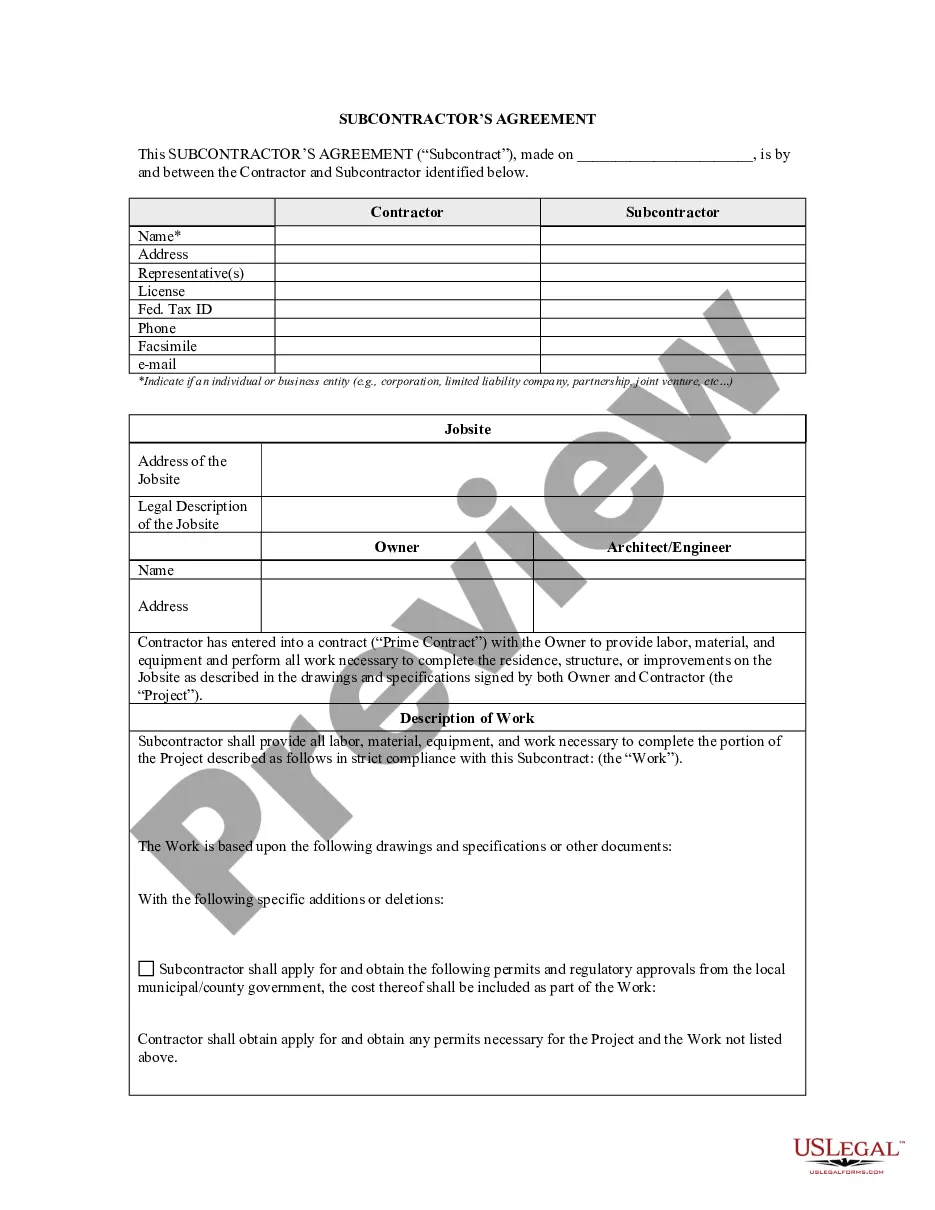

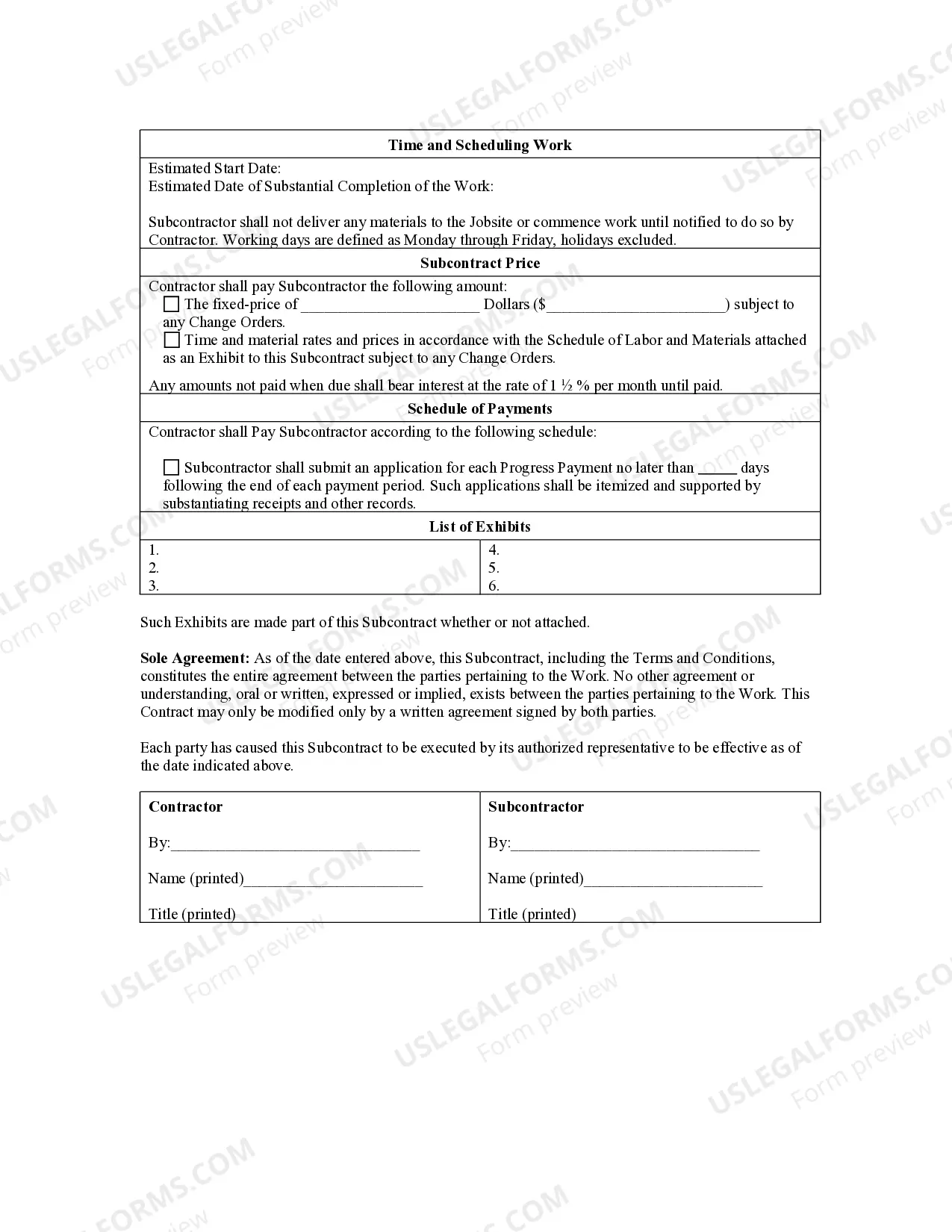

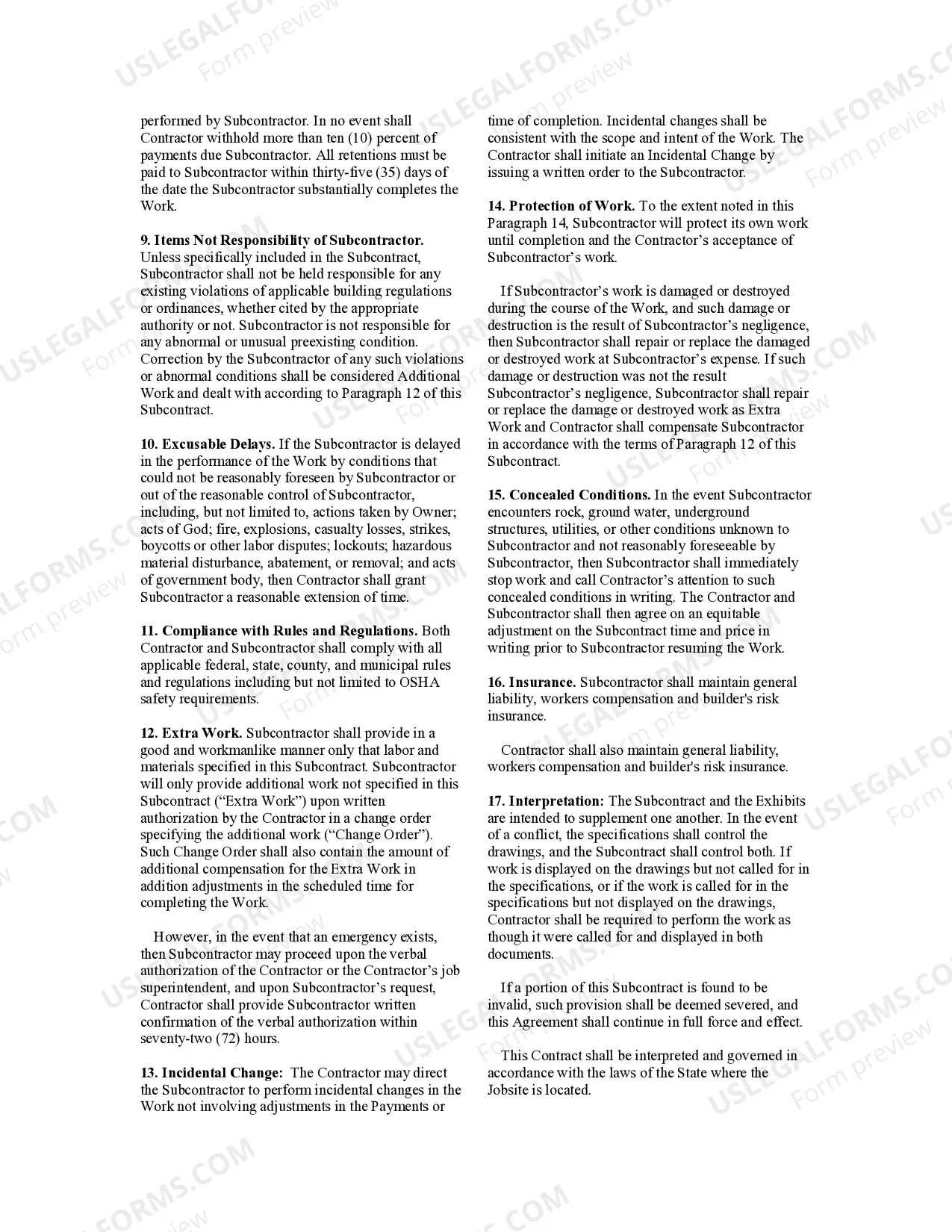

This state specific form addresses issues for subcontract work including: identifying the parties, identifying the job site, describing the work, scheduling the work, payment amount, payment schedule, change orders, contractor’s delay in commencing work, late payments, dispute resolution, excusable delay, concealed conditions, insurance, and contract interpretation.

Omaha Nebraska Subcontractor's Agreement

Description

How to fill out Nebraska Subcontractor's Agreement?

If you have previously utilized our service, Log In to your account and download the Omaha Nebraska Subcontractor's Agreement onto your device by selecting the Download button. Ensure your subscription is active. If it isn't, renew it based on your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to obtain your file.

