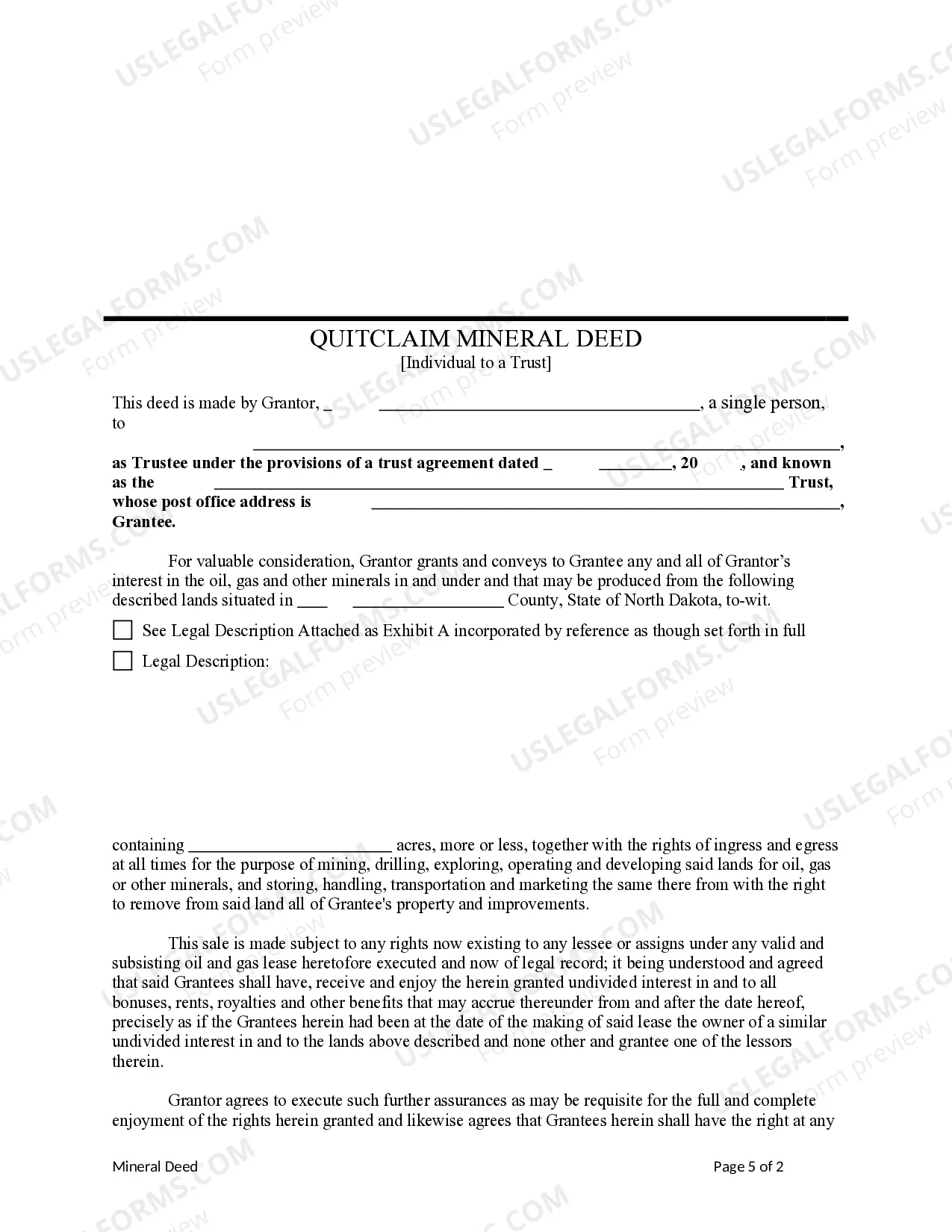

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Fargo North Dakota Quitclaim Mineral Deed - Individual to a Trust

Description

How to fill out North Dakota Quitclaim Mineral Deed - Individual To A Trust?

