Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

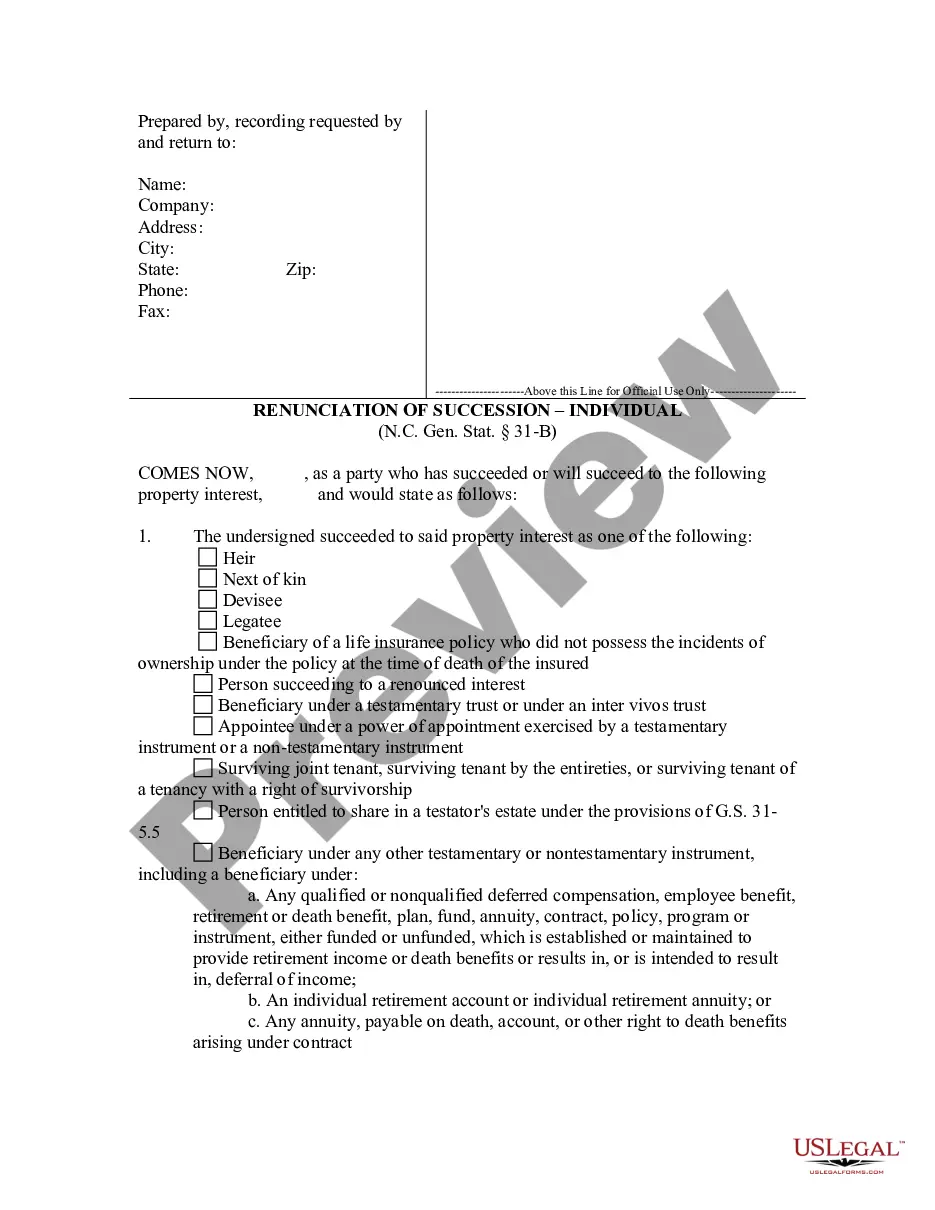

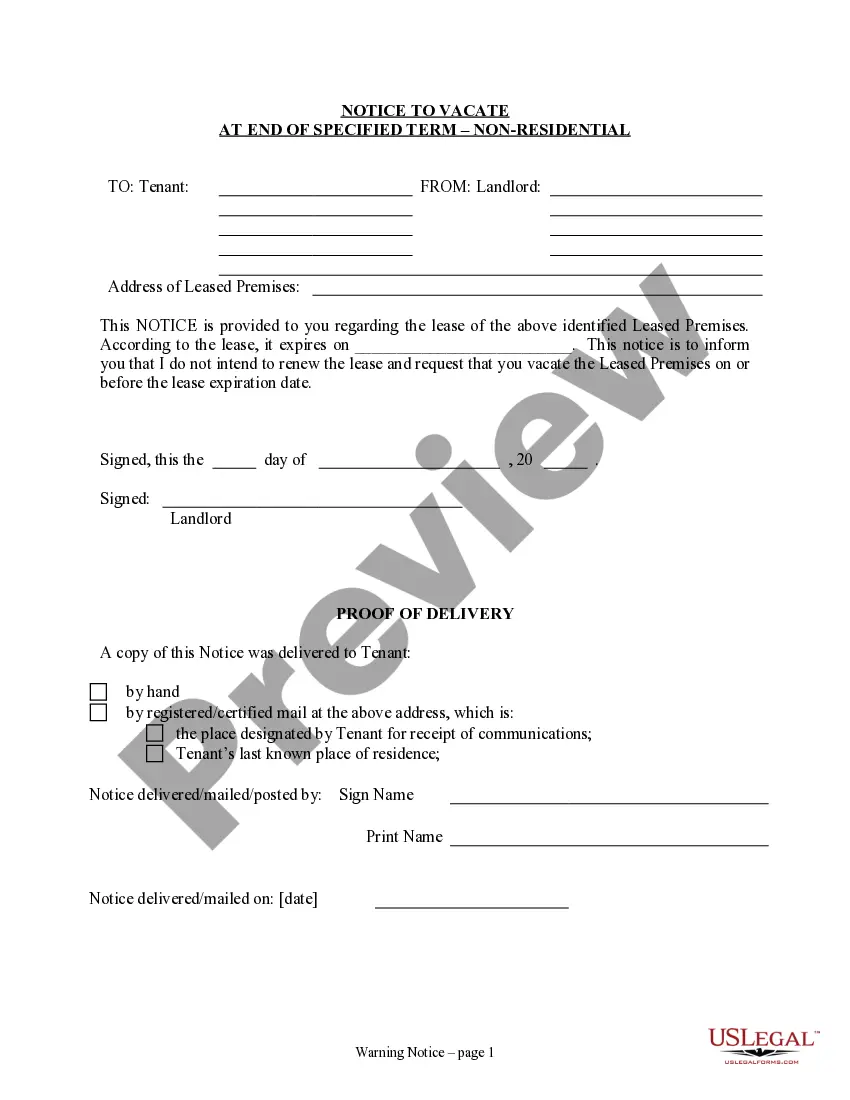

How to fill out North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Are you seeking a dependable and economical supplier of legal forms to obtain the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your divorce process through the court, we have you covered. Our site features more than 85,000 current legal document templates for individual and business applications. All templates we provide are not generic and tailored according to the regulations of particular states and counties.

