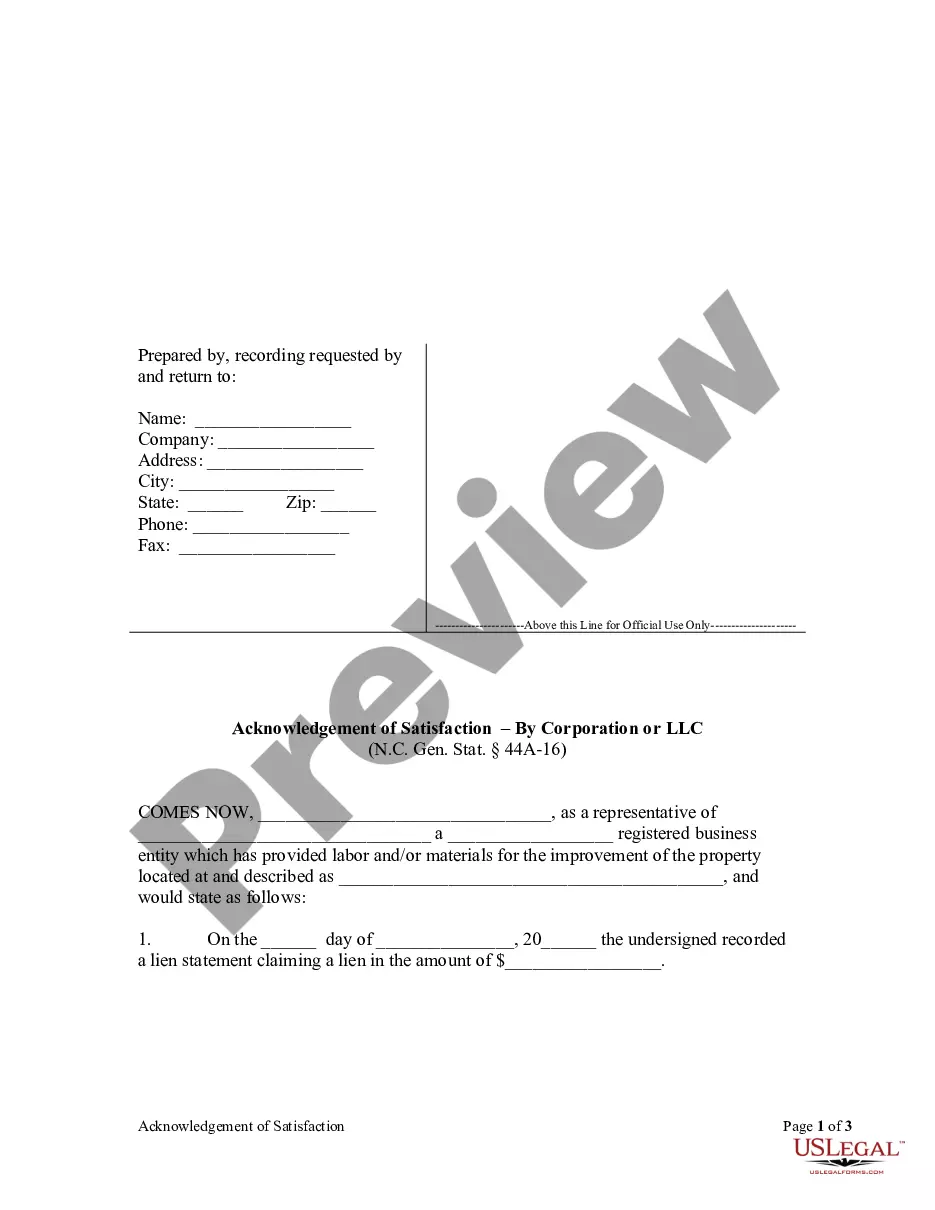

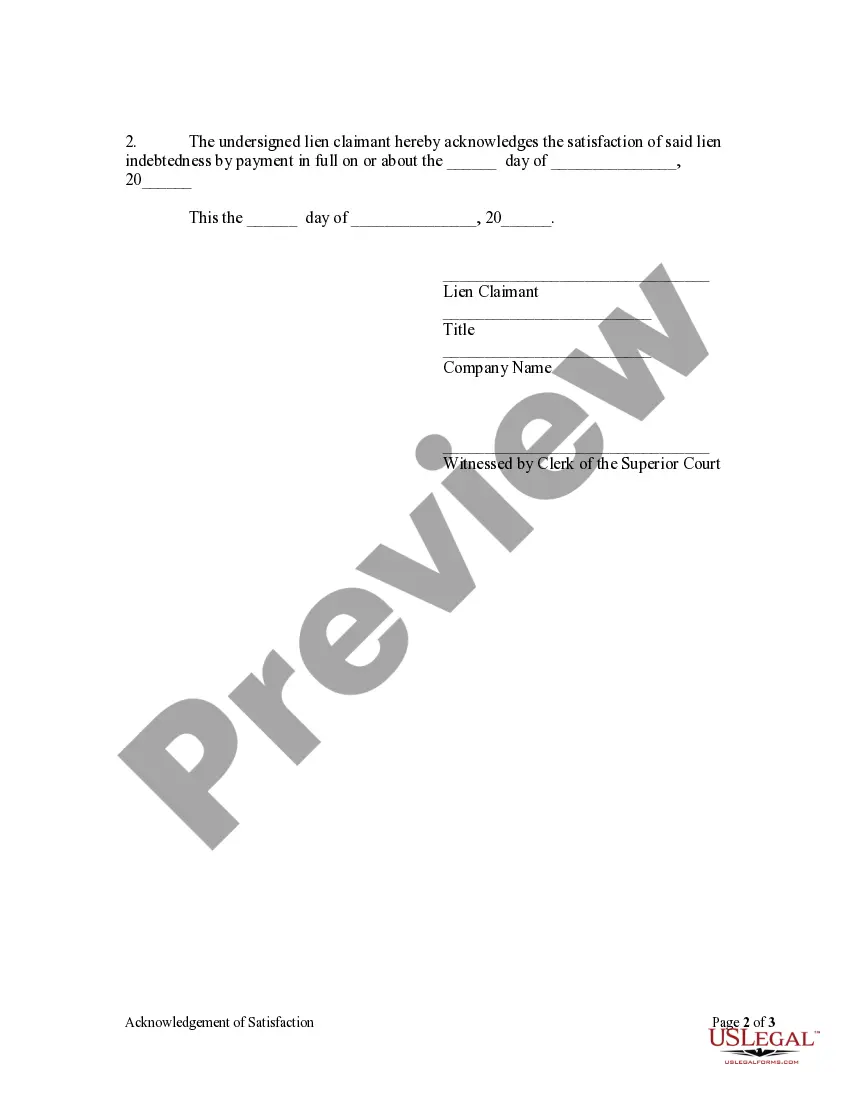

North Carolina statutes set out several methods with which a lien may be discharged. One of these methods allows a lien claimant to sign and acknowledge the satisfaction of the lien in the presence of a clerk of the superior court.

Greensboro North Carolina Acknowledgment of Satisfaction for Corporation

Description

How to fill out North Carolina Acknowledgment Of Satisfaction For Corporation?

Take advantage of the US Legal Forms and gain instant access to any form example you desire.

Our efficient platform with countless document templates streamlines the process of locating and acquiring nearly any document example you need.

You can download, fill out, and verify the Greensboro North Carolina Acknowledgment of Satisfaction for Corporation or LLC in mere minutes rather than spending hours online searching for the perfect template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you haven’t created a profile yet, follow the instructions outlined below.

