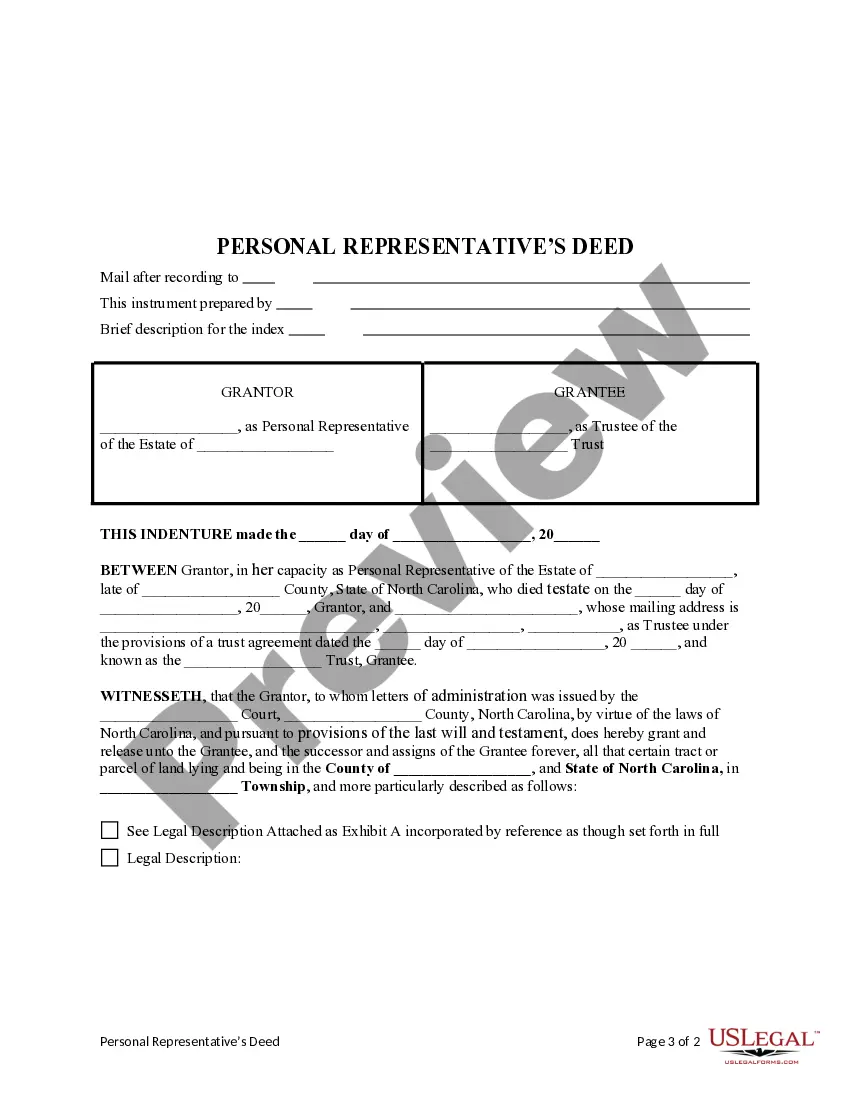

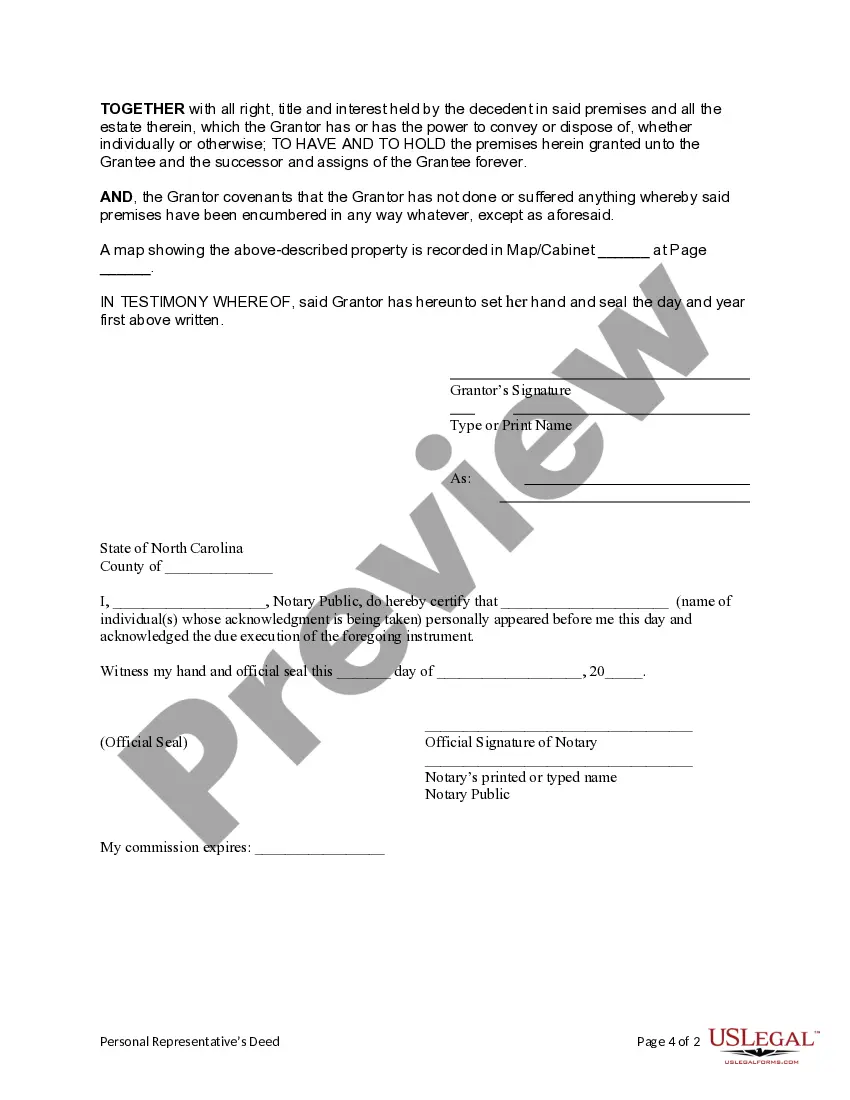

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Cary North Carolina Personal Representative's Deed to a Trust

Description

How to fill out North Carolina Personal Representative's Deed To A Trust?

Locating authenticated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both personal and professional purposes, along with various real-world situations.

All the files are effectively categorized by usage area and jurisdiction, enabling you to find the Cary North Carolina Personal Representative's Deed to a Trust quickly and effortlessly.

Maintaining your paperwork organized and compliant with legal standards is highly crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirements right at your fingertips!

- Check the Preview mode and document description.

- Ensure you’ve selected the correct one that satisfies your needs and entirely aligns with your local jurisdiction criteria.

- Look for another template, if necessary.

- If you identify any discrepancies, use the Search tab above to find the accurate one.

- If it meets your requirements, proceed to the subsequent step.

Form popularity

FAQ

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

Because probate attorney fees in North Carolina will vary, it's difficult to give an exact estimate. Most probate attorneys bill hourly, and fees can often run anywhere from $2,000 - $10,000 or more, depending on how complex the estate is.

Probate is the court-supervised legal process that gives someone the authority to handle an estate. Whether a person dies with or without a will, probate is the only way to get assets out of their name to pass those assets on. In North Carolina, the probate process is managed by the Clerk of Superior Court.

Administering an uncontested probate and estate administration in North Carolina generally takes between six months to a year. The process and time involved can vary depending upon the nature and complexity of the Estate.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim ? in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

Creditors have 90 days to file a claim with the estate. That's three months of the probate process right there. As a general rule, most cases of probate take at least six months to one year to settle. In cases of large estates or estates with numerous or complicated assets, it could take years to settle probate.

Close the estate bank account after all debts are paid and assets are distributed. Once all claims against the estate have been satisfied, file a final accounting with the probate court and ask that the estate be closed.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

With the exception of small estates (less than $20,000 or $30,000, depending upon the nature of the Estate), it usually takes six to twelve months to properly administer an Estate. Any disputes that arise during the administration of the Estate can delay Estate Administration significantly (sometimes years).

Notices to creditors must be published once a week for four (4) consecutive weeks and should state that claims must be filed by a date certain, which date is at least three (3) months from the date of first publication of the notice.