Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out New Jersey Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Are you searching for a trustworthy and affordable legal forms provider to obtain the Jersey City New Jersey Financial Statements solely in Relation to Prenuptial Premarital Agreement? US Legal Forms is your ultimate answer.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered. Our portal offers more than 85,000 current legal document templates for individual and business purposes. All templates provided are specialized and tailored to meet the requirements of particular states and regions.

To acquire the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Are you unfamiliar with our site? No problem. You can create an account with great ease, but prior to that, ensure to do the following.

Now you can register for your account. Next, choose the subscription option and proceed to payment. Once the payment is completed, download the Jersey City New Jersey Financial Statements solely in Relation to Prenuptial Premarital Agreement in any available format. You can return to the website anytime and redownload the document free of charge.

Obtaining current legal documents has never been simpler. Try US Legal Forms today and put an end to wasting hours researching legal papers online once and for all.

- Verify if the Jersey City New Jersey Financial Statements solely in Relation to Prenuptial Premarital Agreement complies with the regulations of your state and locality.

- Review the form’s description (if available) to determine who and what the document serves.

- Initiate the search again if the template does not meet your particular circumstances.

Form popularity

FAQ

It's advisable to wait at least a few days after signing a prenuptial agreement before proceeding with the wedding. This period allows both parties to reflect on the terms and ensure they fully understand their rights and obligations. By considering Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can approach their marriage with clarity. Utilizing platforms such as USLegalForms can further streamline this process and enhance understanding.

The cool down period for a prenuptial agreement is a time designed to help couples prevent hasty decisions regarding their financial future. This period, often overlapping with the signing process, emphasizes careful consideration. When engaging with Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, couples may find it beneficial to utilize resources like USLegalForms. Such tools can simplify understanding complex financial implications.

The 7-day rule for prenuptial agreements serves as a protective measure for both parties. This rule suggests that couples should not sign the agreement under duress, allowing a minimum of seven days to digest the terms. In conjunction with Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, this rule ensures informed decision-making. Taking time to reflect on the agreement fosters mutual understanding and respect.

The 7 day rule for prenuptial agreements refers to the guideline that encourages couples to review their prenup at least seven days before their wedding. This timeframe allows for adequate consideration and reflection on the financial commitments outlined in the agreement. By understanding Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, couples foster transparency and trust. It is vital to ensure that both parties feel comfortable and informed.

The premarital agreement statute in New Jersey is outlined in the New Jersey Uniform Premarital Agreement Act. This statute allows couples to create binding agreements regarding financial matters and other issues that may arise during marriage. To meet the statute's requirements, it is advisable to include Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring that both parties understand their financial rights and obligations.