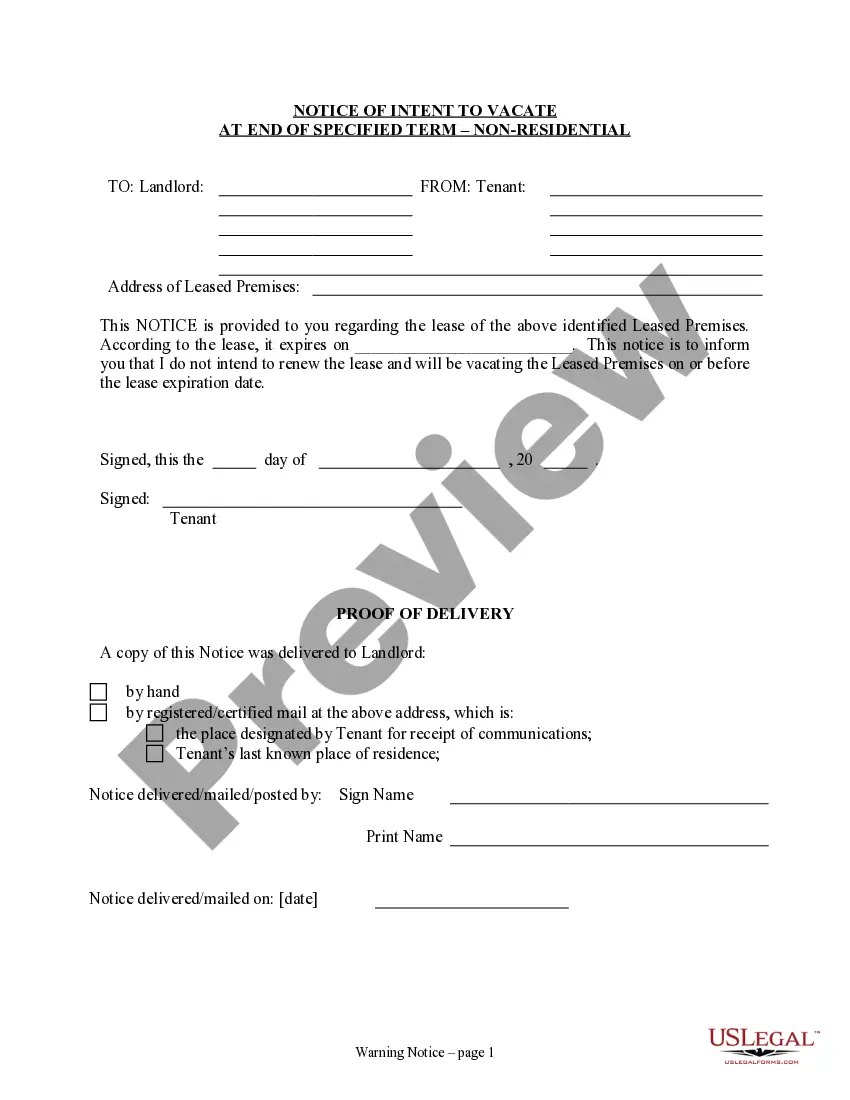

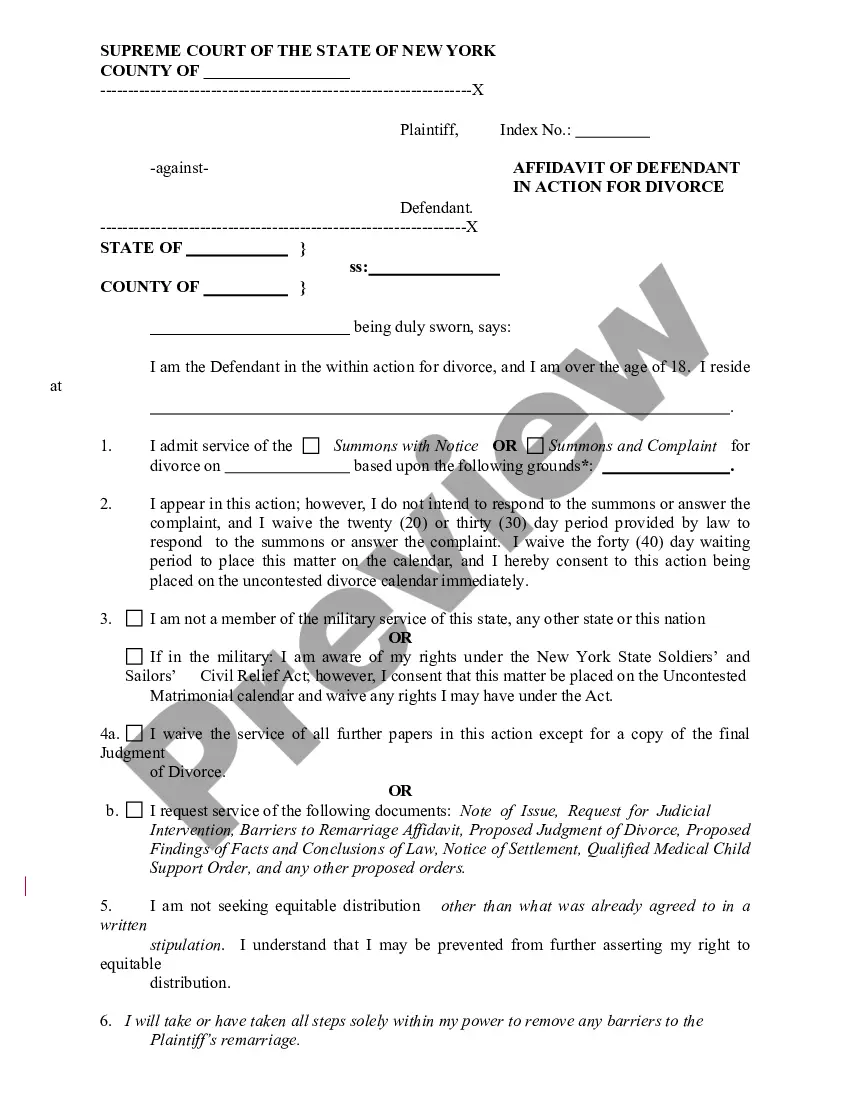

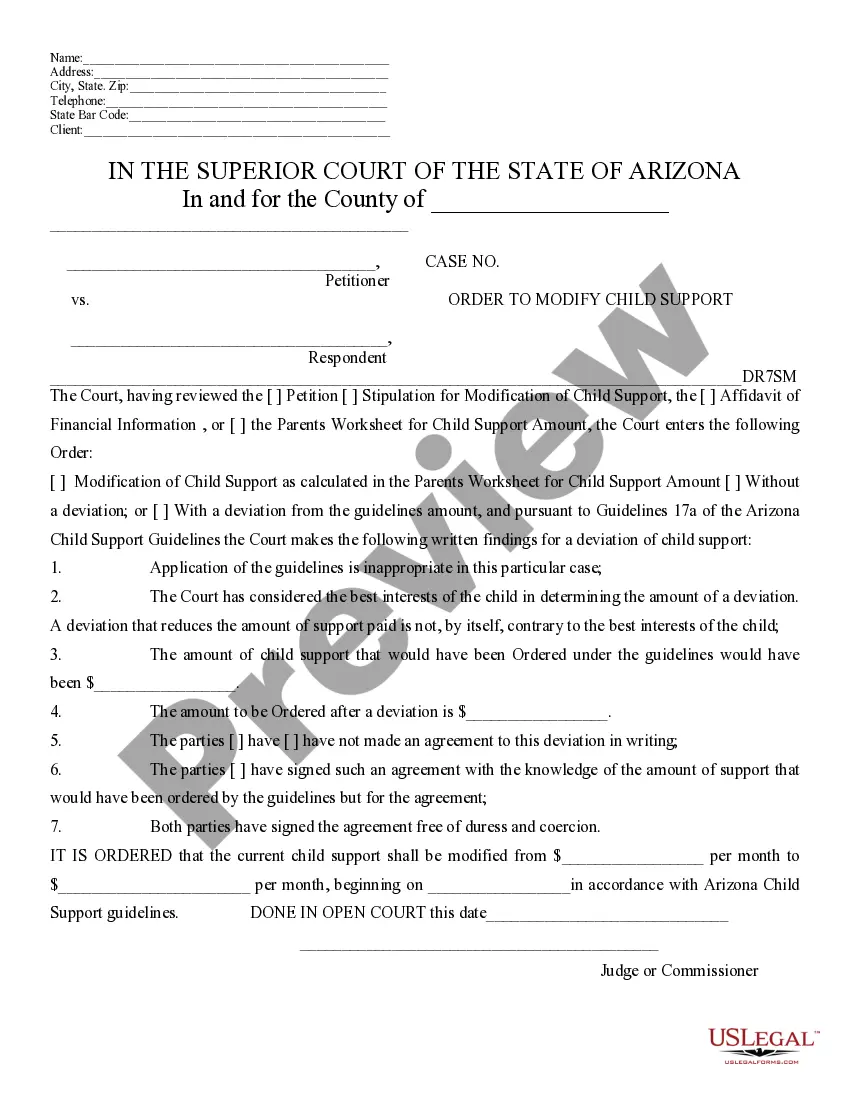

Access the page with the form you need. Ensure that it is the template you were looking for: verify its title and description, and take advantage of the Preview function when available. If not, use the Search bar to locate the correct one.

- Our experienced legal experts consistently examine all the documents to ensure that the templates are pertinent to a specific area and in accordance with new laws and regulations.

- How can you access the Greensboro North Carolina Acknowledgment of Satisfaction for Corporation or LLC.

- If you already have an account, simply Log In to your profile.

- The Download button will be activated on all the documents you view.

- Additionally, you can find all your previously saved documents in the My documents section.

Form popularity

FAQ

Verification typically involves affirming details about a document's authenticity, while acknowledgment confirms that a signature was made voluntarily in the presence of a notary. For Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, acknowledgment is key, as it provides legal assurance that the document represents genuine agreement and compliance.

