Detroit Michigan Warranty Deed from Individuals to Municipality

Description

How to fill out Michigan Warranty Deed From Individuals To Municipality?

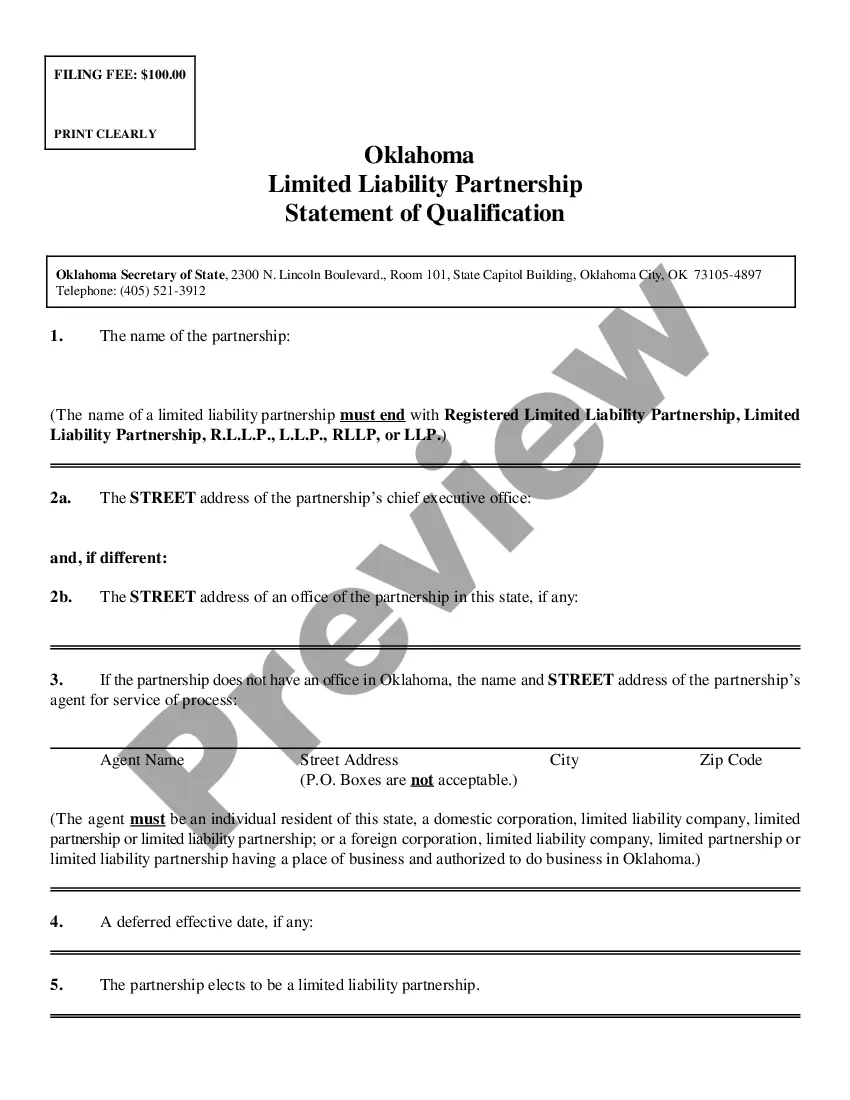

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our advantageous platform featuring a vast number of document templates streamlines the process of finding and acquiring nearly any document sample you need.

You can save, complete, and sign the Detroit Michigan Warranty Deed from Individuals to Municipality in just a few minutes rather than spending hours online searching for the correct template.

Using our catalog is a fantastic way to enhance the security of your form submission. Our skilled attorneys frequently examine all documents to ensure that the templates are suitable for a specific state and adherent to new laws and regulations.

If you do not have an account yet, follow the instructions listed below.

US Legal Forms is one of the largest and most reliable form repositories online. We are always prepared to assist you with any legal matter, even if it's just downloading the Detroit Michigan Warranty Deed from Individuals to Municipality.

- How can you obtain the Detroit Michigan Warranty Deed from Individuals to Municipality.

- If you already have a subscription, simply Log In to your account. The Download button will be visible on all documents you access.

- Moreover, you can find all previously saved files in the My documents section.

