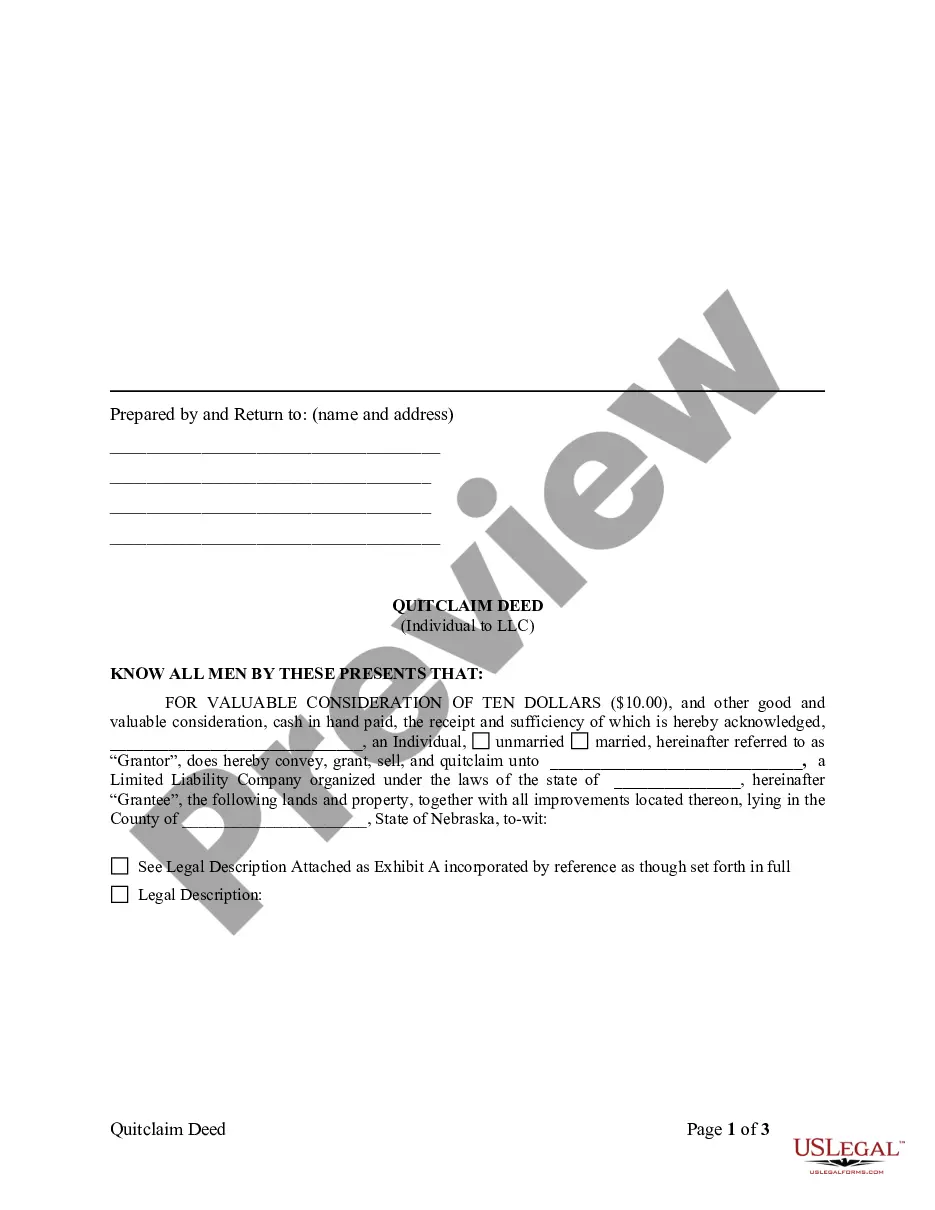

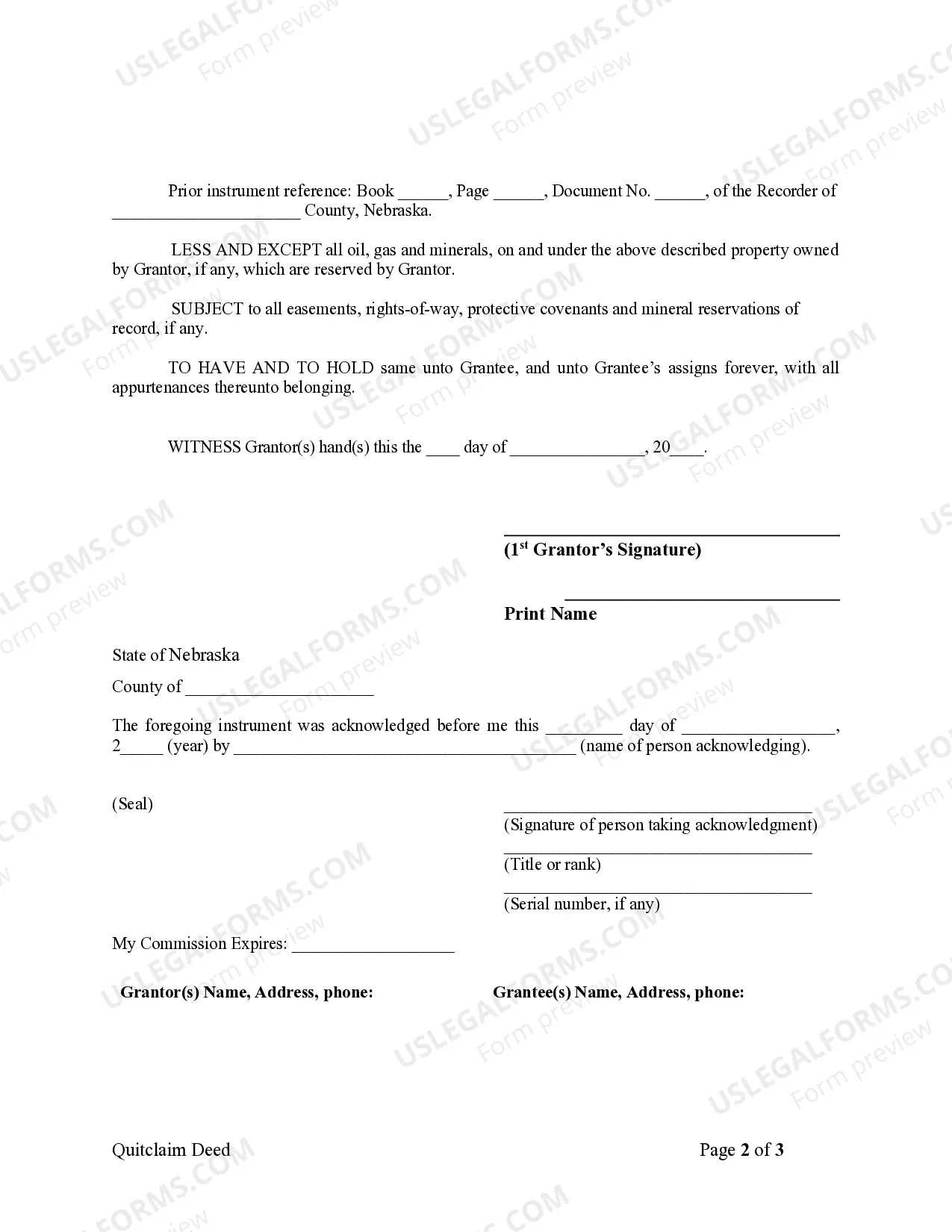

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Omaha Nebraska Quitclaim Deed from Individual to LLC

Description

How to fill out Nebraska Quitclaim Deed From Individual To LLC?

If you are in search of a legitimate form template, it’s exceptionally difficult to find a more user-friendly platform than the US Legal Forms site – arguably one of the most extensive collections on the internet.

With this collection, you are able to access thousands of templates for business and personal use categorized by types and regions, or keywords.

Utilizing our superior search feature, locating the latest Omaha Nebraska Quitclaim Deed from Individual to LLC is as simple as 1-2-3.

Verify your selection. Click the Buy now button. Next, select your desired subscription plan and provide details to register for an account.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the relevance of each document is verified by a team of experienced attorneys who consistently review the templates on our platform and refresh them according to the latest state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Omaha Nebraska Quitclaim Deed from Individual to LLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have opened the template you require. Read its description and utilize the Preview feature (if accessible) to review its content.

- If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the correct document.

Form popularity

FAQ

When the owner dies, a Nebraska TOD deed transfers title to the beneficiary named in the deed. The beneficiary formally takes title by recording the owner's death certificate and a cover sheet with the register of deeds.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed Form 521, which are not subject to the documentary stamp tax until the deed is presented for recording.

Stat. §§ 76-3401-76-3423 (the ?Act?). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

Nebraska Quitclaim Deed Laws Signing - All quitclaim deeds written in the state must be signed by the individual(s) selling the property in the presence of a Notary Public (NRS 76-211) Recording - All quitclaim deeds must be filed in the County Recorder's Office in the city or county where the property is located.

A person requesting recording of a Nebraska deed must submit to the register of deeds a completed real estate transfer statement (Form 521). Form 521 is published by the Department of Revenue. The new owner (the grantee) or the owner's legal agent must sign it.

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.