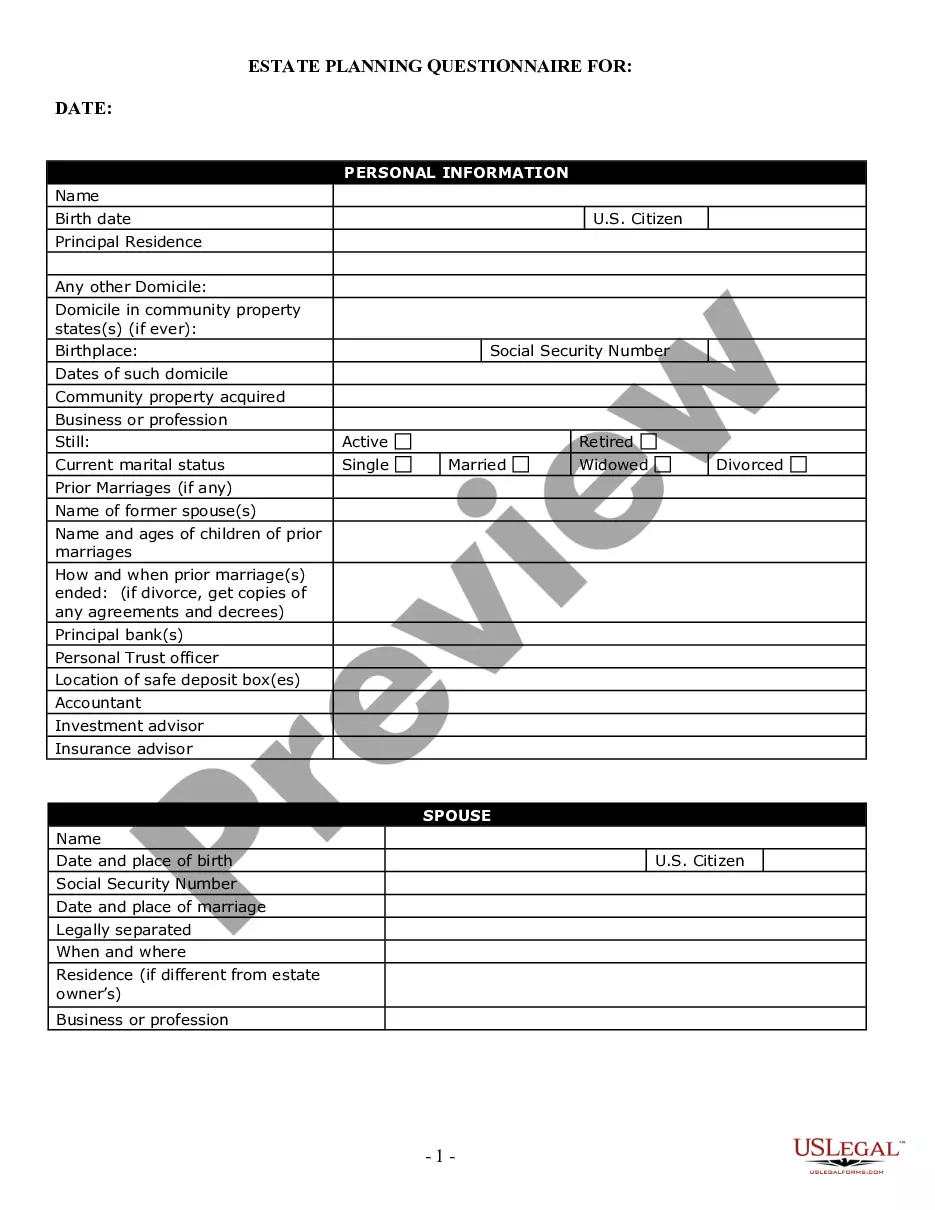

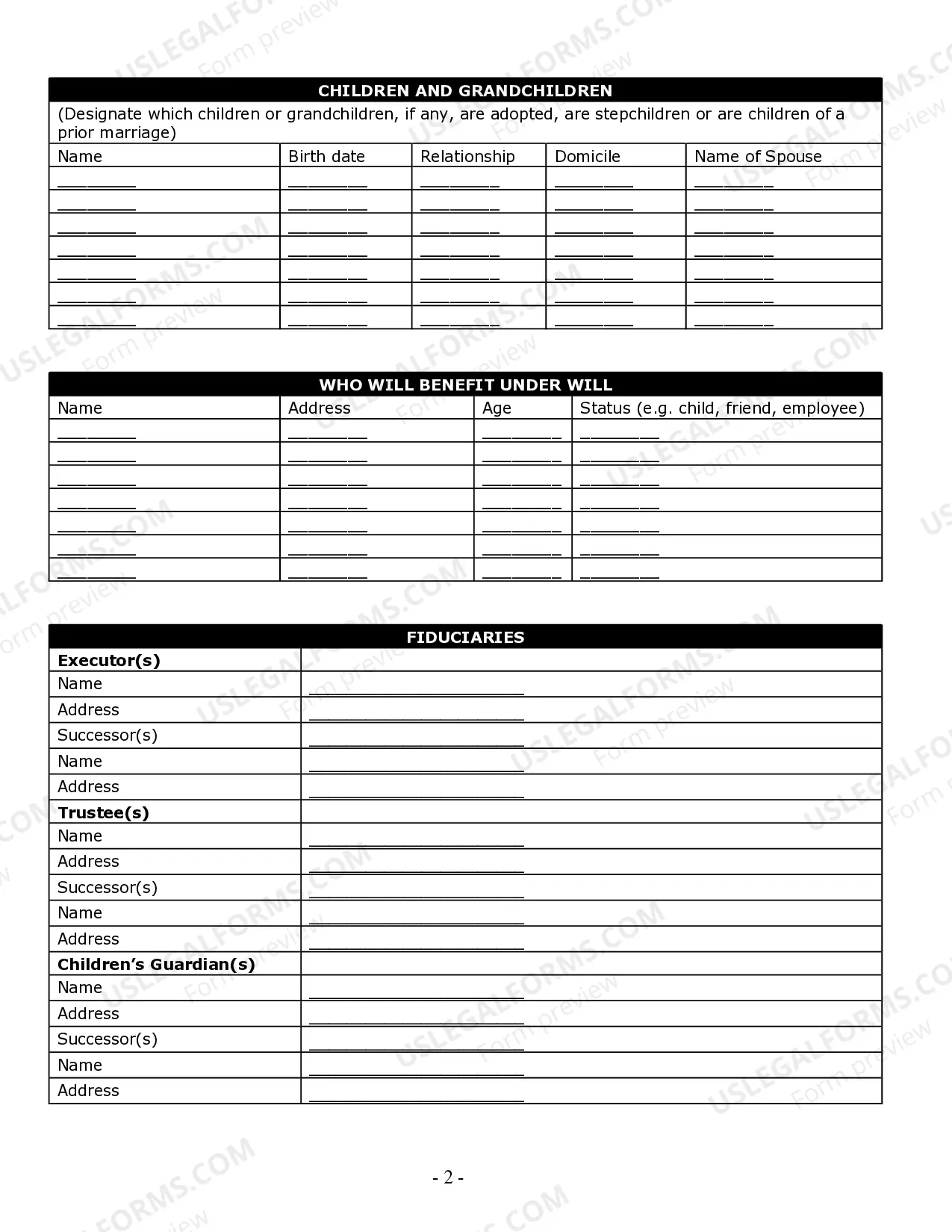

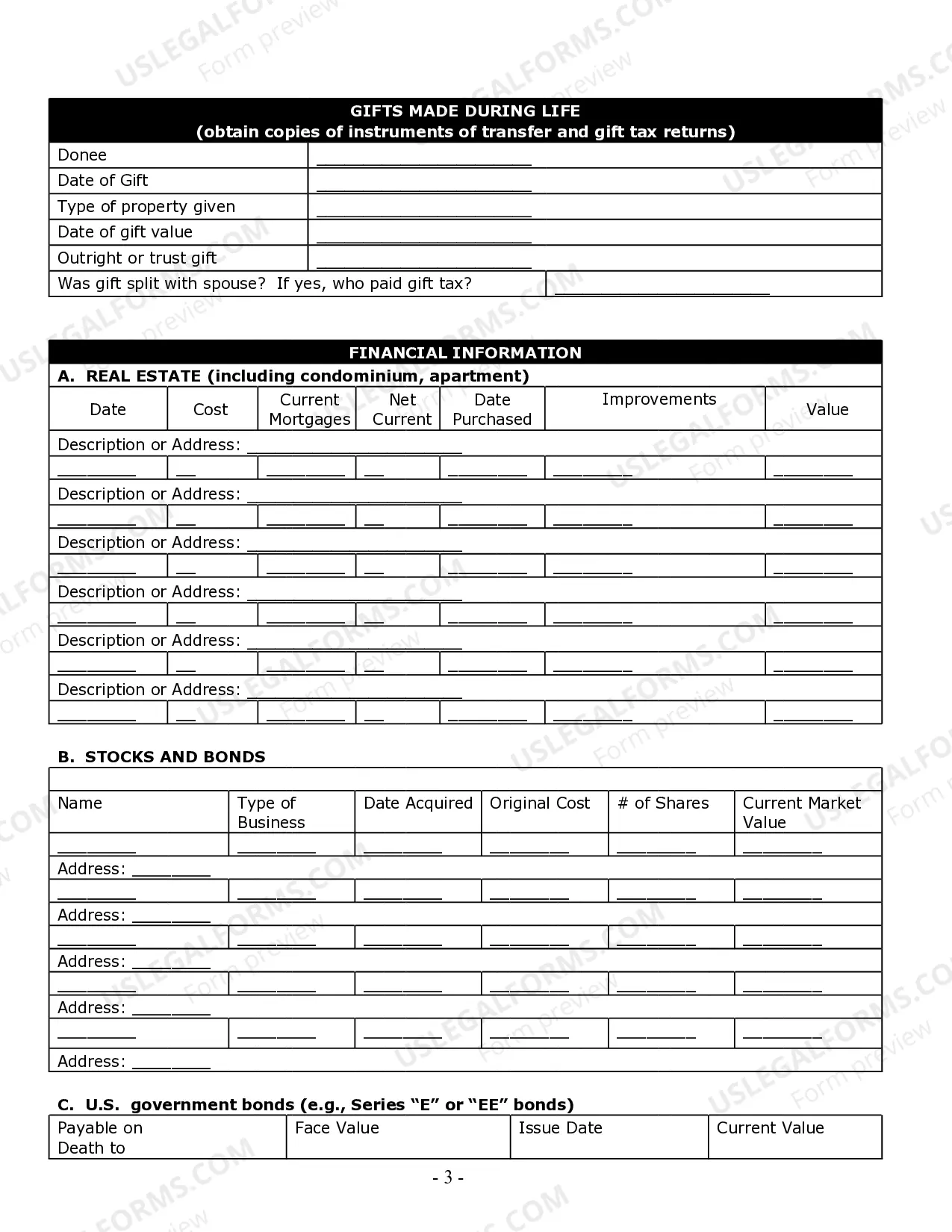

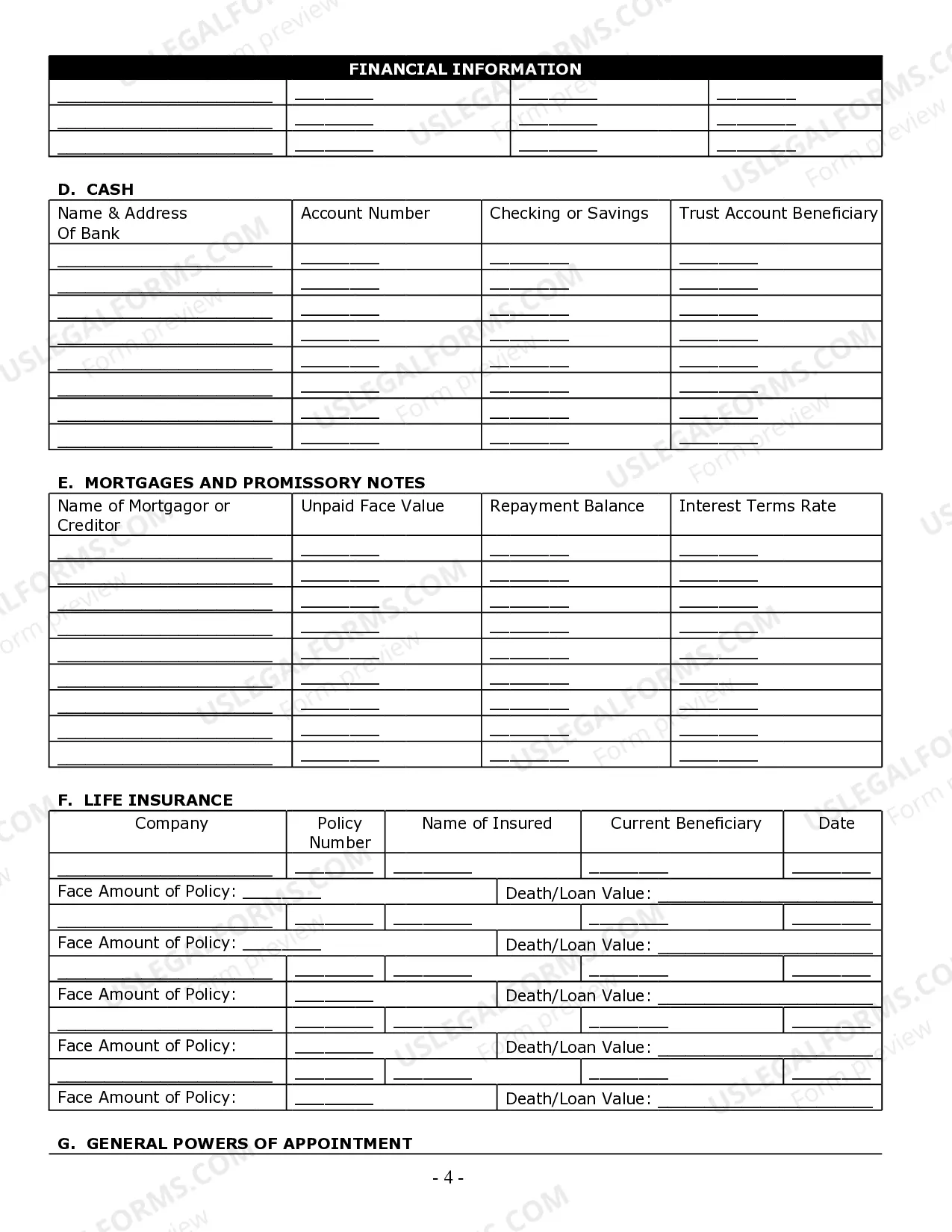

Las Cruces New Mexico Estate Planning Questionnaire and Worksheets

Description

How to fill out New Mexico Estate Planning Questionnaire And Worksheets?

If you have accessed our service previously, Log In to your account and store the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have enduring access to all documents you have acquired: you can find it in your profile under the My documents section whenever you need to refer to it again. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Confirm you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify if it satisfies your needs. If it doesn’t fit your criteria, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and proceed with payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Las Cruces New Mexico Estate Planning Questionnaire and Worksheets. Choose the file format for your document and save it to your device.

- Fill out your template. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

The 5 and 5 rule in estate planning helps you understand gift tax exclusions. According to this rule, you can gift up to $15,000 per person per year without incurring taxes, and if you exceed this amount, there are specific limits on how much can be disregarded. This rule is crucial for individuals looking to minimize their estate tax liabilities. Utilizing the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets can simplify the process of tracking these gifts for your estate plan.

