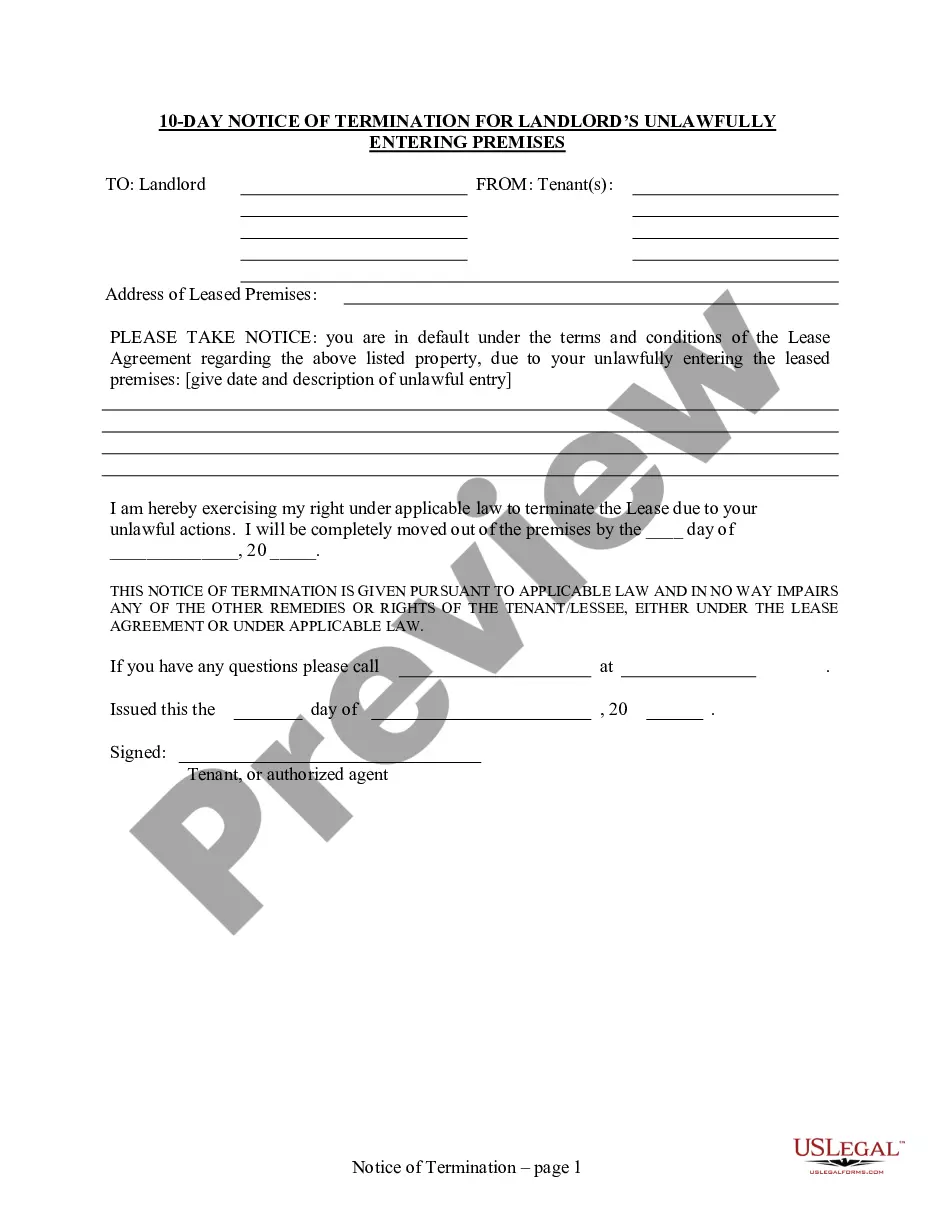

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Omaha Nebraska Business Incorporation Package to Incorporate Corporation

Description

How to fill out Nebraska Business Incorporation Package To Incorporate Corporation?

Regardless of social or professional rank, completing law-related paperwork is a regrettable requirement in the modern world.