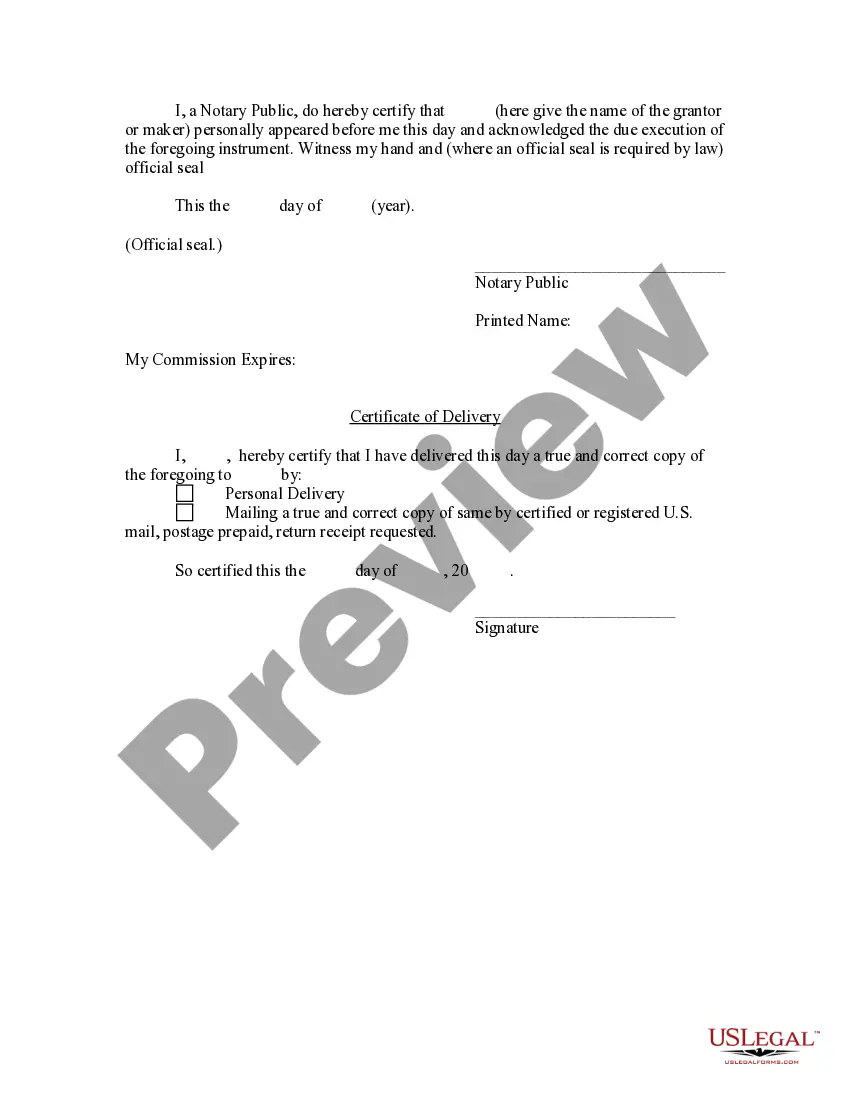

To obtain the form, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time in the My documents section.

Is this your first visit to our site? No problem. You can create an account with ease, but before doing that, ensure to follow these steps.

Now you can register for your account. Then choose your subscription plan and move forward to payment. Once the payment is completed, you can download the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract in any available format. You can return to the website at any time to redownload the form at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and eliminate wasting your precious time trying to understand legal documents online once and for all.

- Verify if the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract complies with your state and local laws.

- Review the details of the form (if available) to determine who and what the form is suitable for.

- Restart your search if the template does not apply to your particular case.

Form popularity

FAQ

Settling an estate without a will in North Carolina involves following the intestate succession laws. The court appoints an administrator to handle the estate, distributing assets according to statutory guidelines. It's essential to understand how renunciations may affect the process, especially concerning life insurance or annuity contracts. For detailed guidance, consider utilizing the resources available through UsLegalForms to navigate these complexities effectively.