Regardless of social or occupational standing, finalizing legal paperwork is an unfortunate requirement in the contemporary professional landscape.

Frequently, it’s nearly impossible for someone lacking legal expertise to generate such documents from scratch, mainly due to the intricate jargon and legal nuances they entail.

This is where US Legal Forms can be a lifesaver.

Confirm that the document you have sourced is appropriate for your location as the regulations of one state or region may not be applicable to another state or region.

Review the document and examine a brief summary (if accessible) of the scenarios for which the paper may be utilized.

- Our platform offers a vast repository of over 85,000 ready-to-use state-specific forms suitable for almost any legal situation.

- US Legal Forms also proves invaluable for associates or legal advisors looking to save time by utilizing our DIY documents.

- Whether you require the Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust or any other paperwork valid in your jurisdiction, everything is easily accessible with US Legal Forms.

- Here’s a quick guide to acquire the Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust using our dependable platform.

- If you're already a customer, proceed to Log In to your account to obtain the necessary form.

- However, if you are new to our platform, ensure you follow these instructions before downloading the Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust.

Form popularity

FAQ

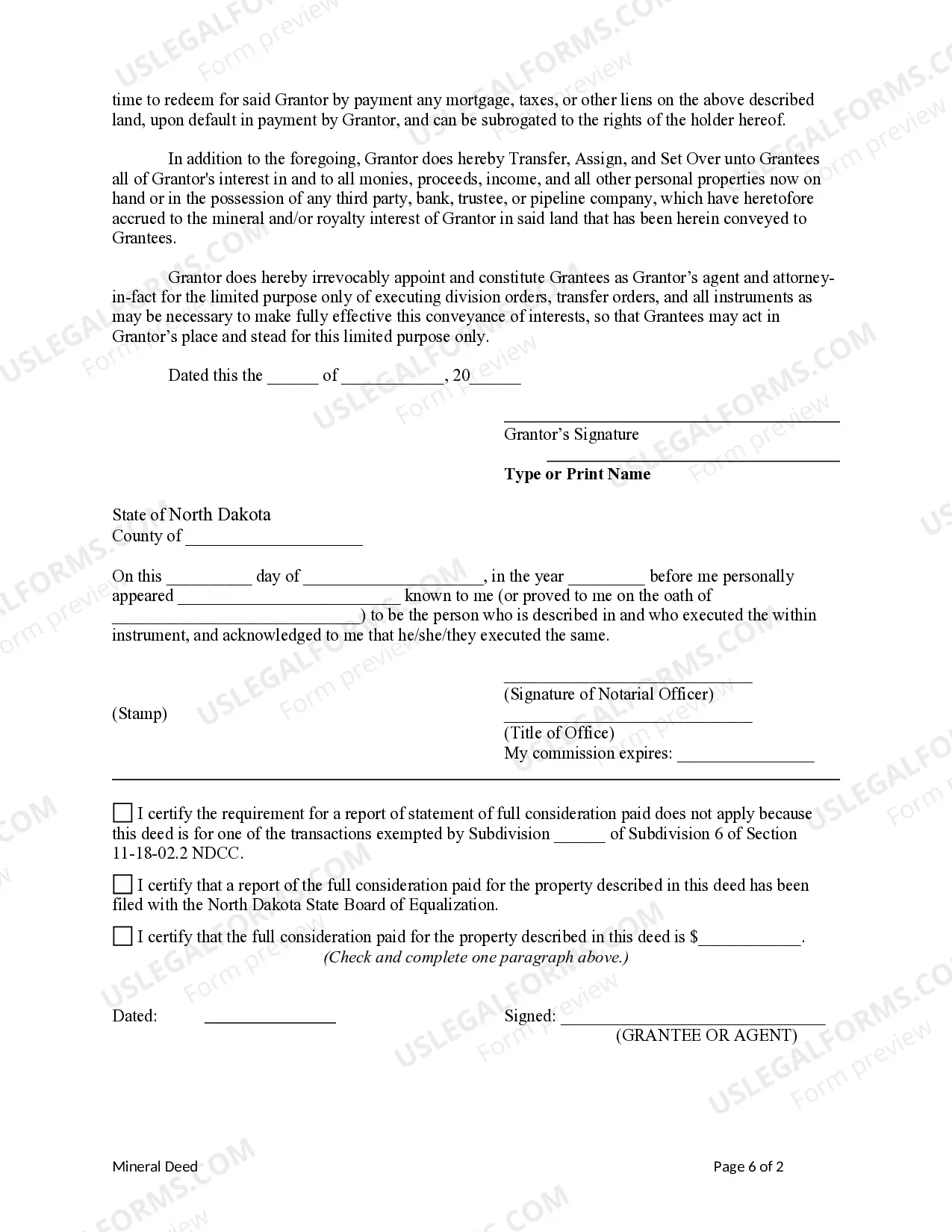

Filling out a Fargo North Dakota Quitclaim Mineral Deed from Individual to a Trust requires careful attention to the details. First, include the full names of the grantor and the trustee of the trust, along with their addresses. Next, provide a clear description of the mineral interests being transferred, ensuring you complete all necessary sections of the form. Finally, remember to sign the deed in the presence of a notary public, as this step is crucial for the deed to be legally valid and enforceable.

North Dakota allows the use of mortgages for property transactions. Unlike some states that favor deeds of trust, North Dakota's legal framework emphasizes mortgages, including in scenarios like a Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust. Understanding the state's laws can help you navigate your property rights effectively.

North Dakota primarily utilizes mortgages rather than deeds of trust for securing loans. This means that when you engage in property transactions, such as a Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust, you will typically work with a mortgage. However, understanding the implications of each is vital for making informed decisions.

