Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual

Description

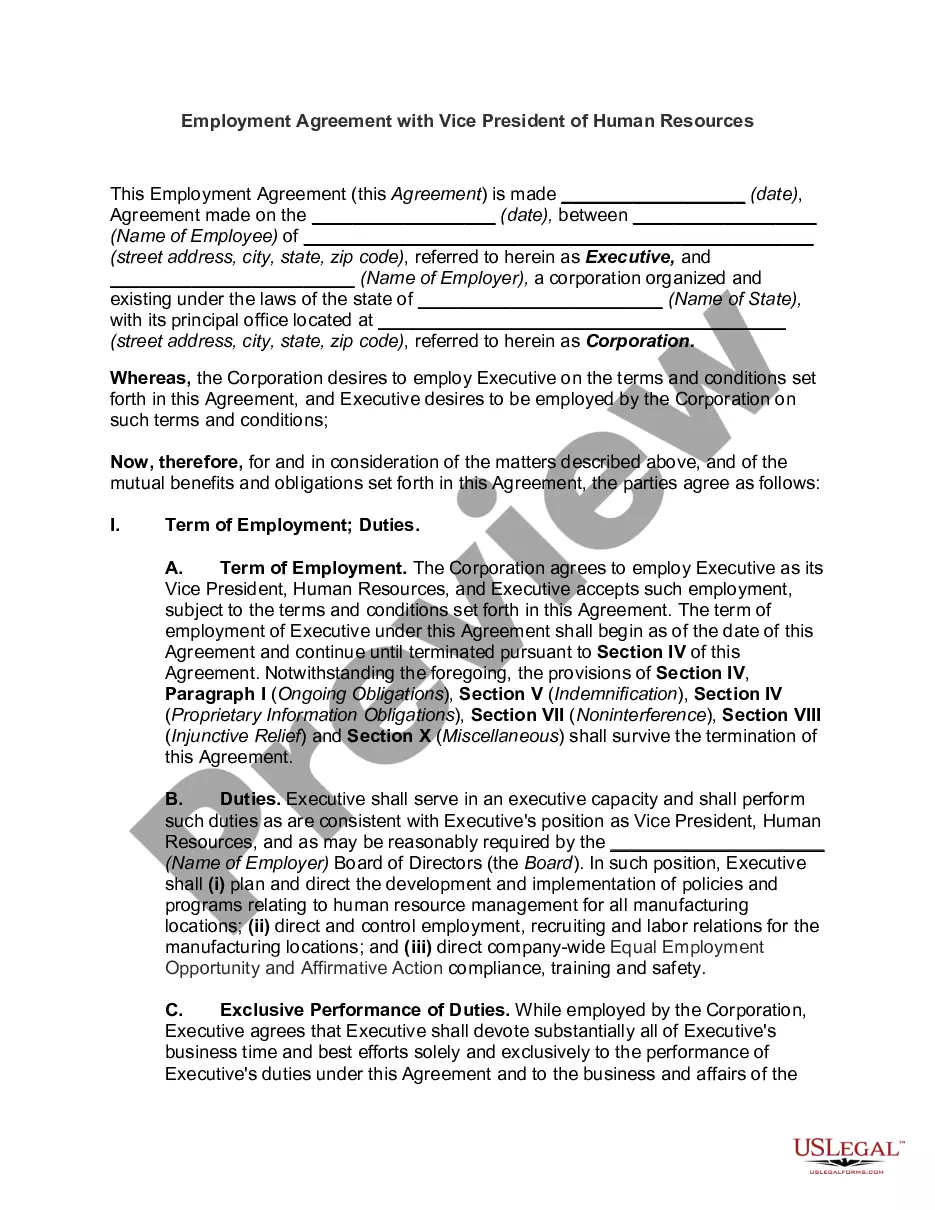

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife / Two Individuals To Individual?

Irrespective of social or career standing, fulfilling legal paperwork is a regrettable requirement in the contemporary world.

Frequently, it is nearly unfeasible for an individual lacking any legal expertise to formulate such documents from scratch, primarily due to the intricate language and legal subtleties they include.

This is where US Legal Forms lends a helping hand.

Ensure the template you select is tailored to your area, as the regulations of one state or region cannot be applied to another.

Review the document and examine a brief overview (if available) of scenarios for which the paper can be used.

- Our platform provides an extensive library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal context.

- US Legal Forms serves as an excellent resource for associates or legal advisors who wish to conserve time by using our DIY documents.

- Whether you need the Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual or any other documentation that will be recognized in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s a quick guide on obtaining the Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual swiftly via our dependable platform.

- If you are already a member, simply Log In to your account to access the required form.

- However, if you are new to our platform, please make sure to follow these instructions before getting the Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual.

Form popularity

FAQ

Transferring a car title when the owner passes away in North Dakota can be straightforward. First, gather the necessary documents, such as the original title and a copy of the death certificate. You will also need to fill out an Application for Certificate of Title, which can usually be obtained from the North Dakota Department of Transportation. If you are considering a Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual, it's wise to consult with an attorney for guidance on how these options could impact the title transfer process.

