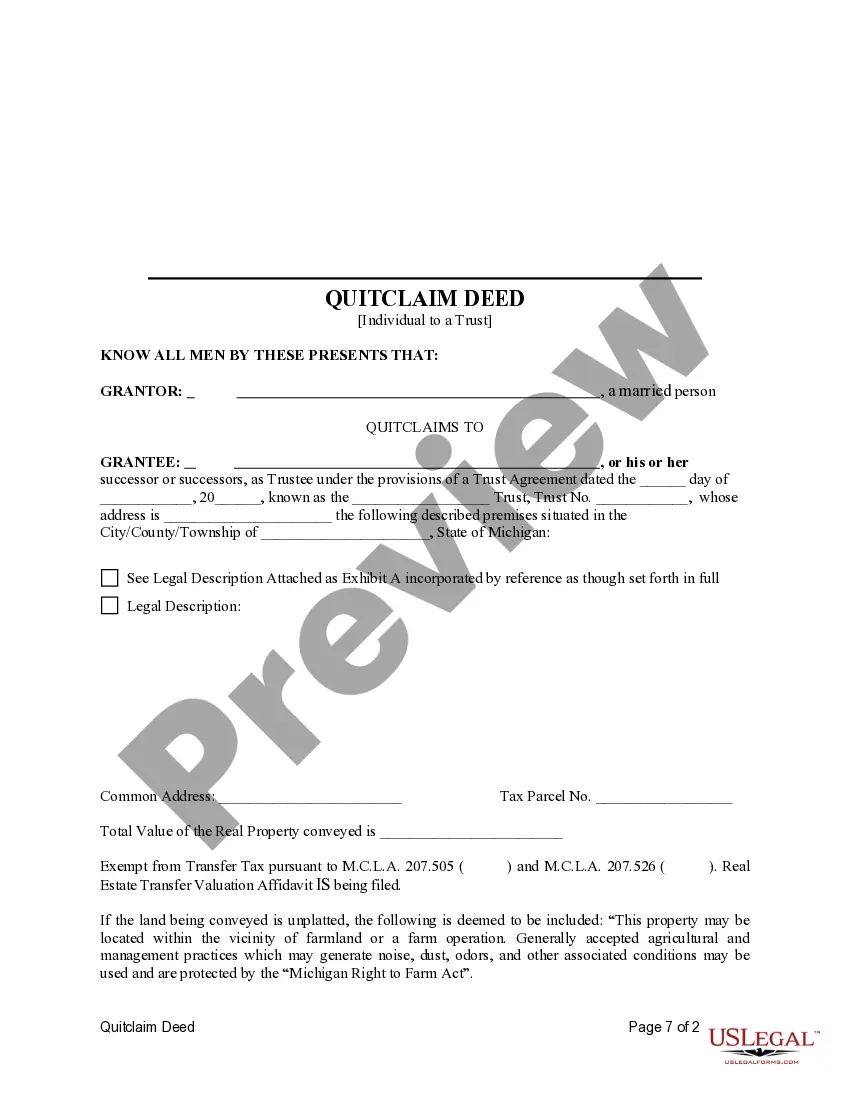

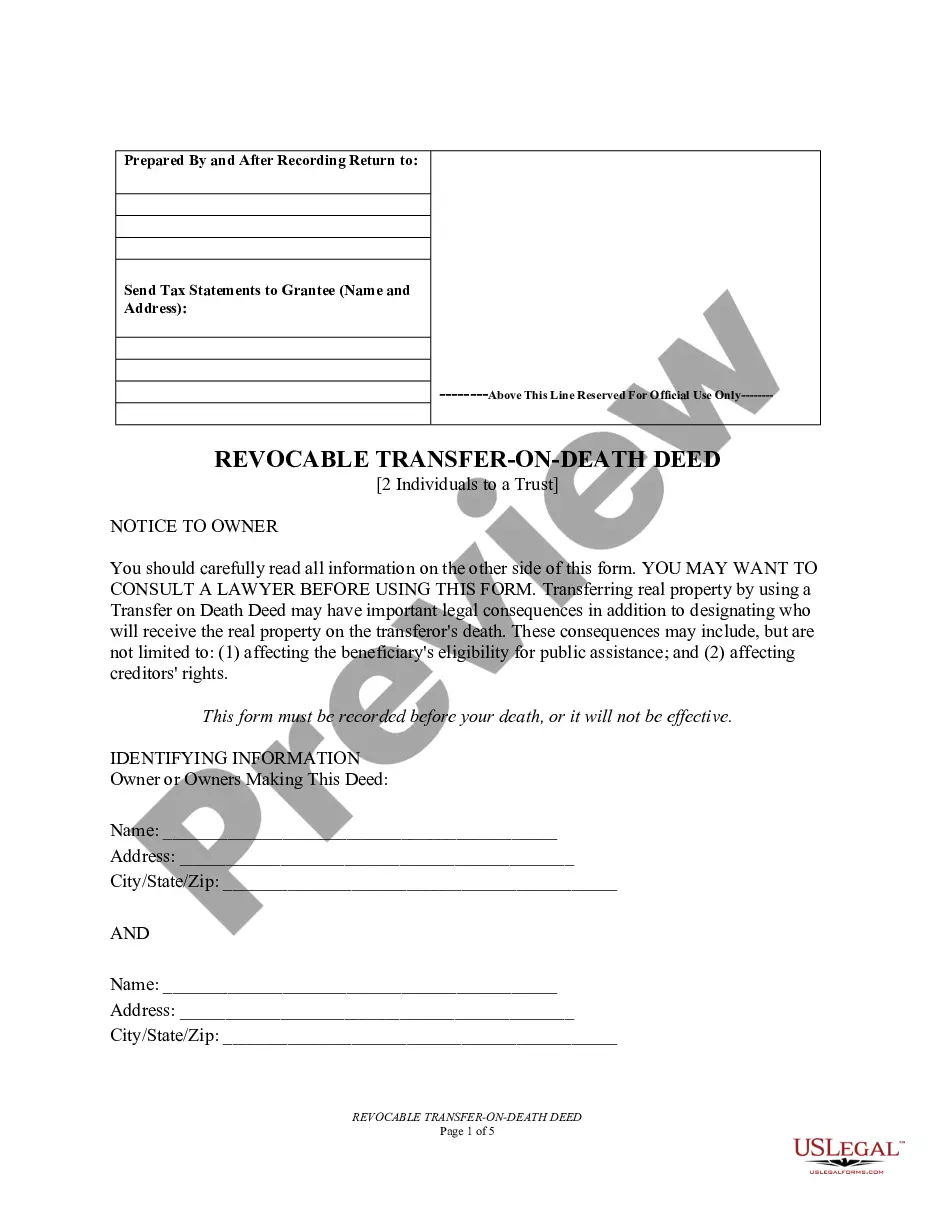

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state laws.