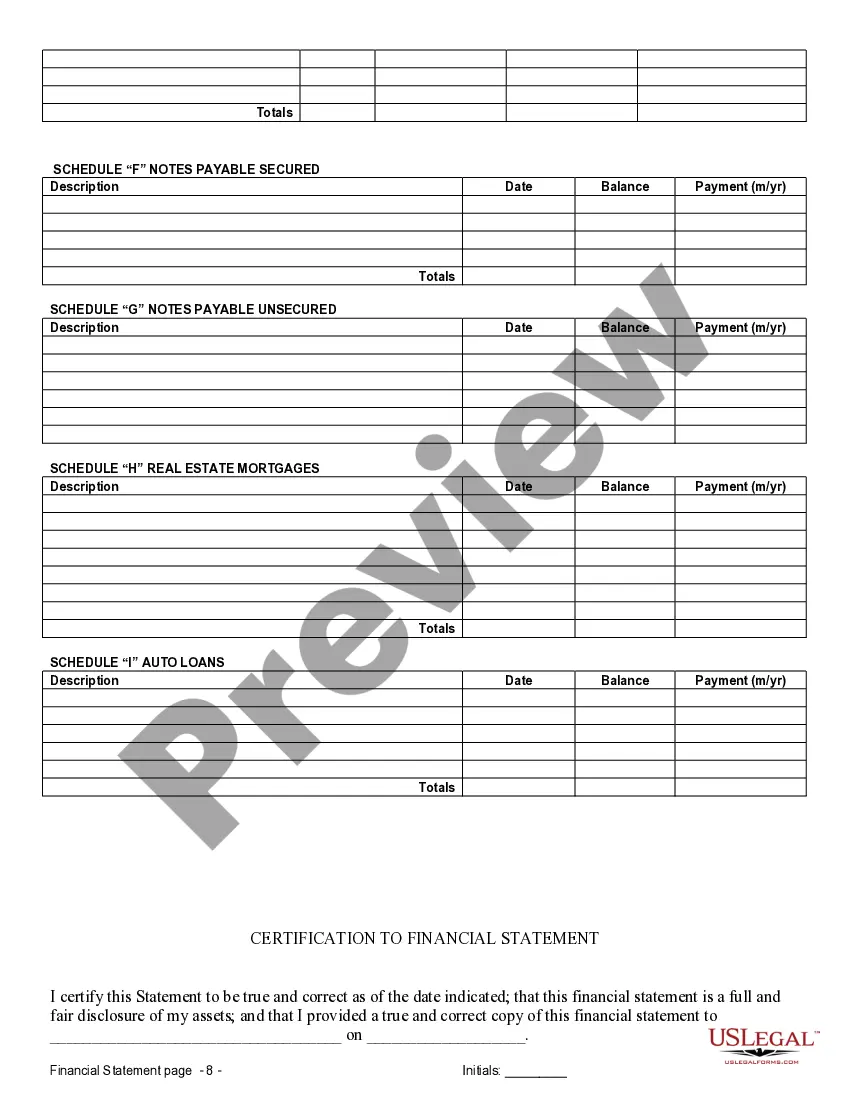

Yes, prenuptial agreements are enforceable in New Jersey, provided they meet specific legal standards. For a prenuptial agreement to hold up in court, both parties must fully disclose their financial information, including Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement. It's essential to have a well-drafted document that complies with state laws to ensure enforceability in the event of a dispute.

A prenup does not protect against situations such as child support or spousal support, as courts often prioritize the best interest of children and ensure fairness in support cases. It also cannot shield one from debts incurred during the marriage or a party's own misconduct, such as cheating. When addressing these matters, Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement may provide partial guidance. Consulting a qualified attorney helps clarify these limitations.

