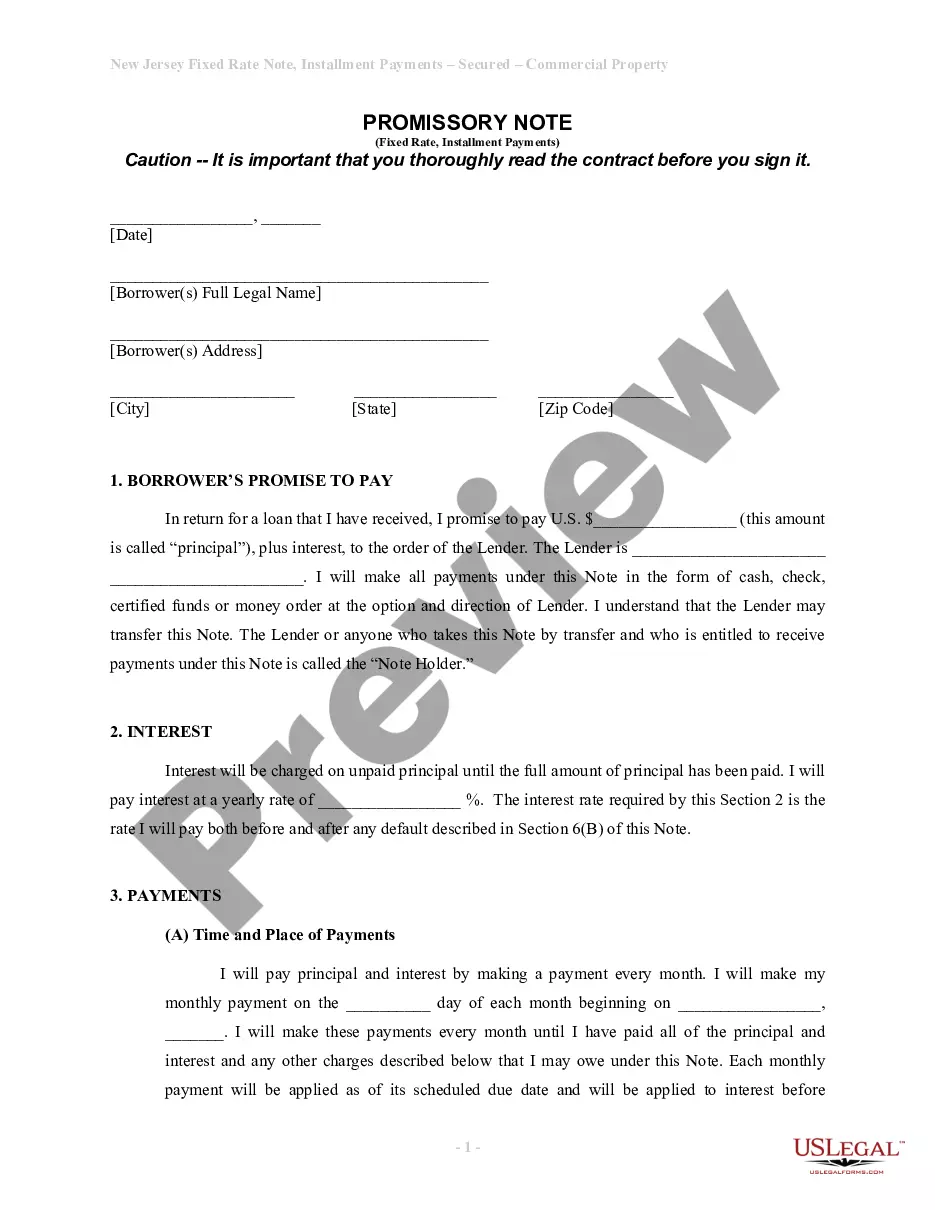

Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are seeking a legitimate form template, it’s challenging to discover a more accessible service than the US Legal Forms site – one of the largest online repositories.

Here you can obtain thousands of document examples for corporate and personal purposes categorized by type and region, or by keywords.

With the superior search functionality, locating the most current Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Choose the file format and download it to your device.

- Moreover, the relevance of each document is verified by a team of experienced attorneys who routinely assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and have an account, all you need to access the Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the sample you require. Examine its description and use the Preview feature (if available) to review its content. If it does not fulfill your needs, use the Search bar at the top of the page to find the suitable document.

- Validate your choice. Click the Buy now button. After that, select your preferred payment plan and provide details to create an account.

