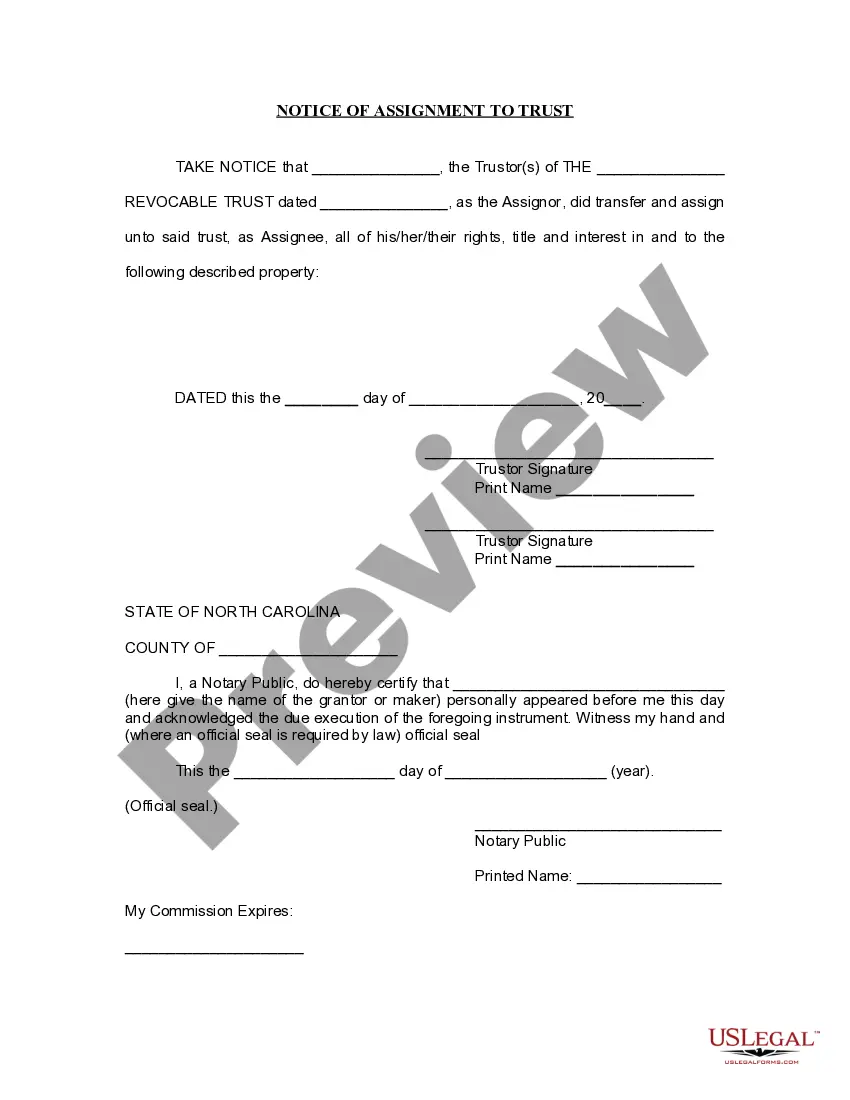

Charlotte North Carolina Notice of Assignment to Living Trust

Description

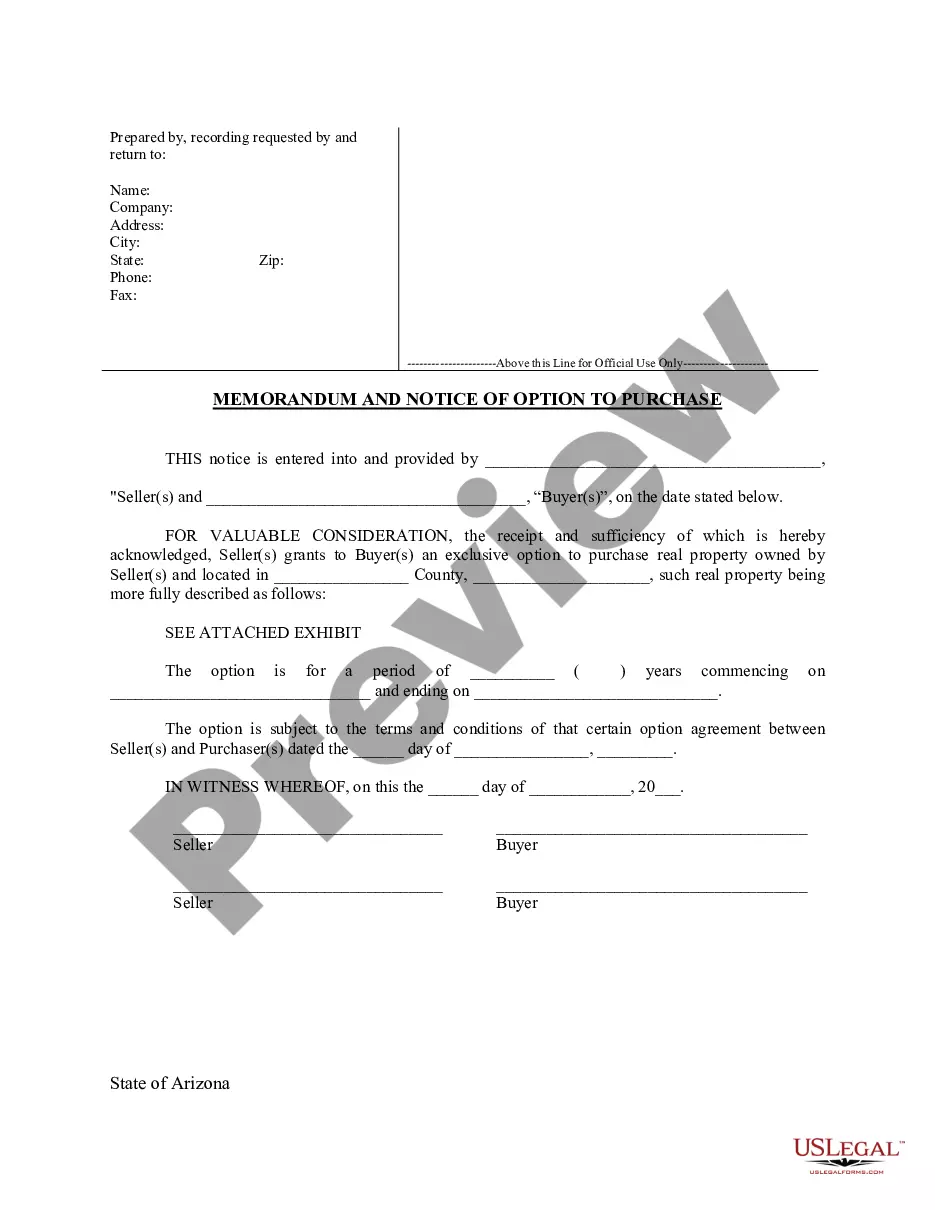

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

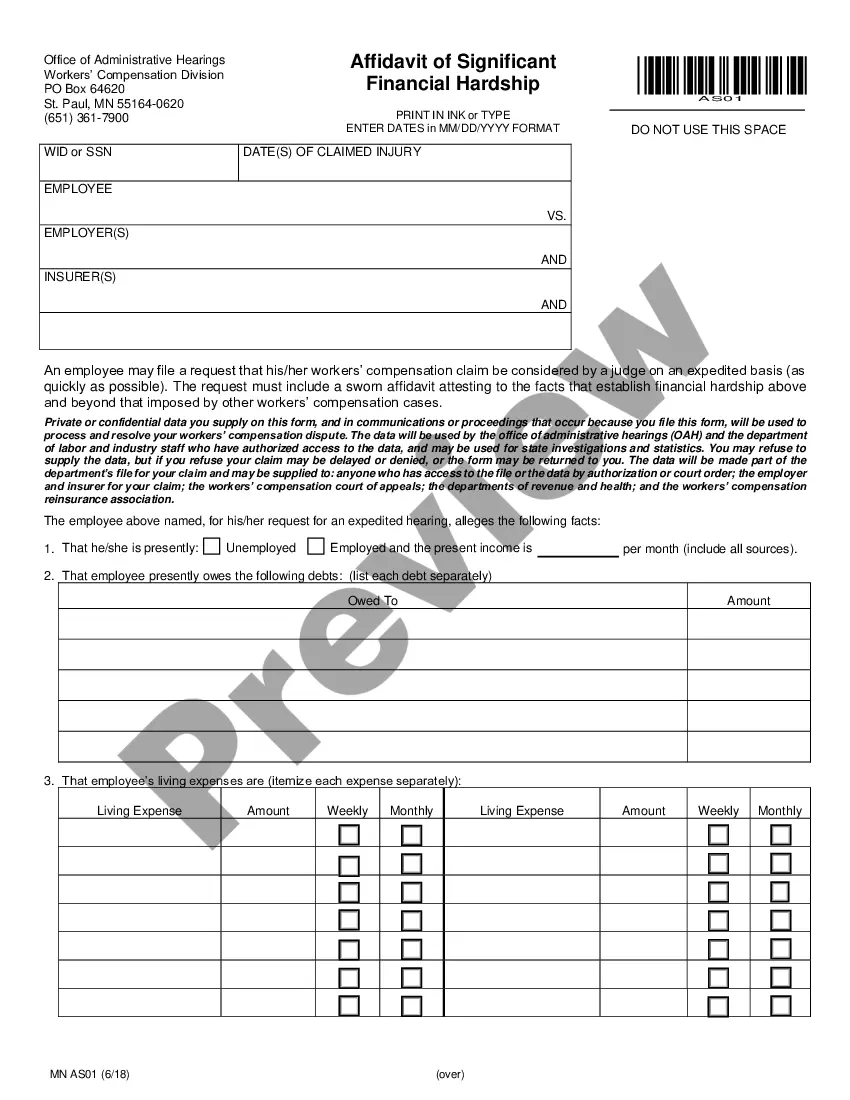

How to fill out North Carolina Notice Of Assignment To Living Trust?

Locating validated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms library.

This is an online resource featuring over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All forms are well categorized by purpose and jurisdiction, making the search for the Charlotte North Carolina Notice of Assignment to Living Trust as straightforward as possible.

Retaining documents organized and compliant with legal specifications is crucial. Utilize the US Legal Forms library to have essential document templates readily available for any requirements at your convenience!

- Examine the Preview mode and document description.

- Ensure you've chosen the correct one that aligns with your requirements and completely adheres to your local legal standards.

- Search for another template, if necessary.

- If you find any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

Deeds of trust and mortgages are a means of securing the payment of a debt or performance of an obligation. The debt may be established by promissory note, bond or other instrument. In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.

Movable property: A trust in relation to movable property can be declared as in the case of immovable property or by transferring the ownership of the property to the trustee. Hence, registration is not mandatory.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

The settlor establishes the trust by transferring the property. The trustee is the person in charge of managing the trust. The beneficiary is the one who will benefit from the trust. As the new legal owner of the property, the trustee manages it according to the settlor's wishes outlined in the deed.

A trust does not go through the North Carolina probate process and becomes a matter of public record.

A trust does not go through the North Carolina probate process and becomes a matter of public record.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.