A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

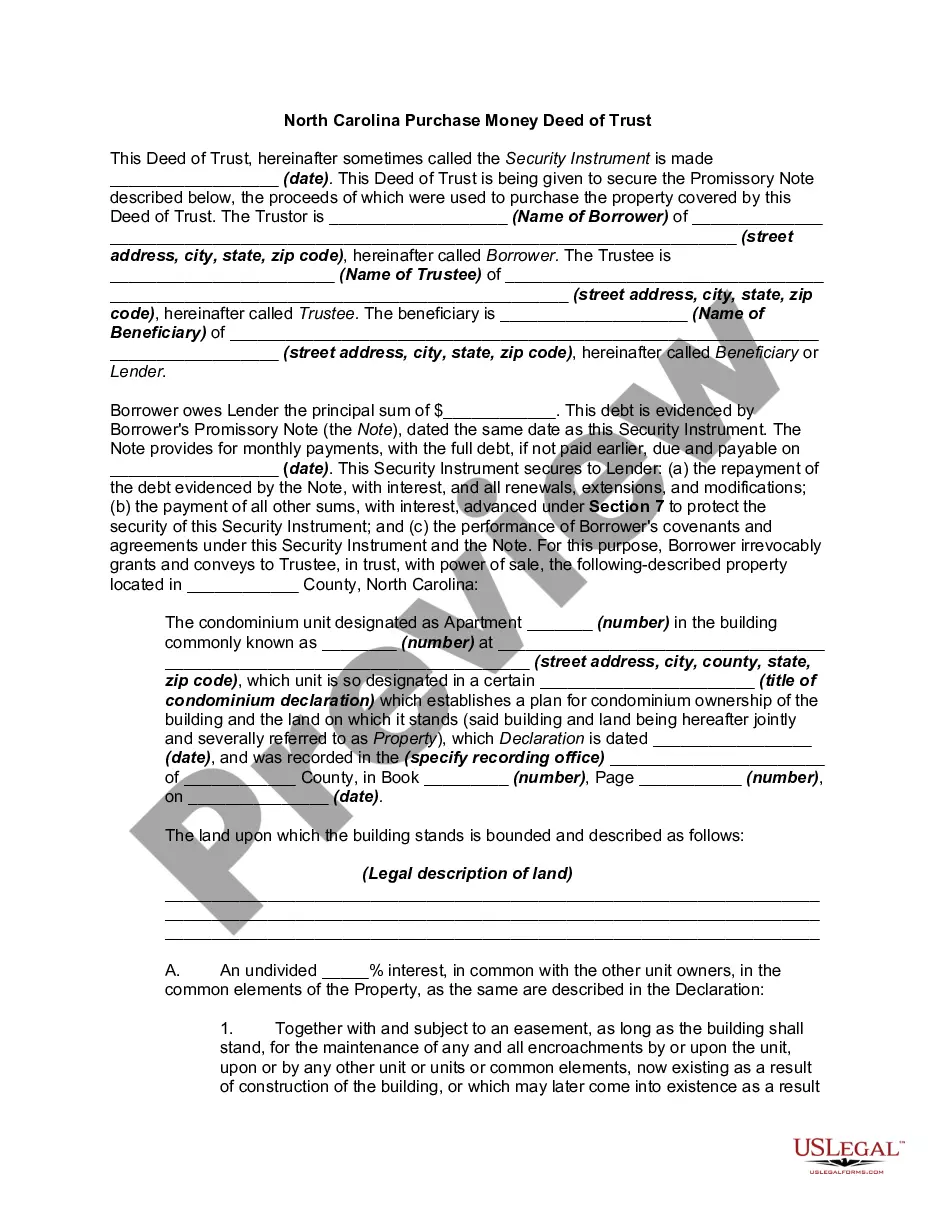

Charlotte North Carolina Purchase Money Deed of Trust - Condominium

Description

How to fill out North Carolina Purchase Money Deed Of Trust - Condominium?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our user-friendly system with countless documents simplifies the process of locating and obtaining nearly any form sample you may require.

You can save, complete, and endorse the Charlotte North Carolina Purchase Money Deed of Trust - Condominium in just minutes instead of spending hours online searching for an appropriate template.

Using our database is an excellent method to enhance the security of your document submissions.

US Legal Forms is likely one of the largest and most trustworthy template repositories available online.

We are always prepared to assist you with nearly any legal process, even if it simply involves downloading the Charlotte North Carolina Purchase Money Deed of Trust - Condominium.

- Our proficient attorneys frequently review all documents to verify that the templates are suitable for a specific area and adhere to updated laws and regulations.

- How can you acquire the Charlotte North Carolina Purchase Money Deed of Trust - Condominium? If you have an account, simply Log In to your profile. The Download button will become active for all the documents you access.

- Moreover, you can locate all previously saved documents in the My documents section.

- If you have not created an account yet, follow the steps outlined below.

- Access the page containing the template you need. Confirm that it is the specific form you were looking for: verify its title and description, and utilize the Preview option if it is available. Alternatively, use the Search box to find the correct one.

- Initiate the downloading process. Click Buy Now and select the pricing option you prefer. Then, set up an account and complete your purchase using a credit card or PayPal.

- Download the form. Choose the format to acquire the Charlotte North Carolina Purchase Money Deed of Trust - Condominium and adjust and complete, or sign it as needed.

Form popularity

FAQ

The difference between a deed and a deed of trust is the type of ownership interest each document conveys. A deed is a full ownership interest. A deed of trust is a security interest.

Both are dictated by state laws. In some states, only a mortgage is legal. In others, lenders can only use a deed of trust. A few states (like Alabama and Michigan) allow both. If your state allows both types of contracts, it's up to your lender to choose which type you receive.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

What is a trust deed. A trust deed is a voluntary agreement between you and the people you owe money to (also called your creditors). You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off.

A legal document that creates a trust, giving a person or organization the right to manage money or property for someone else, and says how this should be done: The trust deed stated clearly what they were entitled to do with the property. The pension scheme is governed by a trust deed and a set of rules.

The statute applies the ten year period tothe foreclosure of a mortgage, or deed in trust for creditors with a power of sale,of real property, where the mortgagor or grantor has been in possession of the property, within ten years after the forfeiture of the mortgage, or after the power of sale became absolute, or

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate. Upon repayment of the debt or performance of the obligation, the conveyance becomes void.

In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate. Upon repayment of the debt or performance of the obligation, the conveyance becomes void.

A deed of trust is a legal document that secures a real estate transaction. It works similarly to a mortgage, though it's not quite the same thing. Essentially, it states that a designated third party holds legal title to your property until you've paid it off according to the terms of your loan.