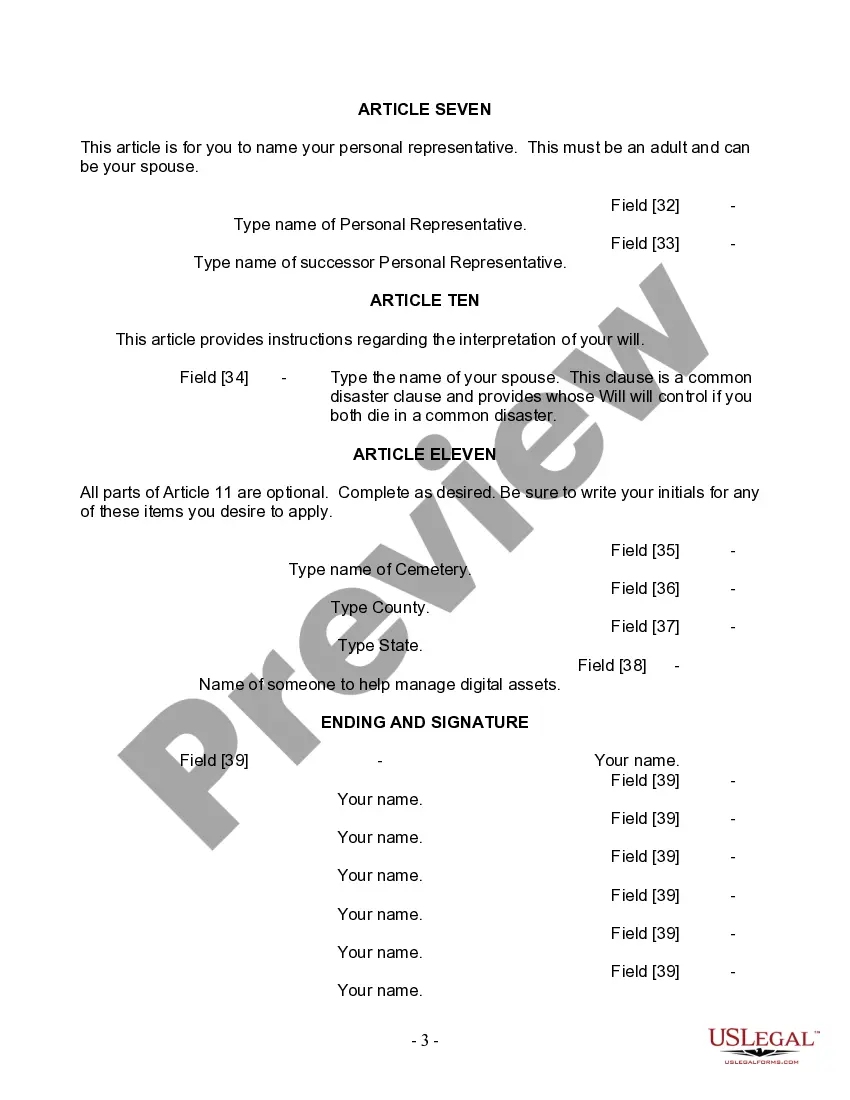

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