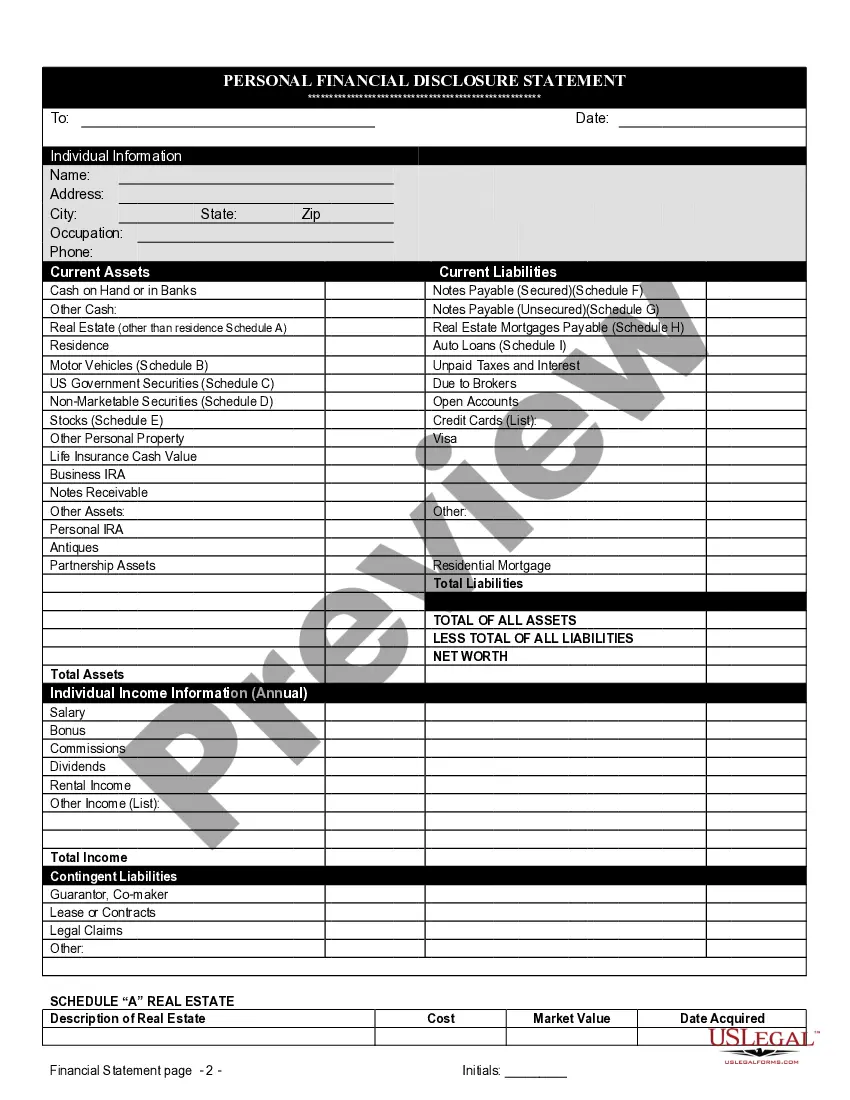

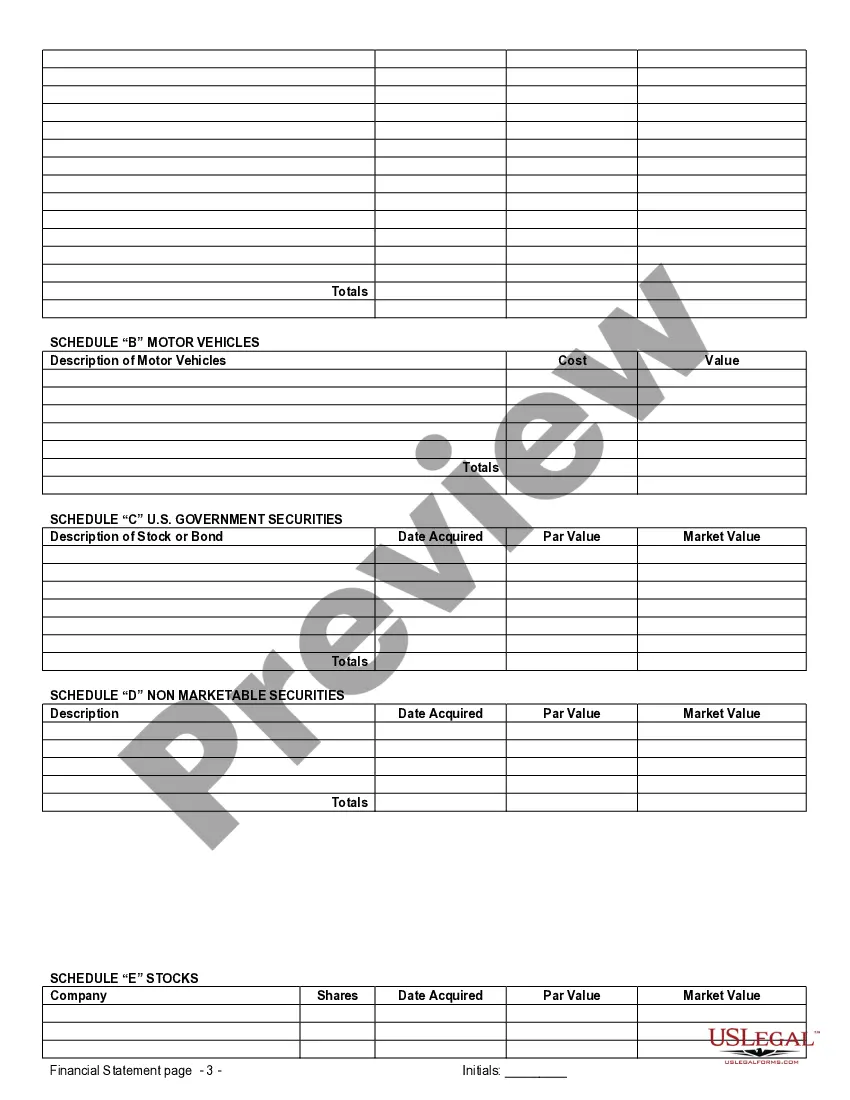

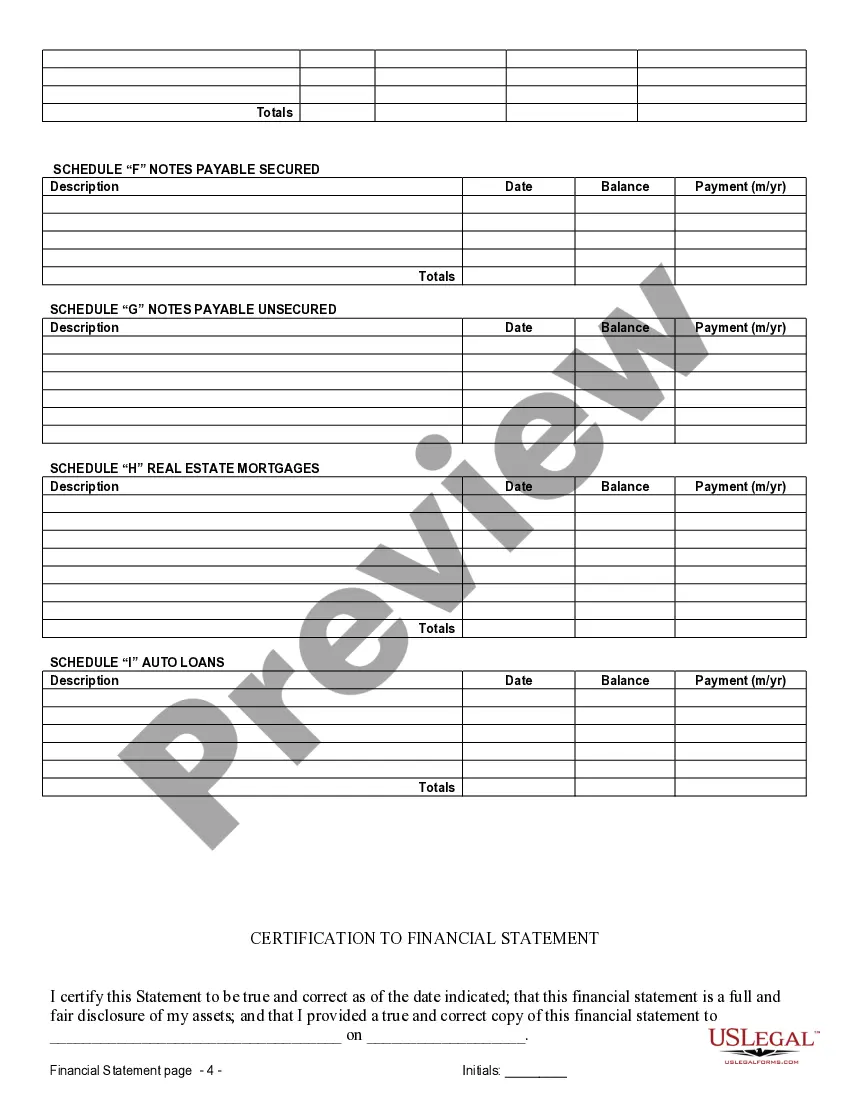

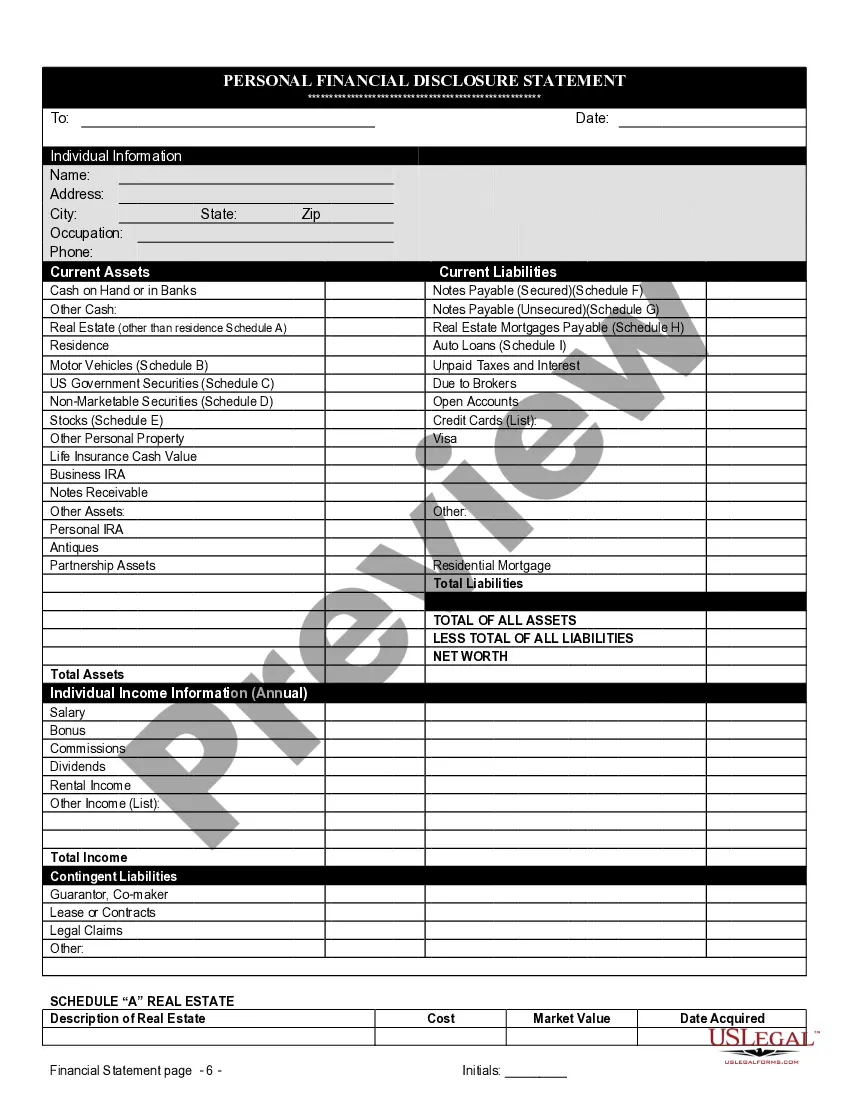

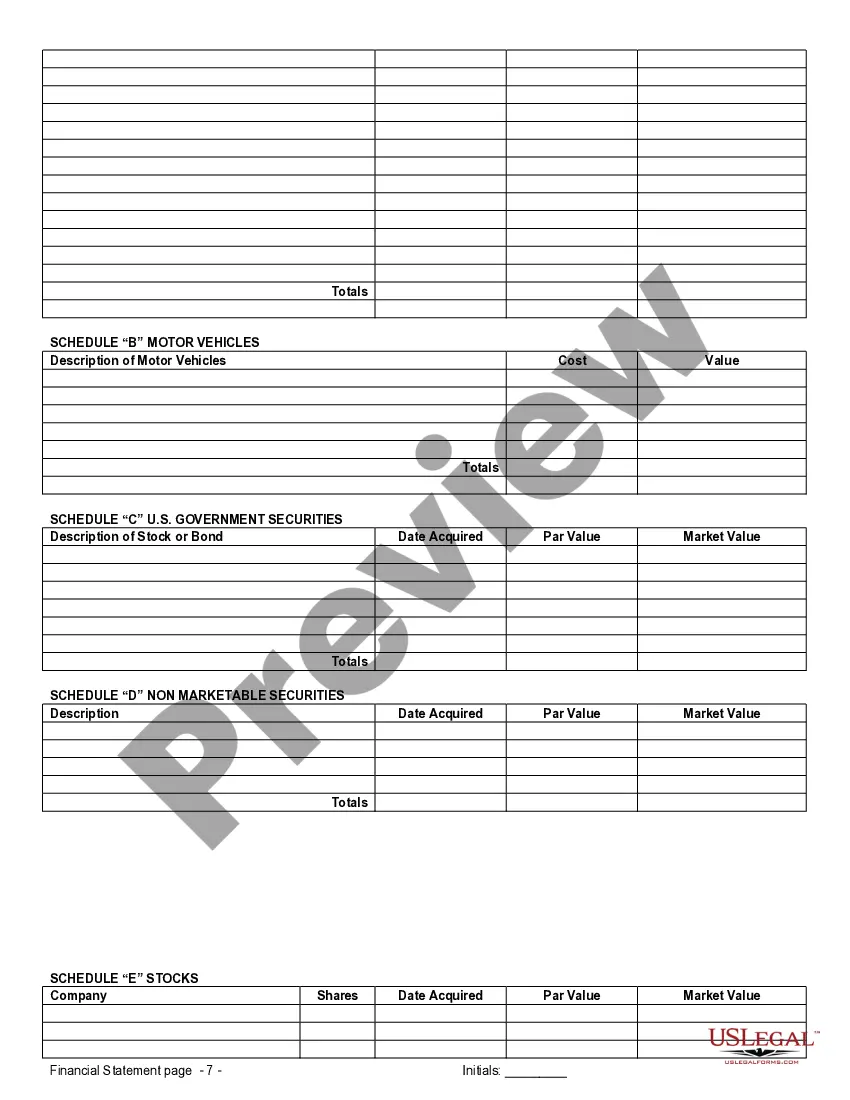

The financial statement of a prenuptial agreement details each partner's assets, liabilities, income, and expenses. This statement serves as a foundation for outlining financial rights and obligations in the agreement. By incorporating Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, you can ensure that all financial aspects are clearly presented. This transparency fosters trust and aids in future decision-making.

Prenuptial agreements primarily focus on assets acquired before marriage, but they can also include terms regarding future earnings and obligations. This allows couples to protect their investments and income earned during the union as well. By employing Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement, you can tailor the agreement to cover both premarital and marital assets adequately. This versatility can lead to stronger financial security.

One common loophole in a prenuptial agreement arises from lack of full financial disclosure by one party. If a partner fails to reveal significant assets or debts, the agreement may be challenged in court. Utilizing Jersey City New Jersey Financial Statements only in Connection with Prenuptial Premarital Agreement can mitigate this risk by emphasizing transparency. Always ensure full disclosure during the negotiation process to avoid potential pitfalls.