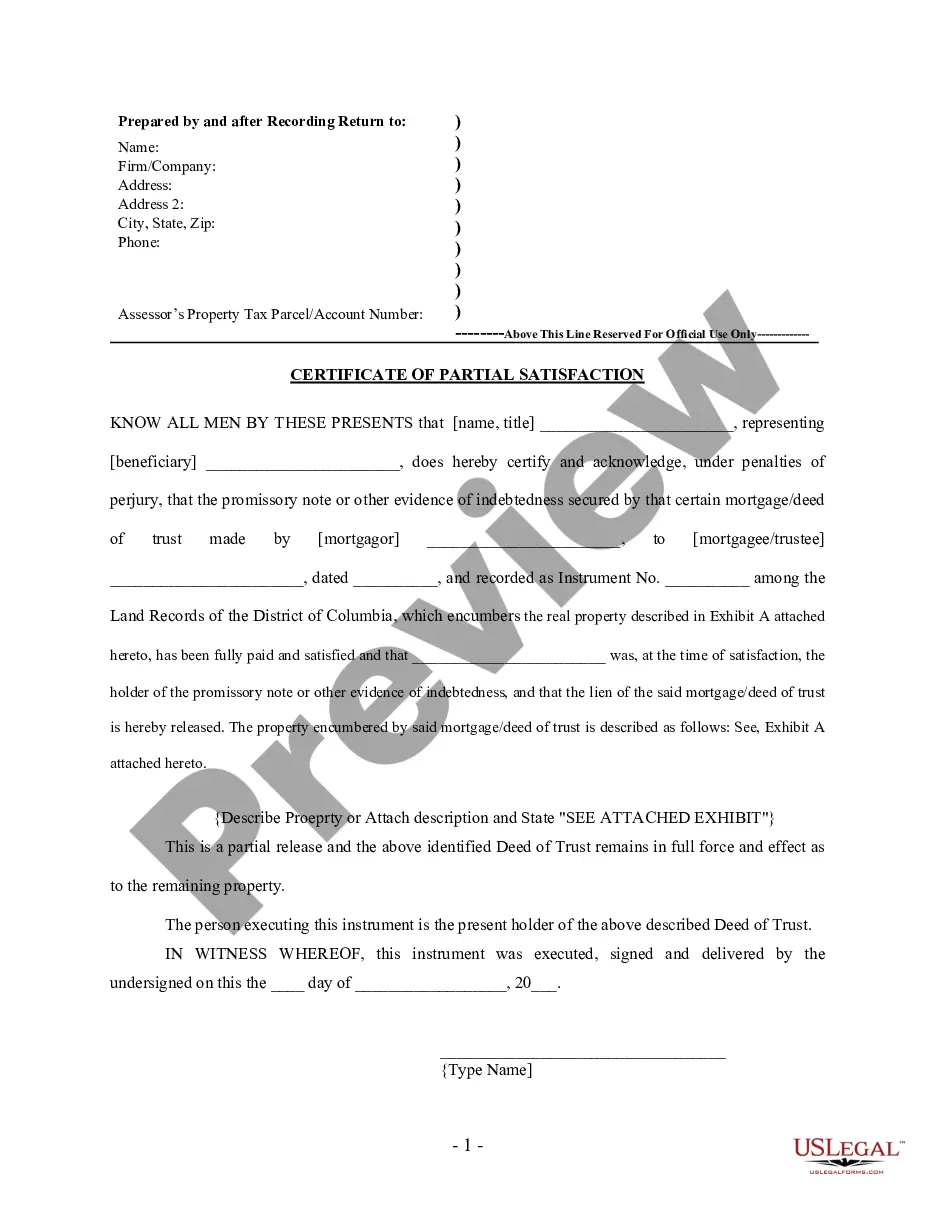

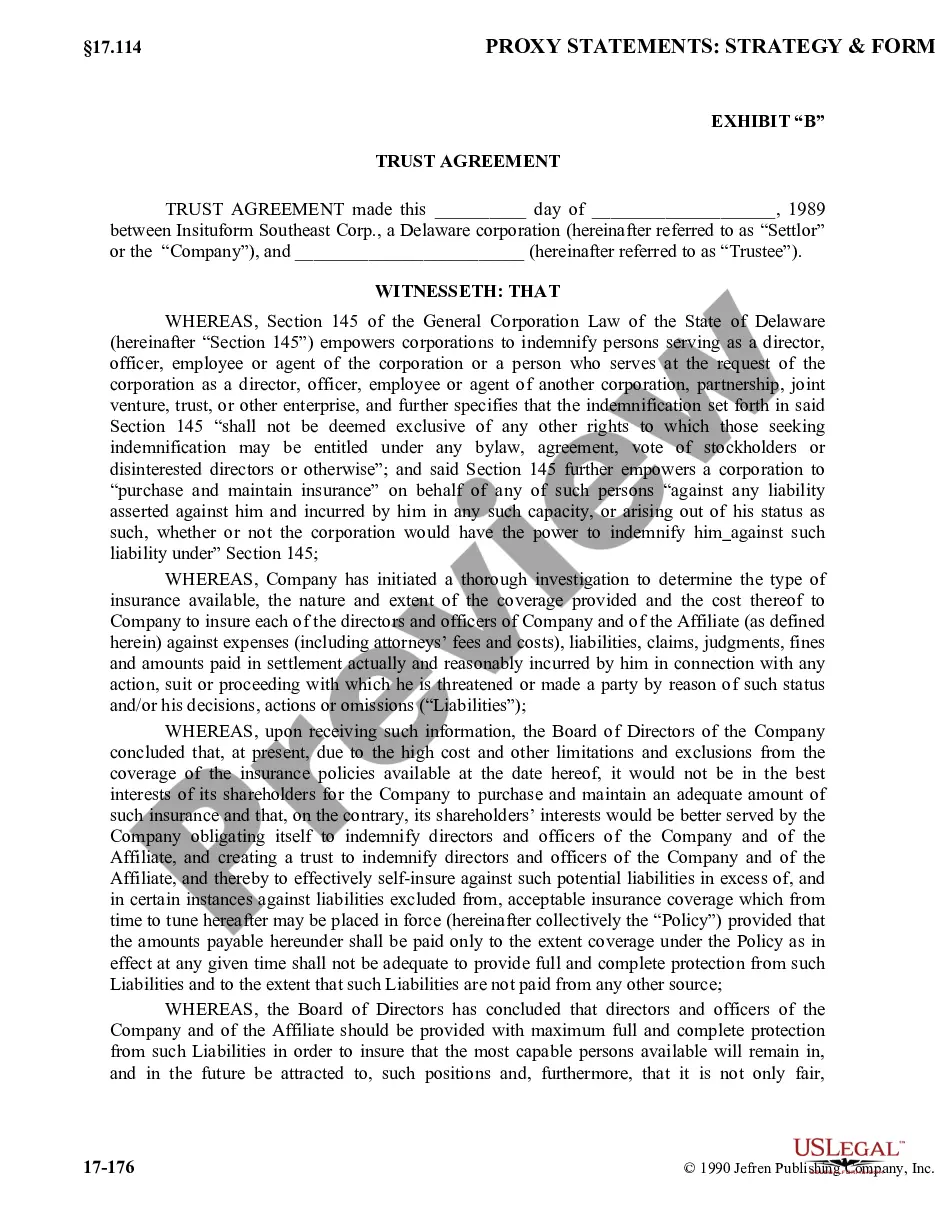

The term spendthrift trust refers to a trust designed to provide for the support of a beneficiary and to protect that support against the beneficiary's contracts and transactions. What is sometimes called a self-settled spendthrift trust is one in which the trustor creates a trust in which he or she is also a beneficiary, usually with the aim of shielding property from uninvited future creditors such as judgment or bankruptcy creditors. A self-settled spendthrift trust is also called an asset protection trust.