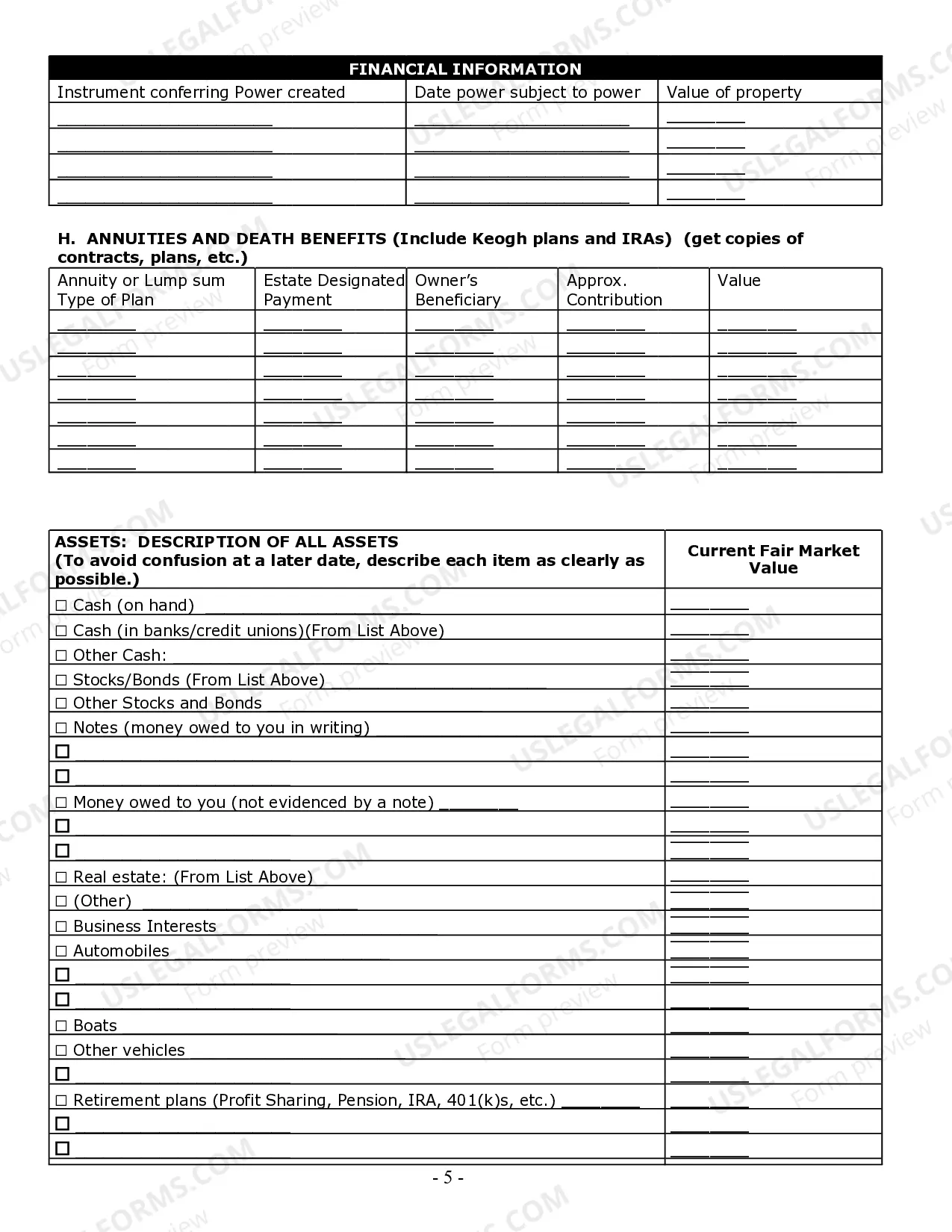

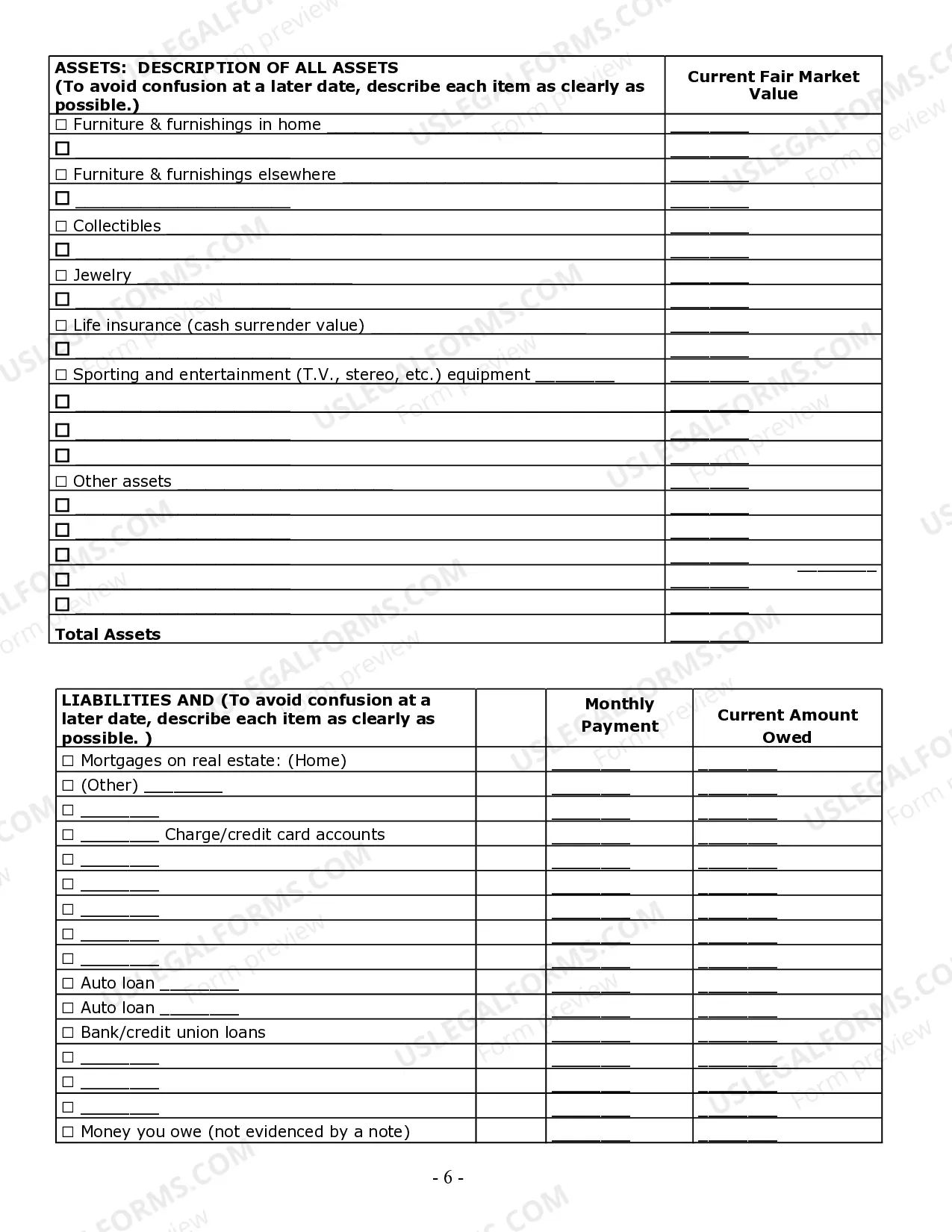

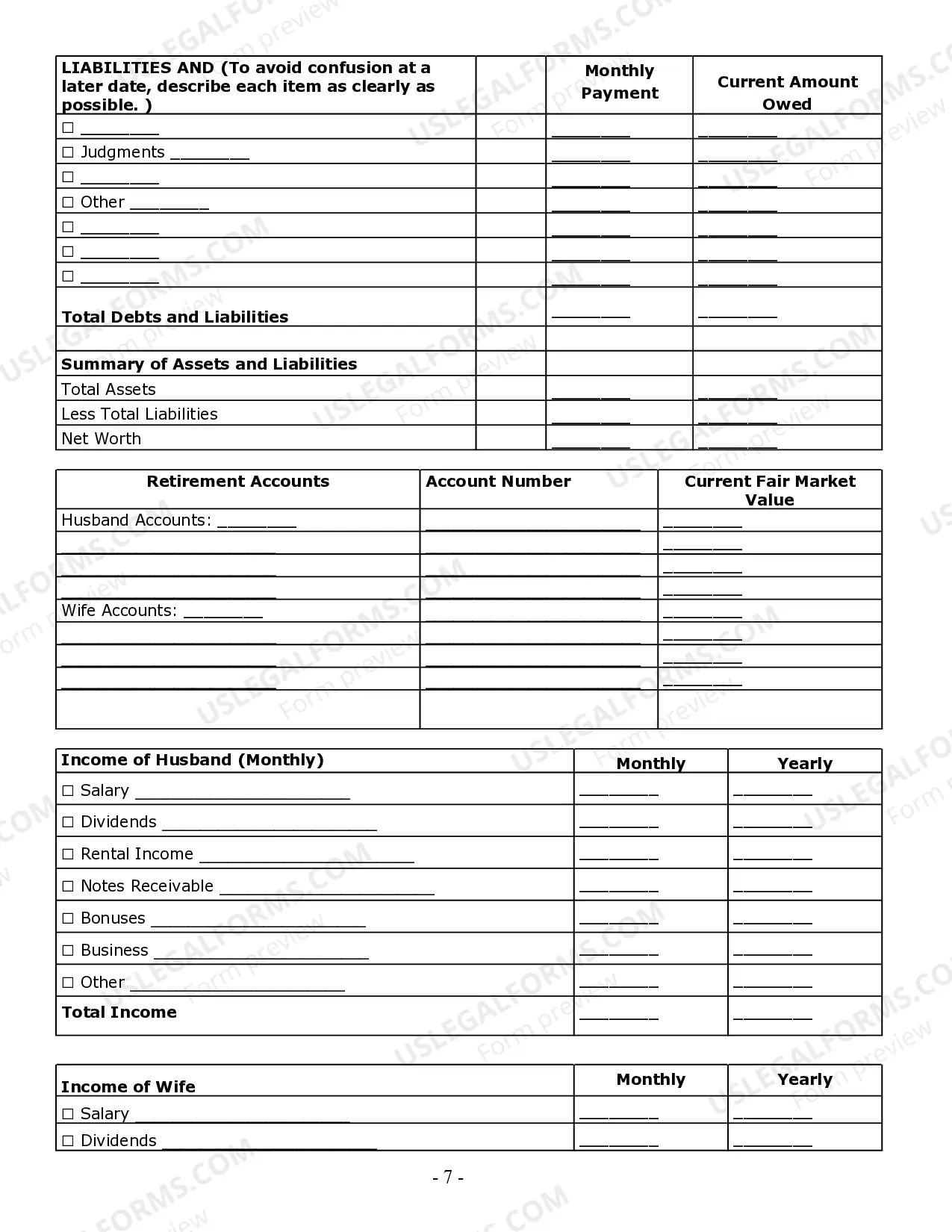

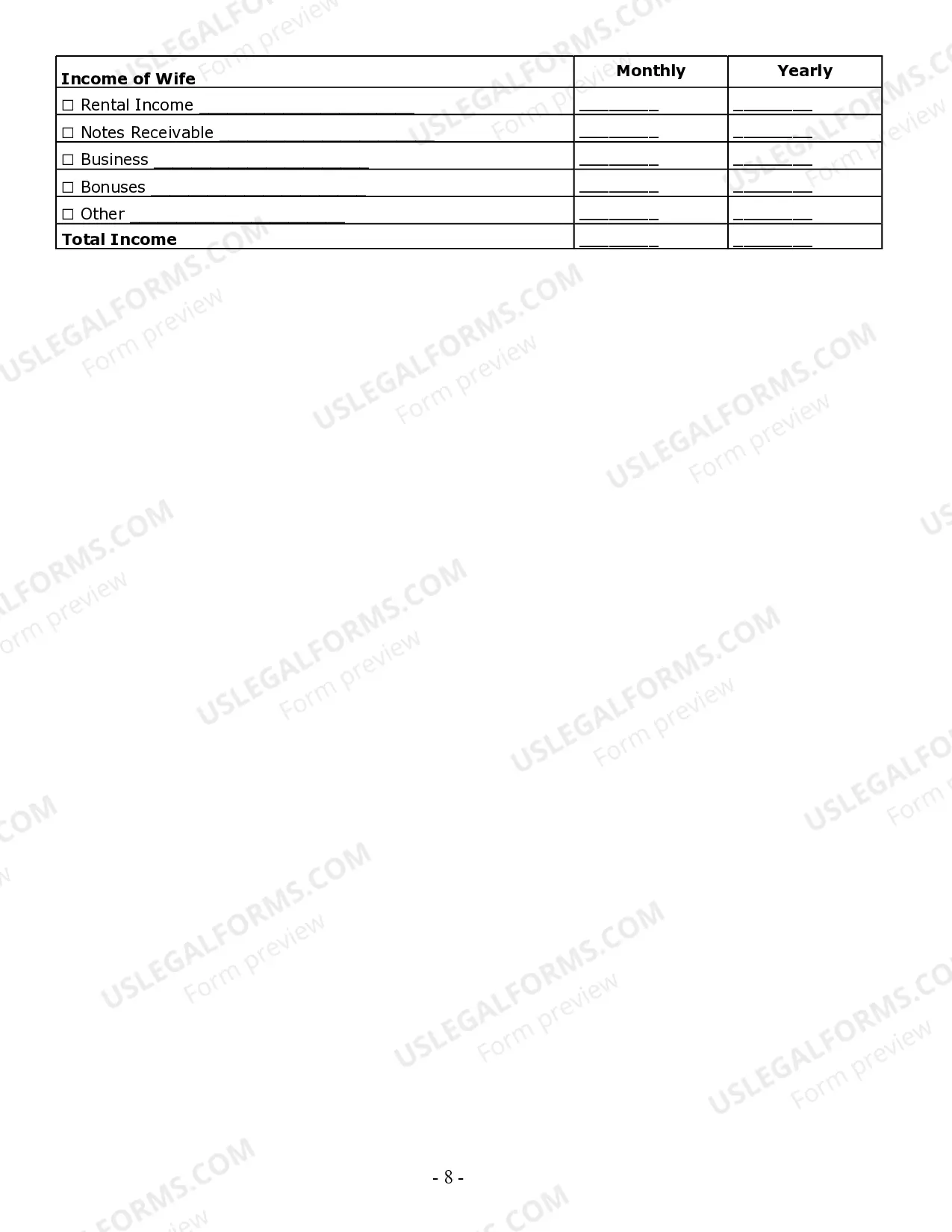

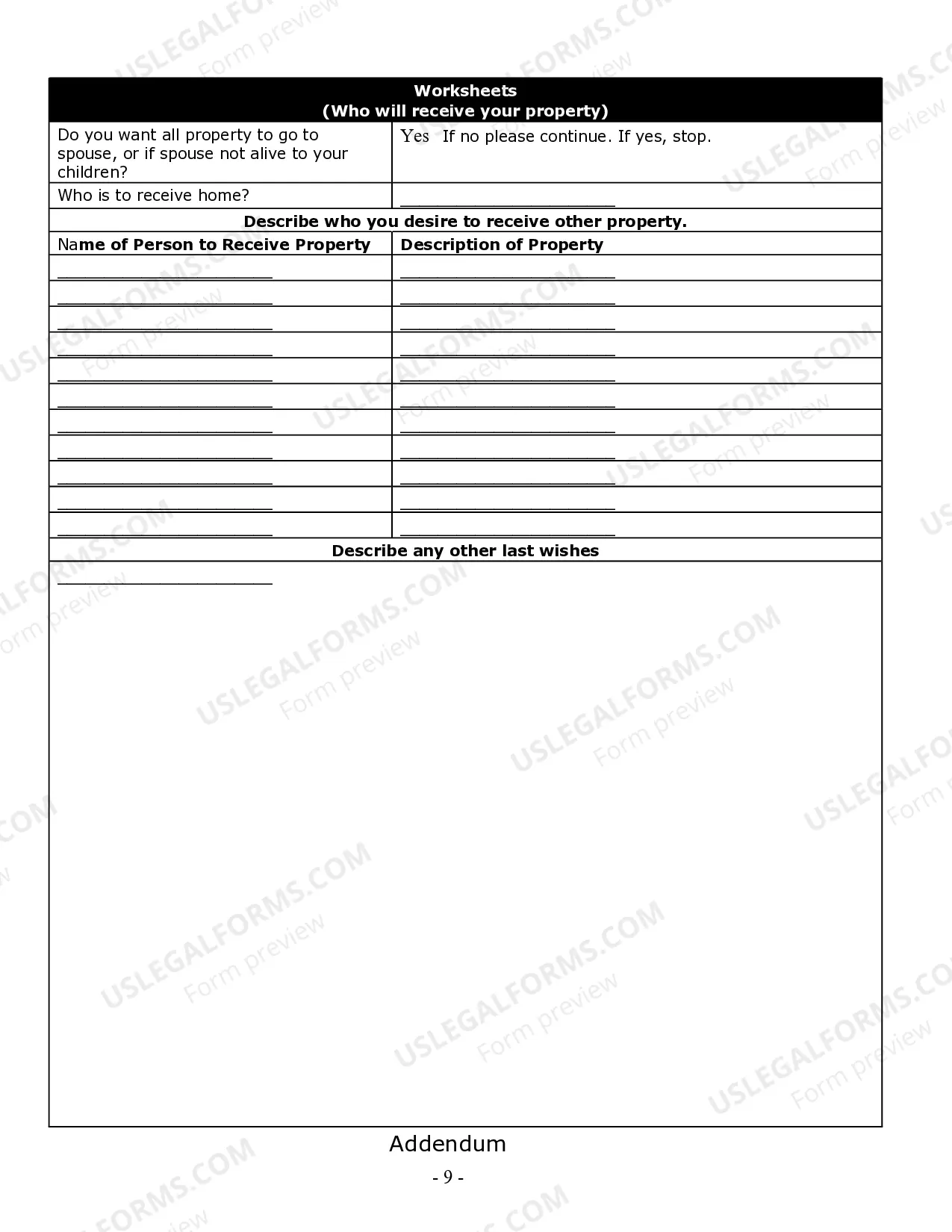

Filling out the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets involves several steps. Begin by gathering important documents like wills, trust agreements, and financial statements. As you proceed, answer each question thoroughly to ensure you cover all aspects of your estate, including assets and beneficiaries. This process helps clarify your wishes and simplifies future legal proceedings.

A significant mistake parents often make when setting up a trust fund is failing to regularly update it as circumstances change. This can lead to unintended consequences, such