Frequently, it's nearly impossible for an individual without a legal background to produce this type of documentation from the ground up, primarily due to the complicated terminology and legal nuances involved.

This is where US Legal Forms steps in to assist.

Confirm that the template you found is appropriate for your location, as the regulations of one area may not apply to another.

Examine the document and read a brief overview (if available) of the situations the document can address.

- Our platform offers an extensive collection of over 85,000 ready-to-utilize, state-specific documents that cater to almost any legal situation.

- US Legal Forms is also a valuable tool for associates or legal advisors seeking to save time by utilizing our DIY forms.

- Whether you require the Omaha Nebraska Business Incorporation Package to form a corporation or any other document that will be accepted in your jurisdiction, US Legal Forms has everything readily accessible.

- Here’s a breakdown of how to obtain the Omaha Nebraska Business Incorporation Package to incorporate your corporation in just a few minutes through our reliable service.

- If you are currently a subscriber, feel free to Log In to your account to download the necessary form.

- If you are new to our collection, ensure you follow these instructions before acquiring the Omaha Nebraska Business Incorporation Package to set up your corporation.

Form popularity

FAQ

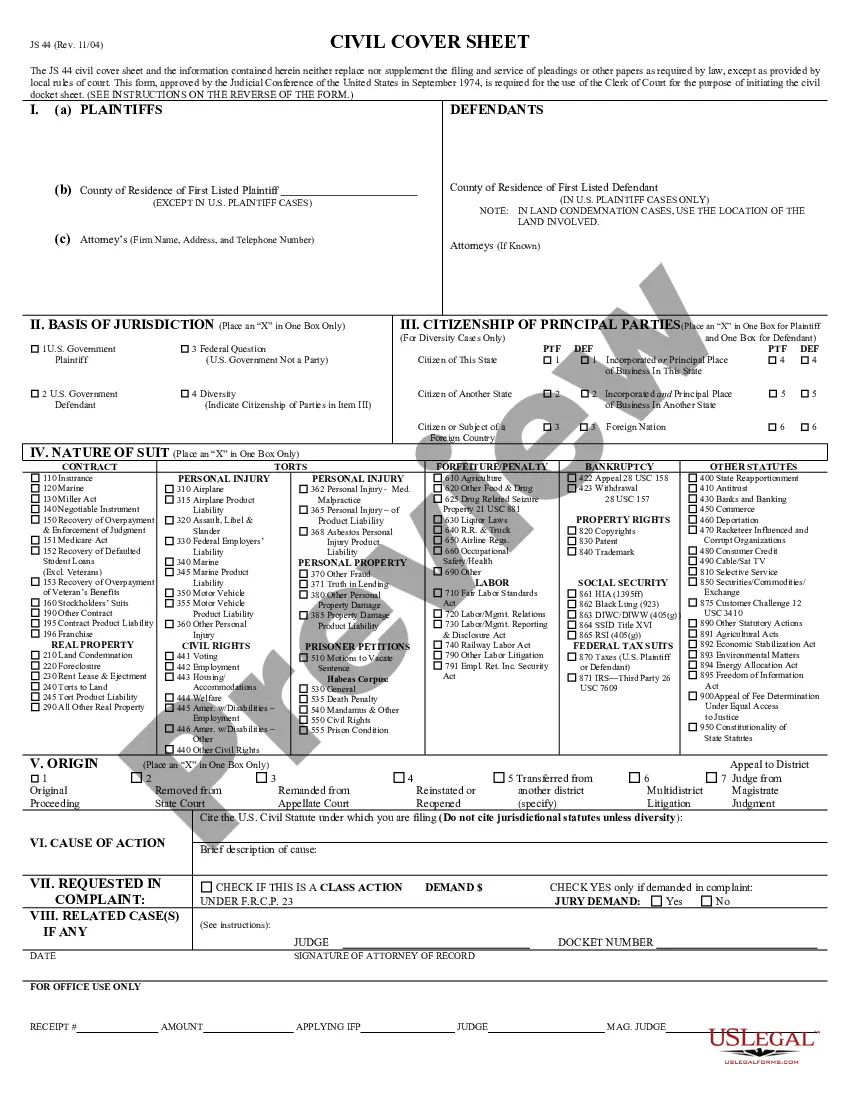

Broadly speaking, ?incorporated? means that your business is registered with a state so that it becomes a separate legal entity. ?Incorporating? could mean you're setting up one of several legal structures, like a limited liability company (LLC), C-corporation (C-corp), or an S-corporation.

