A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner

Description

How to fill out New Hampshire Guaranty Attachment To Lease For Guarantor Or Cosigner?

We consistently endeavor to reduce or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek attorney services that are often exceedingly expensive. Nonetheless, not all legal challenges are of the same complexity. Most can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our library enables you to manage your affairs without resorting to an attorney. We grant access to legal document templates that aren’t always publicly accessible.

Utilize US Legal Forms whenever you need to locate and download the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner or any other document swiftly and securely. Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always re-download it from the My documents tab.

Once you’ve confirmed that the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner is suitable for your circumstances, you can select a subscription plan and make a payment. Afterwards, you can download the form in any appropriate file format. For over 24 years, we’ve assisted millions by providing customizable and up-to-date legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- The procedure is equally simple if you’re a newcomer to the website!

- You can establish your account in a matter of minutes.

- Ensure that the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner complies with the laws and regulations of your state and locality.

- Additionally, it’s vital to review the form’s description (if available), and if you notice any inconsistencies with what you were initially seeking, look for a different form.

Form popularity

FAQ

Yes, your landlord can require a rent guarantor, especially if they consider you to be a higher risk tenant due to insufficient credit or income. This requirement acts as a safety net for the landlord and can also protect you in case of financial hiccups. To understand your rights and obligations, reviewing the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner is advised. If you need assistance, platforms like USLegalForms can provide valuable resources and templates.

While not every person on a lease may need a guarantor, landlords often request this as a security measure for higher-risk tenants. If one tenant has a strong credit history and income, they might not need a guarantor, while others may. Knowing the requirements for the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner helps you prepare accordingly. Always check with your landlord for specific requirements related to your lease.

The main difference between a co-signer and a guarantor lies in their level of responsibility. A co-signer shares equal responsibility for the lease from the start, while a guarantor only becomes liable if the tenant defaults. It's important to understand this distinction, especially when discussing the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner. This knowledge can help you choose the best option for your rental agreement.

Not every tenant is required to have a cosigner, but many landlords prefer this assurance, especially for first-time renters or those with limited credit histories. Whether a cosigner is necessary often depends on individual circumstances, such as income level and credit history. If you fall under the category of needing a cosigner, familiarize yourself with the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner for clarity. It can make the process easier for both you and your landlord.

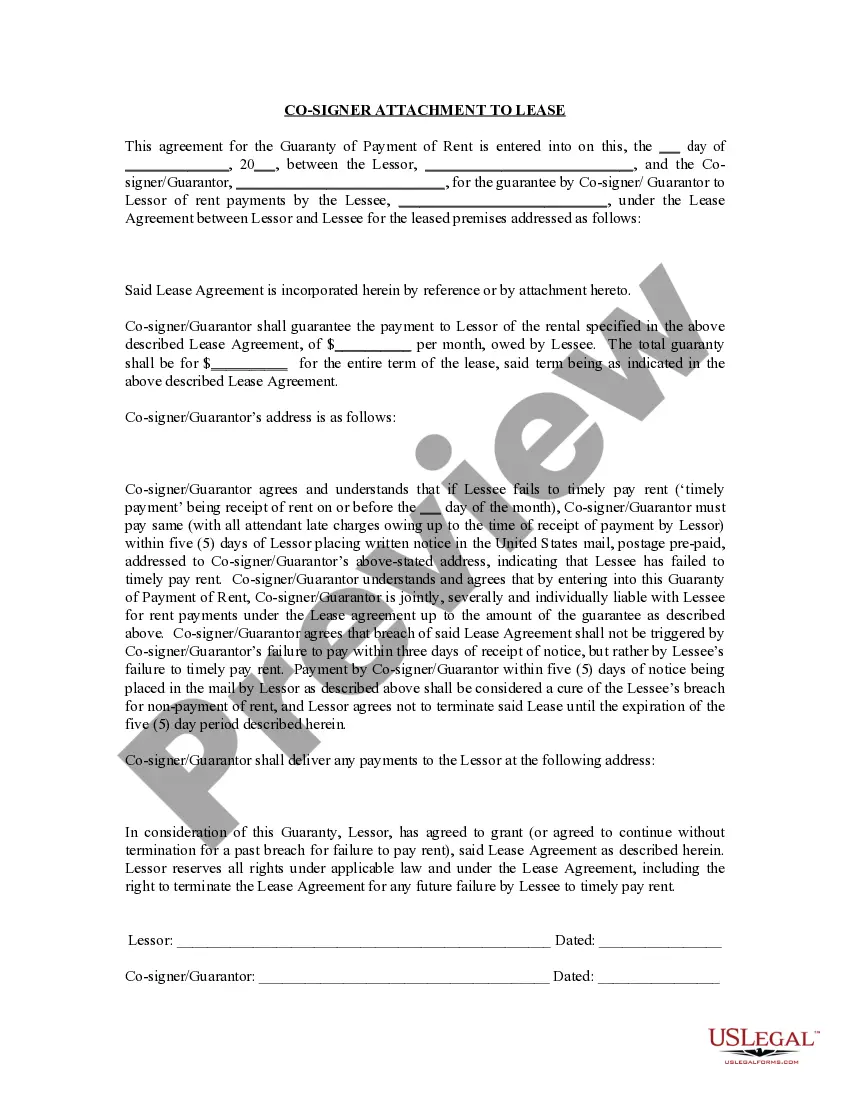

The guarantor addendum is a critical component that outlines the responsibilities of a guarantor in the lease agreement. This document supplements the lease by specifying that the guarantor will cover any unpaid rent or damages. It also clarifies the relationship between the tenant, the landlord, and the guarantor. Understanding the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner ensures a smooth rental process.

To act as a guarantor, you typically need to provide proof of income, a credit report, and personal information such as your Social Security number. It is important to gather these documents to complete the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner. This paperwork demonstrates your financial stability and ability to support the tenant. Using a reliable platform like USLegalForms can help streamline this documentation process.

To be a guarantor for rent, you typically need to provide proof of income, credit history, and identification. A landlord may request a Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner that formalizes your responsibilities. Having these documents ready simplifies the process and aligns expectations between you and the landlord.

The lease addendum for a cosigner outlines the responsibilities and rights of the cosigner, similar to a guarantor’s obligations. It should specify any conditions tied to the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner, ensuring all parties understand their roles. This document helps clarify expectations and foster a healthy rental relationship.

A guarantor primarily guarantees the lease for the tenant named in the rental agreement. In a Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner, this commitment ensures that the landlord receives their dues, regardless of the tenant's financial circumstances. It creates a layer of security that benefits all parties.

Yes, a guarantor guarantees the lease by agreeing to cover rent payments and other costs if the tenant defaults. This is specifically outlined in the Manchester New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner. By signing this document, the guarantor formalizes their responsibility and assures the landlord of financial backing.