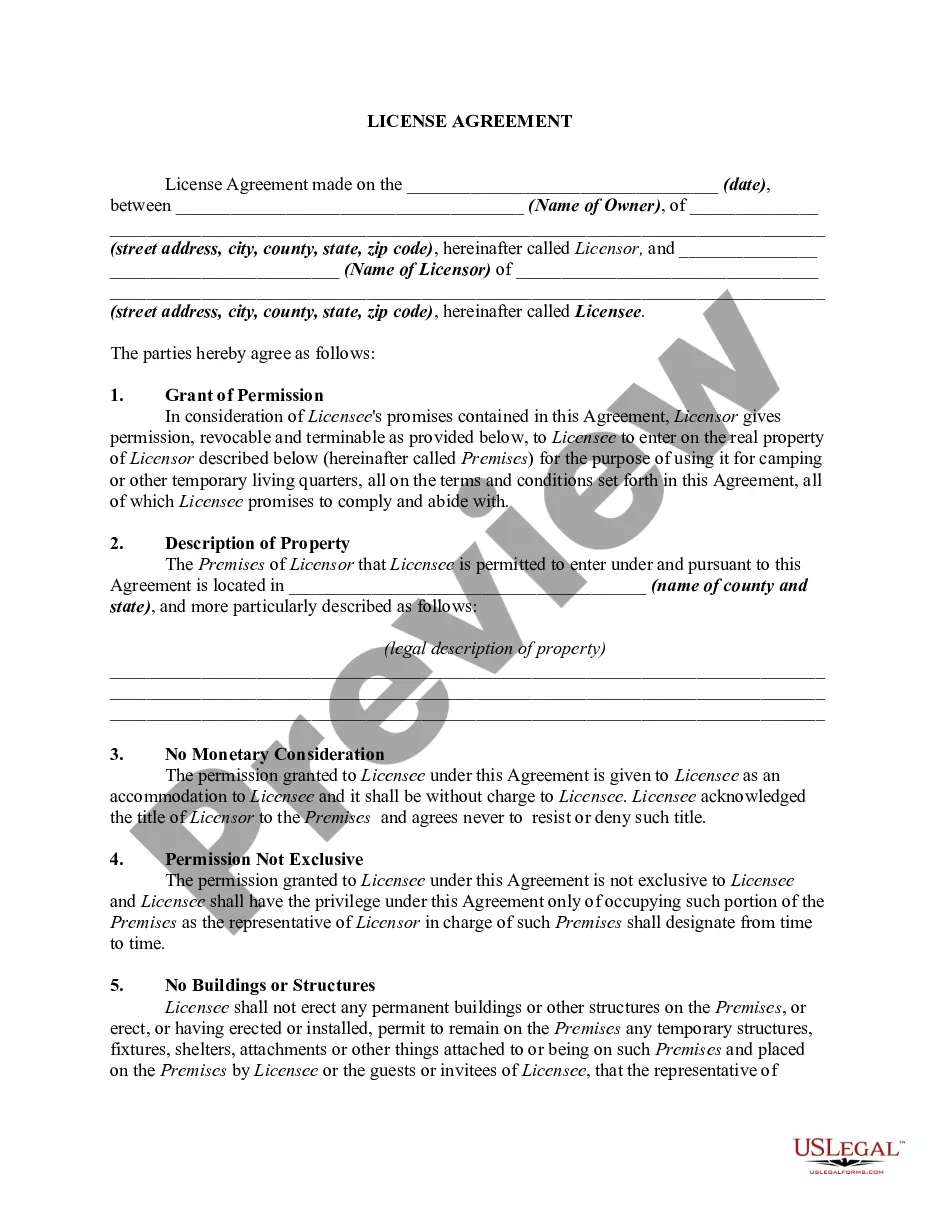

Kansas City Missouri Self-Settled Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

