This form is a General Warranty Deed where the Grantors are two individuals and the Grantee is an individual. Grantors convey and generally warrant the described property to the Grantee. This deed complies with all state statutory laws.

Charlotte North Carolina General Warranty Deed from Two Individuals to an Individual

Description

How to fill out North Carolina General Warranty Deed From Two Individuals To An Individual?

Do you require a trustworthy and affordable legal forms supplier to purchase the Charlotte North Carolina General Warranty Deed from Two Individuals to an Individual? US Legal Forms is your ideal choice.

Whether you are looking for a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we provide are not generic and are tailored based on the specifications of particular states and regions.

To download the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can download your previously acquired form templates at any time from the My documents tab.

Are you unfamiliar with our platform? No problem. You can create an account in just minutes, but first, ensure to do the following.

Now you can establish your account. Next, select the subscription plan and proceed with the payment. After completing the payment, download the Charlotte North Carolina General Warranty Deed from Two Individuals to an Individual in any available format. You can return to the website at any time and redownload the document at no additional cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and eliminate the need to spend hours researching legal paperwork online once and for all.

- Verify if the Charlotte North Carolina General Warranty Deed from Two Individuals to an Individual adheres to the laws of your state and locality.

- Review the form’s specifics (if applicable) to understand who and what the document is meant for.

- Restart the search if the template does not fit your legal needs.

