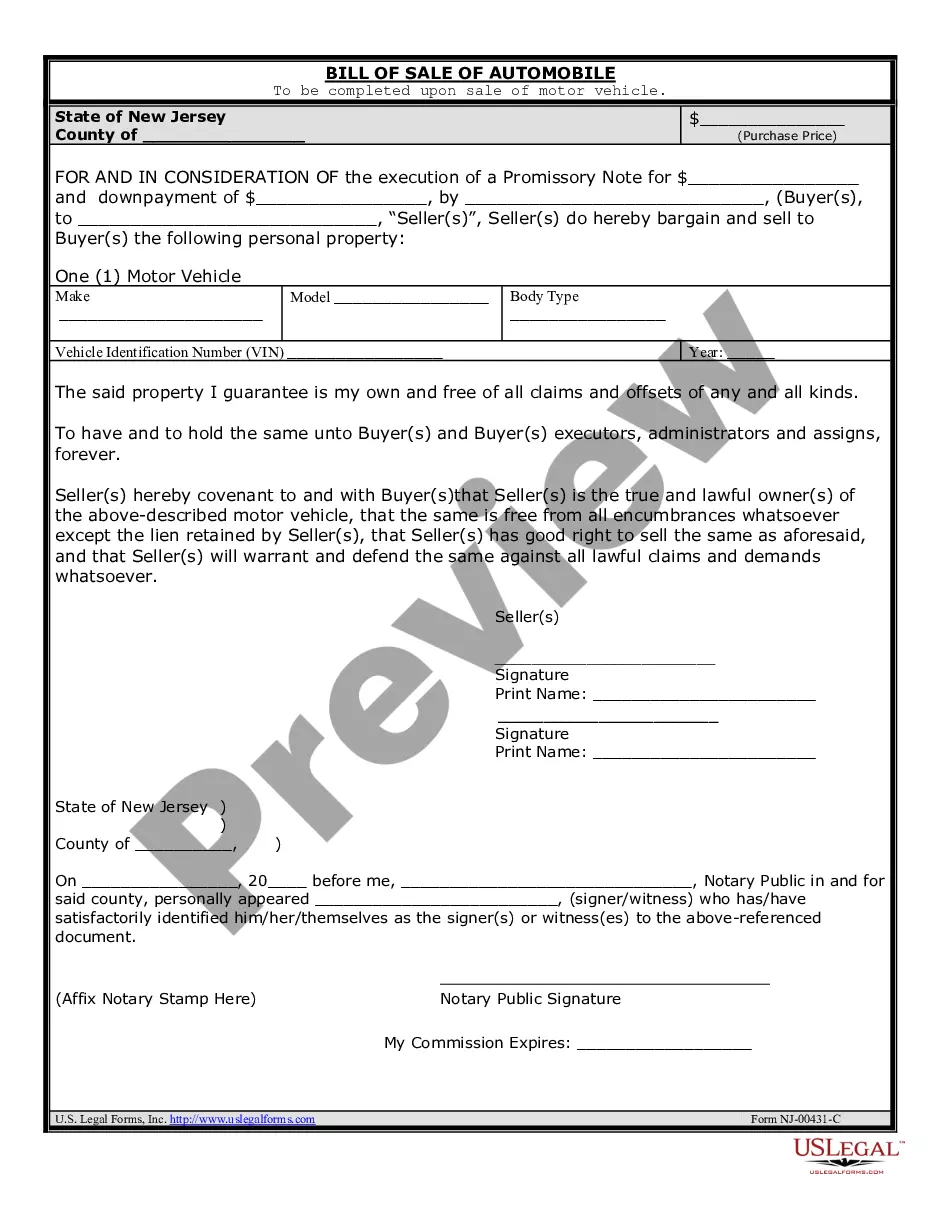

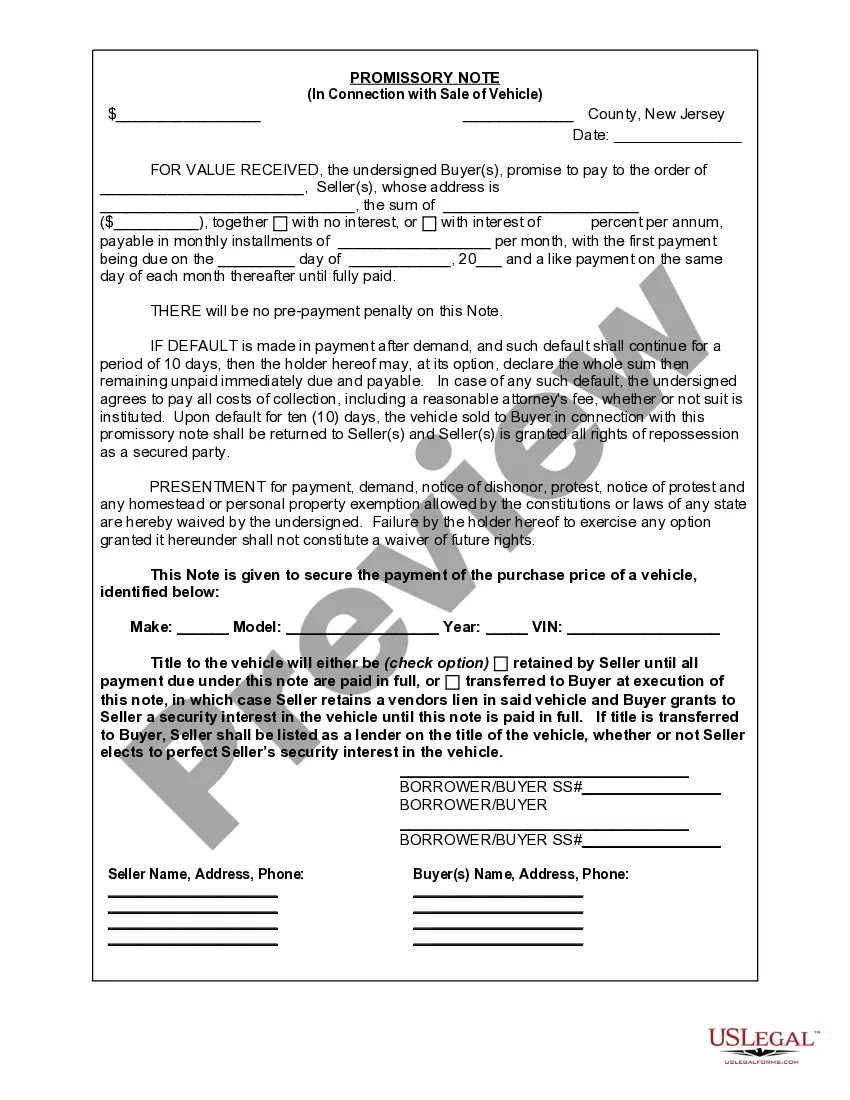

A Jersey City New Jersey promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement. It serves as proof of the borrower's promise to repay the borrowed amount to the lender within a specified period of time. This type of promissory note is specifically designed for vehicle sales within the Jersey City area. Keywords: Jersey City, New Jersey, promissory note, sale of vehicle, automobile, loan agreement, borrowed amount, lender, repayment, specified period of time. There are several types of Jersey City New Jersey promissory notes in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of promissory note establishes a specific duration within which the borrowed amount must be repaid. It outlines the repayment schedule, including the amount due each month and the interest rate applied. 2. Installment Promissory Note: This promissory note requires the borrower to make regular installment payments towards the loan, rather than repaying the entire amount at once. The note specifies the number of installments, their frequency, and the interest rate. 3. Balloon Promissory Note: A balloon note defers a significant portion of the loan's principal balance to the end of the loan term, resulting in lower monthly payments. However, the remaining amount is due in one lump sum, which can be an effective way to reduce monthly repayment burdens. 4. Secured Promissory Note: This type of promissory note is backed by collateral, typically the vehicle being sold. In the event of borrower default, the lender has the right to repossess the vehicle to satisfy the outstanding debt. 5. Unsecured Promissory Note: An unsecured note lacks collateral to secure repayment. Therefore, the lender is relying solely on the borrower's promise to repay. To mitigate the risk, an unsecured promissory note often includes a higher interest rate. It's important for both the borrower and the lender to thoroughly understand the terms specified in a Jersey City New Jersey promissory note in connection with the sale of a vehicle or automobile. Consulting with a legal professional is advisable to ensure compliance with local laws and regulations.

Jersey City New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Jersey City New Jersey Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are searching for a valid form, it’s difficult to find a more convenient service than the US Legal Forms website – one of the most extensive online libraries. With this library, you can get thousands of document samples for organization and personal purposes by types and states, or key phrases. With our high-quality search function, finding the most recent Jersey City New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile is as easy as 1-2-3. Moreover, the relevance of every document is proved by a group of expert lawyers that regularly review the templates on our website and update them according to the latest state and county laws.

If you already know about our system and have a registered account, all you need to get the Jersey City New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the form you need. Read its explanation and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the appropriate file.

- Affirm your decision. Click the Buy now button. Next, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Indicate the format and save it on your device.

- Make changes. Fill out, revise, print, and sign the acquired Jersey City New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile.

Every single template you add to your user profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to receive an extra version for modifying or creating a hard copy, feel free to return and export it once more at any time.

Take advantage of the US Legal Forms professional collection to get access to the Jersey City New Jersey Promissory Note in Connection with Sale of Vehicle or Automobile you were seeking and thousands of other professional and state-specific samples on a single platform!