If you are looking for an applicable form, it’s tough to discover a more suitable location than the US Legal Forms website – one of the most extensive collections available online.

With this collection, you can obtain thousands of templates for corporate and individual needs by categories and regions, or keywords. With our enhanced search capability, locating the latest High Point North Carolina Annual Financial Checkup Package is as simple as 1-2-3.

Furthermore, the pertinence of each record is validated by a team of experienced attorneys who routinely review the documents on our site and update them in accordance with the latest state and county regulations.

Obtain the form. Choose the file format and download it to your device.

Make modifications. Complete, edit, print, and sign the received High Point North Carolina Annual Financial Checkup Package. Every form you add to your user profile has no expiration date and belongs to you indefinitely. You can conveniently access them via the My documents menu, so if you wish to have an extra copy for editing or producing a hard copy, feel free to revisit and download it again whenever you desire.

- If you are already familiar with our platform and possess an account, all you need to acquire the High Point North Carolina Annual Financial Checkup Package is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the very first time, just follow the instructions listed below.

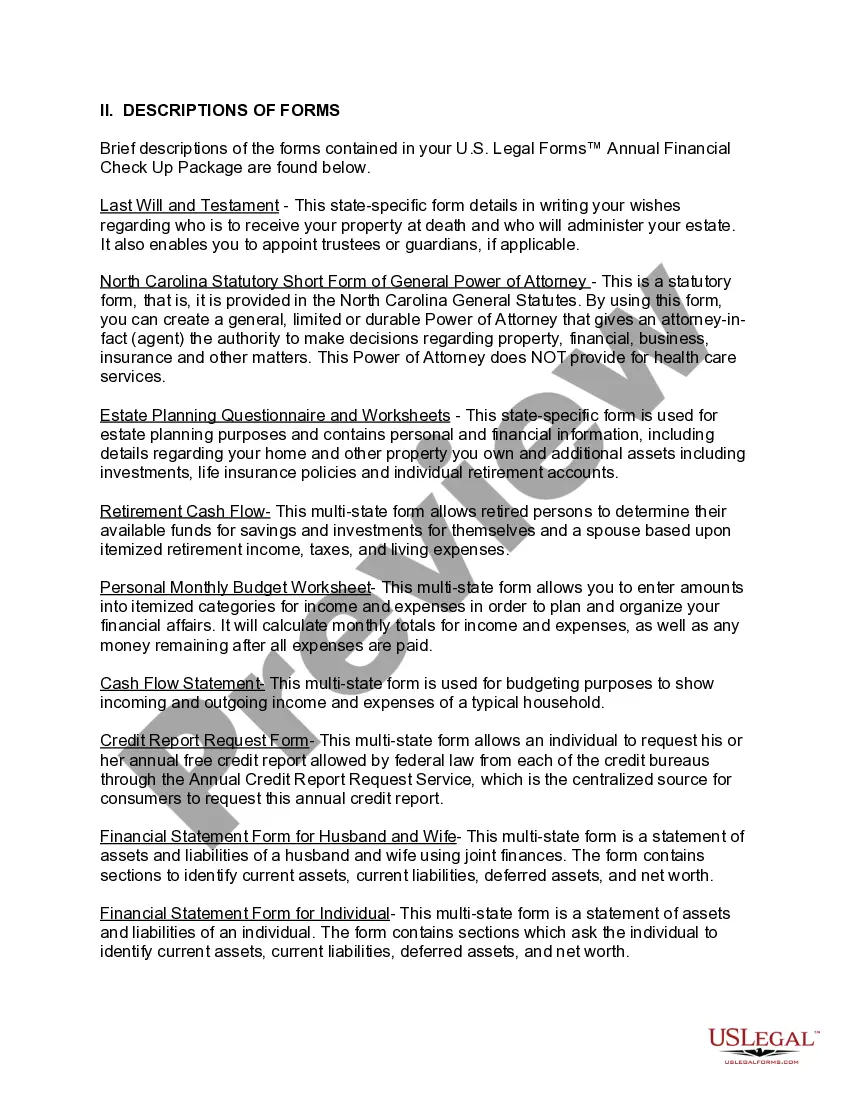

- Ensure you have accessed the form you desire. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t meet your requirements, utilize the Search box near the top of the screen to find the proper document.

- Confirm your choice. Click the Buy now button. Then, select the desired subscription plan and provide information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.