Form popularity

FAQ

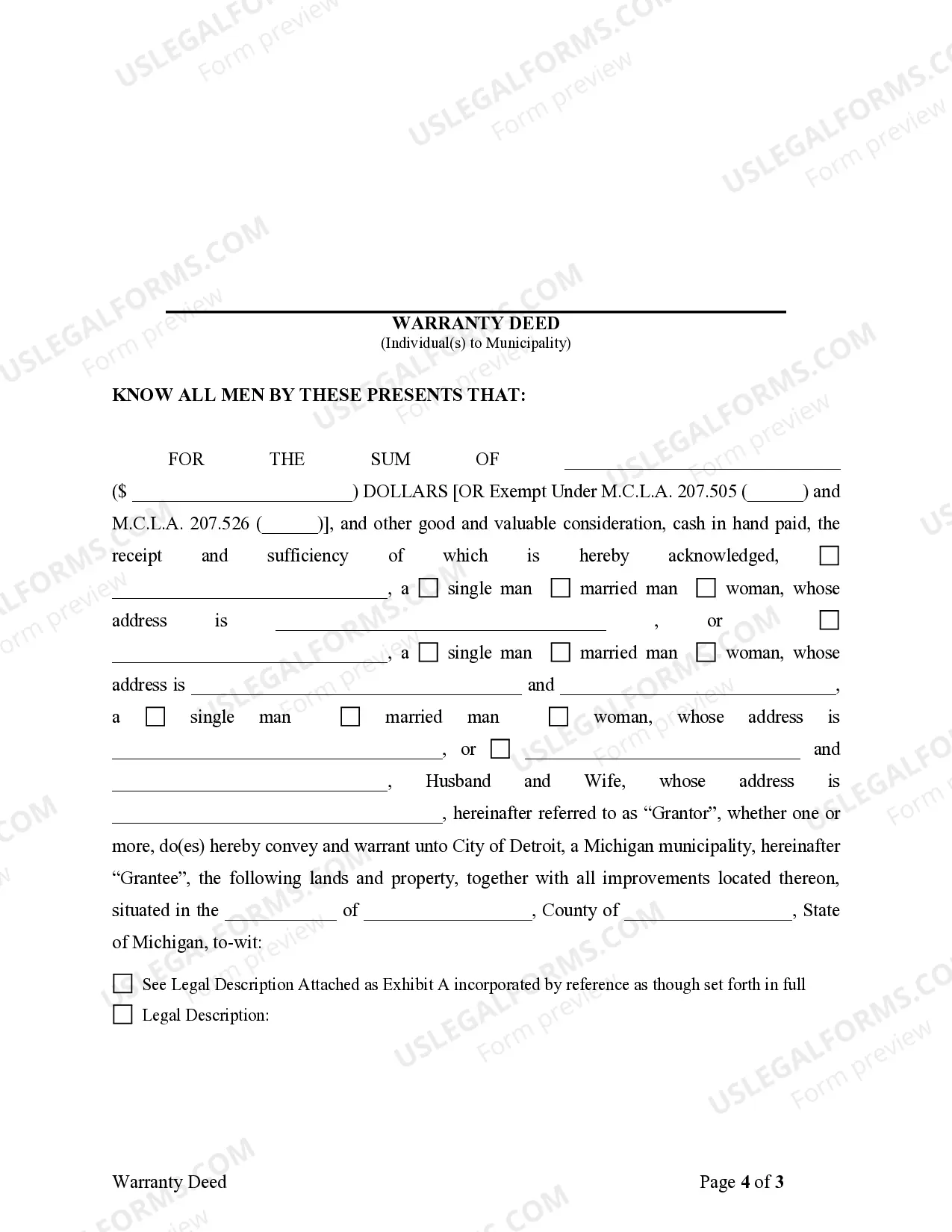

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee).

In most cases, the fees will amount to between £100 and £500 +VAT. Your conveyancer may or may not include cover for additional charges within their service.