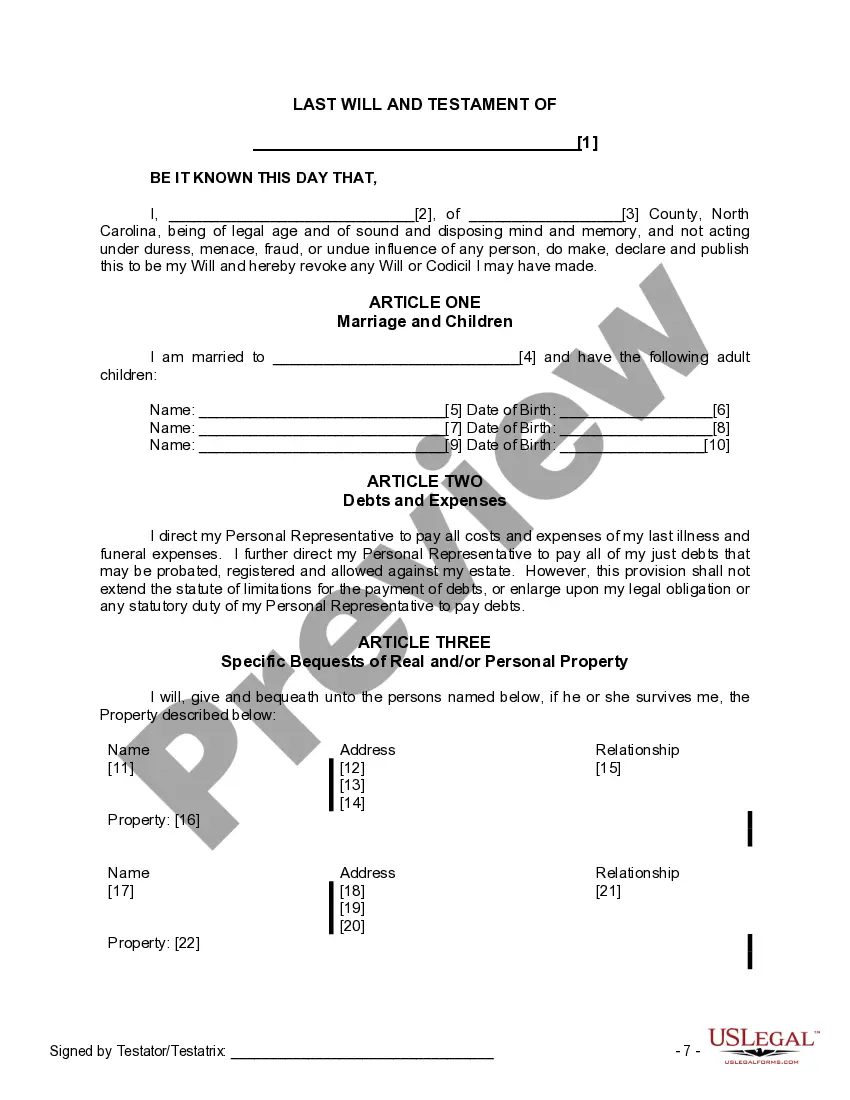

Charlotte North Carolina Last Will and Testament for Married person with Adult Children