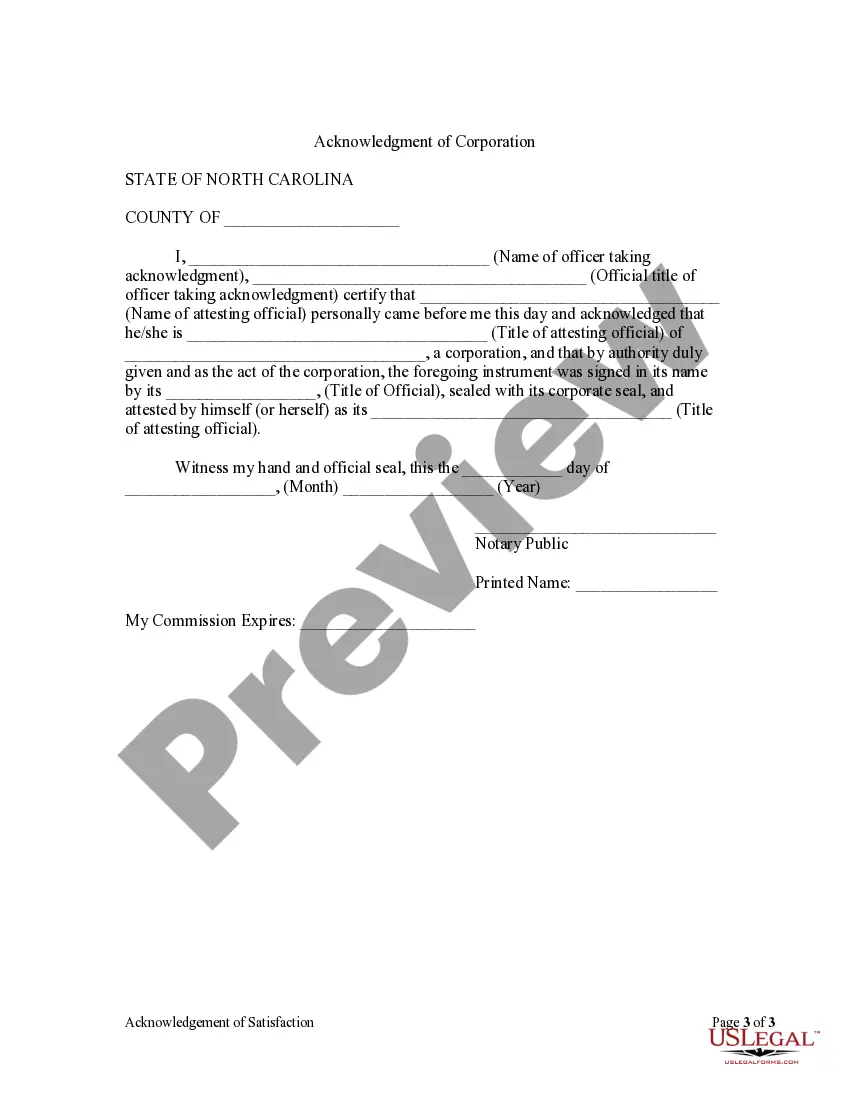

To get a document notarized in North Carolina, find a licensed notary public and present your documents for signature. The notary will check your identification and witness your signing process. Platforms like uslegalforms offer solutions to help you find licensed notaries in Greensboro, simplifying the process of obtaining an acknowledgment for the Greensboro North Carolina Acknowledgment of Satisfaction for Corporation.

An acknowledgment is a process where a notary certifies a signature, while a direct notary act encompasses various notary services, including witnessing signatures and administering oaths. In the context of Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, the acknowledgment specifically confirms that the corporation's obligations have been satisfied through its authorized representative’s signature.

Typically, the authorized representative of the corporation signs the notary acknowledgment. This individual must have the authority to bind the corporation legally. When dealing with Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, it's essential that the right corporate officer is present to ensure the acknowledgment is valid.

A signature represents a person’s consent or agreement, while an acknowledgment is a formal recognition of that signature by a notary. In Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, this distinction is crucial. The acknowledgment verifies that the signer appeared before the notary and confirmed the signature, adding a layer of authenticity.

A corporate notary acknowledgment is a formal declaration by a notary public that a corporation's authorized representative has signed a document. This process verifies the authenticity of the signature and ensures it was made willingly. In the context of Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, this acknowledgment confirms that the corporation has fulfilled its obligations.

The proper attestation for a notary in North Carolina should include a statement confirming the identity of the signer and the act of notarization. It usually states, 'Witness my hand and official seal.' When finalizing your Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, utilizing this attestation strengthens the credibility of your document.

Key terms for an acknowledgement notary include 'personally appeared,' 'acknowledged,' and 'signature.' These words help define the notary's role in confirming the identities and intentions of the signers. When addressing Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, it’s important to incorporate these keywords effectively for clarity.

A signature acknowledgement usually involves the notary writing a statement that indicates they witnessed the signer’s signature. For example, the notary may write, 'On this day, the individual personally appeared before me, acknowledged their signature, and affirmed their understanding of the document.' When handling a Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, this format ensures the legal standing of your document.

Notarial wording can vary, but it typically includes phrases that affirm the identity of the signer and their intent. For instance, wording may start with 'State of North Carolina, County of Guilford,' followed by a statement that confirms the acknowledgment. This kind of language is crucial for your Greensboro North Carolina Acknowledgment of Satisfaction for Corporation, as it validates your document.