Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property

Description

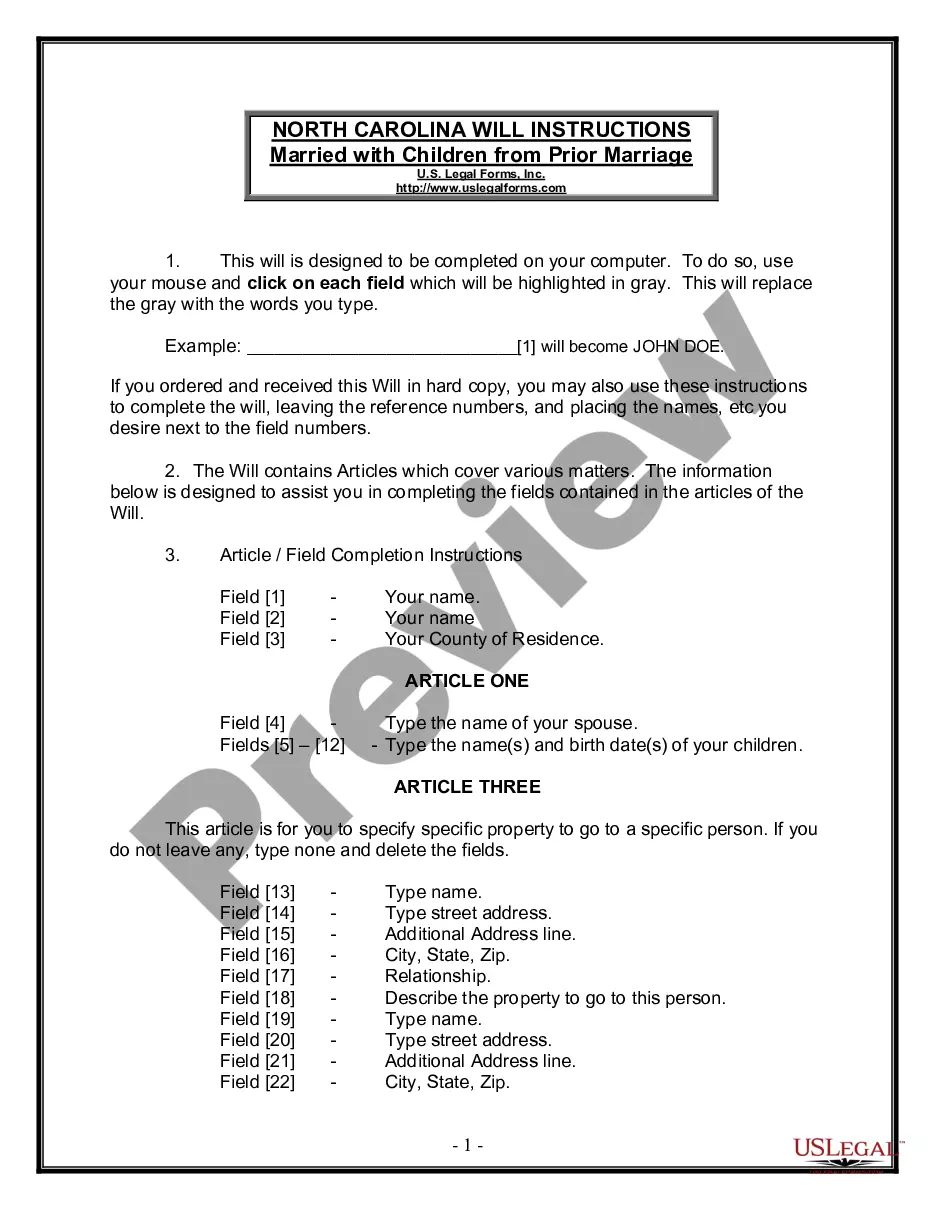

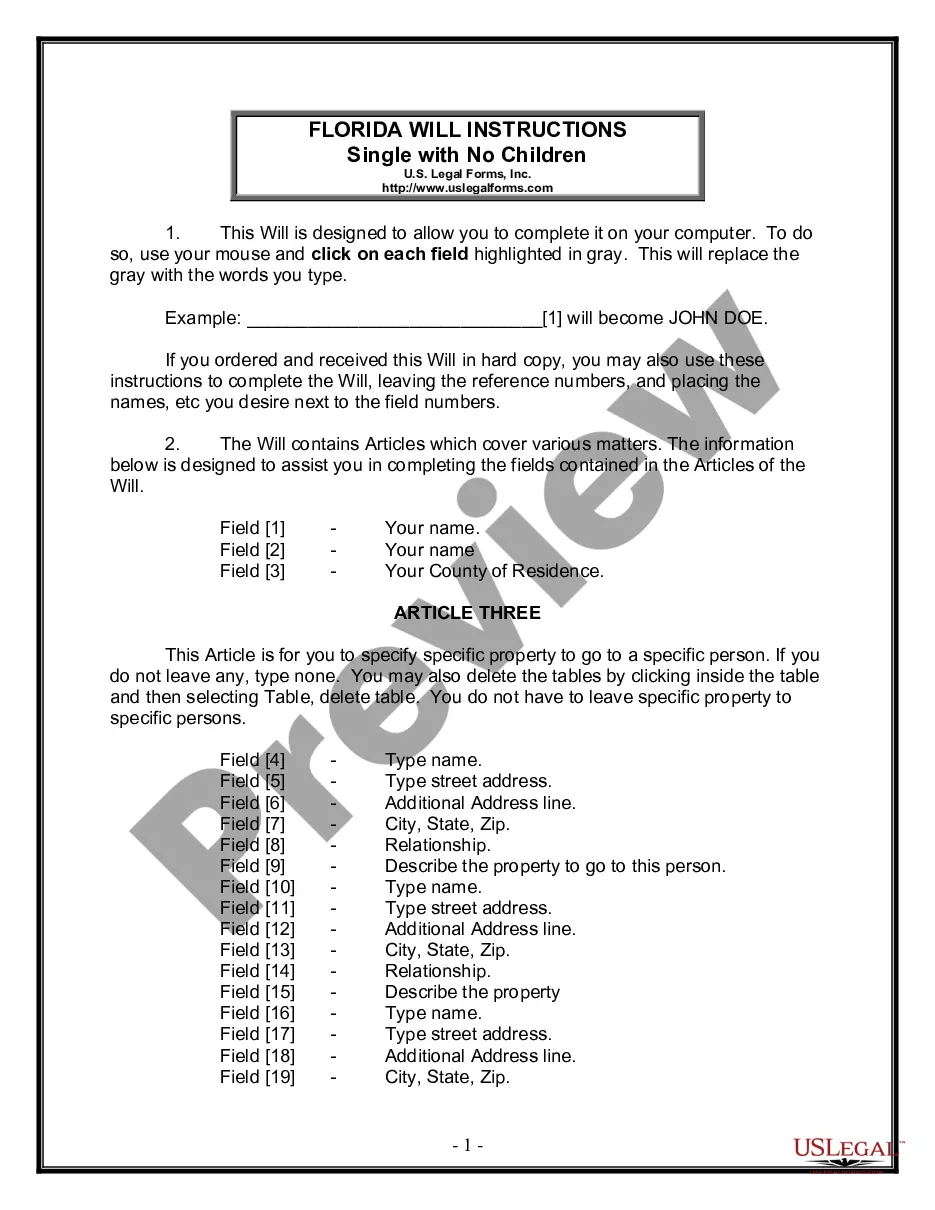

How to fill out North Carolina Installments Fixed Rate Promissory Note Secured By Personal Property?

Locating verified templates that comply with your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms tailored for both personal and professional requirements as well as various real-life situations.

All documents are systematically organized by usage category and jurisdiction, making it simple and quick to find the Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property.

Keeping documents organized and compliant with legal standards is extremely important. Leverage the US Legal Forms library to always have vital document templates accessible for any requirements at your fingertips!

- Review the Preview mode and form overview.

- Ensure you’ve selected the accurate template that fulfills your criteria and entirely aligns with your local jurisdiction needs.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tool above to find the appropriate document.

- If it meets your expectations, proceed to the next step.

Form popularity

FAQ

To record a promissory note payment, maintain a detailed ledger indicating each payment date and amount. You can also utilize online platforms like US Legal Forms to help manage your records efficiently. Keeping accurate records for a Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property helps maintain clarity and accountability.