Detroit Michigan Quitclaim Deed from an Individual to a Trust

Description

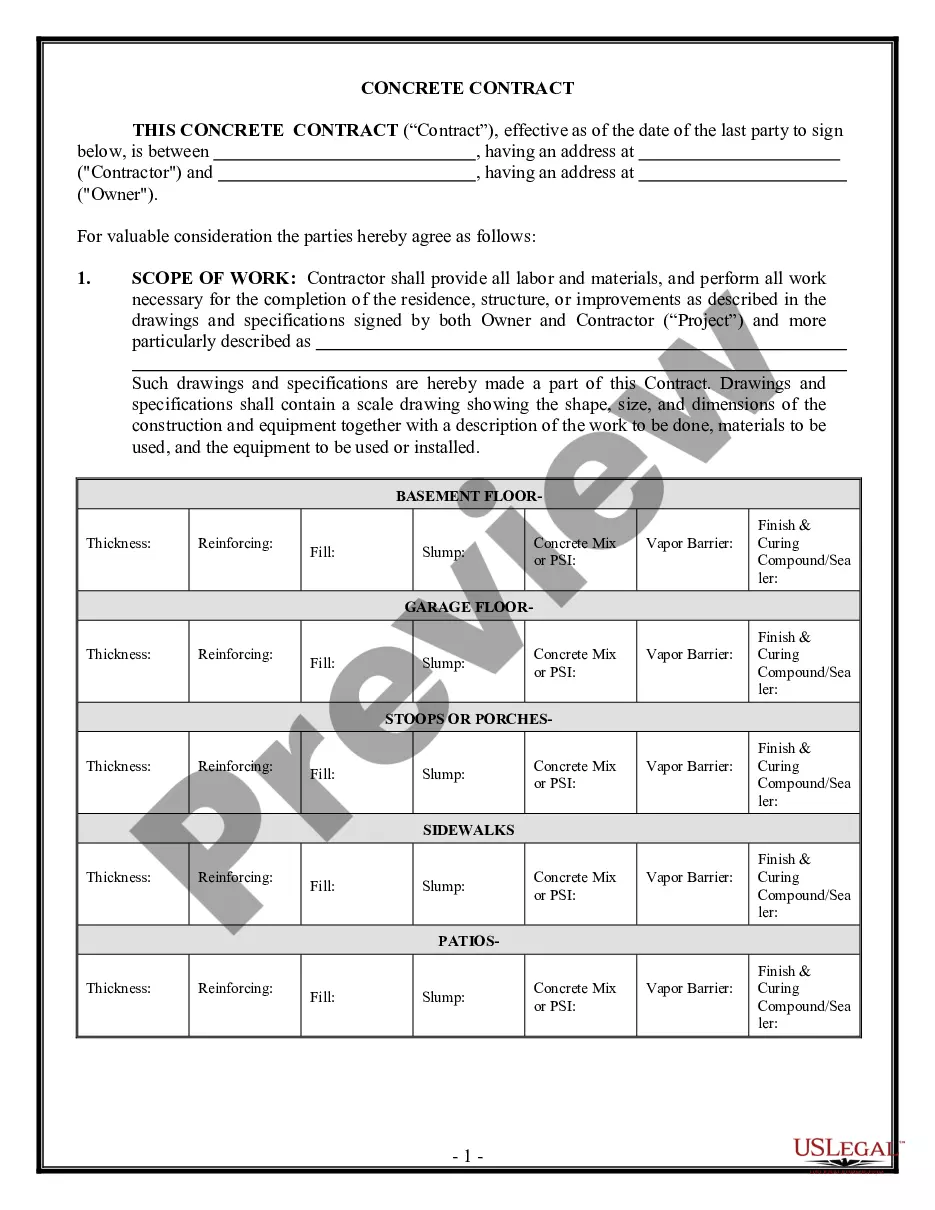

How to fill out Michigan Quitclaim Deed From An Individual To A Trust?

Take advantage of the US Legal Forms and gain instant access to any form example you desire.

Our user-friendly website featuring a vast array of document templates enables you to locate and acquire nearly any document sample you may need.

You can download, complete, and sign the Detroit Michigan Quitclaim Deed from an Individual to a Trust within minutes instead of spending hours searching the Internet for an appropriate template.

Utilizing our library is a great approach to enhance the security of your document filing.

Initiate the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, set up an account and complete your purchase using a credit card or PayPal.

Obtain the document. Select the format to receive the Detroit Michigan Quitclaim Deed from an Individual to a Trust and modify, fill, or sign it according to your needs. US Legal Forms is among the most comprehensive and trustworthy template libraries online. We are always available to assist you with any legal process, even if it's just downloading the Detroit Michigan Quitclaim Deed from an Individual to a Trust. Feel free to utilize our platform and simplify your document experience!

- Our knowledgeable legal experts frequently assess all the records to ensure that the templates are suitable for specific areas and comply with updated laws and regulations.

- How can you obtain the Detroit Michigan Quitclaim Deed from an Individual to a Trust.

- If you already have a subscription, simply Log In to your account. The Download option will be activated on all the documents you view. Additionally, you can access all your previously saved records in the My documents section.

- If you haven't created an account yet, follow the steps outlined below.

- Locate the form you require. Confirm that it is the form you intended to find: check its title and description, and utilize the Preview option when accessible. Alternatively, use the Search field to seek the necessary one.

