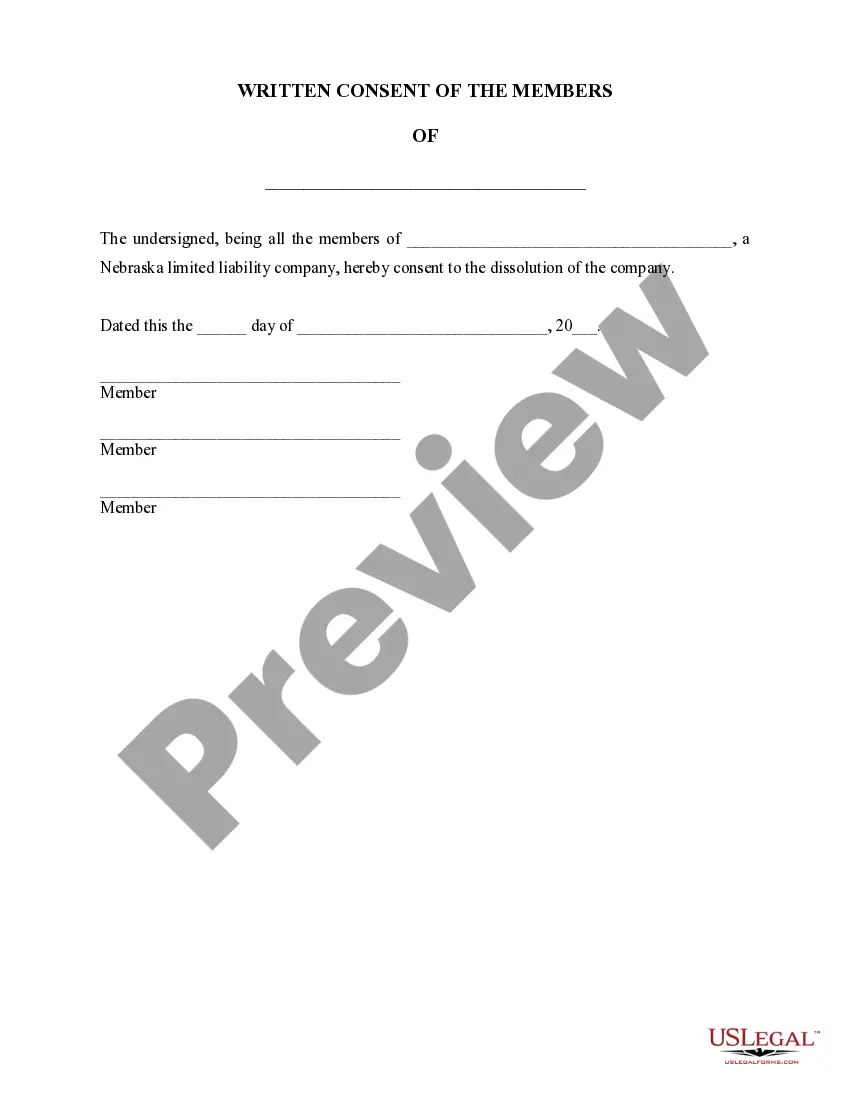

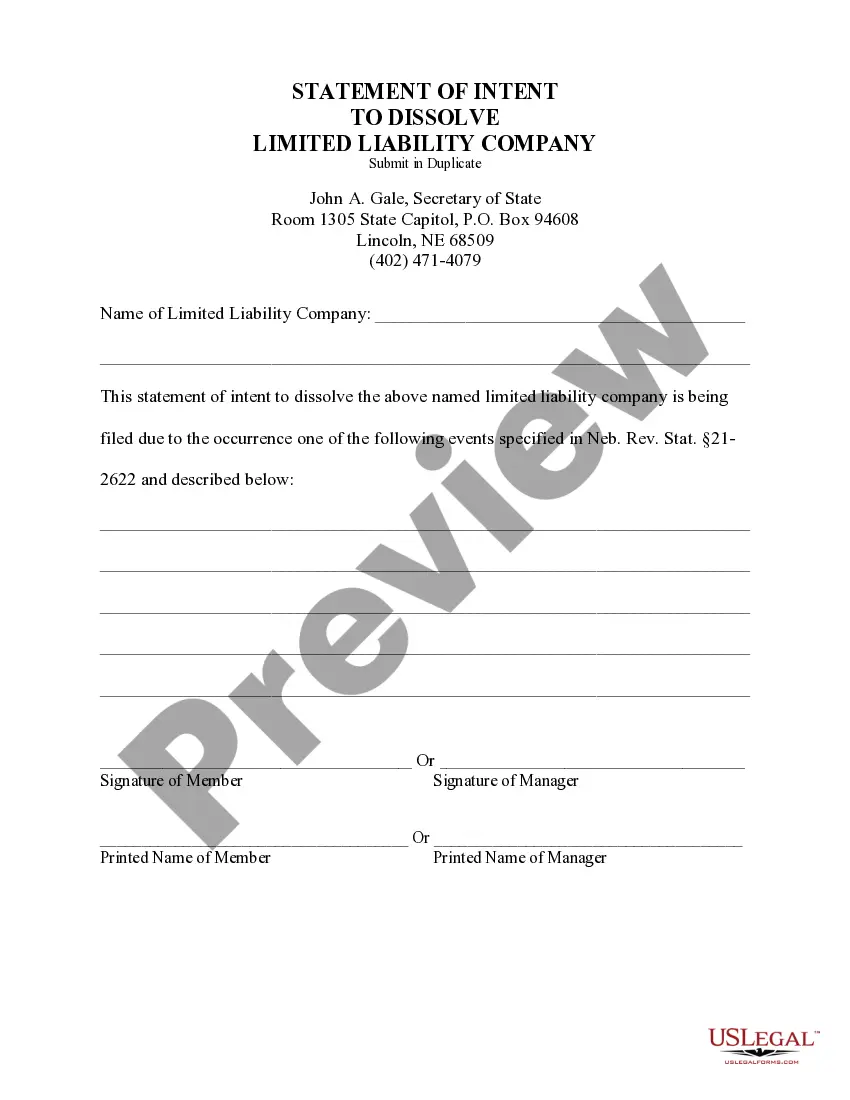

The dissolution package contains all forms to dissolve a LLC or PLLC in Nebraska, step by step instructions, addresses, transmittal letters, and other information.

Omaha Nebraska Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Nebraska Dissolution Package To Dissolve Limited Liability Company LLC?

We consistently seek to reduce or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite expensive.

However, not every legal problem is as complicated.

Most of them can be managed independently.

Utilize US Legal Forms anytime you need to quickly and securely obtain and download the Omaha Nebraska Dissolution Package to Dissolve Limited Liability Company LLC or any other form. Simply Log In to your account and click the Get button next to it. If you have misplaced the form, you can always retrieve it again in the My documents tab.

- US Legal Forms is a web-based resource of current DIY legal paperwork covering everything from wills and powers of attorney to incorporation documents and dissolution petitions.

- Our platform allows you to manage your legal matters without relying on an attorney.

- We offer access to legal document templates that are not always accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

Because an LLC is set apart from its owners, creditors can only collect repayment through its assets. Once you file the paperwork to terminate your LLC, you must then liquidate your business's inventory and pay off creditors in the appropriate order of priority.

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

The Process of Dissolving a NJ LLC Dissolution is a process in which the LLC begins its legal termination. It is the death of the LLC. It takes place when one or more of its members cease their association with the LLC or an event takes place which so affects the company it is forced to legally dissolve.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Domestic Limited Liability Company Name of Official DocumentForm #Paper FeeFranchise Tax Registration (use with LL-01)No FeeStatement of DissolutionLL-04$50.00Statement of Revocation of Dissolution for LLC$25.00Statement of Authority, Amendment, Cancellation or Denial for LLC$25.0016 more rows

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.