Form popularity

FAQ

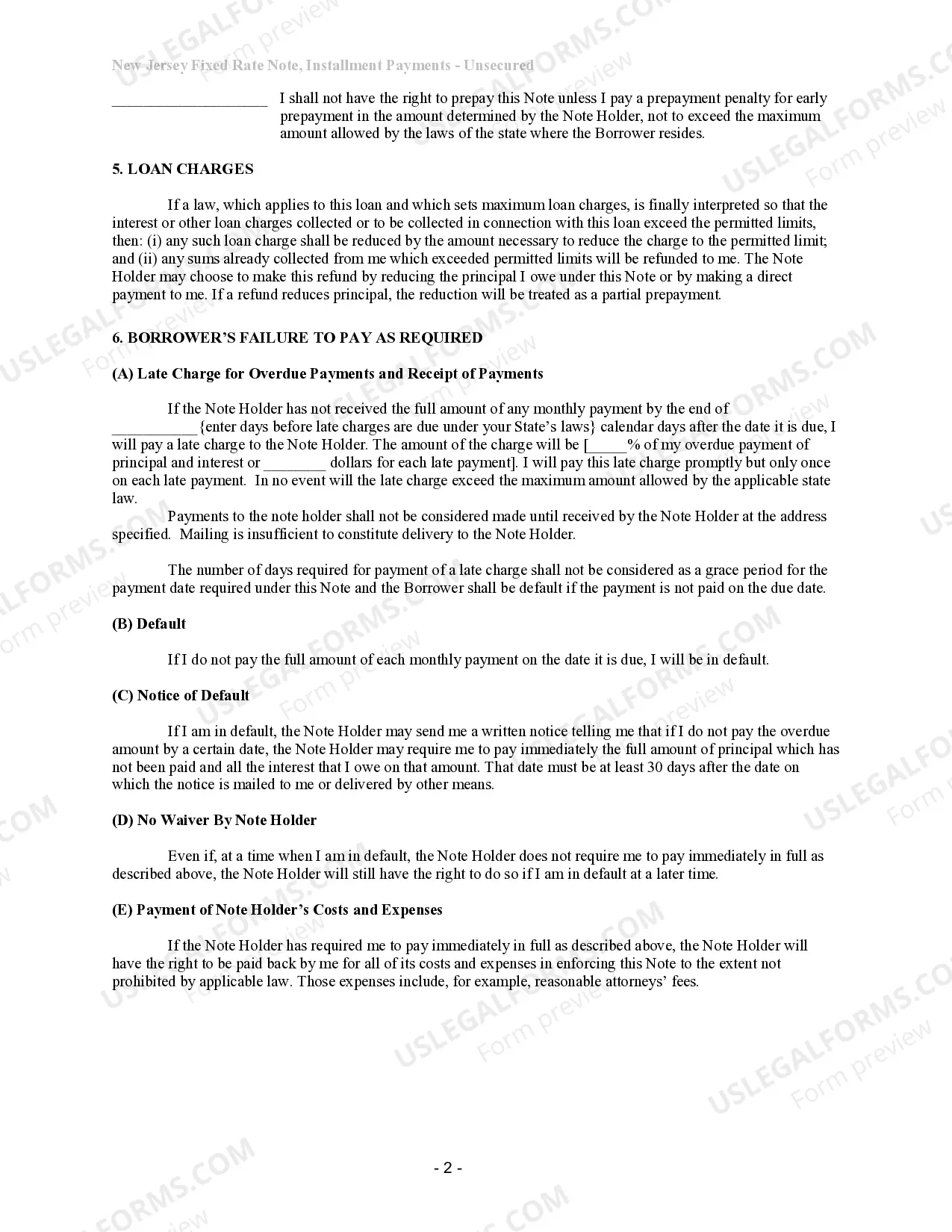

Yes, a promissory note can be legally binding without notarization. However, having a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate notarized can enhance its credibility and support enforceability in court. Notarization serves as a formal verification process, providing additional security to both parties. Still, ensuring proper completion and mutual agreement is essential for legal validity.

A reasonable interest rate for a promissory note typically varies based on current market rates and the borrower's creditworthiness. In the framework of a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, it's crucial to ensure that the rate aligns with state regulations. Generally, rates could range from 5% to 15%, but you should conduct thorough research. Understanding prevailing rates can help you negotiate better terms.

A promissory note itself is not an installment sale, but it can be used within one. An installment sale typically involves selling a product or service where payment occurs over time, with a promissory note outlining the borrower’s commitment. If you are exploring options for a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, understanding these concepts will help clarify your financial agreements.