as outdated beneficiaries or misaligned intentions. To avoid this, utilize the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets, which can guide you through regular reviews and updates of your trust to ensure alignment with your goals.

The 5 and 5 rule applies to irrevocable trusts by permitting beneficiaries to withdraw a specified amount each year without incurring gift taxes. This measure allows efficient access to trust assets while maintaining the trust's core purpose. For detailed guidance, explore the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets, which can help clarify the implications of this rule in your estate plan.

The 5 by 5 rule allows beneficiaries of certain trusts to withdraw a portion of the trust assets each year, specifically up to the greater of $5,000 or 5% of the trust value. This rule serves as a strategic tool for wealth management, providing beneficiaries with control over their inheritance. By incorporating the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets, you can effectively navigate these rules to enrich your estate plan.

An estate planning questionnaire gathers essential information regarding your assets, beneficiaries, and wishes for your estate. Completing this document aids in the creation of a comprehensive estate plan that reflects your intentions. The Las Cruces New Mexico Estate Planning Questionnaire and Worksheets can streamline this process, ensuring you cover all critical aspects of your future planning.

The 5 or 5 rule refers to a provision in estate planning that allows a beneficiary to withdraw up to 5% of the trust’s principal each year. This option encourages flexibility and accessibility for beneficiaries when managing their inheritances. By utilizing the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets, you can explore how this rule could apply to your estate plan, tailoring it to your specific needs.

For effective estate planning, you typically need a will, durable power of attorney, and healthcare directive. Depending on your circumstances, you might require a trust to manage your assets as well. The Las Cruces New Mexico Estate Planning Questionnaire and Worksheets provide a thorough checklist to ensure that you gather all necessary documents for your estate plan.

The two key documents for preparing an estate plan are a will and a power of attorney. A will specifies how your assets should be divided, while a power of attorney allows someone to make decisions on your behalf if you become incapacitated. Both documents are essential for a comprehensive estate plan, and the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets can guide you through creating these documents.

The two main components of estate planning are asset distribution and healthcare decisions. Asset distribution involves determining how your possessions will be divided after your death. Healthcare decisions ensure that your medical preferences are respected if you become unable to communicate. Utilizing the Las Cruces New Mexico Estate Planning Questionnaire and Worksheets can help you navigate these important components.