Form popularity

FAQ

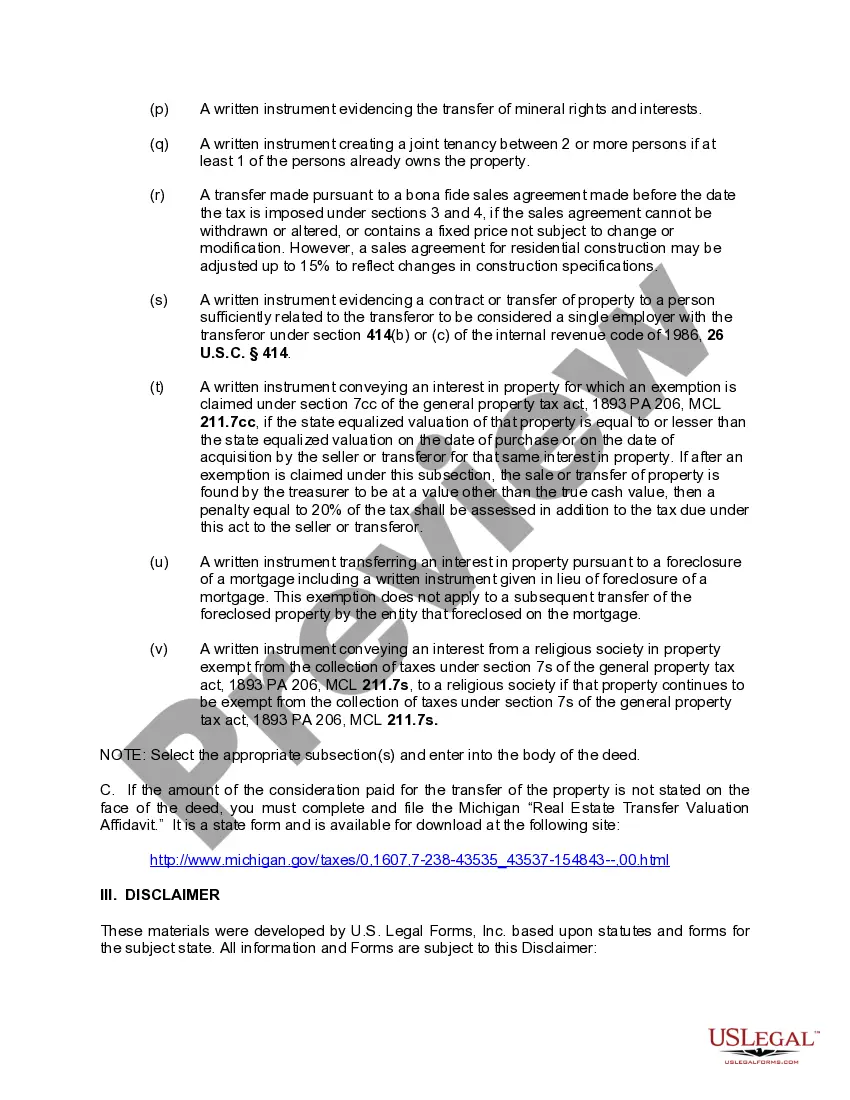

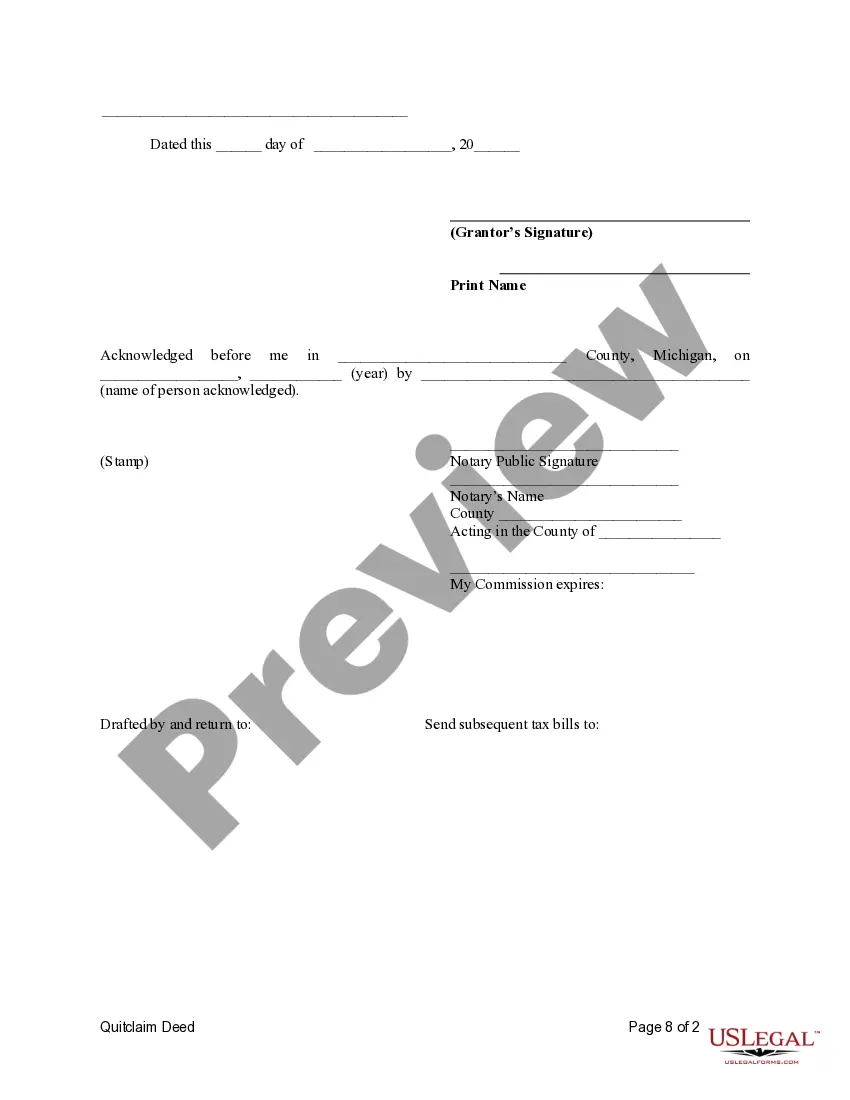

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

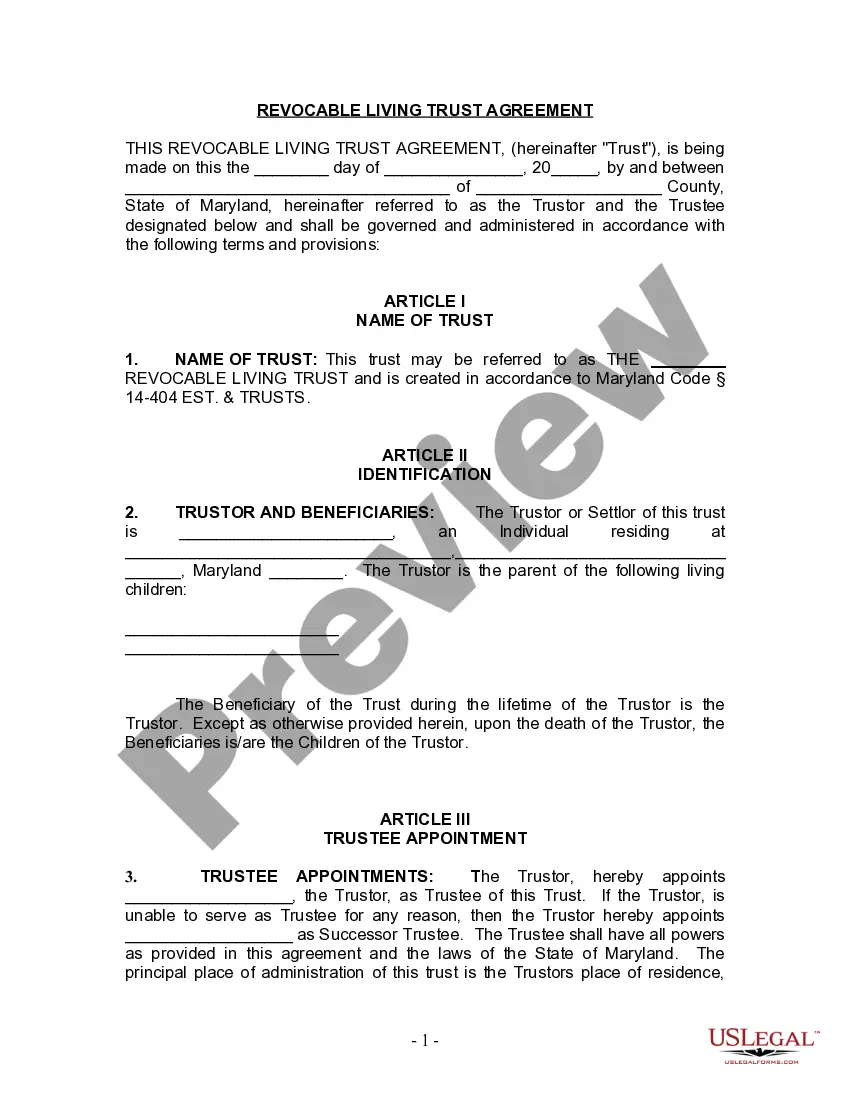

In Michigan, three elements are necessary to constitute a valid gift: (1) the donor (i.e. the person making the gift) must intend to gratuitously pass title/ownership of the property to the donee (i.e. the recipient of the gift); (2) actual or constructive delivery of the property must be made; and (3) the donee must

To successfully execute a quitclaim deed in Michigan, the property owner needs to complete a quitclaim deed form and sign it in front of a notary. Then they pay any transfer taxes due and record the deed in the land recorder's office in the county in which the property is located.