You do not file a promissory note in any public registry, especially for unsecured notes like the Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate. Instead, keep it in a secure place alongside other financial documents. If you wish to protect your rights, discuss with a lawyer about potential steps you can take. Retaining physical documentation is crucial in safeguarding your interests.

Yes, a promissory note can be unsecured, meaning it does not require collateral to back it. The Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate falls into this category. Borrowers often prefer unsecured notes for their flexibility and simplicity. Remember, unsecured notes may involve higher interest rates due to the added risk for lenders.

In New Jersey, a promissory note, like the Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, does not generally require notarization to be enforceable. However, having it notarized can enhance its legality and offer stronger proof in disputes. Consider getting it notarized to safeguard your interests. Always check with a legal expert for the best approach.

A promissory note, including a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, does not need to be recorded in the county real estate records. However, it is advisable to keep a copy in a safe place. Recording may provide additional legal support in case of disputes. It’s always smart to consult with a legal professional for guidance.

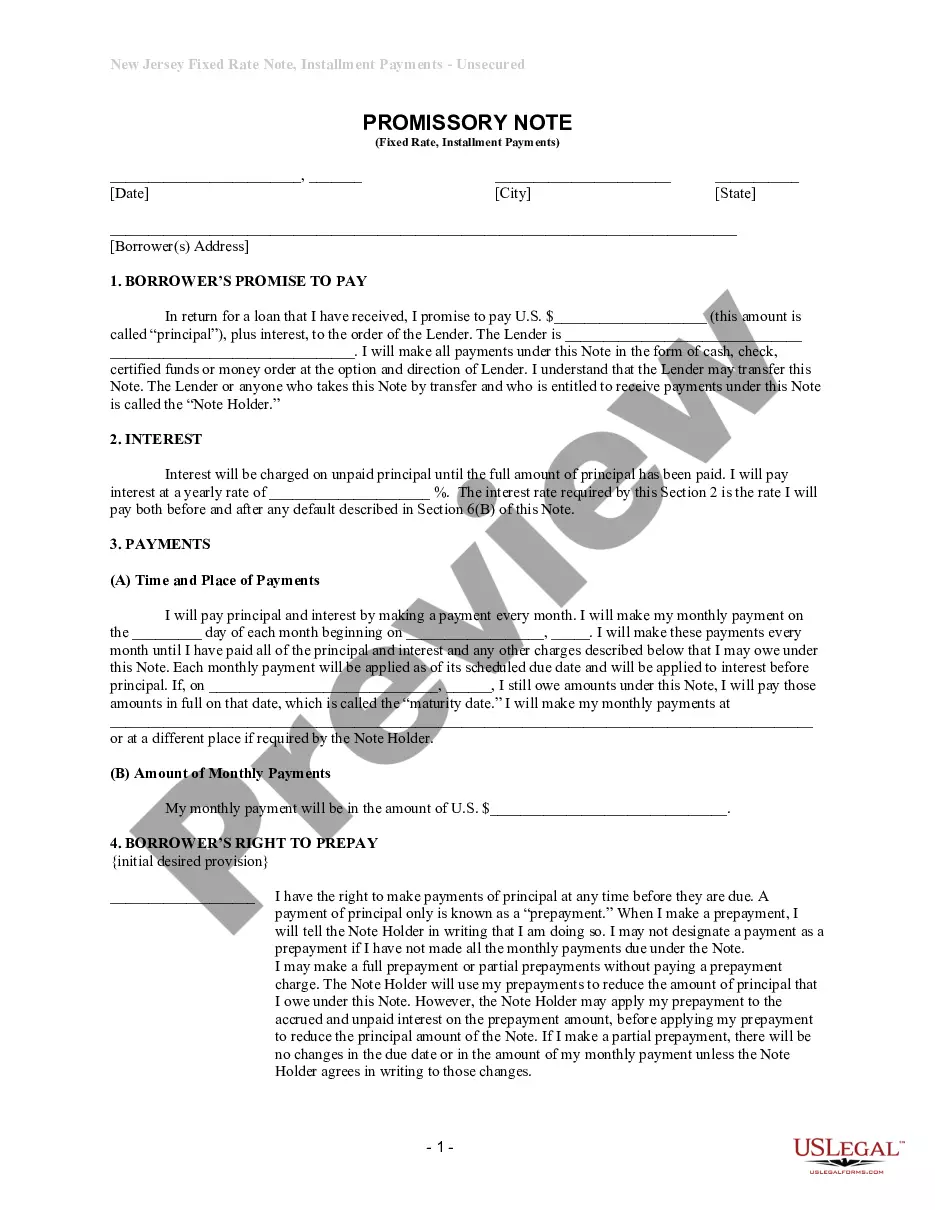

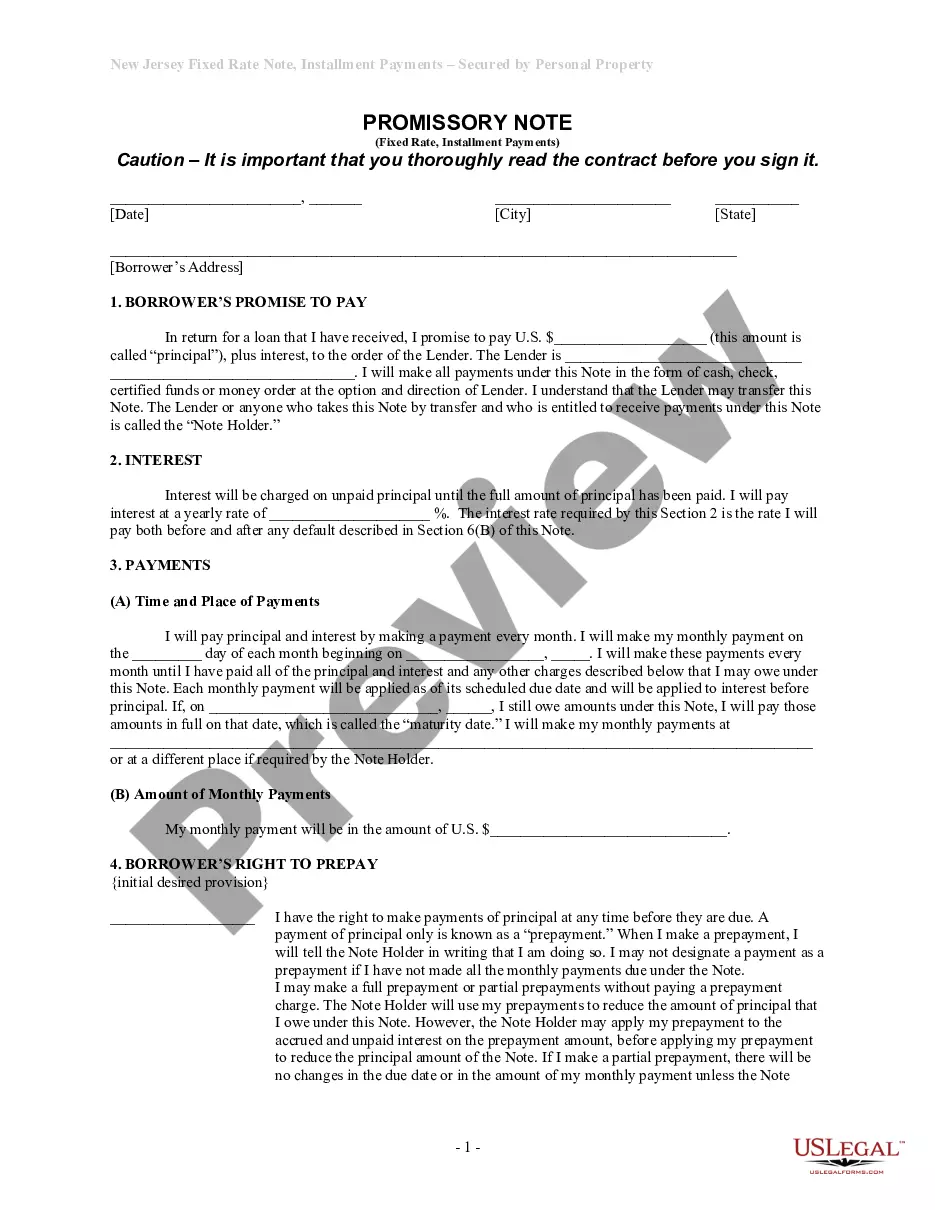

Writing a promissory note for payment requires clarity and thoroughness. Begin by including the names of the borrower and lender, the amount due, and the interest rate if applicable. Remember to outline the payment structure, especially for a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring both parties understand when and how payments will be made.

Filling out a promissory note involves including essential details such as the principal amount, interest rate, and repayment terms. For a Newark New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, ensure you clearly state the payment schedule and signature section. Utilizing a platform like uslegalforms can simplify this process, offering templates and guidance to ensure you complete the document accurately.