Form popularity

FAQ

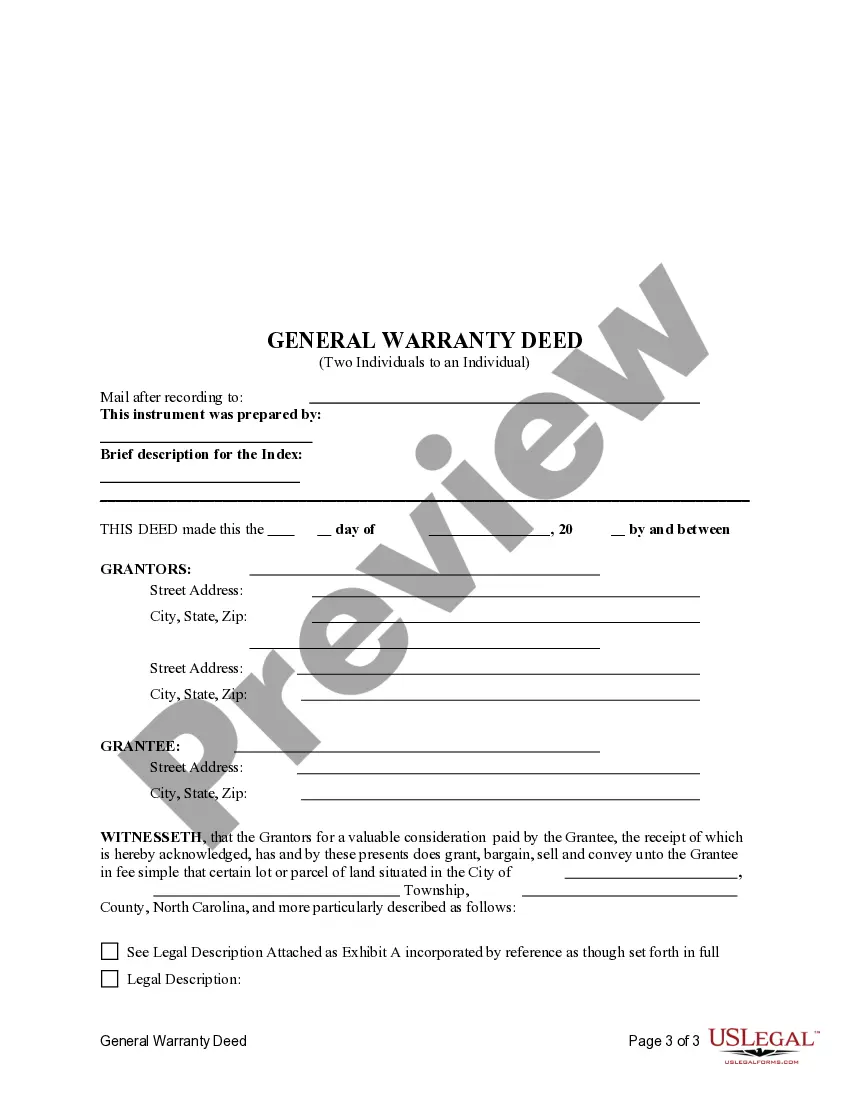

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

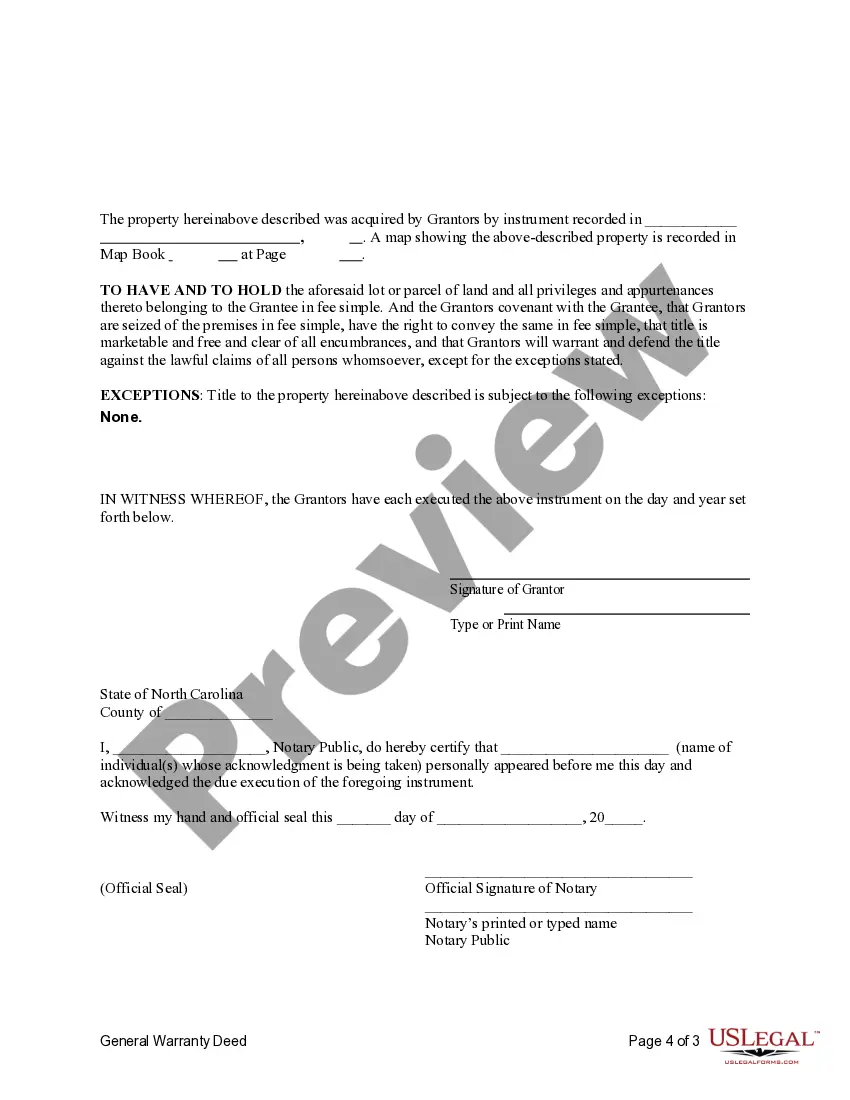

In most cases, the fees will amount to between £100 and £500 +VAT. Your conveyancer may or may not include cover for additional charges within their service.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Yes you can. This is called a transfer of equity but you will need the permission of your lender.