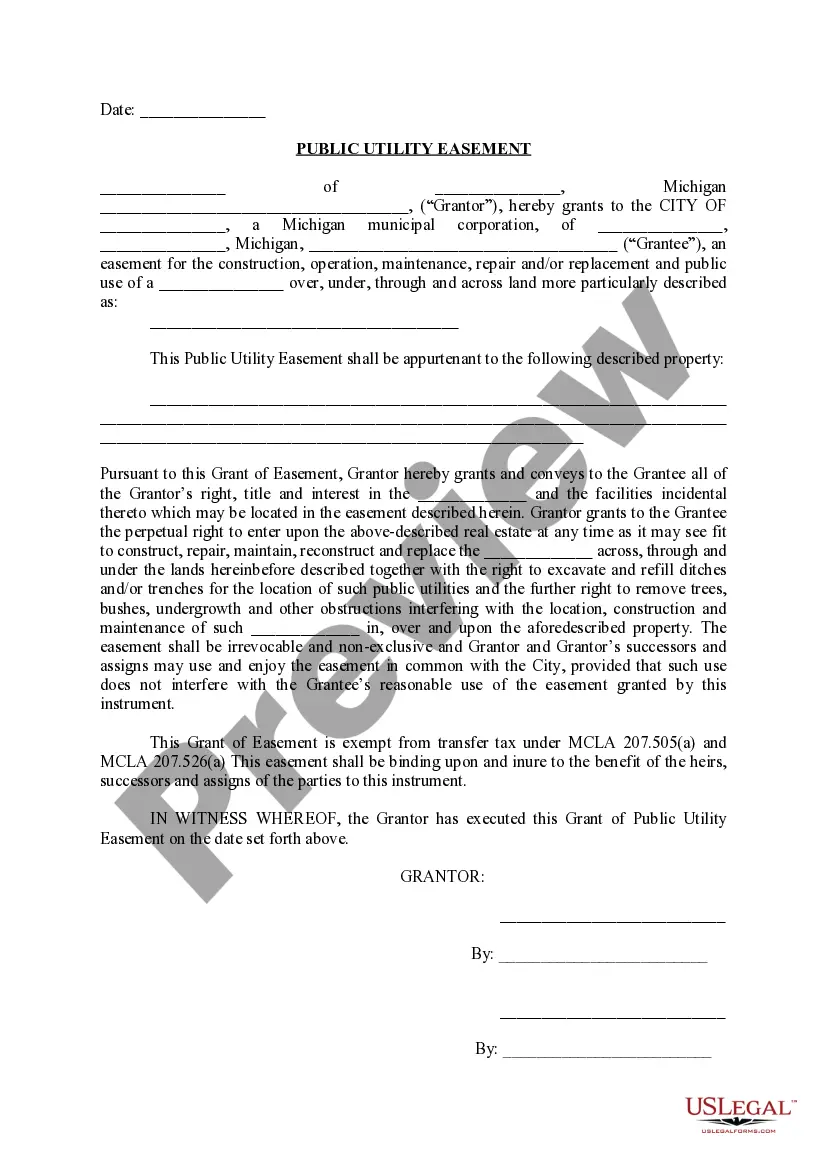

Grand Rapids Michigan Acknowledgment for Corporation

Description

How to fill out Michigan Acknowledgment For Corporation?

Obtaining authentic templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online assortment of over 85,000 legal documents catering to both personal and professional requirements across various real-life situations.

All the records are conveniently categorized by usage area and jurisdictional regions, making the search for the Grand Rapids Michigan Acknowledgment for Corporation as simple as ABC.

Maintain neat and lawful documentation is of utmost importance. Take advantage of the US Legal Forms library to always have crucial document templates for any needs at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the correct one that aligns with your needs and fully meets your local jurisdiction criteria.

- Search for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the library’s resources.

Form popularity

FAQ

Filling out a notary acknowledgment in Michigan involves a few straightforward steps. First, ensure that the document is signed in the presence of a notary public. The notary will then complete the acknowledgment portion, including their signature and seal. If you're looking for the correct format for a Grand Rapids Michigan Acknowledgment for Corporation, USLegalForms provides templates to guide you through the process seamlessly. Remember, accuracy is key to ensuring your documents are valid.

Several cities in Michigan impose a city tax, including Detroit, Grand Rapids, and Ann Arbor, among others. Each city determines its own tax structure, so it’s vital to check local regulations. If you are filing business documents, including a Grand Rapids Michigan Acknowledgment for Corporation, be aware of any city taxes that may affect your financial obligations. For personalized guidance, consider utilizing resources offered by USLegalForms.

The tax rate in Grand Rapids varies depending on the type of tax you are referring to, such as property or income tax. As of the latest updates, the city levies a property tax rate and a local income tax rate for residents and non-residents. If you're setting up a Grand Rapids Michigan Acknowledgment for Corporation, understanding the applicable tax rates will be essential for compliance. Always consult the city's finance department or their website for the most accurate and current rates.

In Michigan, you can obtain an apostille through the Michigan Department of State or designated county clerk offices. They handle the certification of documents that require an apostille, including those needed for international use. If your documents involve a Grand Rapids Michigan Acknowledgment for Corporation, make sure to check that the notarization is compliant to avoid any issues. The process is generally straightforward, and staff are accustomed to assisting with these requests.

To determine if you reside in the city of Grand Rapids, check your address against official city maps or the city’s website. You can also look for local government correspondence, like tax bills, that will list the city. Ensuring your address is within the Grand Rapids boundaries is important, especially if you need a Grand Rapids Michigan Acknowledgment for Corporation. If you're still unsure, contacting local officials can provide clarity.

The tax rate in Grand Rapids includes various local and state taxes, such as income tax and corporate tax. As noted earlier, the city tax for residents is 1.0%, while the corporate tax rate follows state guidelines. Keeping track of these regulations is vital for planning, especially concerning the Grand Rapids Michigan Acknowledgment for Corporation.

Yes, Michigan recognizes S-corporations, allowing these entities to enjoy pass-through taxation. This means that the income is taxed at the individual level, rather than at the corporate rate. Entrepreneurs in Grand Rapids should consult legal resources or platforms like uslegalforms to understand the full implications of choosing S-corporation status.

Yes, Grand Rapids does have a city-specific income tax. This tax affects both residents and non-residents who earn income within the city limits. Businesses must comply with this tax to maintain compliance with local regulations, further emphasizing the importance of the Grand Rapids Michigan Acknowledgment for Corporation.

While tax burdens can vary greatly, cities like Detroit and Grand Rapids tend to have higher tax obligations than others in Michigan. Factors influencing these rates include local income taxes, property taxes, and corporate taxes. Businesses operating in these areas should conduct thorough tax planning to manage their financial responsibilities.

Grand Rapids imposes an income tax on residents and income earned within the city. The city tax rate stands at 1.0% for residents and 0.5% for non-residents. Businesses should factor this into their financial assessments when operating in Grand Rapids.