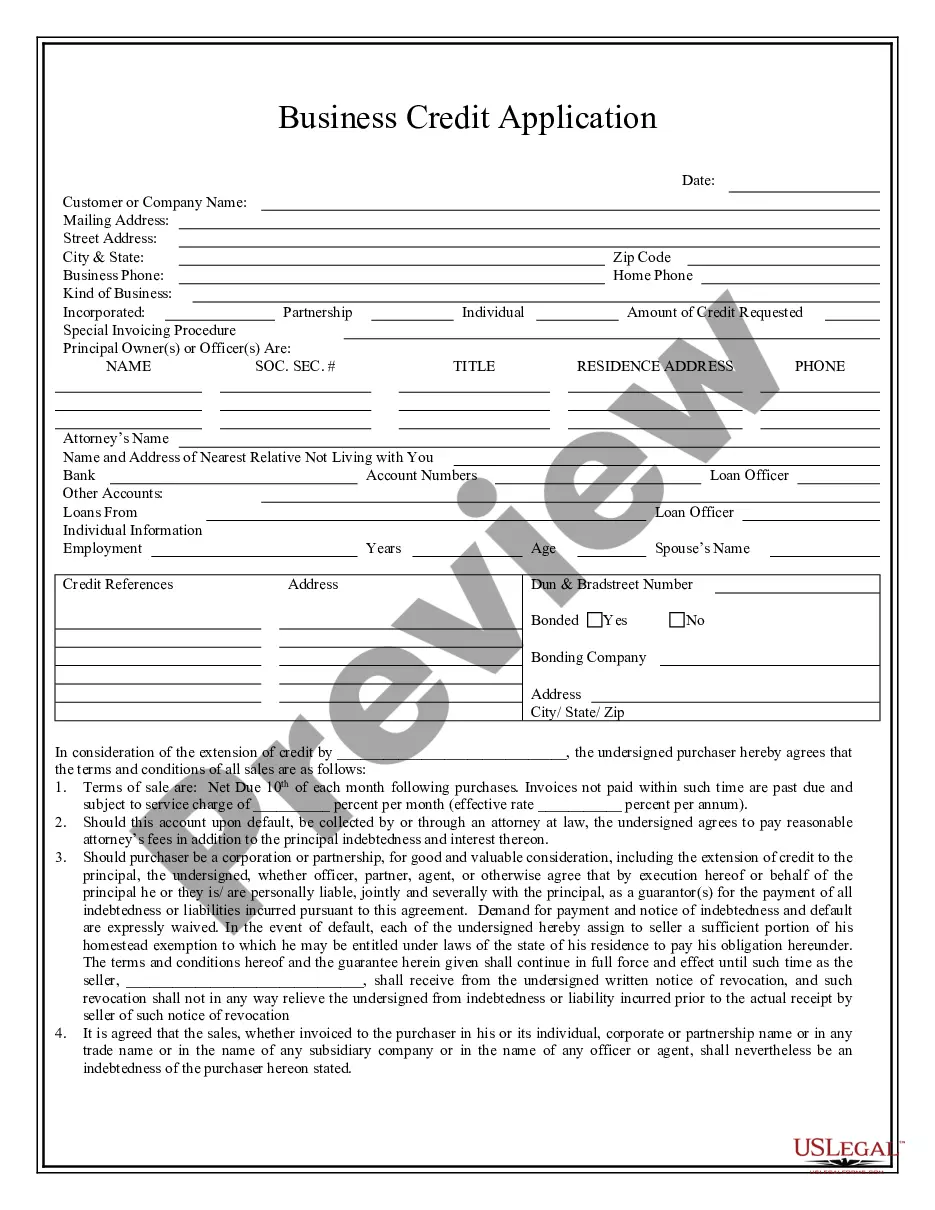

Las Vegas Nevada Business Credit Application

Description

How to fill out Nevada Business Credit Application?

We consistently aim to reduce or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we enlist attorney services that are typically very costly.

Nevertheless, not all legal situations are equally complicated. Many of them can be managed independently.

US Legal Forms is an online directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

