Albuquerque New Mexico Living Trust for Husband and Wife with No Children

Description

How to fill out New Mexico Living Trust For Husband And Wife With No Children?

If you are looking for an authentic document, it’s unfeasible to discover a more suitable platform than the US Legal Forms site – one of the most extensive collections on the web.

Here you can locate a vast selection of templates for business and personal needs categorized by types and regions, or keywords.

With our top-notch search functionality, locating the latest Albuquerque New Mexico Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

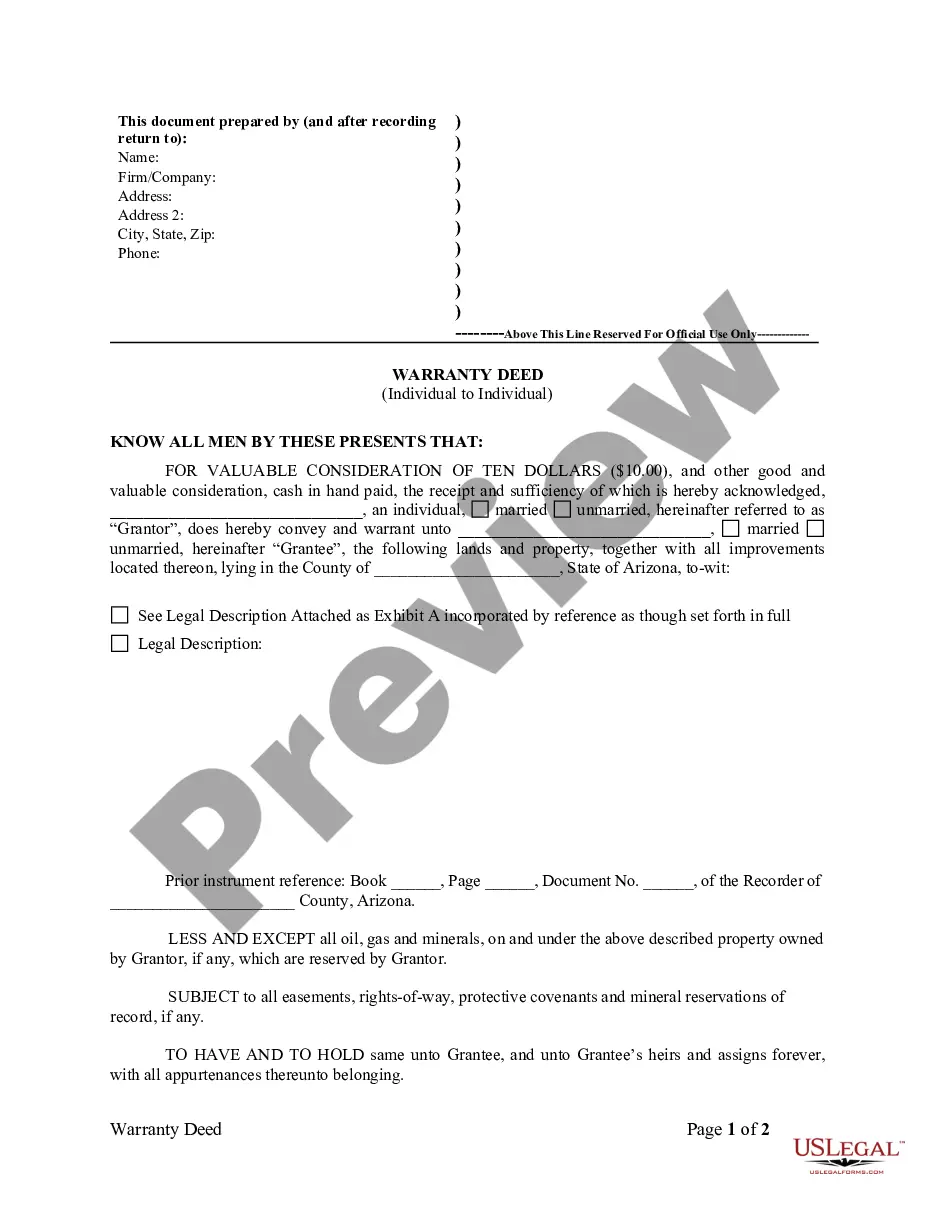

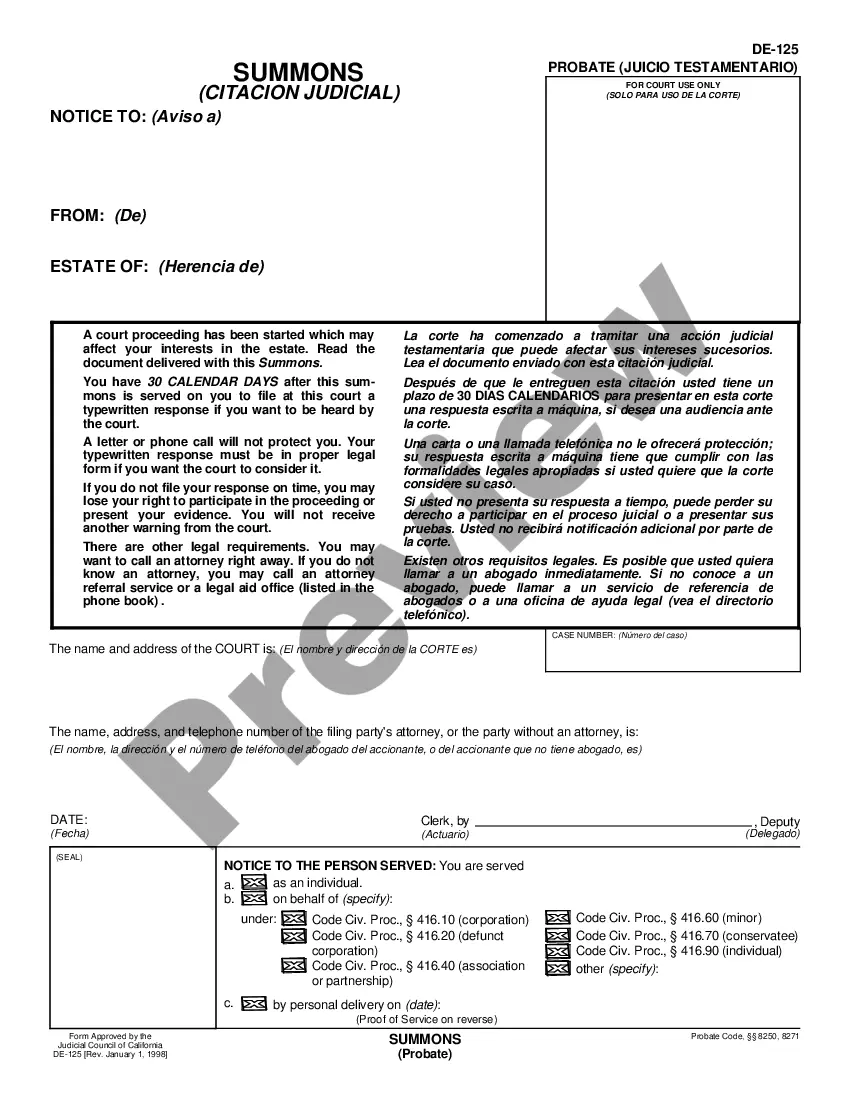

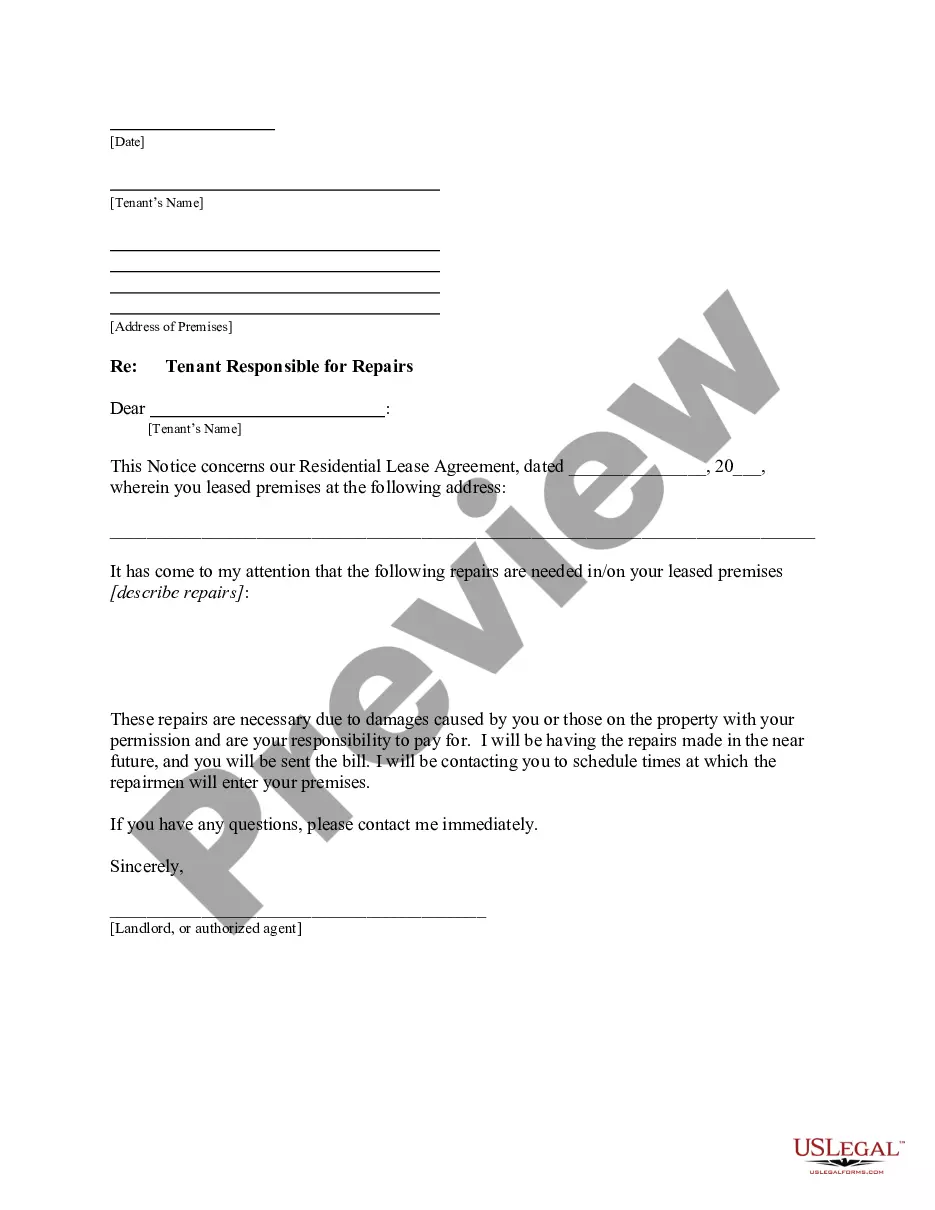

Obtain the document. Specify the file format and download it to your device. Edit. Fill in, modify, print, and sign the obtained Albuquerque New Mexico Living Trust for Husband and Wife with No Children.

- Moreover, the accuracy of each document is validated by a team of experienced attorneys who routinely review the templates on our site and refresh them to align with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Albuquerque New Mexico Living Trust for Husband and Wife with No Children is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the steps outlined below.