Description

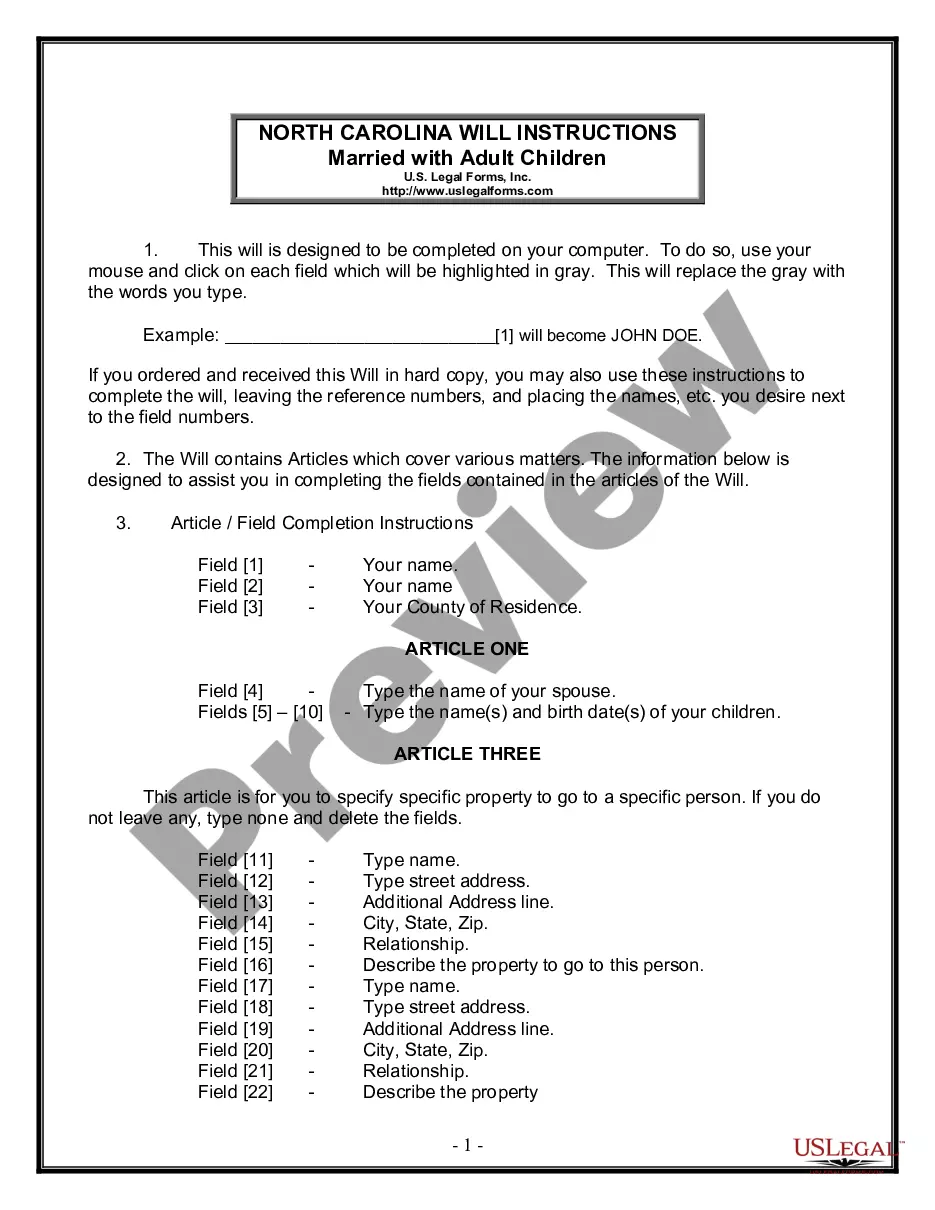

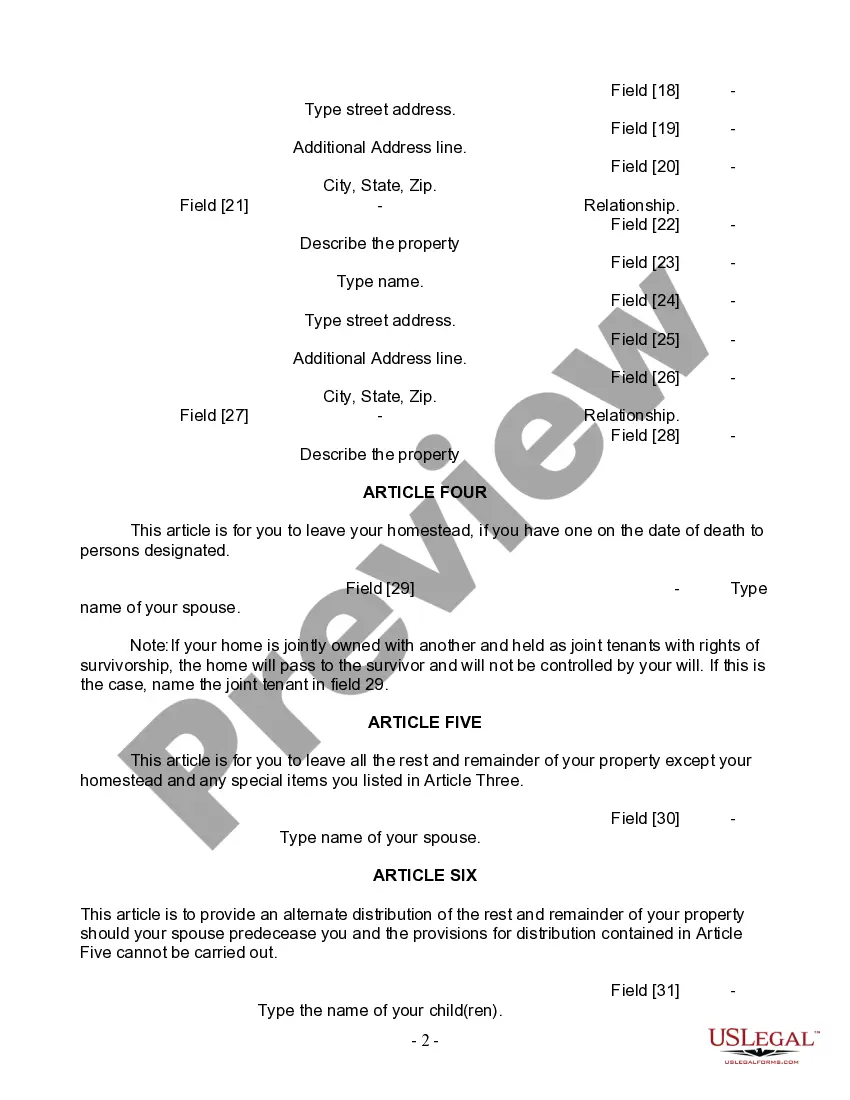

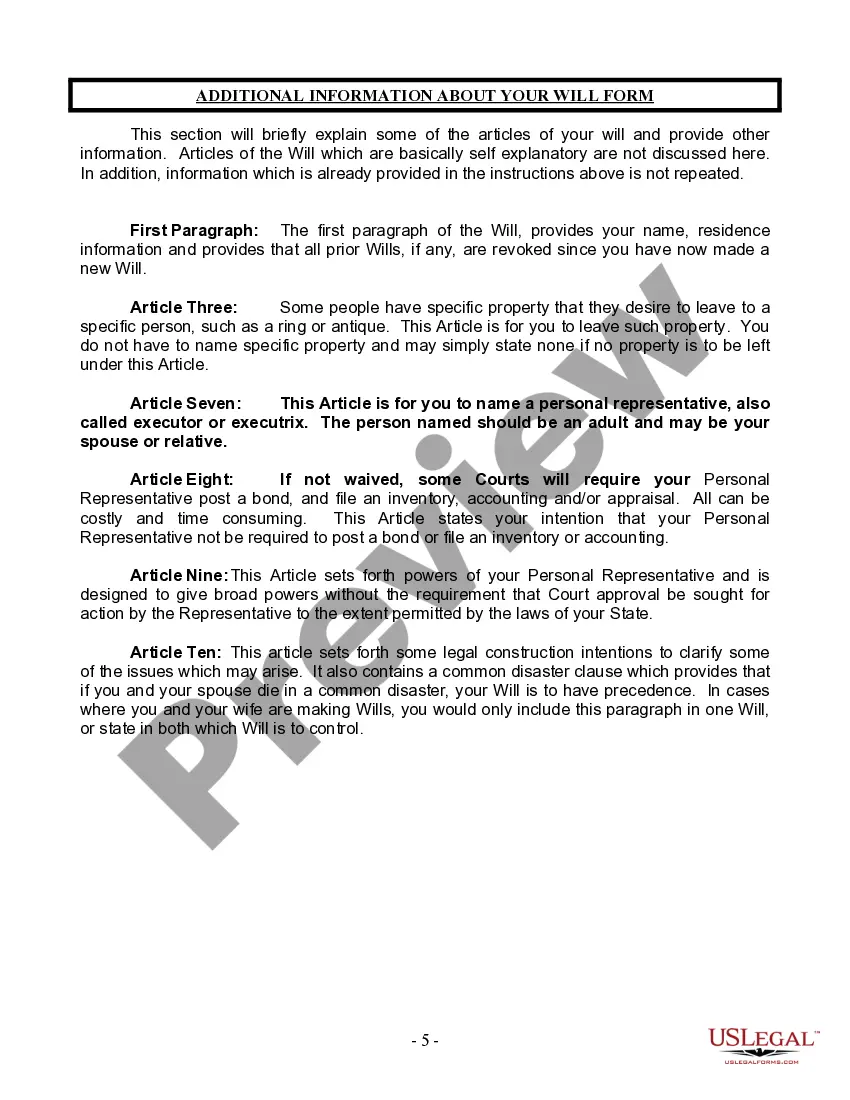

How to fill out North Carolina Last Will And Testament For Married Person With Adult Children?

Finding certified templates tailored to your local rules can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and business purposes, as well as any practical situations.

All the files are accurately classified by area of use and jurisdiction, making it as straightforward as pie to find the Charlotte North Carolina Legal Last Will and Testament Form for a Married individual with Adult Children.

Acquire the Charlotte North Carolina Legal Last Will and Testament Form for a Married individual with Adult Children to save it on your device for completion and access it later in the My documents section of your profile whenever you need it. Maintaining orderly paperwork that complies with legal requirements is crucial. Utilize the US Legal Forms library to ensure you have essential document templates readily available for any needs!