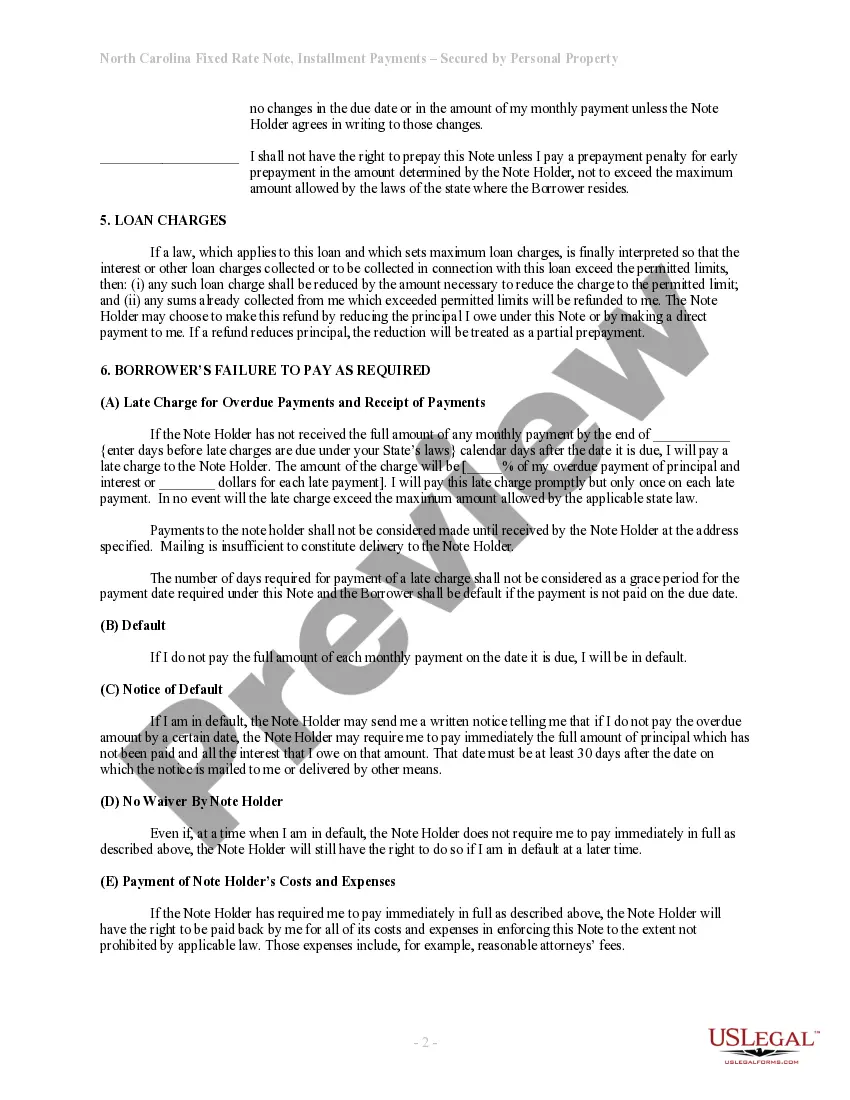

When filling out a promissory note, start with the names and addresses of both the lender and borrower. Specify the principal amount, interest rates, and terms of payment in clear language. Ensure that the note is signed and dated to make it legally binding, especially for a Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property.

A promissory note for debt payable in equal installments is designed to divide the total amount owed into equal payments over a specified period. This method is beneficial for managing budgets and ensuring timely repayments in Fayetteville North Carolina. It creates a clear framework that helps both parties avoid misunderstandings about payment expectations.

A reasonable interest rate for a promissory note can vary, but it typically falls within the range of 5% to 15%, depending on market conditions and the borrower's creditworthiness. In Fayetteville North Carolina, a fixed rate ensures predictable payments over time. Always assess local regulations and consult with a financial advisor to determine fair rates.

In North Carolina, notarization of a promissory note is not always required; however, it can provide added legal protection. For the Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property, having the note notarized strengthens its enforceability. Although it may not be mandatory, taking this step can be beneficial for both parties involved.

In North Carolina, a promissory note typically remains valid for three to six years, depending on the nature of the note. However, it's essential to check specific terms outlined in the Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property. Understanding the validity period helps ensure that you can enforce your rights under the note if necessary.

You can obtain a promissory note from various sources, such as financial institutions, legal offices, or through online platforms. For a Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property, consider using a reputable online service like US Legal Forms. They provide templates and guidance to ensure you have the right documentation for your needs.