Yes, it is possible to have both a deed of trust and a mortgage on the same property. However, this situation may complicate your financial obligations and legal standing. If you are dealing with a Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust, it is wise to consult a professional for advice on managing these instruments effectively.

Deeds of trust and mortgages serve similar purposes but differ by state. States like California and Texas commonly utilize deeds of trust, whereas others prefer traditional mortgages. Understanding these distinctions is crucial when dealing with property transfers, especially in Fargo North Dakota Quitclaim Mineral Deed Individual to a Trust scenarios.

Yes, a quit claim deed can transfer property from a trust to another party. When doing so, it is important to ensure the trust is allowed to convey the property under its terms. For transferring mineral rights, utilizing a Fargo North Dakota Quitclaim Mineral Deed can facilitate this process smoothly, confirming the ownership and protecting the rights of all parties involved.

Transferring mineral rights to a trust requires executing a deed that identifies the trust as the new owner of the rights. You can utilize a Fargo North Dakota Quitclaim Mineral Deed for this process, clearly stipulating the details of the transfer. Consulting with a legal expert can ensure you navigate the requirements seamlessly and confirm the trust's ownership.

To claim mineral rights in North Dakota, you typically need to demonstrate a legal interest in the property. This may involve searching public records to establish ownership or making claims on unclaimed rights. Engaging a legal professional with expertise in Fargo North Dakota Quitclaim Mineral Deed transactions could streamline the process and help you secure your rights effectively.

Transferring mineral rights involves executing a formal deed that specifies the transfer of ownership. In Fargo, North Dakota, using a Quitclaim Mineral Deed allows for a straightforward transfer, outlining the rights being conveyed. Ensure you file the deed with the local county recorder to finalize the process and protect your interests.

If another party owns your mineral rights, they have the legal authority to explore and extract resources from the land. This situation can complicate your property ownership and may limit your benefits from the land. If you are facing challenges with mineral rights ownership, a Fargo North Dakota Quitclaim Mineral Deed can be a valuable tool to clarify and transfer ownership interests.