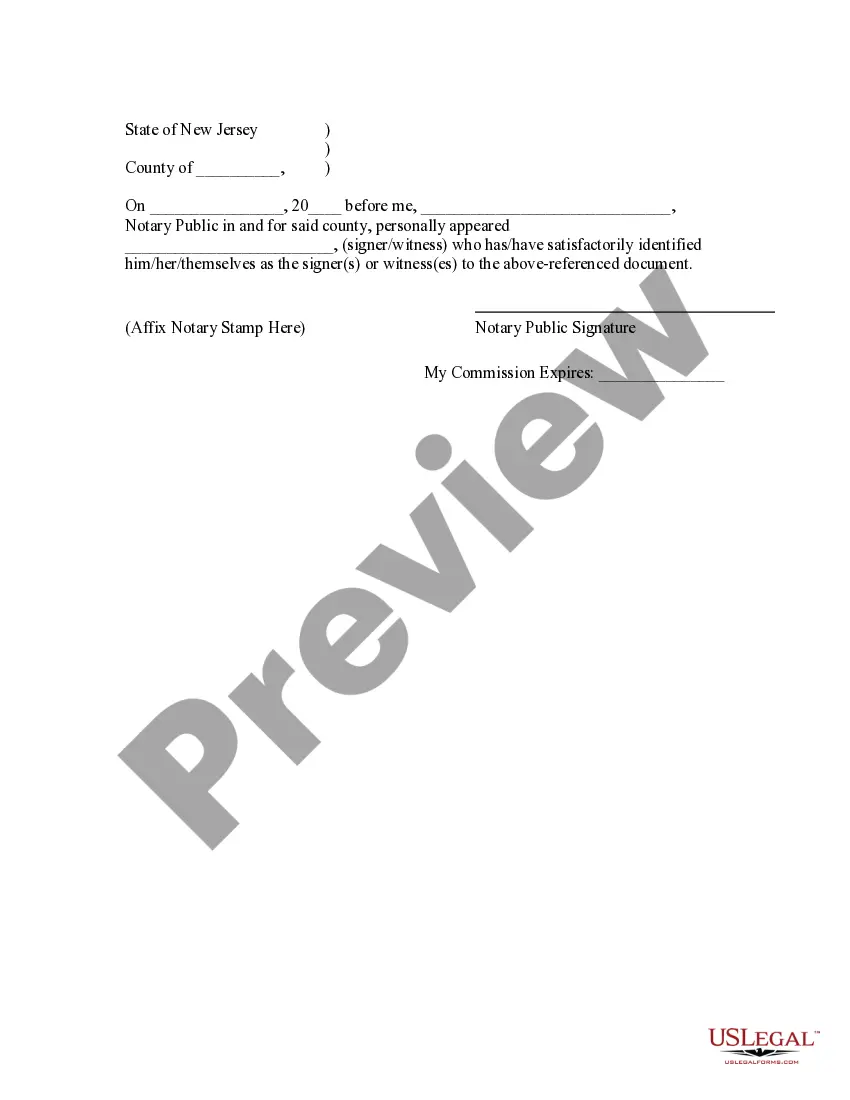

Paterson Disclaimer of Right to Inherit or Inheritance — New Jersey: A Comprehensive Guide In the state of New Jersey, individuals have the option to disclaim their right to inherit or refuse an inheritance through a legal process known as a Paterson Disclaimer of Right to Inherit or Inheritance. This legally binding act allows individuals to formally reject an inheritance, thereby preventing them from being obligated to assume any associated debts or responsibilities. Key Points: 1. What is a Paterson Disclaimer of Right to Inherit or Inheritance? 2. Reasons to Consider a Paterson Disclaimer of Right to Inherit or Inheritance 3. Process and Requirements for a Paterson Disclaimer of Right to Inherit or Inheritance 4. Different Types of Paterson Disclaimer of Right to Inherit or Inheritance 1. What is a Paterson Disclaimer of Right to Inherit or Inheritance? A Paterson Disclaimer of Right to Inherit or Inheritance is a legal procedure that allows beneficiaries to officially reject any interest or claim to an inheritance. By disclaiming their right to inherit, individuals can avoid the potential burden of inherited debts, liabilities, or unwanted assets. 2. Reasons to Consider a Paterson Disclaimer of Right to Inherit or Inheritance: a. Estate Planning: Disclaiming an inheritance can be a strategic estate planning tool to ensure the assets pass directly to intended beneficiaries or minimize potential taxes. b. Financial Stability: Inherited debts or liabilities can negatively impact an individual's financial stability. By disclaiming, they can protect their own assets. c. Personal Preferences: Some individuals might simply not want to inherit certain assets or have personal reasons for disclaiming. 3. Process and Requirements for a Paterson Disclaimer of Right to Inherit or Inheritance: a. Time Limit: In New Jersey, a disclaimer must be made within nine months from the date of death of the decedent. b. Written Document: The disclaimer must be in writing and signed by the disclaim ant. c. No Acceptance: To disclaim ant should not have benefited in any way from the inheritance they wish to disclaim. d. Legal Validation: The disclaimer document must meet specific legal requirements to be considered valid. 4. Different Types of Paterson Disclaimer of Right to Inherit or Inheritance: While there are no specific types of Paterson Disclaimer of Right to Inherit or Inheritance in New Jersey, disclaimers can be classified based on the circumstances or assets involved, such as: a. Debt Disclaimers: Individuals may disclaim an inheritance to avoid assuming substantial debts associated with the estate. b. Real Estate Disclaimers: This involves rejecting inherited properties, land, or buildings. c. Cash or Financial Disclaimers: Disclaiming monetary inheritances, including bank accounts, investments, or assets held in trust. In conclusion, a Paterson Disclaimer of Right to Inherit or Inheritance in New Jersey is a legal process that grants individuals the right to disclaim an inheritance fully or partially. By taking this step, individuals can protect themselves from unwanted financial obligations, liabilities, or assets. It is important to consult with an experienced attorney to navigate the legal complexities and ensure proper compliance.