- Review the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your requirements and matches your local jurisdiction regulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate document. If it fits your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

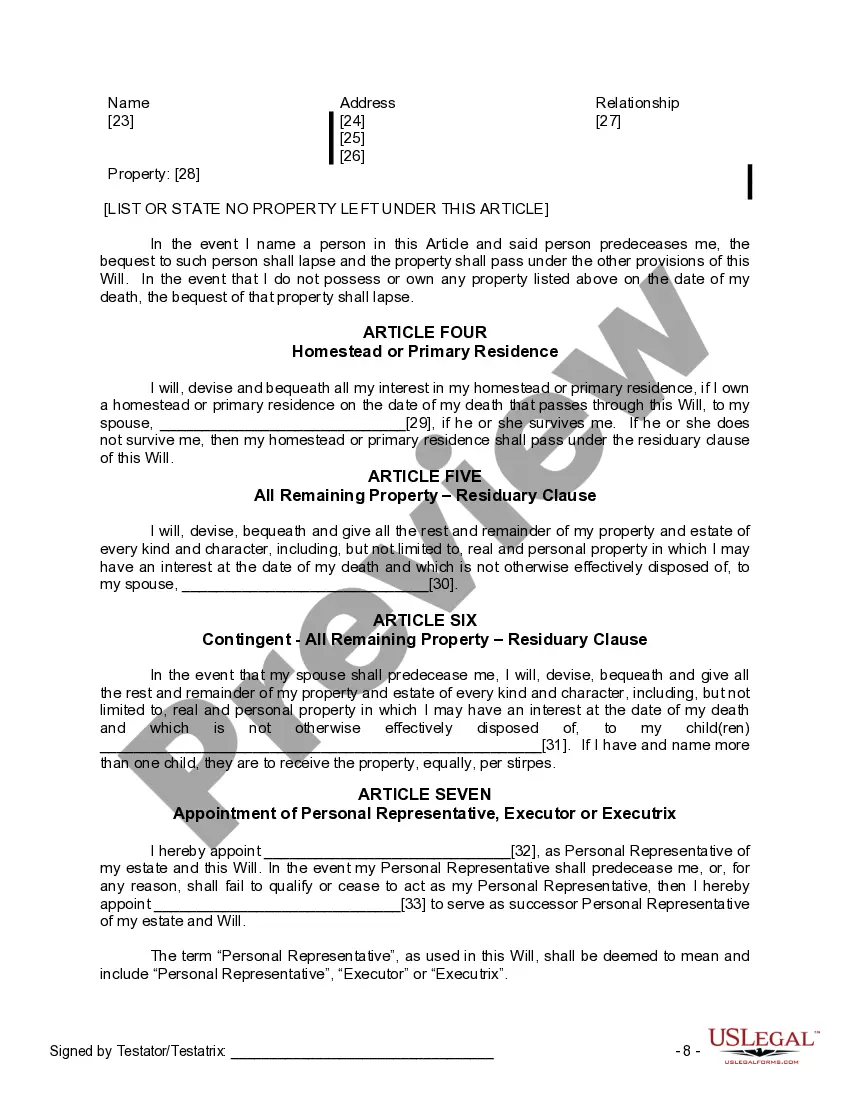

Q.Is Inheritance Considered Marital Property in a North Carolina Divorce? No. Unless the inheritance was giving as a marital gift or the spouse receiving the inheritance contributes the funds into a shared bank account or provides the additional spouse reasonable access to the inherited assets.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

This means that you are free to set out who you want to benefit from your Estate in your Will and exclude anyone you don't want to inherit from you, including your children or even your spouse. So, technically you can disinherit anyone under your Will.

29-14. As detailed in this statute, if the person who dies is survived by a spouse, the spouse will take in one of the following manners: If the person who dies is not survived by a child, a grandchild, or a parent, the spouse takes the entire estate, both real and personal property.

The surviving children will split 2/3 of the real estate and the remaining personal property assets in equal shares under the rules of intestacy in North Carolina. Again, surviving or predeceased parents do not matter to the equation if there is a surviving spouse and at least one surviving child.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

Your spouse only, no children or parents living: Your spouse will receive all property that could pass under a will. 4. Your spouse and one child: Your spouse will receive the first $60,000.00 of personal property, one-half (1/2) of the remaining personal property, and one-half (1/2) all real estate.

Neither marriage or divorce nor the birth or adoption of a child revokes a will. Marriage does alter a will to the extent that North Carolina law provides an ?elective share? of a deceased person's estate to his or her spouse.

North Carolina's Elective Share Such statutes are put in place to protect a surviving spouse from being disinherited upon the death of a spouse who leaves the surviving spouse out of his or her will. As defined in N.C.G.S.

To be valid, the person making the Will (the testator) must, with the intent to sign the Will, sign it personally or direct another person to sign it in the testator's presence.