The process of incorporation involves writing up a document known as the articles of incorporation and enumerating the firm's shareholders. In a corporation, the assets and cash flows of the business entity are kept separate from those of the owners and investors, which is called limited liability.

As soon as you're ready to materialize your idea and take the next steps in forming a team, building the idea or developing the application, entering into contracts, seeking investor funding, issuing stock options to your employees, advertising, or making a sale, you should consider incorporation.

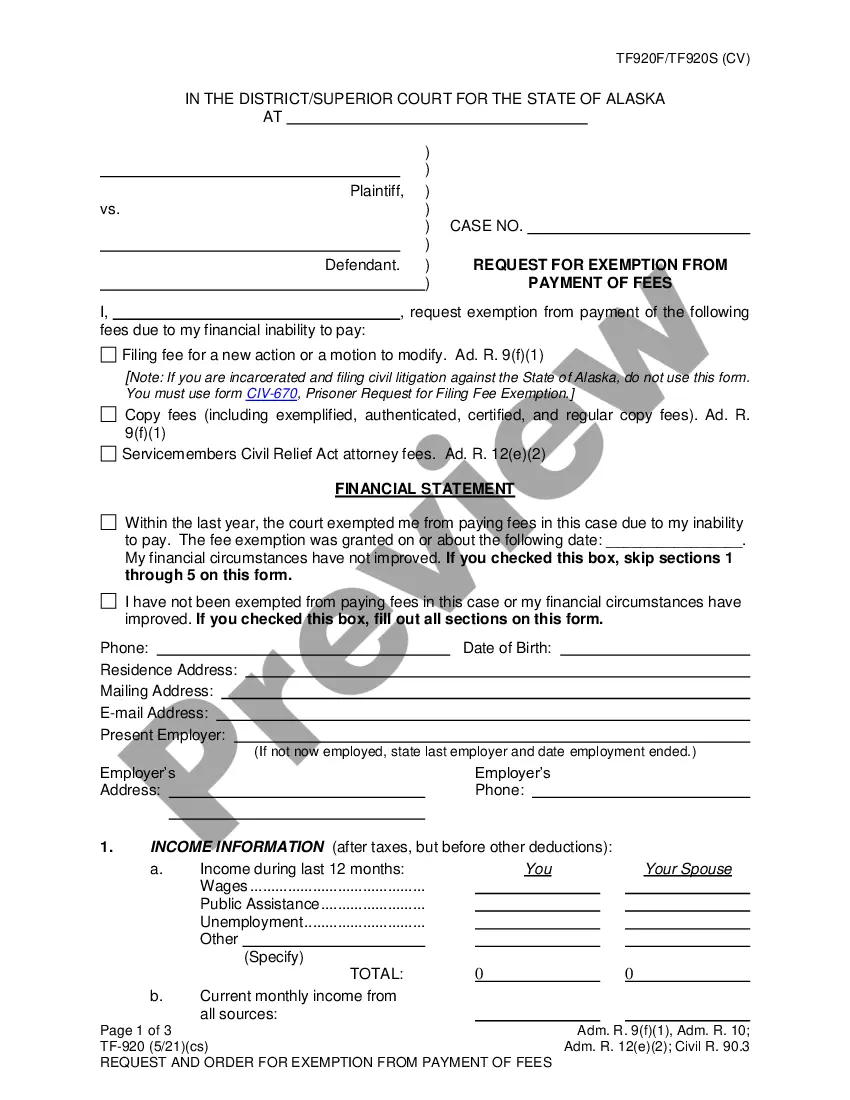

To start a corporation in Nebraska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost a minimum of $65 to file.