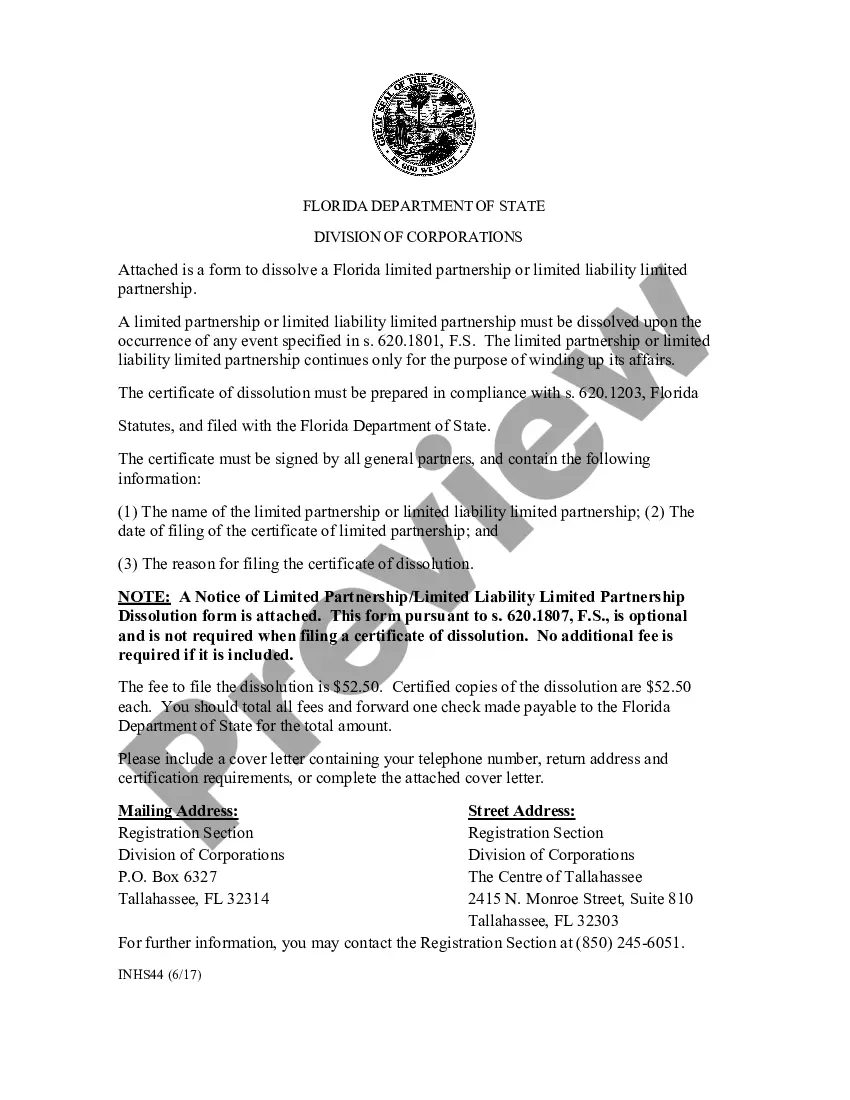

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

You can prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool. If you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. Then give the quitclaim deed to your ex-spouse or your ex-spouse's lawyer.

Here are 5 ways to avoid probate in Michigan: Make sure your assets have named beneficiaries.Create a Trust (revocable trust or irrevocable trust).Create a Lady Bird Deed for your real estate. Add joint ownership to your assets.Gift assets away (speak to an accountant or lawyer first).

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

If there is a title deed in the name of the previous owner, you would need a lawyer, called a conveyancing attorney, to transfer the title deed into your name. The conveyancing attorney sees to it that the title deed is signed into your name by the Registrar of Deeds and files a copy in the Deeds Office.

In most cases, the fees will amount to between £100 and £500 +VAT. Your conveyancer may or may not include cover for additional charges within their service.