Paterson New Jersey Disclaimer of Right to Inherit or Inheritance

Description

How to fill out Paterson New Jersey Disclaimer Of Right To Inherit Or Inheritance?

Do you need a trustworthy and affordable legal forms supplier to get the Paterson Disclaimer of Right to Inherit or Inheritance - New Jersey? US Legal Forms is your go-to option.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Paterson Disclaimer of Right to Inherit or Inheritance - New Jersey conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Paterson Disclaimer of Right to Inherit or Inheritance - New Jersey in any provided format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online once and for all.

Form popularity

FAQ

To disclaim inheritance in New Jersey, you must complete a formal disclaimer document outlining your decision. You should file this document with the probate court or the estate's executor within the required timeframe. This process ensures that your renunciation is legally recognized, preventing you from inheriting any assets. For a smoother experience, consider US Legal Forms, which provides templates and guidance for effective disclaimers.

In New Jersey, the rules for disclaiming inheritance include filing a disclaimer with the appropriate court or estate executor. Additionally, you must do so within nine months of the deceased’s passing. This disclaimer must express your intention to renounce your share, and it's crucial to comply with specific state laws to avoid complications. Utilizing platforms like US Legal Forms can simplify this process and help you adhere to legal requirements.

Yes, you can renounce an inheritance in New Jersey. This legal act allows individuals to refuse any rights to inherit assets from a deceased relative. The process is often referred to as a disclaimer of right to inherit or inheritance. To proceed, you should consult legal guidance and consider using resources like US Legal Forms to ensure that you complete the process correctly.

The rules for disclaiming an inheritance in New Jersey require that your disclaimer is made in writing and delivered to the executor or the probate court. The disclaimer must be made within nine months of the decedent's passing and cannot be conditional. Understanding the specific stipulations of the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance is essential to ensure that your disclaimer is valid and effective.

To disclaim an inheritance in New Jersey, you must submit a formal disclaimer that complies with state laws. This includes filing a written document that clearly states your decision not to accept the inheritance. Using resources like the uslegalforms platform can help you access templates and legal guidance regarding the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance process.

A qualified disclaimer in Paterson must meet certain criteria outlined in New Jersey law. The disclaimer must be in writing, declare your intent not to accept the inheritance, and be submitted within nine months of the decedent's death. Additionally, the disclaimer should not be contingent upon any conditions or qualifications to ensure compliance with the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance requirements.

Writing a disclaimer letter for inheritance requires a clear and straightforward approach. Begin with your personal information and detail your relationship to the decedent. Clearly indicate your decision to disclaim the inheritance, referencing the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance, to validate the document and ensure your intentions are understood.

To write an inheritance disclaimer letter, start by clearly stating your intention not to accept the inheritance. Include your name, the decedent’s name, and a statement that specifies your refusal based on the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance laws. Also, ensure you sign the document and provide a copy to the executor or administrator of the estate.

In Paterson, New Jersey, inheritance does not necessarily need to be declared to anyone, but you must understand the legal implications of accepting an inheritance. You must consider tax obligations and any debts associated with the estate. If you choose to disclaim your right to inherit, discussing the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance with a legal professional is crucial.

To write a beneficiary disclaimer letter, begin with a clear introduction stating your intent to disclaim your inheritance. Include your full name, the decedent's name, and a precise description of what you are declining. Conclude with your signature and date. For more comprehensive guidance and examples relating to the Paterson New Jersey Disclaimer of Right to Inherit or Inheritance, refer to US Legal's resources.