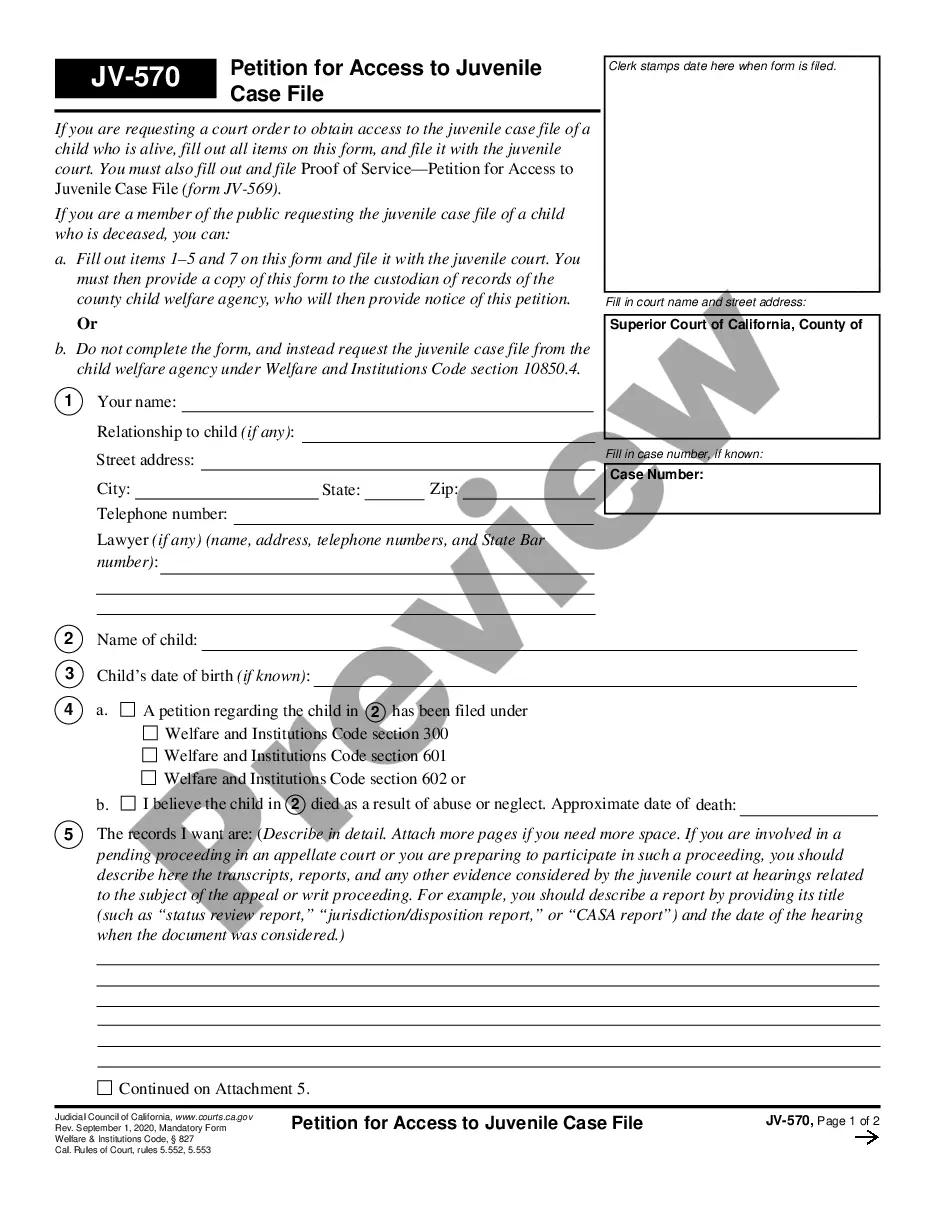

How to fill out Missouri Self-Settled Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

