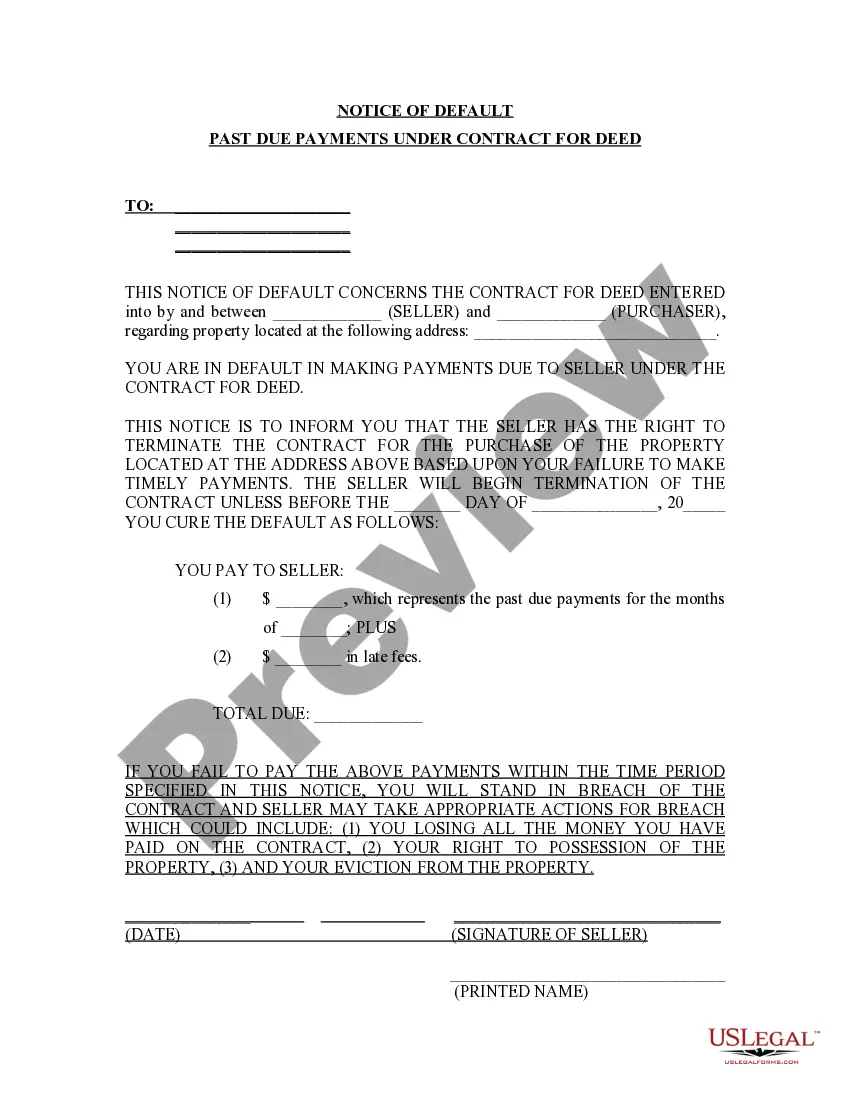

North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Nevada Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of societal or occupational standing, completing legal documents is an unfortunate requirement in today’s workplace.

Often, it’s nearly impossible for an individual without any legal education to draft such paperwork from the ground up, primarily because of the intricate language and legal nuances they involve.

This is where US Legal Forms proves to be beneficial.

Confirm that the form you found is applicable for your region as the laws of one state or county may not apply to another.

Review the document and read a brief summary (if available) of situations the document can be utilized for.

- Our service provides a vast repository with over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency using our DIY templates.

- Whether you require the North Las Vegas Nevada Notice of Default for Past Due Payments regarding a Contract for Deed or any other relevant paperwork suited for your state or county, US Legal Forms has everything readily available.

- Here’s how you can obtain the North Las Vegas Nevada Notice of Default for Past Due Payments related to a Contract for Deed in just a few minutes using our reliable platform.

- If you are already a registered user, you can proceed to Log In to your account to download the form you need.

- However, if you are new to our library, make sure to follow these steps before downloading the North Las Vegas Nevada Notice of Default for Past Due Payments linked to a Contract for Deed.

Form popularity

FAQ

Receiving a notice of default indicates that you are behind on your payments and risk losing your property. In the context of the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed, this notice alerts you to the seriousness of your financial situation. It is a precursor to potential foreclosure and should be taken seriously. By understanding this notice, you can explore options to remedy the situation before further steps are necessary, such as seeking help from platforms like USLegalForms.

Entry of default is a legal step taken when a party fails to respond to a complaint in a timely manner. This action occurs in court and may connect to the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed, as it signifies that the lender may now pursue legal remedies. Essentially, once a default is entered, the borrower may lose certain rights regarding their property. It's important to act quickly if you find yourself in this situation.

In Nevada, a notice of intent to default serves as an official warning indicating that a borrower has fallen behind on payments. This notice is crucial for anyone dealing with the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed. It informs the borrower that if payments do not resume promptly, further action may be taken to reclaim ownership of the property. Understanding this notice can help you take timely steps to avoid potential foreclosure.

Foreclosure in Las Vegas involves a legal process where a lender takes possession of a property due to the homeowner's inability to make required payments. Initially, the lender files a Notice of Default, which starts a timeline for potential foreclosure. Knowledge of the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed can be vital for homeowners facing this situation. Seeking assistance from experienced legal professionals can help safeguard your interests.

Similar to houses, the timeline to foreclose on a home in Nevada can range from about three months to more than a year. The process begins with a Notice of Default, which is critical in understanding your rights and options moving forward. The North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed can provide crucial insights during this stressful time. Therefore, it’s advisable to consult professionals who can guide you through this complex process.

In Nevada, the foreclosure process can take anywhere from three months to over a year, depending on various factors including the lender and the specific case. When a North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed is issued, the timeline usually begins from that point. It's important for homeowners to stay informed about the timelines involved and to communicate regularly with their lenders. Legal counsel can provide critical assistance during this period.

One disadvantage of a deed is that it can have negative impacts on your credit score, similar to a foreclosure. Additionally, lenders may not always agree to a deed in lieu, making it necessary to explore other avenues. Understanding the implications of the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed helps clarify your options. Engaging with a legal expert can ensure you make informed decisions.

A deed in lieu of foreclosure allows a homeowner to offer the property's deed back to the lender to avoid foreclosure proceedings. This option can be beneficial for both parties, as it simplifies the process and avoids prolonged legal disputes. Familiarity with the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed can help you navigate this alternative efficiently. It's wise to seek guidance from a legal professional when considering this option.

In Nevada, the redemption period typically lasts for six months after a foreclosure sale, according to the law. During this time, homeowners can reclaim their property by paying the total amount owed. Understanding the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed is crucial, as it provides clear insights on options available during this period. Always consult with a legal expert to clarify your specific situation.

The US Electronic Transaction Act provides a legal framework for electronic records and signatures, ensuring they have the same legal weight as traditional documents. This act promotes trust in digital transactions across the country. For those dealing with real estate issues, including the North Las Vegas Nevada Notice of Default for Past Due Payments in connection with Contract for Deed, understanding this act is essential for a seamless transaction process.