Corporations use a Certificate of Incorporation ? also known as an Articles of Incorporation ? and bylaws. Whether you file a general, benefit, close, or non-profit corporation, you'll file a Certificate of Incorporation (or equivalent document) and bylaws. You may or may not have to file a shareholder agreement.

Generally speaking, if you make more than $60,000 in taxable profits a year, it's possible that incorporation could save you big bucks on your taxes. If you do meet this threshold, talk to a tax professional to see if incorporation makes sense for you.

Incorporating your business is one of the best ways you can protect your personal assets. A corporation can own property, carry on business, incur liabilities, and sue or be sued. As a separate legal entity, a corporation is responsible for its own debts.

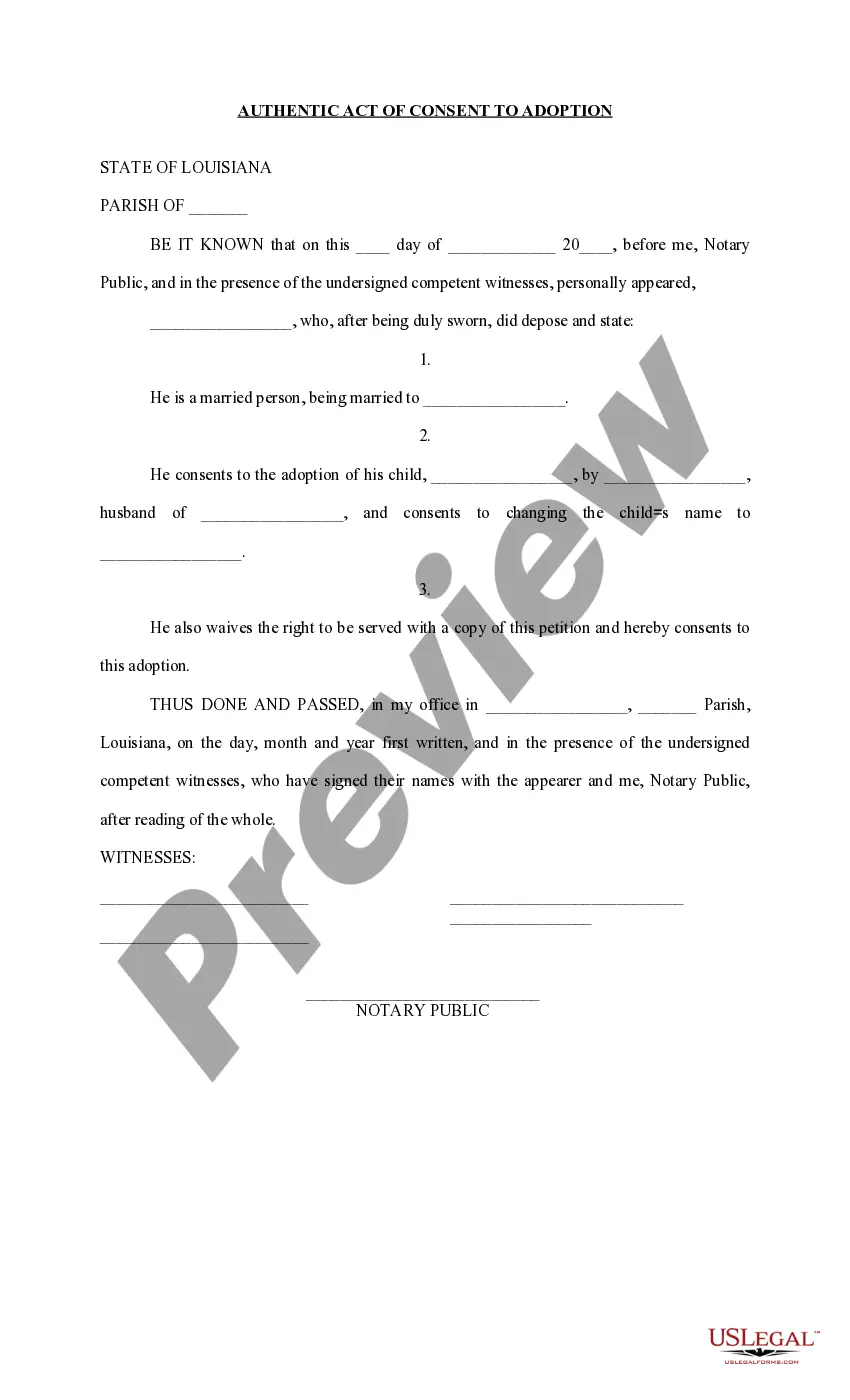

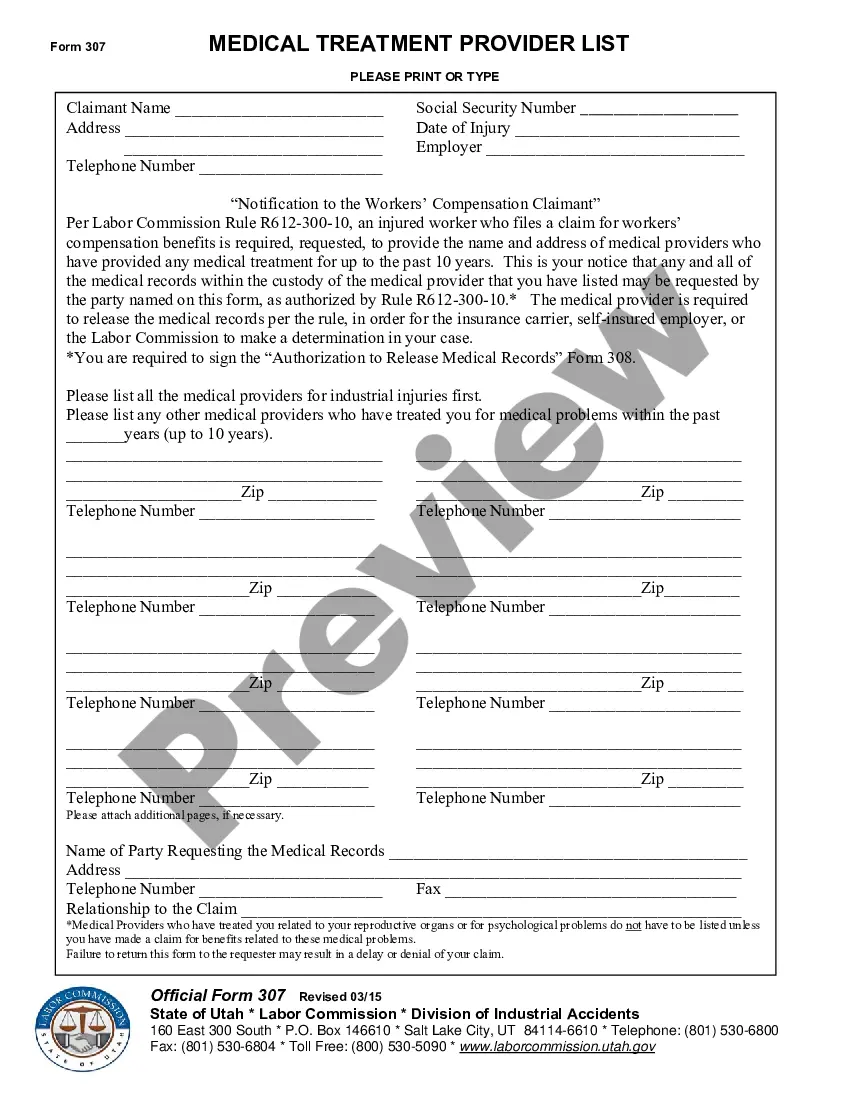

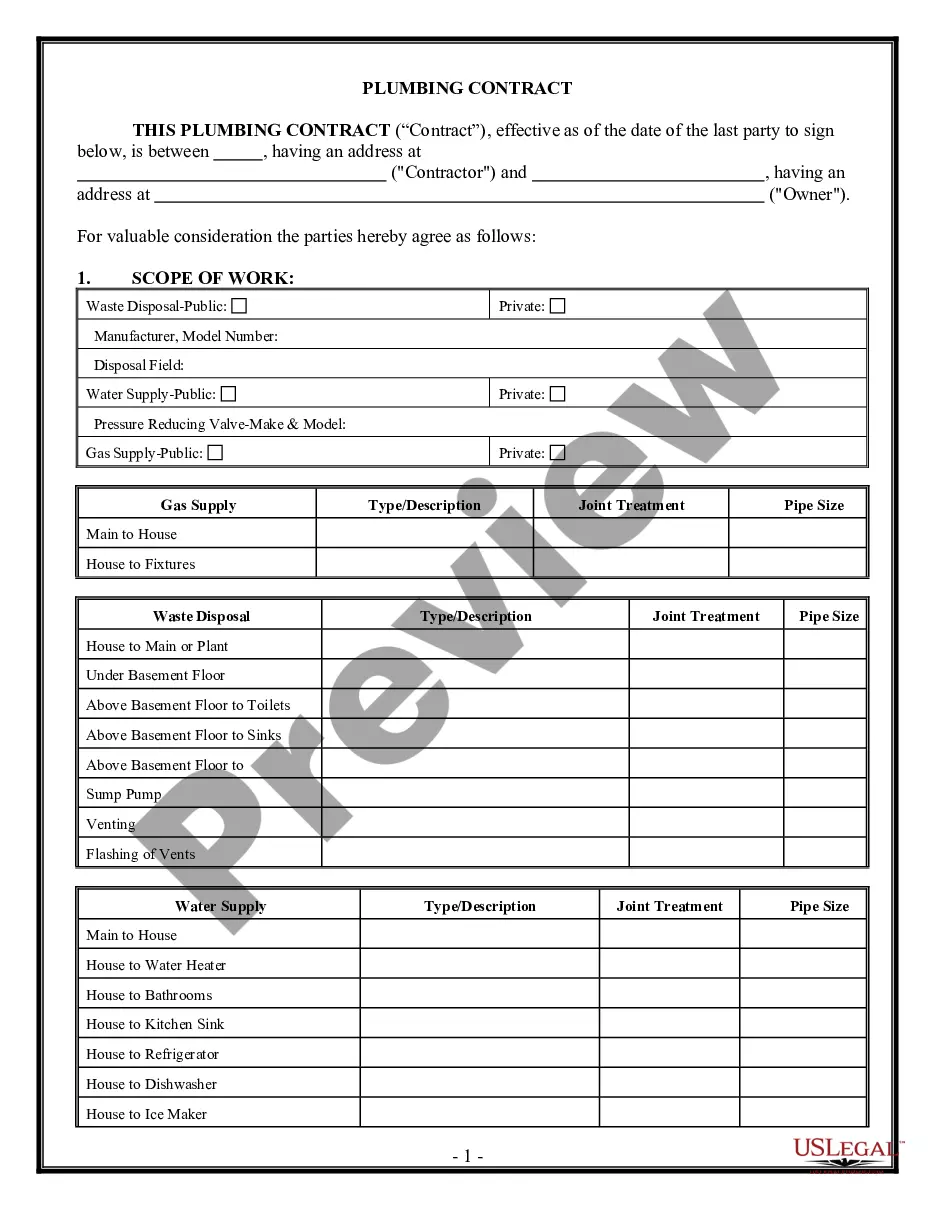

Legal Documents Needed To Incorporate Your Business Request for Reservation of Corporate Name. This form verifies and reserves the proposed corporate name.Articles of Incorporation.Corporate Bylaws.Minutes of First Meeting.Stock Certificate(s).

Incorporation is probably best for you if: You want to grow your business and make more money than you need. You will need to hire employees or raise money. You will be selling anything other than your own freelance/consultant services. There is some degree of danger or financial risk in your business.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).