You have continuous access to all documents you have acquired: you can locate them in your profile under the My documents section whenever you need to retrieve them again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional requirements!

- Confirm you have located the correct document. Review the description and use the Preview feature, if accessible, to determine if it fulfills your needs. If it doesn't suit you, utilize the Search tab above to discover the right one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and finalize your payment. Use your credit card information or the PayPal option to complete the payment.

- Retrieve your Omaha Nebraska Subcontractor's Agreement. Choose the file format for your document and save it to your device.

- Finalize your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

How to Start a Business in Nebraska Choose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.

Contractor is any person who repairs property annexed to real estate, who annexes building materials and fixtures to real estate, or who arranges for such annexation. A contractor who elects Option 2 is the consumer of building materials and fixtures purchased and annexed to real estate.

Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.

The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

Contractor is any person who repairs property annexed to real estate, who annexes building materials and fixtures to real estate, or who arranges for such annexation. A contractor who elects Option 1 is a retailer of building materials and fixtures purchased and annexed to real estate.

Nebraska Handyman License Guide You do not have to obtain a Nebraska handyman license to do this type of work legally in the state.Nebraska does not have a handyman license.

You can work as a handyman in Nebraska without a state license. However, you will need to register with the Nebraska Department of Labor. This requirement applies to all general contractors, subcontractors or people who perform construction, alterations, renovations, additions, installations or repairs.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.