Promissory notes may present some disadvantages, such as limited legal protection compared to formal contracts. In the case of the Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property, if issues arise, enforcing the note can be complicated. Additionally, borrowers may face higher interest rates if they present more risk, especially if the note is not secured by strong collateral.

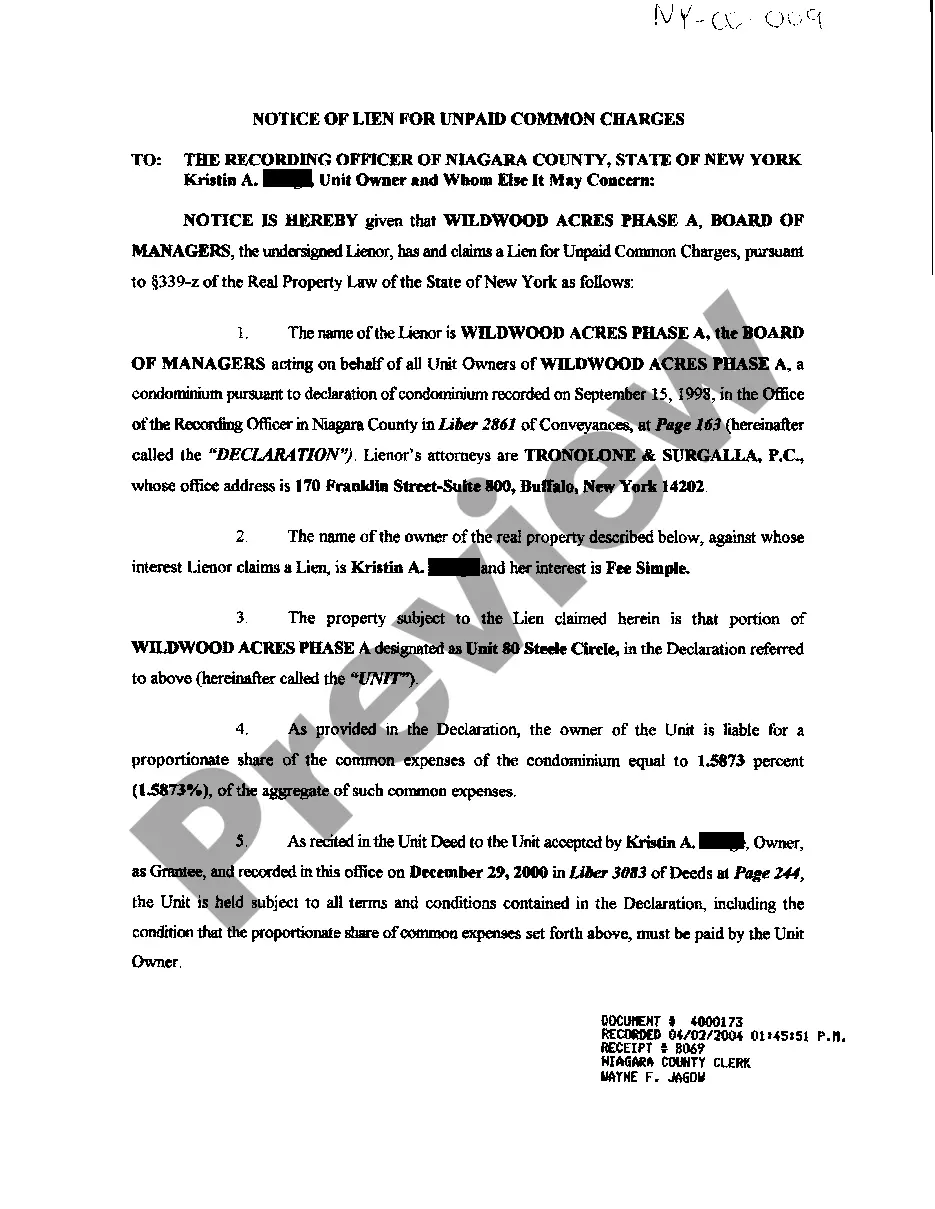

The foreclosure process in North Carolina typically involves several key steps. Initially, the lender sends a notice of default to the borrower, outlining the missed payments and the intent to foreclose. Following this, a notice of sale is published which leads to an auction of the property. Understanding your rights and options, like utilizing a Fayetteville North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property, can be beneficial in navigating this complex process.