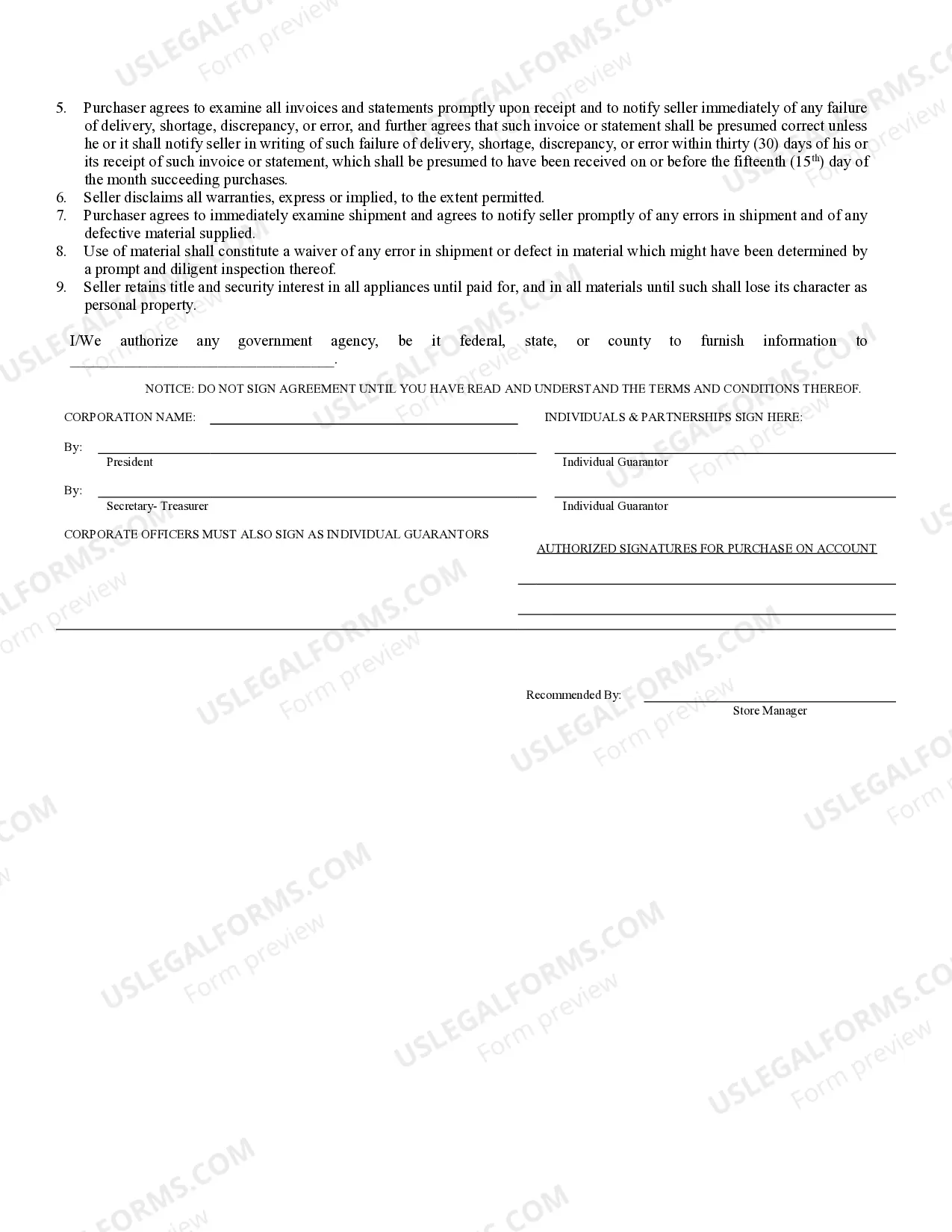

Just Log In to your account and click the Get button next to the form. If you happen to lose the form, you can always retrieve it again from the My documents tab. The procedure is equally simple for newcomers to the site! You can set up your account in just a few minutes. Ensure that the Las Vegas Nevada Business Credit Application adheres to the laws and regulations of your state and locality. Additionally, it is essential to review the form's description (if available), and if you find any inconsistencies with what you were originally seeking, look for another template. Once you confirm that the Las Vegas Nevada Business Credit Application suits your needs, you can choose a subscription plan and make the payment. You can then download the form in any convenient format. For more than 24 years, we have assisted millions by providing customizable and current legal documents. Optimize the benefits of US Legal Forms now to save time and resources!

- Our platform empowers you to handle your affairs without needing to consult a lawyer.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, significantly easing the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Las Vegas Nevada Business Credit Application or any other form quickly and securely.

Form popularity

FAQ

If you have been in business for three or more years, you may qualify for a business credit card using your business credit score. More likely, though, you'll be applying with your own Social Security number, and issuers will check your personal credit score.

640 to 700: Business loan providers generally consider a credit score that falls somewhere between 640 and 700 to be good but not excellent. Generally, the minimum credit score for SBA and term loans is around 680.

One of the easiest ways to build business credit is to apply for net terms with vendors and suppliers. As you buy supplies, inventory, or other materials on credit, those purchases and payments get reported to business credit reporting agencies.

All businesses operating in Nevada must obtain a State Business License issued by the Nevada Secretary of State. The license is renewable annually. You may apply online or obtain the forms from their website ( ). 202 North Carson St.

Experian Business Like Equifax, Experian also offers either a one-time report and scores or the option to subscribe to ongoing monitoring. For $39.95, you can pull one business credit report and see your Experian business credit scores. For ongoing access to both your reports and scores, you can pay $179 a year.

Some experts suggest that it takes three years to build satisfactory credit for your business. However, some lenders may require only one year of a business's operating tenure.

The first step to getting business credit is to establish a company. You can easily do this by registering an LLC, corporation, or other legal entity. Once you have a company, you must start a business bank account and set up net-30 tradelines with net-30 vendors.

Pay creditors early Payment history is the most important factor in determining your business credit score. While on-time payments are good, early payment is even better. Why? Dun & Bradstreet only assigns perfect Paydex scores, which measures a business's payment history, to companies that pay early.

Eight steps to establishing your business credit Incorporate your business.Obtain an EIN.Open a business bank account.Establish a business phone number.Open a business credit file.Obtain business credit card(s)Establish a line of credit with vendors or suppliers.Pay your bills on time.

One of the easiest ways to build business credit is to apply for net terms with vendors and suppliers. As you buy supplies, inventory, or other materials on credit, those purchases and payments get reported to business credit reporting agencies.