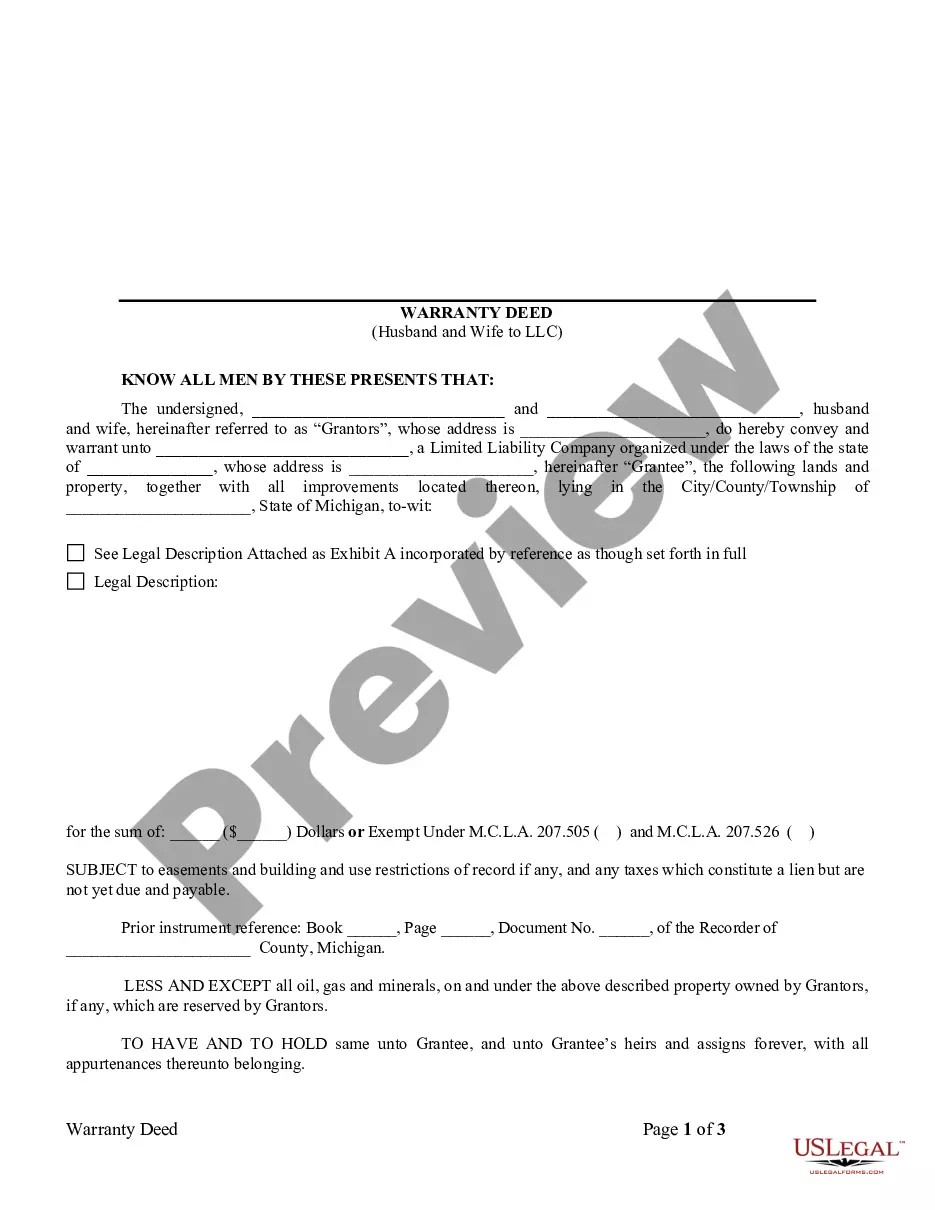

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Detroit Michigan Warranty Deed from Husband and Wife to LLC

Description

How to fill out Michigan Warranty Deed From Husband And Wife To LLC?

We consistently aim to lessen or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we seek attorney services that, generally speaking, tend to be quite expensive.

Nevertheless, not all legal problems are quite as complicated.

Many of them can be handled by ourselves.

Take advantage of US Legal Forms whenever you need to quickly and securely find and download the Detroit Michigan Warranty Deed from Husband and Wife to LLC or any other document.

- US Legal Forms is an online repository of current do-it-yourself legal documents encompassing everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our library enables you to take charge of your legal matters without the need for an attorney's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

There will be a $30 recording fee. If you prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool, detailed instructions on what to do next will print out along with the deed.

Steps to Create a Michigan Rental Property LLC Name Your Michigan LLC. Appoint a Registered Agent. File Michigan Articles of Organization. Create an Operating Agreement. Apply for an Employment Identification Number (EIN) Transfer Title of the Property to LLC. Talk to Lenders and Tenants.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

Sometimes people think if only one spouse's name is on a property deed, the other spouse does not own the property or have any right to it. This is not true. Real estate is marital property if it was purchased or paid for during your marriage. It doesn't matter whose name is on the deed.

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.