Albuquerque New Mexico Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out New Mexico Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you are looking for a legitimate form template, it’s tough to select a more suitable platform than the US Legal Forms site – one of the largest collections online.

With this collection, you can locate a vast number of form examples for business and personal needs categorized by types and states, or keywords.

With our premium search feature, finding the latest Albuquerque New Mexico Assumption Agreement of Mortgage and Release of Original Mortgagors is as simple as 1-2-3.

Receive the template. Choose the format and download it to your device.

Make modifications. Fill out, revise, print, and sign the acquired Albuquerque New Mexico Assumption Agreement of Mortgage and Release of Original Mortgagors.

- If you are already familiar with our system and possess an account, all you require to obtain the Albuquerque New Mexico Assumption Agreement of Mortgage and Release of Original Mortgagors is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Verify that you have found the template you need. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t align with your requirements, use the Search feature at the top of the screen to find the necessary document.

- Confirm your choice. Click the Buy now option. After that, choose your preferred pricing plan and provide your details to create an account.

- Complete the financial transaction. Use your debit card or PayPal account to finish the registration process.

Form popularity

FAQ

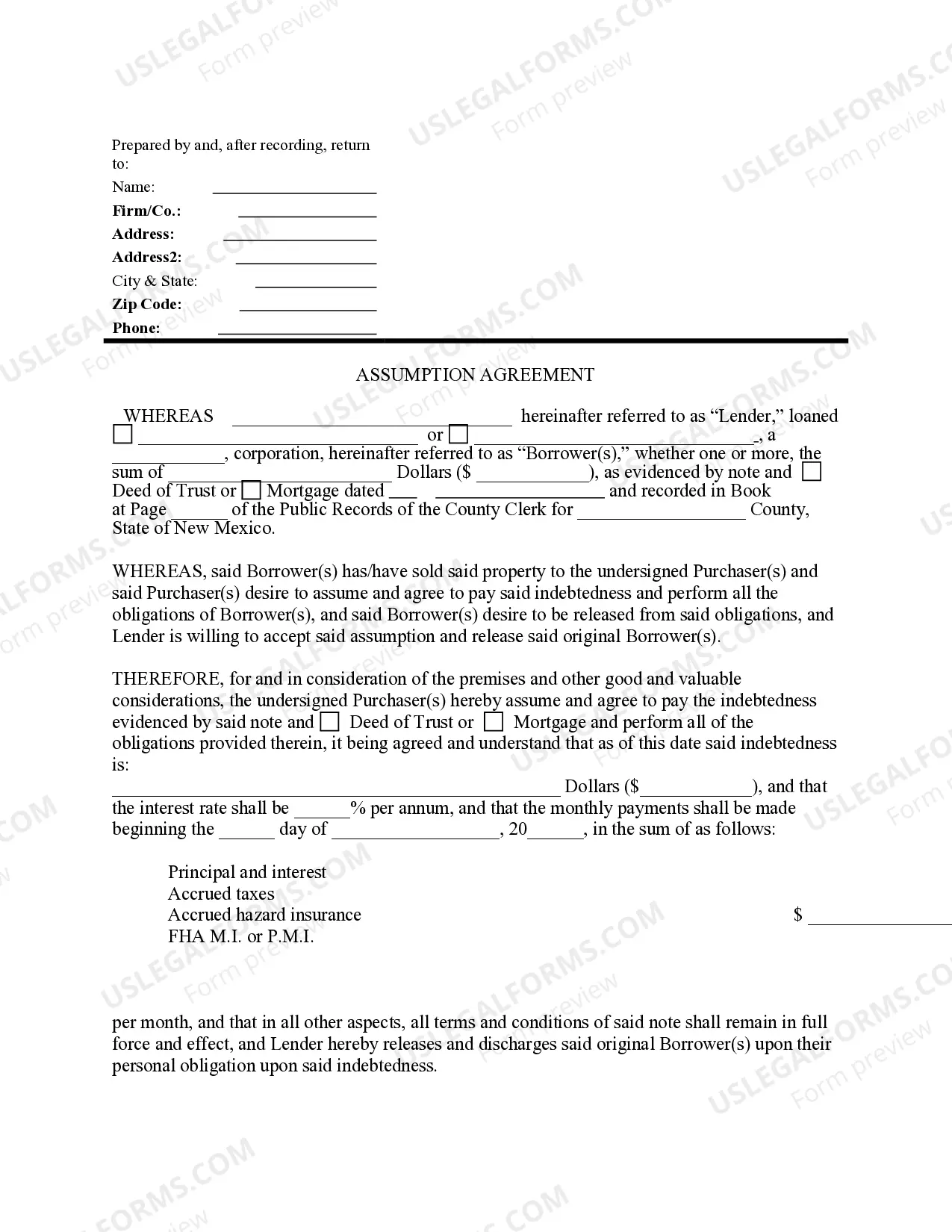

Both involve the sale of a property without paying off the underlying mortgage. With an assumption, the buyer agrees to become personally liable for any deficiency judgment upon default; subject to means the seller remains primarily liable for the note and the mortgage.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

Assumption and Release means the agreement to be entered into by ADI, the Subsidiary Borrower and the Administrative Agent pursuant to which the Subsidiary Borrower assumes all of the Obligations and becomes the ?Borrower?, in each case for all purposes of this Agreement and the other Loan Documents, and ADI is