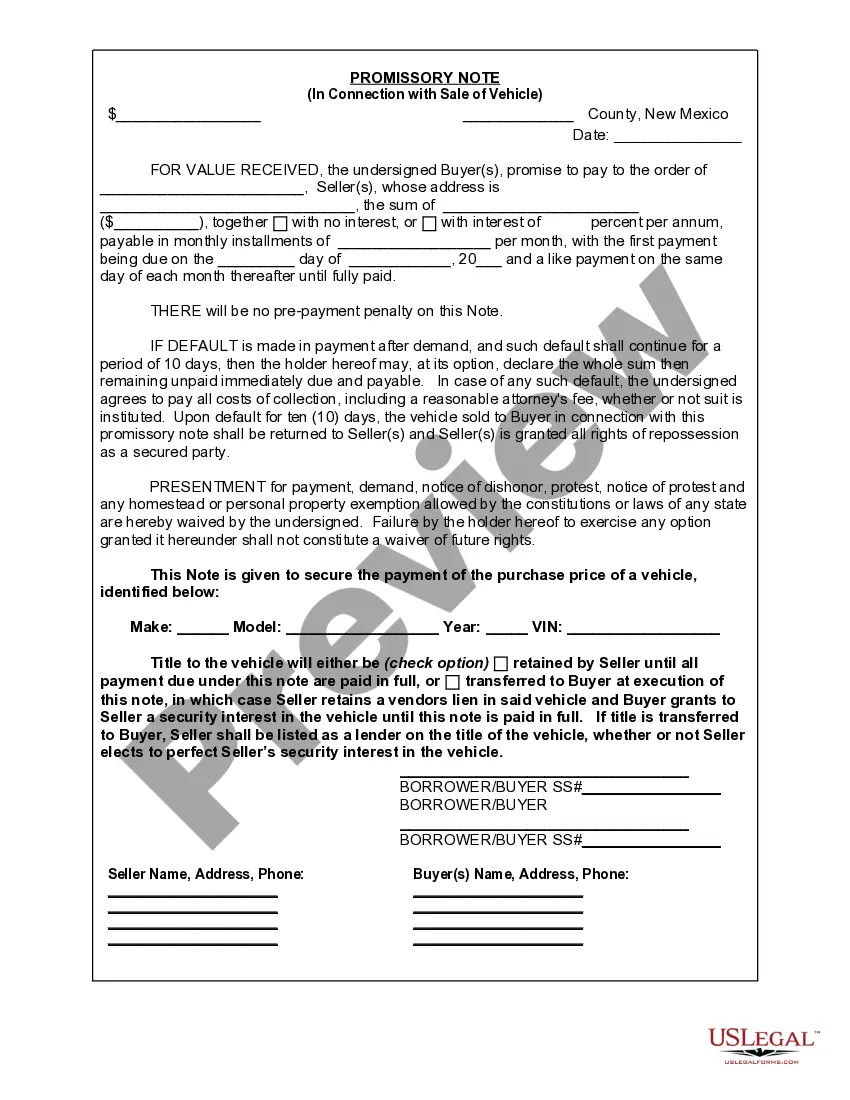

Albuquerque New Mexico Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out New Mexico Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Irrespective of social or occupational standing, filling out legal forms is an unfortunate obligation in the current environment.

It is often nearly impossible for an individual lacking any legal education to generate such documents from scratch, primarily due to the intricate terminology and legal intricacies they involve.

This is where US Legal Forms steps in to offer assistance.

Ensure the template you select is appropriate for your region since the regulations of one state do not apply to another.

Review the document and examine a brief description (if provided) of the situations for which the document is applicable.

- Our platform boasts a vast assortment of over 85,000 state-specific forms that cater to nearly every legal situation.

- US Legal Forms also acts as a valuable tool for partners or legal advisors aiming to conserve time by utilizing our DIY templates.

- Whether you require the Albuquerque New Mexico Promissory Note related to the sale of a vehicle or any other form convenient for your region, US Legal Forms has everything readily accessible.

- Here’s how you can acquire the Albuquerque New Mexico Promissory Note associated with the sale of a vehicle in just minutes using our reliable service.

- If you are already a member, you can go ahead and Log In to your account to retrieve the necessary document.

- If you're not yet familiar with our library, be sure to follow these steps before obtaining the Albuquerque New Mexico Promissory Note related to the sale of a vehicle.

Form popularity

FAQ

Promissory Notes: An Overview. Bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. Bills of exchange are more often used in international trade, whereas promissory notes are used most often in domestic trade.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame.

There is no legal requirement for promissory notes to be witnessed or notarized in New Mexico. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A seller note is a form of debt financing structured as an interest-bearing loan. In this case, the seller pays a portion of the purchase price as a promissory note, which is effectively a binding IOU. The note is a commitment that as the borrower, you will pay the amount owed through a series of debt payments.

A promissory note is a specific form of a bill of exchange with the essential difference being that a promissory note is a promise by the maker to pay whereas an 'ordinary' bill of exchange is an order to someone else to pay.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank, which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.