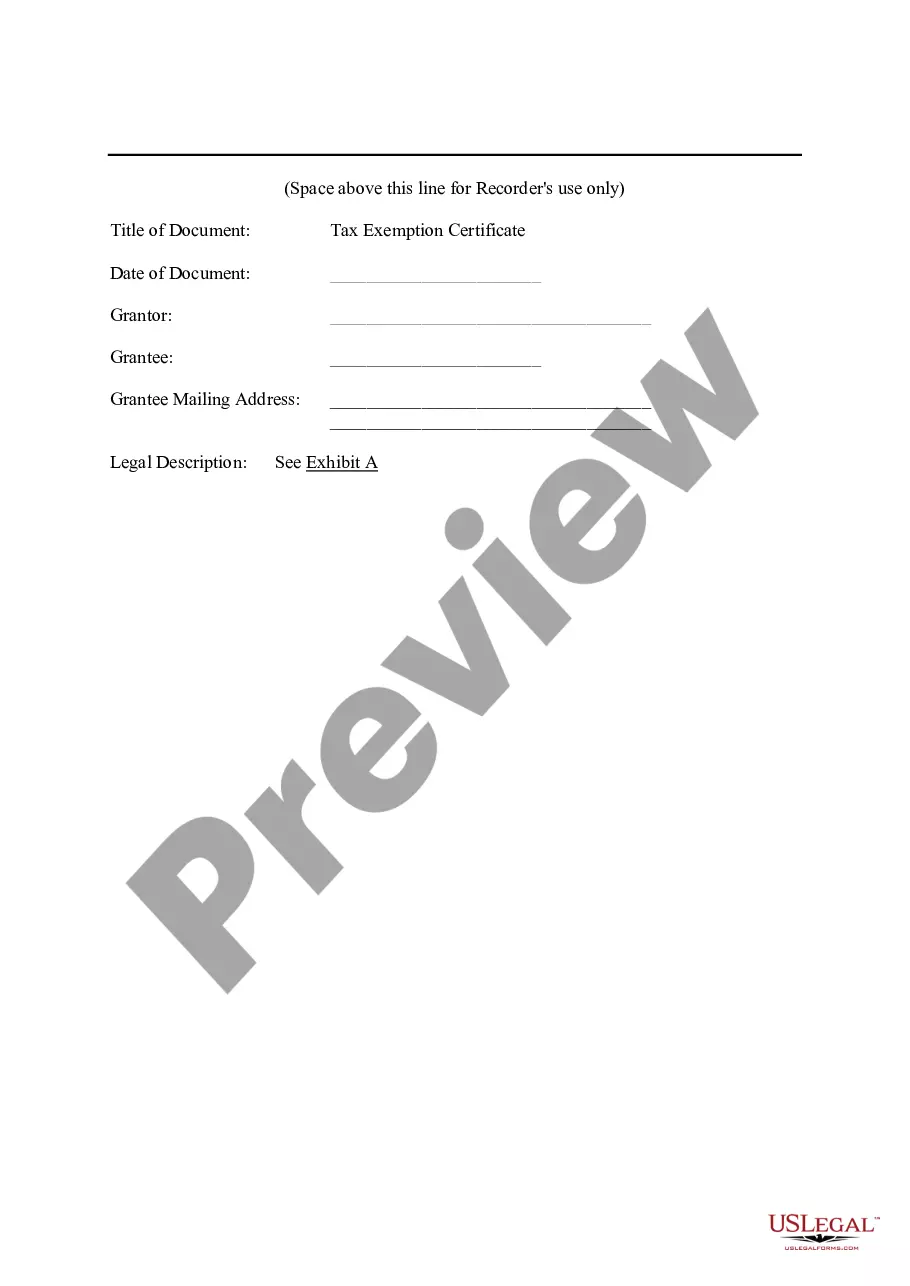

Lee's Summit Tax Exemption CertificateThe Planned Industrial Expansion Authority of_____City, Missouri

Description

This ad valorem tax exemption certificate was issued to the

developer by the City as part of the contract to redevelop land

within the city.

How to fill out Tax Exemption CertificateThe Planned Industrial Expansion Authority Of_____City, Missouri?

Are you searching for a reliable and budget-friendly legal document provider to acquire the Lee's Summit Missouri Tax Exemption Certificate? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce process in court, we have everything you need. Our platform boasts over 85,000 current legal document templates for individual and business purposes. All the templates we provide access to are not one-size-fits-all but tailored to meet the requirements of specific states and jurisdictions.

To obtain the form, you must Log In to your account, search for the desired template, and click the Download button adjacent to it. Please remember that you can access your previously purchased document templates at any time from the My documents section.

Are you unfamiliar with our site? No problem. You can create an account in just a few minutes, but before you do, ensure you complete the following.

Now you can register your account. Then select the subscription plan and continue to checkout. Once the payment is finalized, download the Lee's Summit Missouri Tax Exemption Certificate in any available file format. You can return to the website whenever necessary and redownload the form at no additional charge.

Acquiring current legal documents has never been simpler. Give US Legal Forms a try today, and put an end to spending hours understanding legal paperwork online once and for all.

- Verify if the Lee's Summit Missouri Tax Exemption Certificate aligns with the regulations of your state and locality.

- Read the form's details (if available) to learn who and what the form is suitable for.

- Reinitiate your search if the template does not fit your legal needs.

Form popularity

FAQ

Any social, civic, religious, political subdivision, or educational organization can apply for a sales tax exemption by completing Form 1746PDF Document, Missouri Sales Tax Exemption Application.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Where To Get a Certificate of Tax Exemption? The Certificate of Tax Exemption (CTE) is obtained from the Revenue District Office (RDO) having jurisdiction over the residence of the taxpayer or where the taxpayer is registered.

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

MO Code Regs.In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

Go to the Missouri Department of Revenue for more information or call at (573) 751-2836 to get a sales tax number or sales tax exemption.

The definition of a farm is straightforward: An area of land and its buildings used for growing crops and/or raising animals.

In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

The sales tax exemption specifically applies to ?a motor vehicle or trailer used for agricultural use,? and according to LR 8039, a zero-turn lawn mower is neither. It's difficult to keep track of what qualifies for a sales tax exemption in different states, and what doesn't.