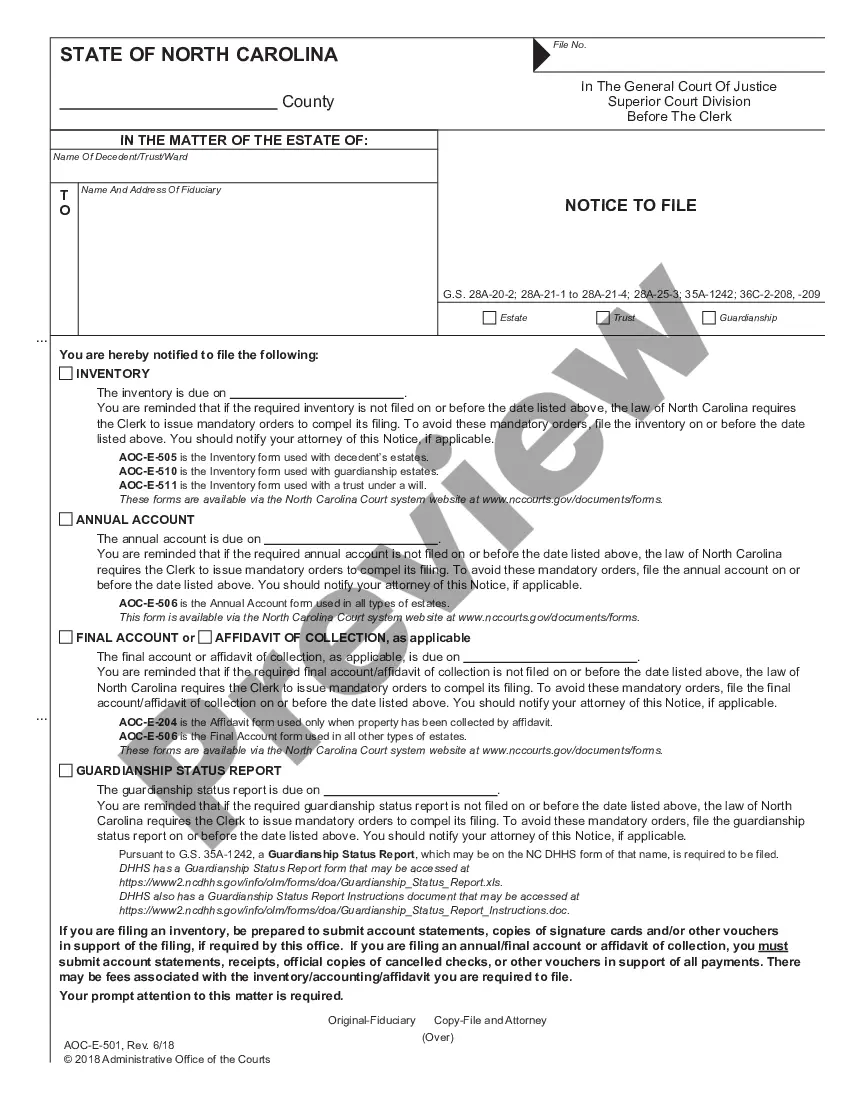

Account, Annual or Final: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Fayetteville North Carolina Account Annual Final

Description

How to fill out North Carolina Account Annual Final?

Take advantage of the US Legal Forms and gain immediate access to any form sample you require.

Our helpful website featuring thousands of templates enables you to locate and acquire nearly any document sample you may need.

You can export, complete, and sign the Fayetteville North Carolina Account Annual Final in just a few minutes instead of spending several hours searching the internet for the correct template.

Utilizing our library is an excellent method to enhance the security of your form submissions.

If you haven't created an account yet, follow the steps outlined below.

Open the page with the template you require. Ensure that it is the template you are looking for: check its title and description, and use the Preview feature when available. If not, utilize the Search function to find the suitable one.

- Our experienced legal professionals frequently review all documents to ensure that the templates are pertinent to a specific region and comply with updated laws and regulations.

- How can you secure the Fayetteville North Carolina Account Annual Final.

- If you already possess an account, simply Log In to your profile.

- The Download option will be available on all the documents you view.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

The estate account for the deceased is a financial record that tracks all transactions related to the assets and liabilities of the deceased's estate. This account is vital for executing the final accounting and ensuring proper distribution to beneficiaries. By maintaining an accurate estate account, you streamline the process of the Fayetteville North Carolina Account Annual Final and meet all legal obligations.

The final account of the estate in North Carolina is a detailed report that reflects all activities associated with the estate from its inception to closure. This document must include all income, expenses, and distributions made to beneficiaries. Completing the final account is crucial for your Fayetteville North Carolina Account Annual Final, as it signifies the end of the estate's financial management.

Final accounts for an estate summarize all financial transactions that occurred during the estate administration. They include all receipts, disbursements, and an accounting of the estate's assets. Preparing these accounts is essential for the Fayetteville North Carolina Account Annual Final to ensure transparency and the accurate execution of the estate's final distribution.

To file an estate claim in North Carolina, you must submit a written claim to the estate’s personal representative. This claim should provide necessary details, including the basis for the claim and the amount owed. Utilizing the resources available through your Fayetteville North Carolina Account Annual Final will help you navigate and properly document this process.

AOC-E 201 is a North Carolina form used for the final accounting of an estate. This document details all financial transactions executed, including receipts and disbursements. By completing the AOC-E 201 as part of your Fayetteville North Carolina Account Annual Final, you help maintain clear and accurate financial records for the estate.

North Carolina follows a specific order of inheritance when there is no will. Typically, the surviving spouse inherits the first share, followed by children, parents, and siblings. Understanding this order is crucial for managing the Fayetteville North Carolina Account Annual Final effectively, ensuring that assets are distributed according to the law.

In North Carolina, the form for final accounting of an estate is the Estate Account, which is filed with the clerk of court. This form provides a comprehensive summary of all incoming and outgoing funds related to the estate. By utilizing the Fayetteville North Carolina Account Annual Final, you can ensure compliance with local regulations and facilitate the final settlement process.

Final accounting to beneficiaries involves providing a detailed report of all financial activities related to the estate before distributing the assets. This report includes all income, expenses, and assets, ensuring that beneficiaries understand the estate's status. For those navigating Fayetteville North Carolina Account Annual Final, this step is crucial for maintaining transparency and trust with beneficiaries.

To probate a will in North Carolina, you must file the will with the clerk of court in the appropriate county. This initiates the legal process and allows the estate to be settled in accordance with the deceased's wishes. Familiarizing yourself with Fayetteville North Carolina Account Annual Final can support you in managing the financial aspects during probate.

The process of final accounting involves reviewing all financial records, reconciling balances, and preparing statements for distribution. This step ensures all parties understand the financial outcome of operations, which is essential for transparency. Utilizing Fayetteville North Carolina Account Annual Final techniques can streamline this process, making it more efficient.