- Ensure you have located the template you desire. Review its description and use the Preview option (if available) to examine its contents. If it does not fulfill your needs, utilize the Search bar located at the top of the screen to find the correct document.

- Confirm your choice. Hit the Buy now button. Then, choose your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

Dying without a Will in New Mexico If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the estate of the decedent.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

§ 45-2-102 and N.M. Stat....What Next Of Kin Inherit Under New Mexico Law? Survivors of the DecedentShare of Intestate EstateParents, no spouse or children? Parents inherit entire estateSiblings only, no spouse, children, or parents? Siblings inherit entire estate6 more rows ?

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

How to Create a Living Trust in New Mexico Figure out which type of trust is best for you. If you're single, a single trust is probably what you'll want.Take inventory of your assets.Choose your trustee.Write a trust document.Sign the trust in front of a notary. Fund the trust by moving property into it.

Surviving spouse's trust refers to the trust controlled by the living spouse in an AB trust scheme. In an AB trust, a couple plans to split their assets into two trusts to limit the estate taxes incurred by their property before being given to the beneficiaries.

Traditionally, a trust would be set up in the trust creator's state of residence or in the state where the key beneficiaries reside.

A living trust, sometimes referred to as a revocable trust or inter vivos trust, is established and takes effect during your lifetime by a written document known as a trust agreement. A will is written during your lifetime, but does not take effect until after your death.

If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the estate of the decedent.

If a decedent had no children and no Will, the surviving spouse receives all of the decedent's separate property. If the decedent had children and no Will, the decedent's children (or their heirs) receive 75% of the separate property, and the surviving spouse receives 25%.