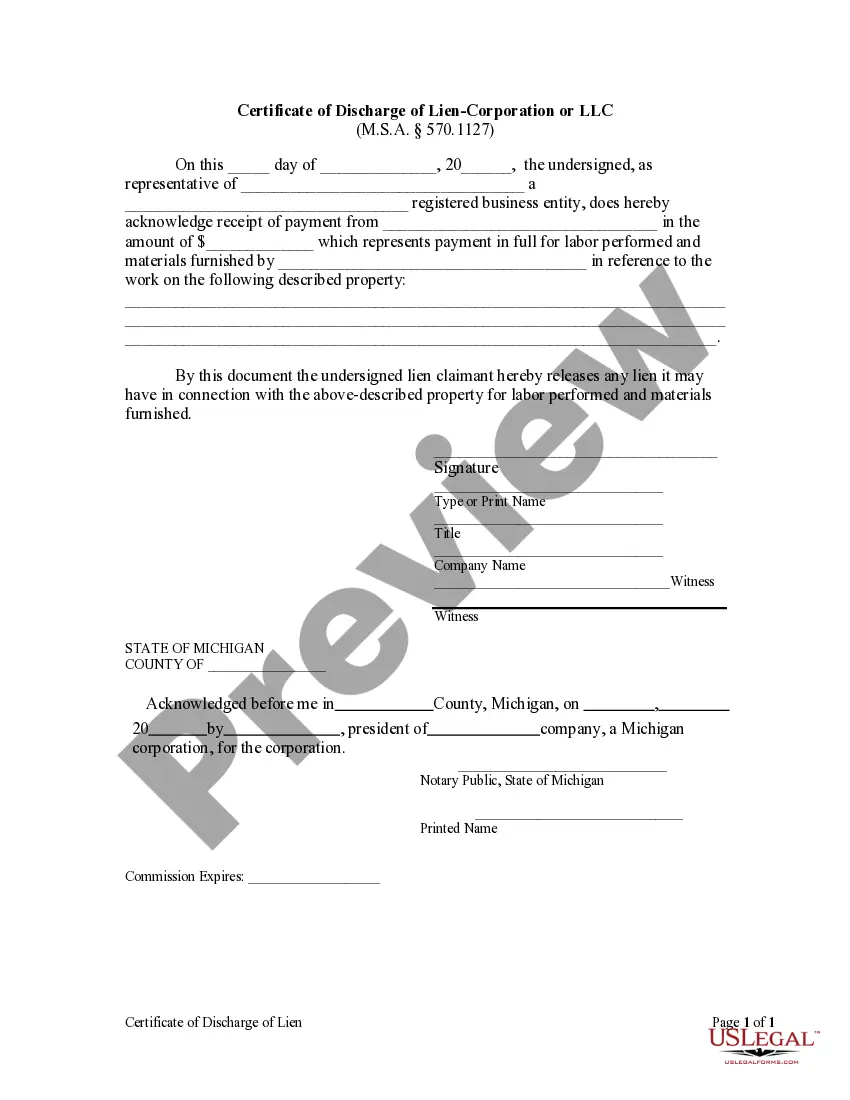

Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC

Description

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

We consistently aim to lessen or evade legal complications when handling intricate law-related or fiscal issues.

To achieve this, we enlist legal services that are typically quite costly.

Nonetheless, not all legal issues are of the same intricacy. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal templates covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Log in to your account and click the Get button next to it. If you've misplaced the document, you can always re-download it from within the My documents tab.

- Our collection allows you to take control of your situations without requiring a lawyer.

- We provide access to legal document templates that aren't always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Benefit from US Legal Forms whenever you need to acquire and download the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC or any other document swiftly and securely.

Form popularity

FAQ

To file a quit claim deed in Wayne County, MI, you need to visit the Wayne County Register of Deeds office. This is where you submit your document to officially record it. Make sure to bring the completed quit claim deed, as well as payment for any applicable fees. If you need assistance with this process, consider using the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC service offered by US Legal Forms, which can streamline your filing process and ensure your documents are correctly prepared.

In Wayne, Michigan, the responsibility for the local transfer tax typically lies with the seller. However, this can be negotiated in the sale agreement. It's important to clarify this aspect during the transaction to ensure both parties understand their obligations. If you need assistance with your transactions, consider using the USLegalForms platform for comprehensive guidance on preparing necessary documents, including the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC.

In Michigan, a quitclaim deed must include specific information to be valid. It should contain the names of the parties involved, a legal description of the property, and the statement of the transfer. Additionally, the deed must be signed and notarized. For those needing assistance with the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, US Legal Forms can provide templates and vital resources to ensure your quitclaim deed meets all legal requirements.

To retrieve a copy of your house deed in Michigan, locate your local county's Register of Deeds office either online or in person. You will need to provide details such as the property address or parcel number to assist in your search. If you require support in this area, consider using US Legal Forms to access easy-to-follow instructions and necessary forms. This service can be particularly helpful if you're dealing with the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC.

A quitclaim deed is commonly used to transfer property ownership without warranties. It's often suitable in family transfers, such as between relatives or adding someone to a title. In cases involving the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, a quitclaim can help remove any claims on the property. Overall, it’s a straightforward method to convey property when there’s trust between parties.

To obtain a copy of a deed in Wayne County, MI, you can visit the Wayne County Register of Deeds office in person or access their online services. The office maintains records of all deeds, including the Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC. Additionally, you may request copies by mail, but make sure to include the appropriate identification and fees. Using US Legal Forms can simplify this process, providing you with the necessary documents and guidance.

In Michigan, a deed is valid when it includes the necessary elements such as the grantor’s signature, the grantee’s name, a legal description, and acknowledgment by a notary. Furthermore, it should convey the intent to transfer property rights. To successfully secure a Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, adhering to these validity criteria is vital.

A quit claim deed in Michigan must identify the parties involved, describe the property clearly, and be signed by the grantor. While it conveys interest in the property, it does not guarantee that the title is clear. If you are wondering how to obtain a Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, our easy-to-use service can help you with the necessary documentation.

For a deed to be valid in Michigan, it must be signed by the grantor. If the grantor is a corporation or LLC, an authorized representative must sign on behalf of the entity. If you are preparing to submit a Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, ensure the signature meets these requirements to avoid any complications.

A valid deed in Michigan requires the grantor’s signature, a grantee’s name, a legal description of the property, and an acknowledgment by a notary public. The acknowledgment ensures that the grantor's signature is genuine. To ensure you meet all requirements for a Wayne Michigan Certificate of Discharge of Lien - Corporation or LLC, consider using our platform for seamless processing.