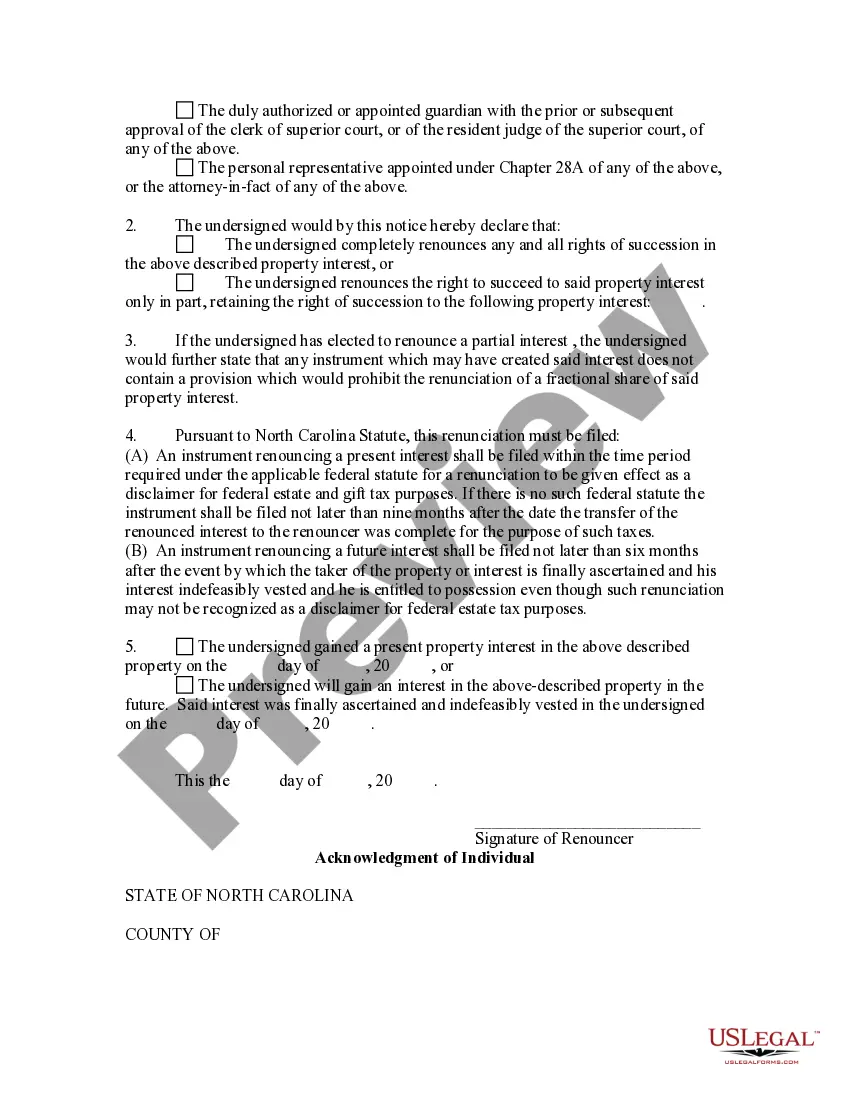

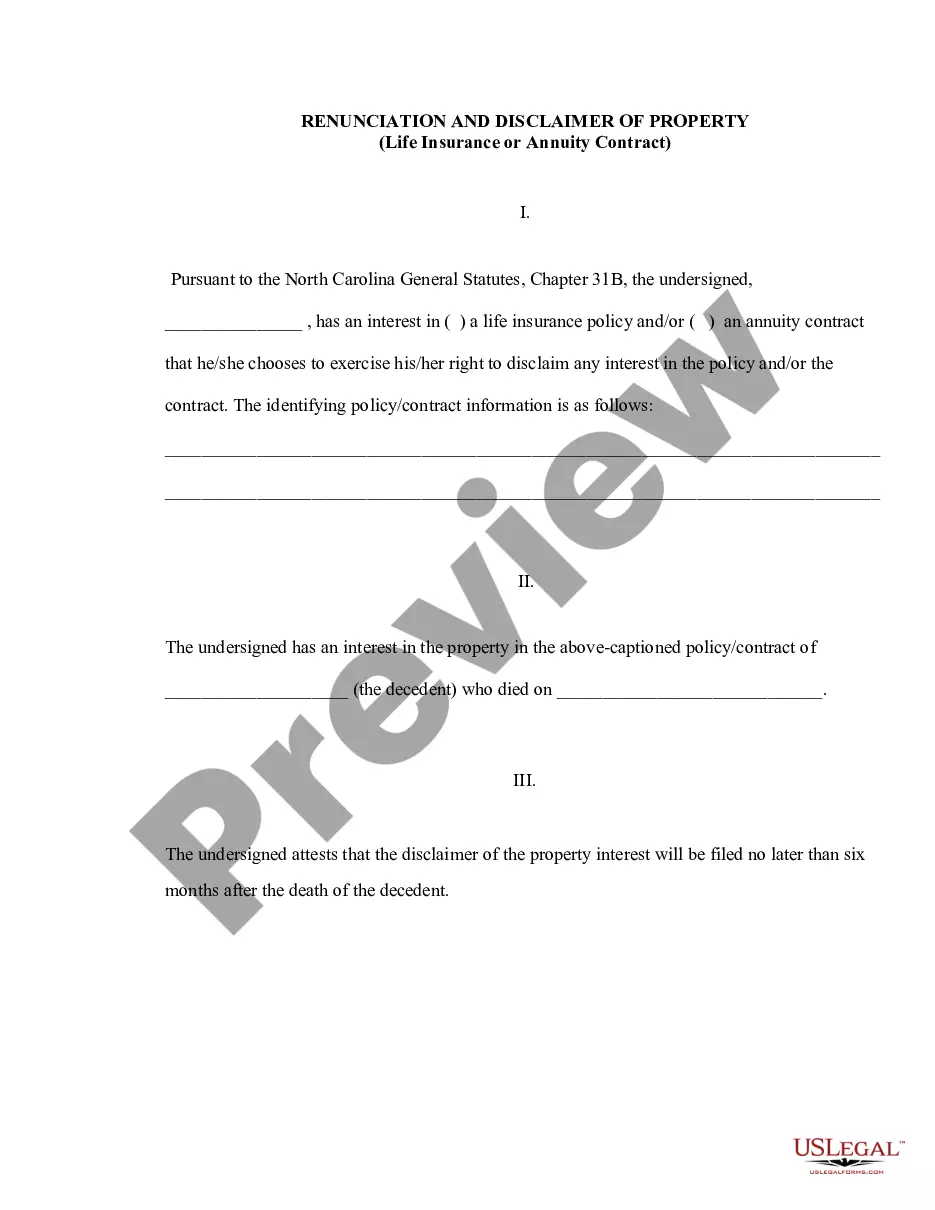

The statute of renunciation in North Carolina outlines the legal procedures for disclaiming property interests. This statute is key for individuals aiming to utilize the Cary North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract effectively. Typically, this involves submitting a formal written disclaimer within a specified timeframe. By adhering to this statute, individuals ensure compliance and protect their interests.

The doctrine of renunciation allows individuals to decline their inheritance rights, particularly when it comes to life insurance or annuity proceeds in Cary, North Carolina. This legal principle ensures that disclaiming an inheritance does not generate any negative consequences for the individual. For example, it can protect heirs from liabilities associated with the inherited property. This process provides essential flexibility in estate planning.

In North Carolina, a spouse does not automatically inherit all assets in every situation. The specifics depend on whether there is a will and the nature of the property. If there is no will, the laws of intestacy determine the distribution of assets. Often, a spouse may receive a significant portion, but understanding Cary North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can clarify any nuances.

The law of renunciation allows individuals in Cary, North Carolina, to refuse inheritance or property interests. This legal framework provides a structured way to disclaim assets, including those from life insurance or annuity contracts. Typically, the renunciation must be executed in writing, adhering to specific guidelines. Understanding these laws is crucial for individuals looking to navigate their estate responsibilities effectively.

A letter of renunciation serves to formally decline an inheritance or property benefit, particularly in the context of Cary North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Individuals use this document to ensure that assets bypass their estate, often to benefit other heirs. By renouncing a property interest, one can also avoid potential tax implications. This process helps clarify intentions and facilitates smoother estate management.

You can contest a life estate deed if you have valid grounds for doing so, such as challenging its validity or the circumstances under which it was created. This process can be complex and often requires the guidance of legal experts. With the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, you may find resources to support your case and ensure your rights are protected.

Yes, a life estate deed can be contested under certain circumstances in Cary, North Carolina. Common grounds for contesting include allegations of fraud, undue influence, or lack of mental capacity at the time the deed was signed. If you’re considering this route, consulting with a legal professional familiar with the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can provide you better clarity.

In general, a will does not supersede a life estate deed. A life estate deed grants specific rights to the lifetime occupant, while a will distributes your assets upon death. If you are involved in property matters in Cary, make sure to understand how the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can affect your situation.

Yes, you can remove someone from a life estate deed, but the process may vary depending on the specific laws of Cary, North Carolina. You typically need consent from the involved parties and may also require a legal document to formalize the removal. For those considering property renunciation, the Cary North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract might provide helpful guidelines.