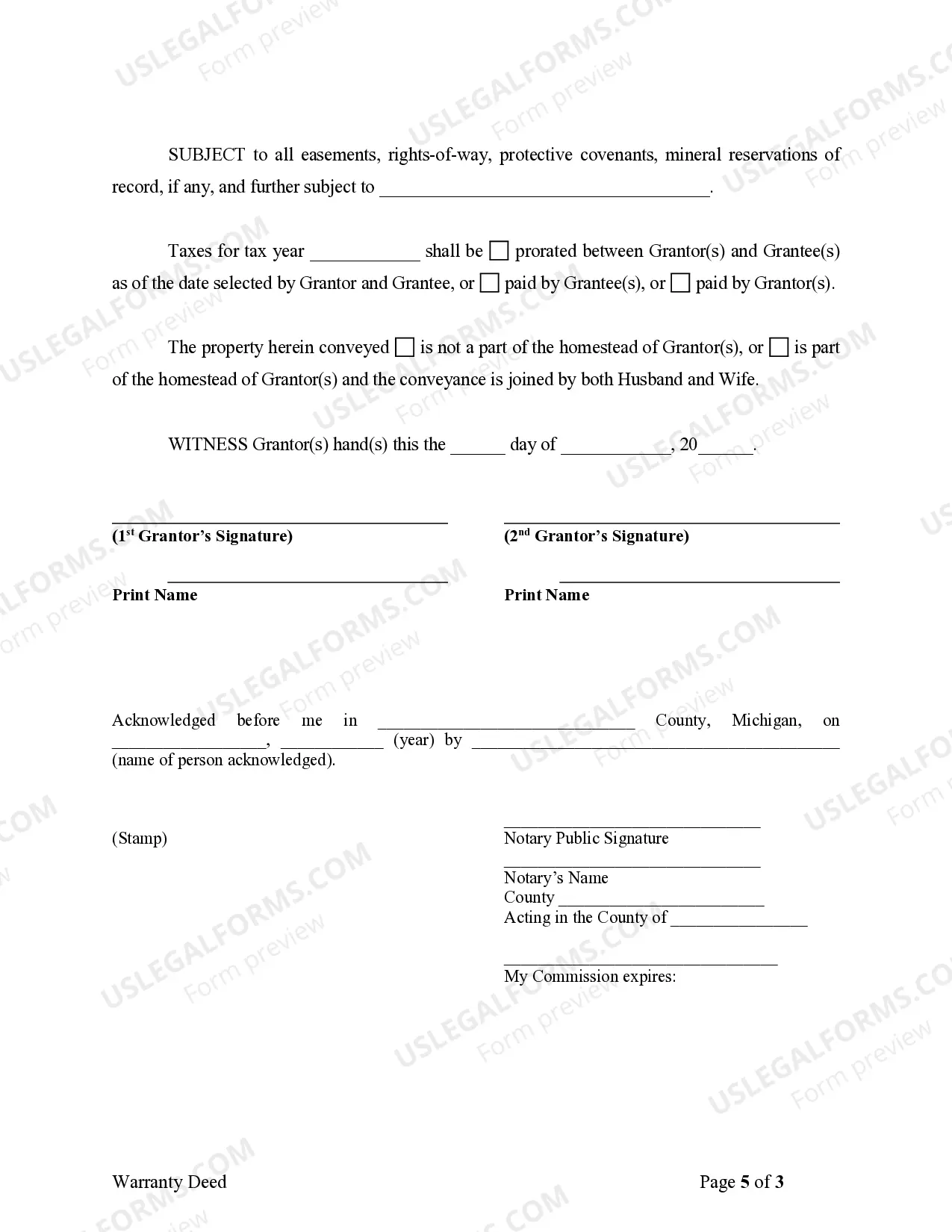

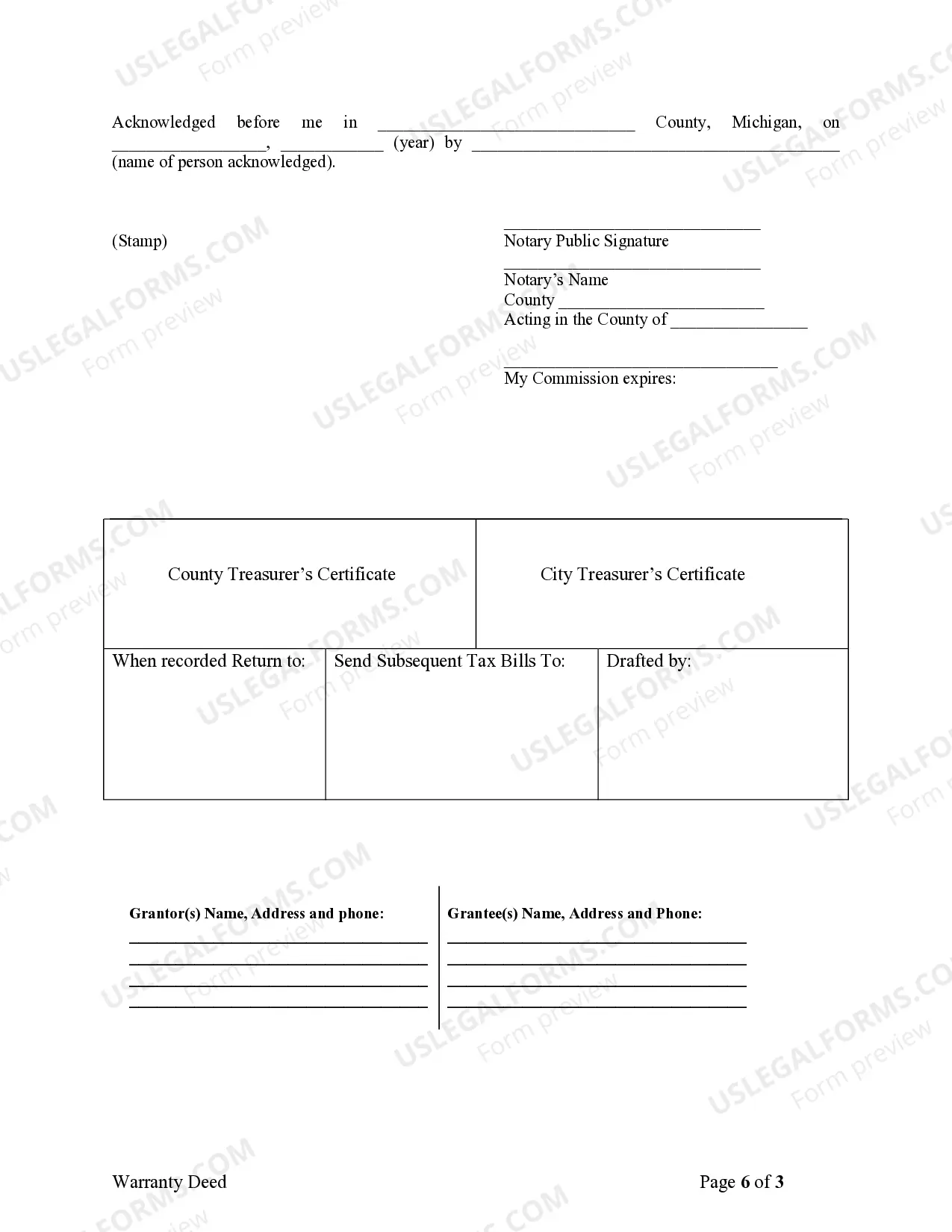

Warranty Deeds With a warranty deed, the grantor (seller) warrants that they have good title to the property and that they have a right to sell the property to the grantee (buyer). ?Good title? means that there are no liens, conditions, or restrictions on the property.

The Michigan warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

How can I get a copy of my deed? You should get your deed when you first purchase the property. If you do not have your deed, then you can get a certified copy of it at the Register of Deeds office; and a certified copy is just as good as the original.

In Michigan, three elements are necessary to constitute a valid gift: (1) the donor (i.e. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e. the recipient of the gift); (2) actual or constructive delivery of the property must be made; and (3) the donee must

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

If there is a title deed in the name of the previous owner, you would need a lawyer, called a conveyancing attorney, to transfer the title deed into your name. The conveyancing attorney sees to it that the title deed is signed into your name by the Registrar of Deeds and files a copy in the Deeds Office.

Visit our Office We are located at 400 Monroe, 7th floor - above Fishbones Restaurant in Greektown (downtown Detroit). Search fee for a property is $5.00. This fee is waived if you can provide proof you are searching for your personal residence (valid driver's license, for example).

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.