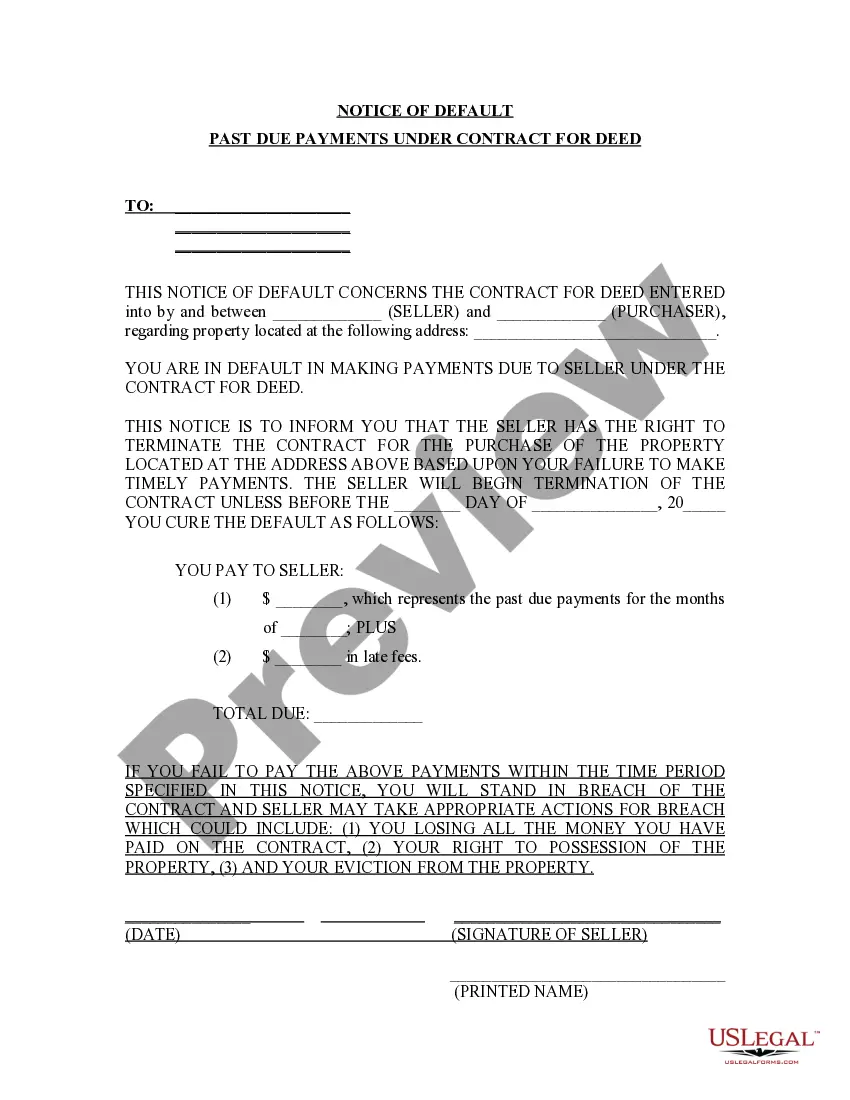

Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out New Hampshire Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Irrespective of societal or occupational position, filling out legal documents is an unfortunate obligation in the contemporary professional landscape.

Frequently, it’s nearly unattainable for an individual without a legal background to generate this type of documentation from the ground up, primarily due to the intricate terminology and legal nuances they contain.

This is where US Legal Forms can be a lifesaver.

Confirm that the template you have located is tailored to your area because the regulations of one state or region do not apply to another.

Review the document and go through a brief summary (if available) of situations the document can be utilized for.

- Our platform offers a vast collection of over 85,000 ready-to-use state-specific forms that are applicable for nearly any legal situation.

- US Legal Forms also acts as a valuable resource for partners or legal advisors who wish to save time utilizing our DIY forms.

- Whether you require the Manchester New Hampshire Notice of Default for Outstanding Payments related to a Contract for Deed or any other document that is applicable in your state or region, with US Legal Forms, all you need is at your disposal.

- Here’s how to quickly acquire the Manchester New Hampshire Notice of Default for Past Due Payments related to a Contract for Deed using our reliable platform.

- If you are already a member, you can proceed to Log In to your account to access the necessary form.

- However, if you are not familiar with our collection, be sure to follow these steps before obtaining the Manchester New Hampshire Notice of Default for Past Due Payments related to a Contract for Deed.

Form popularity

FAQ

When someone defaults on a land contract, the seller typically has legal grounds to terminate the agreement and recover the property. This process may include providing a notice of default and allowing for a grace period, depending on state regulations. Knowing the process and seeking informed legal guidance, particularly through resources like the Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed, can be beneficial.

If you stop paying on a land contract, the seller may initiate proceedings to reclaim the property, as per the contract's terms. This situation can lead to significant complications, including loss of investment and credit damage. Understanding your options and potential remedies, such as the Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed, is critical.

If a buyer defaults on payments under a land contract, the seller can enforce the terms outlined in the agreement, which may include foreclosure or eviction. The consequences can vary, depending on state laws and the specifics of the contract. It is important to recognize the implications of default, especially in relation to the Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed.

When a buyer defaults on a real estate contract, the seller typically has the right to terminate the contract and possibly regain possession of the property. The seller may pursue legal actions based on the terms defined in the contract. For clarity and resolution, seeking guidance regarding the Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed is advisable.

When a buyer fully pays back the debt related to a land sale contract, they generally receive the title to the property. This process culminates in the buyer holding legal ownership and having clear rights to the property. It's essential to document this transfer properly, especially in the context of the Manchester New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed.

When you receive a notice of default, you enter a critical phase regarding your Contract for Deed. This notice usually triggers a period during which you can rectify the situation by making overdue payments. If you do not address the default within the specified period, your lender may begin foreclosure proceedings. Understanding the Manchester New Hampshire Notice of Default for Past Due Payments can aid you in navigating this challenging time and potentially preserving your property.

A request for a notice of default signifies that a party is seeking formal notification of any defaults on your Contract for Deed. This request usually comes from entities interested in understanding the status of financial obligations related to the property. It’s an important step in the foreclosure process, as the notice impacts lender rights and options. Stay informed about the implications of such requests, particularly concerning the Manchester New Hampshire Notice of Default for Past Due Payments.

Receiving a default notice indicates that you have fallen behind on payments related to your Contract for Deed. This notice serves as a formal warning from the lender or seller, informing you of your current delinquency. It is crucial to take this notice seriously, as it can lead to further actions, such as legal proceedings. Understanding your rights and options in relation to the Manchester New Hampshire Notice of Default for Past Due Payments can help you navigate this situation.