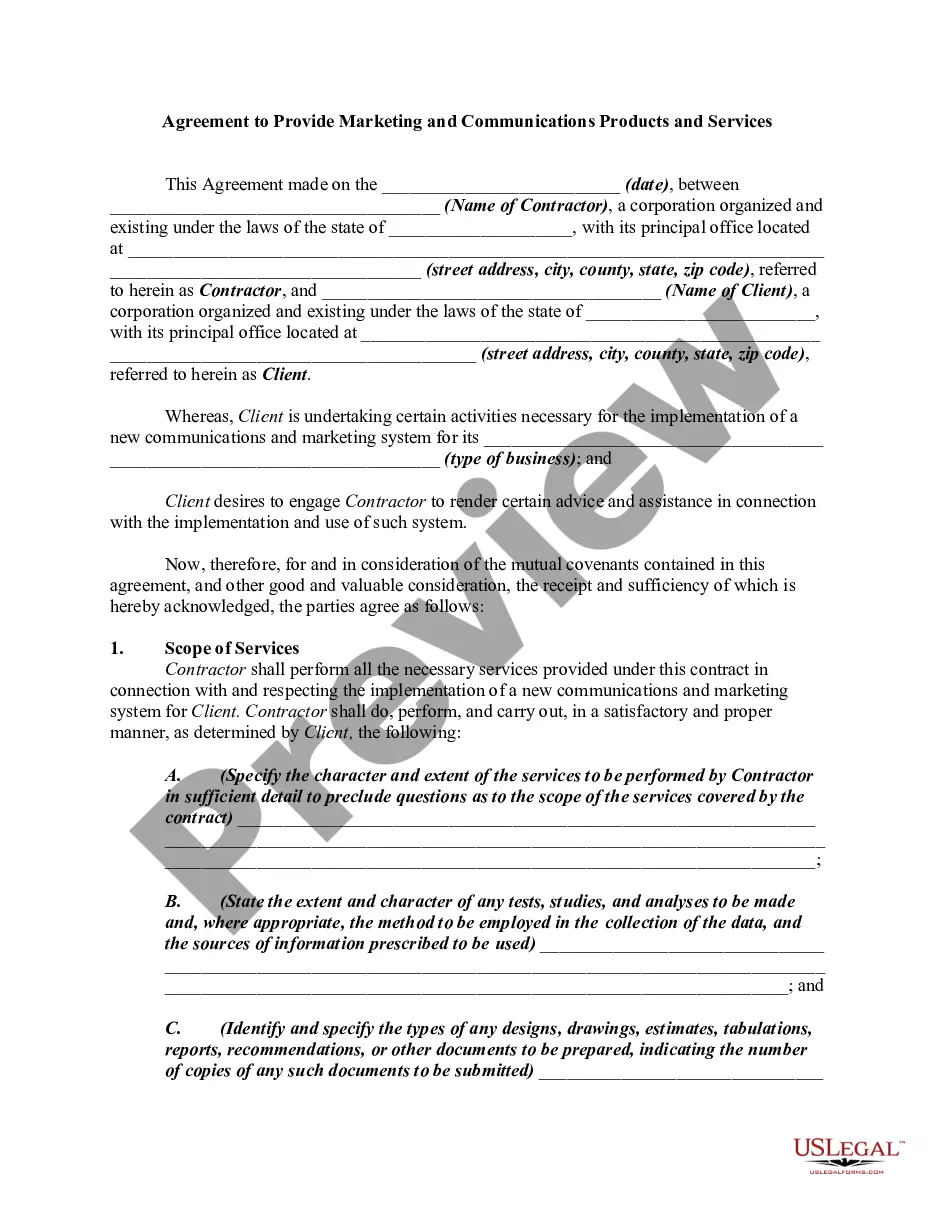

If you’ve previously utilized our service, sign in to your account and store the Kansas City Missouri Self-Settled Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have constant access to every document you have purchased: you can locate it in your profile within the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to conveniently find and save any template for your personal or business requirements!

- Make sure you’ve located an appropriate document. Read the description and employ the Preview feature, if available, to determine if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the right one.

- Purchase the template. Press the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Kansas City Missouri Self-Settled Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor. Select the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

