Las Cruces New Mexico Financial Account Transfer to Living Trust

Description

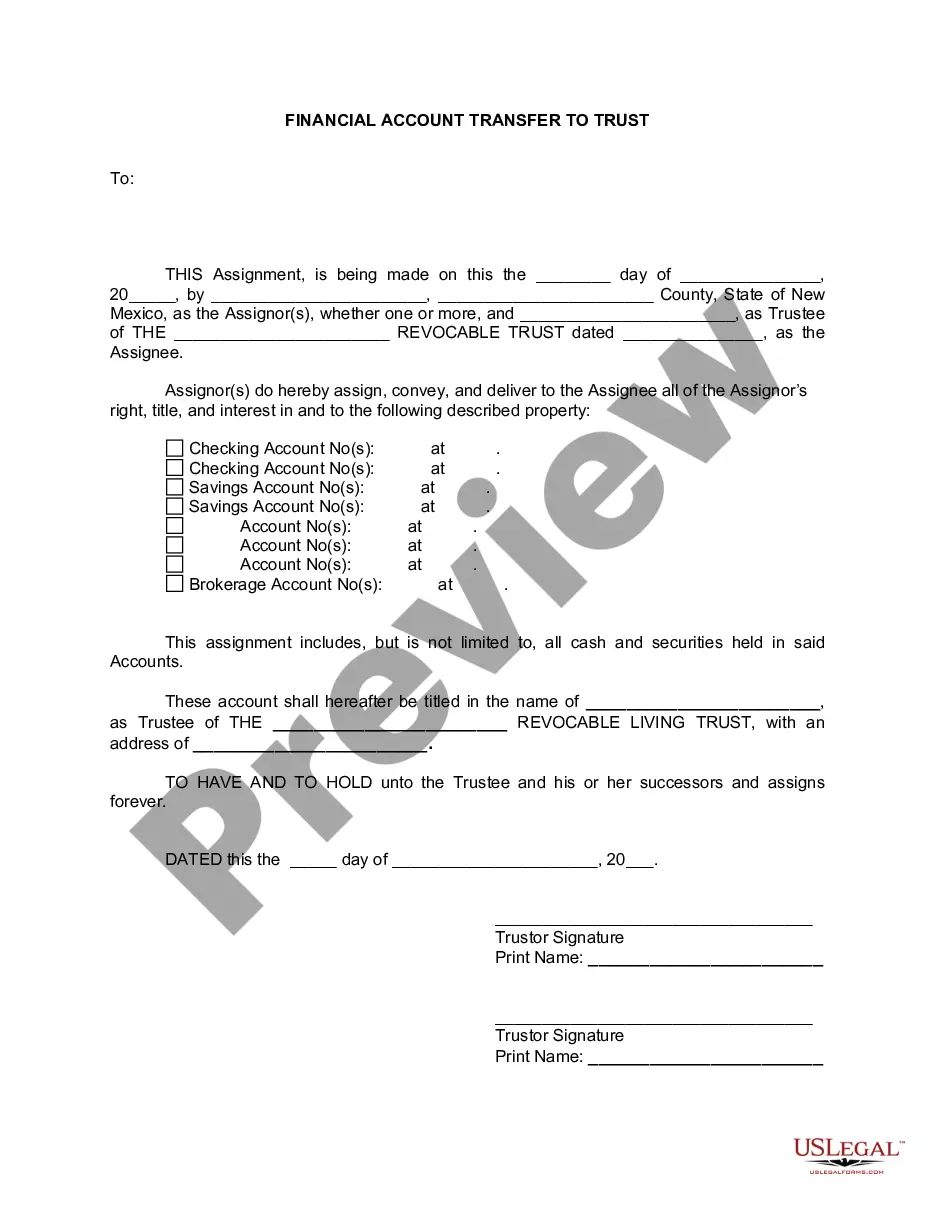

How to fill out New Mexico Financial Account Transfer To Living Trust?

Finding approved templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and business requirements and various real-life situations.

All the forms are meticulously organized by usage category and jurisdiction, making it easy for you to search for the Las Cruces New Mexico Financial Account Transfer to Living Trust with ease.

Maintain your paperwork in an organized manner and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirements just at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your needs and aligns with your local jurisdiction regulations.

- Search for another template, if necessary.

- If you find any discrepancies, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You must register for an account to access the library’s resources.

Form popularity

FAQ

One significant mistake parents often make when establishing a trust fund is failing to fund it properly. While creating the trust document is vital, it’s equally important to transfer assets, like savings or investments, into the trust. Without properly funding your trust in Las Cruces, New Mexico, your assets may not be protected or distributed as intended. Utilize US Legal Forms to streamline this process and safeguard your family's future.

To transfer your bank account to your living trust in Las Cruces, New Mexico, start by contacting your bank. Request the necessary forms to change the account ownership to your living trust. You will typically need to provide a copy of your trust document and identification. Once completed, this transfer can help ensure your assets are managed according to your wishes in your living trust.

Including bank accounts in a living trust can simplify the transfer of assets upon your passing. By utilizing a living trust, you ensure that your financial accounts in Las Cruces, New Mexico, are managed according to your wishes, without the need for probate. This can be particularly beneficial for maintaining privacy and reducing delays in asset distribution. Consider using the US Legal Forms platform for guidance on the financial account transfer to a living trust, making the process clear and seamless.

A living trust in New Mexico allows you to transfer your financial accounts and assets into a trust, which you manage during your lifetime. This means that when you pass away, your assets can be distributed to your beneficiaries without going through probate, streamlining the process. For residents considering a Las Cruces New Mexico Financial Account Transfer to Living Trust, it's an efficient way to ensure your loved ones receive their inheritance seamlessly. Additionally, setting up a living trust can provide privacy and protect your assets from potential disputes.

3 main reasons to consider putting assets in a revocable trust: Avoid probate. Retain control over your assets. Estate tax planning opportunities.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Retirement accounts definitely do not belong in your revocable trust ? for example your IRA, Roth IRA, 401K, 403b, 457 and the like. Placing any of these assets in your trust would mean that you are taking them out of your name to retitle them in the name of your trust. The tax ramifications can be disastrous.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

In short, YES, you can designate a trust as the future beneficiary of your 401(k) retirement account. Leaving your inheritance in a trust allows you to control where and how your assets are divided after your death.