The decision between a Transfer on Death Deed and a beneficiary deed depends on your specific needs and circumstances. A Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual often simplifies the process of transferring property upon death, bypassing probate. However, a beneficiary deed may be more suitable for other asset types. Evaluating your unique situation will guide you in choosing the best option for your estate planning.

While naming a beneficiary is an essential aspect of estate planning, it is not the same as a Transfer on Death Deed. A TOD deed specifies that the property will transfer to the named beneficiary upon the owner's death without going through probate. In contrast, simply naming a beneficiary might refer to various asset types without necessarily providing the same transfer mechanism. It's crucial to understand these differences when planning your estate.

Yes, North Dakota recognizes the use of Transfer on Death Deeds, also known as TOD deeds, which allow individuals to pass on real estate directly to their named beneficiaries upon death. This option is beneficial because it avoids the probate process, making it easier and quicker for beneficiaries to acquire the property. Thus, residents looking to simplify their estate planning can consider a Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual.

A Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual is specifically designed for transferring real estate upon death. While both types serve similar functions, a TOD deed applies solely to property, whereas a beneficiary deed might encompass various assets. Importantly, a TOD deed allows the property owner to retain control during their lifetime, making it a preferred option for many individuals.

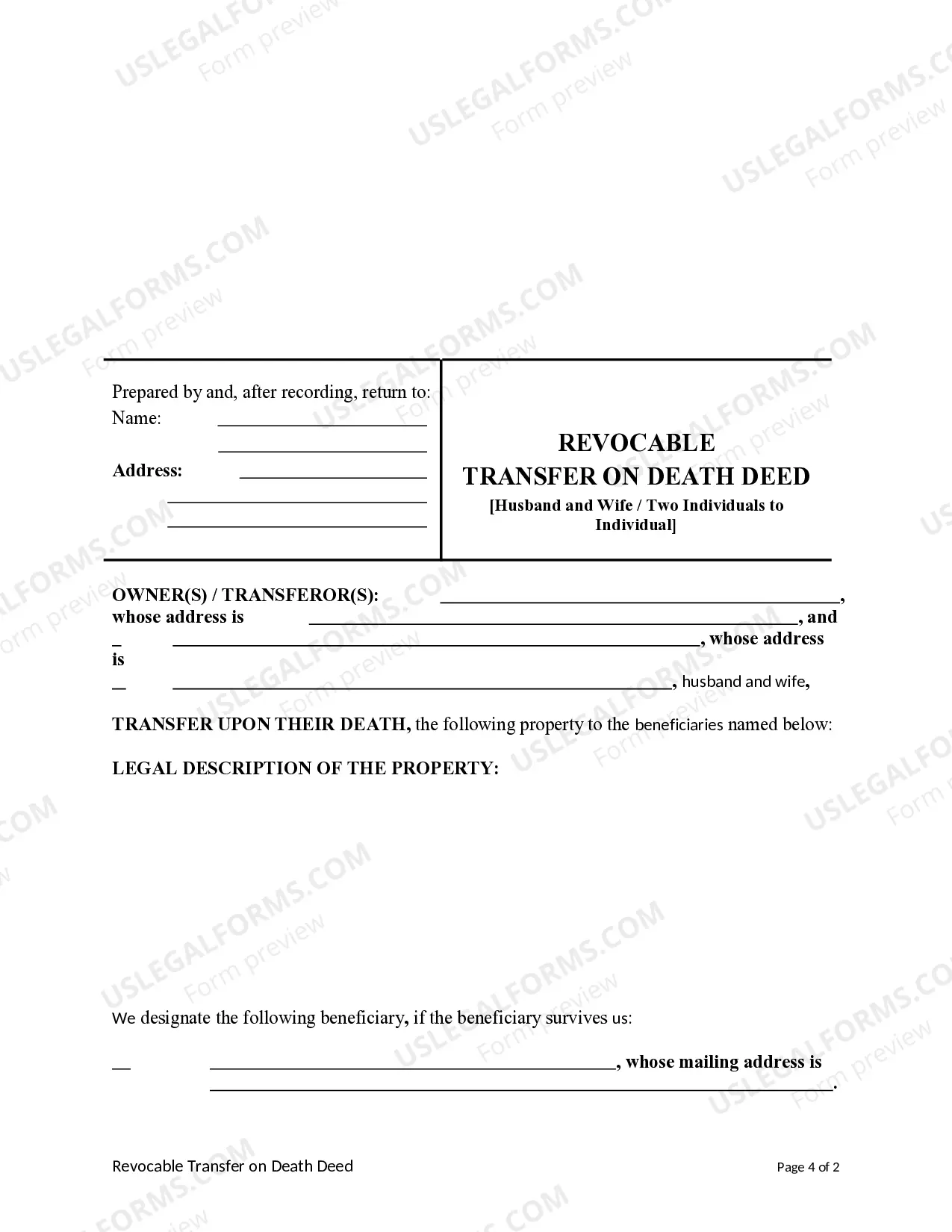

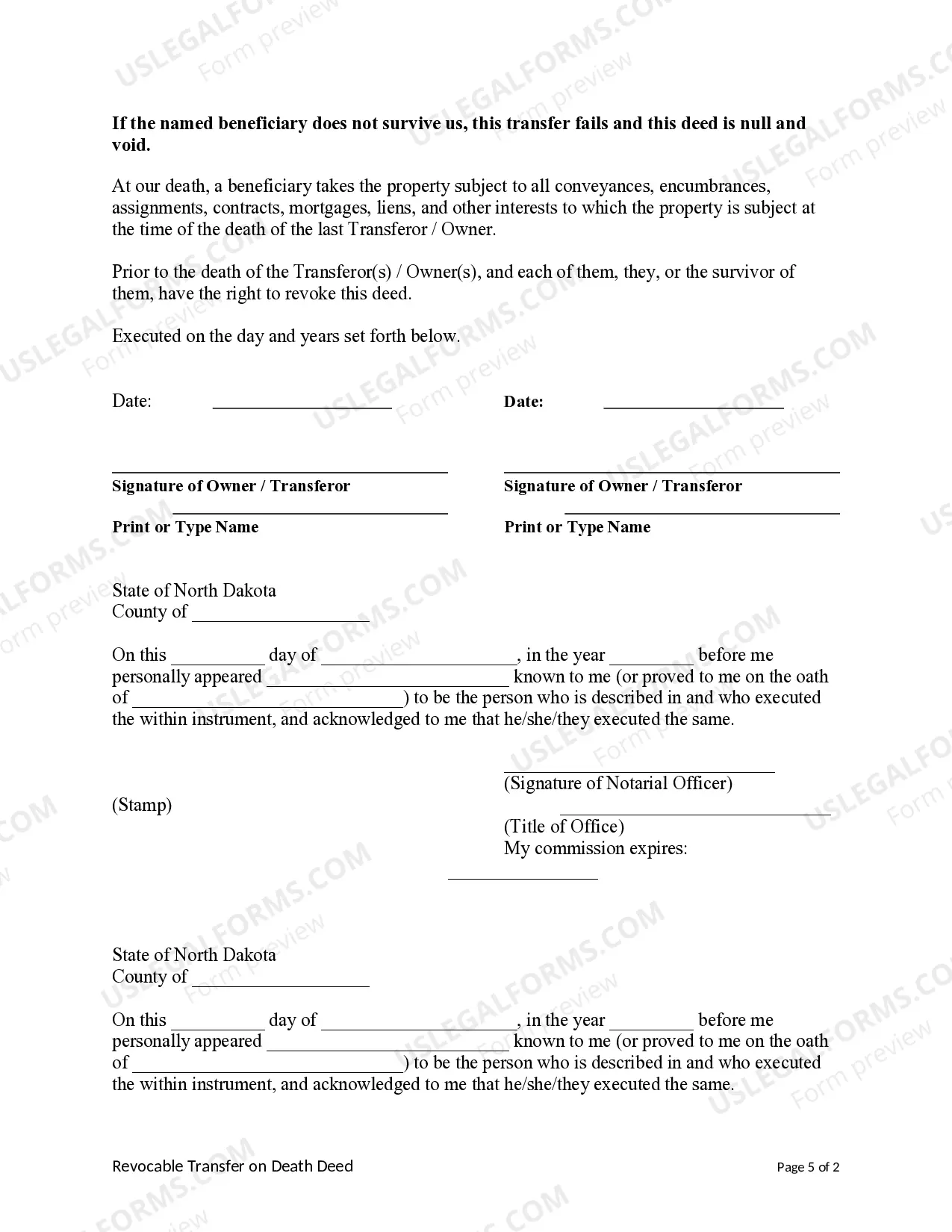

To write a beneficiary deed in Fargo, North Dakota, you need to create a formal document that includes specific language declaring the transfer upon death. Clearly identify the property, the names of the current owners, and the names of the beneficiaries. After drafting the deed, you must sign it in front of a notary public and record it with your county’s register of deeds. This legal process ensures that your intentions are accurately reflected in your estate plan.

Yes, North Dakota does have beneficiary deeds, often referred to as the Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual. This legal instrument allows property owners to designate beneficiaries for their real estate, ensuring that the property transfers outside of probate upon the owner's death. Utilizing such deeds can streamline the process for families and reduce legal complications. If you need assistance, consider using the UsLegalForms platform to access the necessary documentation.

One disadvantage of the Fargo North Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individuals to Individual is that it does not provide comprehensive estate planning. While it allows property to transfer to beneficiaries without probate, it does not address issues like taxes or debts. Additionally, if the owner becomes incapacitated, the TOD may not allow the intended beneficiary to manage the property until the owner recovers. Thus, it is essential to consider additional estate planning tools.