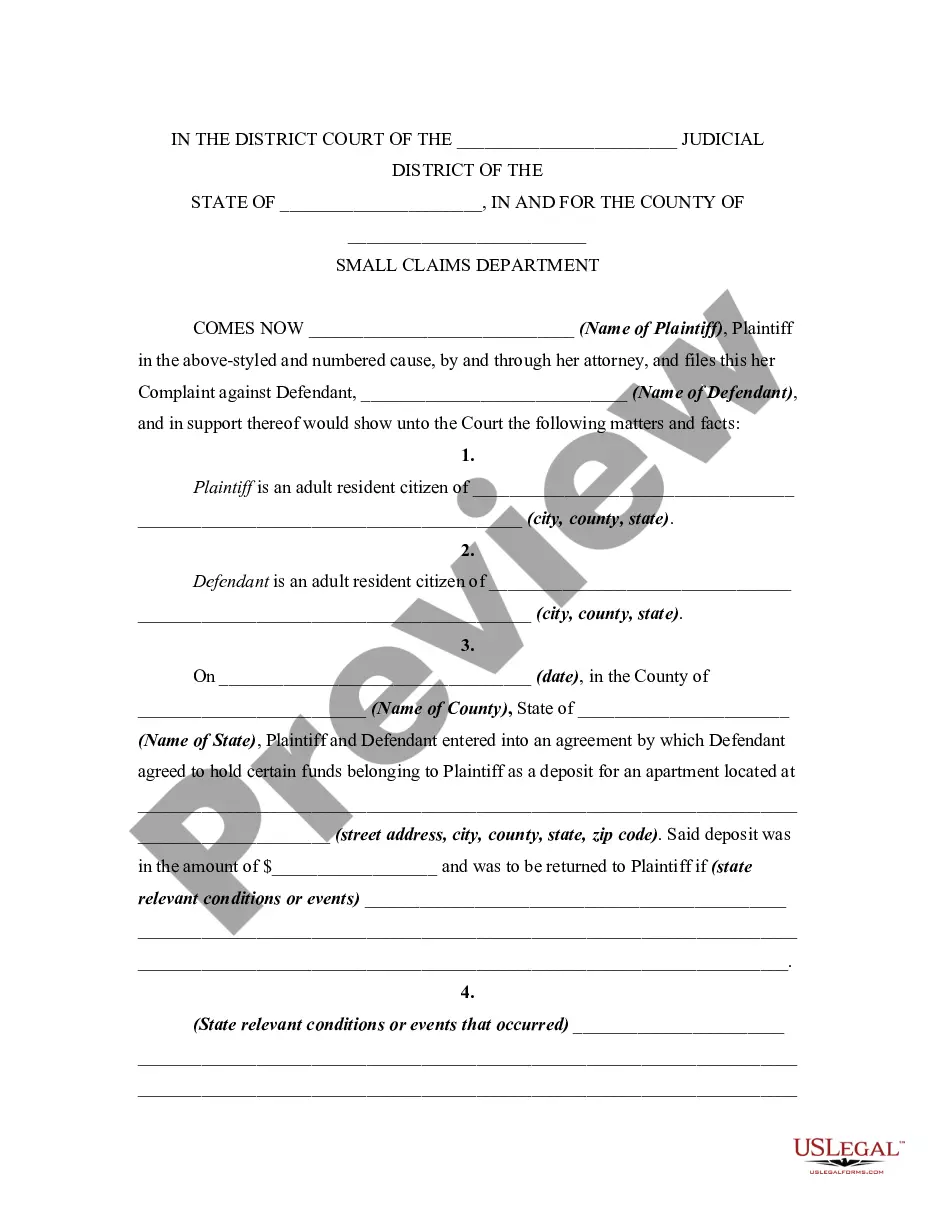

This rule generally prohibits the IRS from levying any assets that you placed into an irrevocable trust because you have relinquished control of them. It is critical to your financial health that you consider the tax and legal obligations associated with trusts before committing your assets to a trust.

What is a self-settled trust? These trusts, also known as domestic asset protection trusts, self-designated trusts, or spendthrift self-settled trusts, are irrevocable trusts that allow the grantor to also be a beneficiary of the trust.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

One fundamental tax-focused decision when structuring a trust is whether the trust should be a grantor trust or a non-grantor trust. If the former, the grantor will be responsible for paying the income tax on income (including capital gains) produced by the trust assets. If the latter, the trust will pay its own taxes.

Irrevocable Trust Lawyer in Missouri An Irrevocable Trust is exactly what it sounds like ? a trust that cannot easily be modified after the agreement has been signed.

So, the list below are some more disadvantages of an irrevocable trust: Loss of Control over Assets. Inflexible as opposed to a Revocable Trust. Unforeseen circumstances. IRS rules state if you die within three years, assets transfer back to the estate.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors. If none of these situations applies, you should not have an irrevocable trust.

An Irrevocable Trust means you can protect yourself, your loved ones and your estate against future legal action. It also means you can protect the financial future of your estate by avoiding substantial estate taxes.