Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out North Dakota Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It is an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the papers are accurately categorized by function and jurisdiction, making it as straightforward as ABC to search for the Fargo North Dakota Final Notice of Default for Delinquent Payments related to Contract for Deed.

Maintain orderly documentation that adheres to legal requirements is crucial. Take advantage of the US Legal Forms repository to always have vital document templates readily available for any requirements!

- Familiarize yourself with the Preview mode and document description.

- Ensure you’ve selected the right one that aligns with your necessities and fully complies with your local jurisdiction prerequisites.

- If necessary, look for an alternative template.

- Upon identifying any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your standards, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

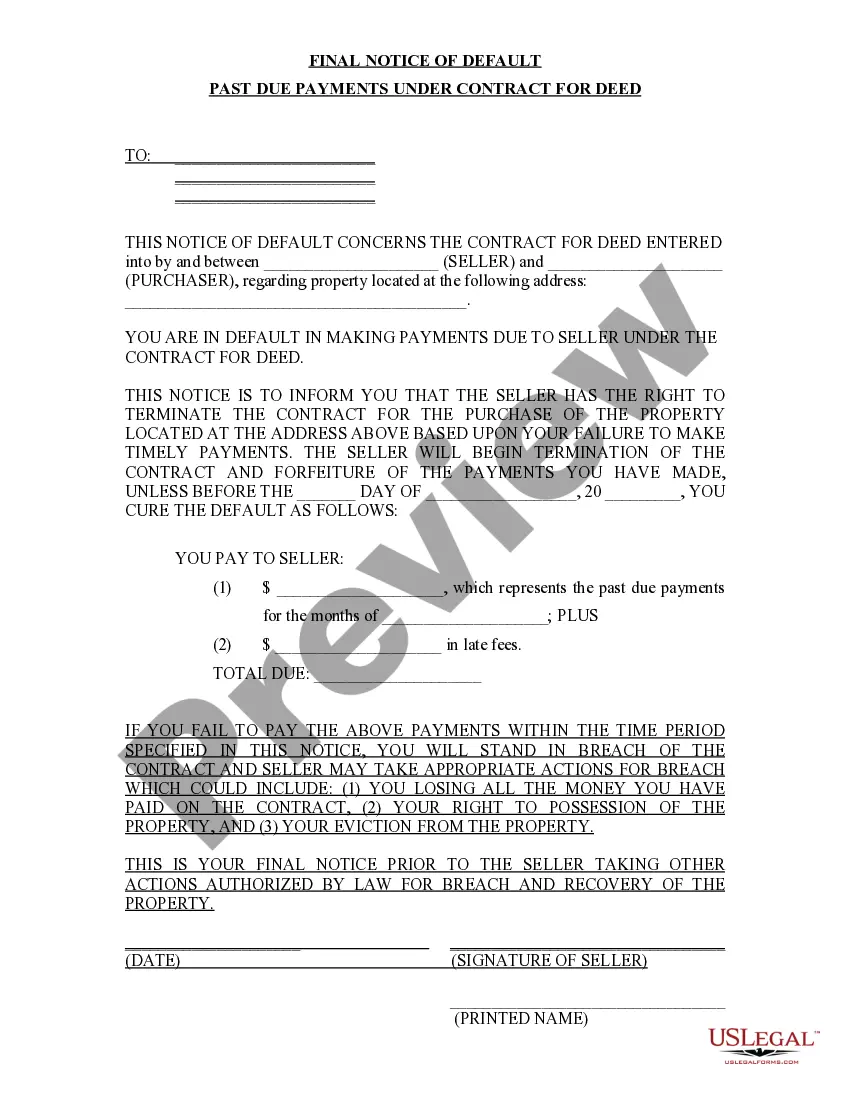

Filing a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed is a crucial step in the process. First, gather all relevant documents associated with your contract for deed, including payment records and communication history. Next, complete the notice form accurately, ensuring to include all necessary details, such as the debtor's information and the amount owed. Finally, file the notice with the appropriate county office and consider using a service like US Legal Forms to simplify this process and ensure compliance with local regulations.

In a contract for deed in North Dakota, the buyer generally assumes responsibility for property taxes. This obligation usually starts as soon as the buyer takes possession of the property. Properly managing these taxes is essential to preventing issues like a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, which can complicate your financial situation.

The average interest rate on a contract for deed in North Dakota typically ranges between 5% to 10%. Factors such as the seller's terms, the buyer's creditworthiness, and market conditions can influence the exact rate. Understanding the interest component can help you avoid receiving a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed due to payment challenges.

A contract for deed is an agreement between a buyer and a seller where the buyer makes payments for a property directly to the seller. The seller retains the title until the buyer fulfills all payment obligations. If you are facing a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, Understanding this agreement is crucial, as it outlines your rights and obligations. Always review your contract carefully and seek legal advice if needed.

Writing up a contract for deed involves detailing specific elements such as property description, payment schedule, interest rates, and any repairs required. It is also vital to stipulate the consequences of late payments, which may include a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed. Utilizing templates from uslegalforms can simplify this process, ensuring you cover all necessary legal aspects.

Two main disadvantages of a contract for deed are the risk of losing the property and the possibility of higher costs over time. If the buyer is unable to keep up with payments, they may receive a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, resulting in potential eviction. Additionally, buyers often face limitations in their rights compared to traditional mortgage arrangements.