Boston Massachusetts Fiduciary Deed - Trustee to Individual

Description

How to fill out Massachusetts Fiduciary Deed - Trustee To Individual?

Are you seeking a trustworthy and affordable provider of legal forms to purchase the Boston Massachusetts Fiduciary Deed - Trustee to Individual? US Legal Forms is your ideal choice.

Whether you require a straightforward arrangement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the court system, we have you covered. Our website features over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored based on the needs of specific states and regions.

To obtain the form, you need to Log In to your account, locate the necessary template, and click the Download button next to it. Please remember that you can retrieve your previously acquired document templates at any time in the My documents section.

Are you unfamiliar with our website? No problem. You can create an account with remarkable ease, but before that, ensure to do the following.

Now you can set up your account. Next, select the subscription option and complete the payment. Once the payment is finalized, download the Boston Massachusetts Fiduciary Deed - Trustee to Individual in any available file format. You can return to the website whenever you need and redownload the form at no additional cost.

Acquiring current legal documents has never been simpler. Give US Legal Forms a try today and forget about spending hours researching legal papers online once and for all.

- Verify if the Boston Massachusetts Fiduciary Deed - Trustee to Individual complies with the regulations of your state and locality.

- Review the description of the form (if available) to understand who and what the form is designed for.

- Restart the search if the template does not fit your legal needs.

Form popularity

FAQ

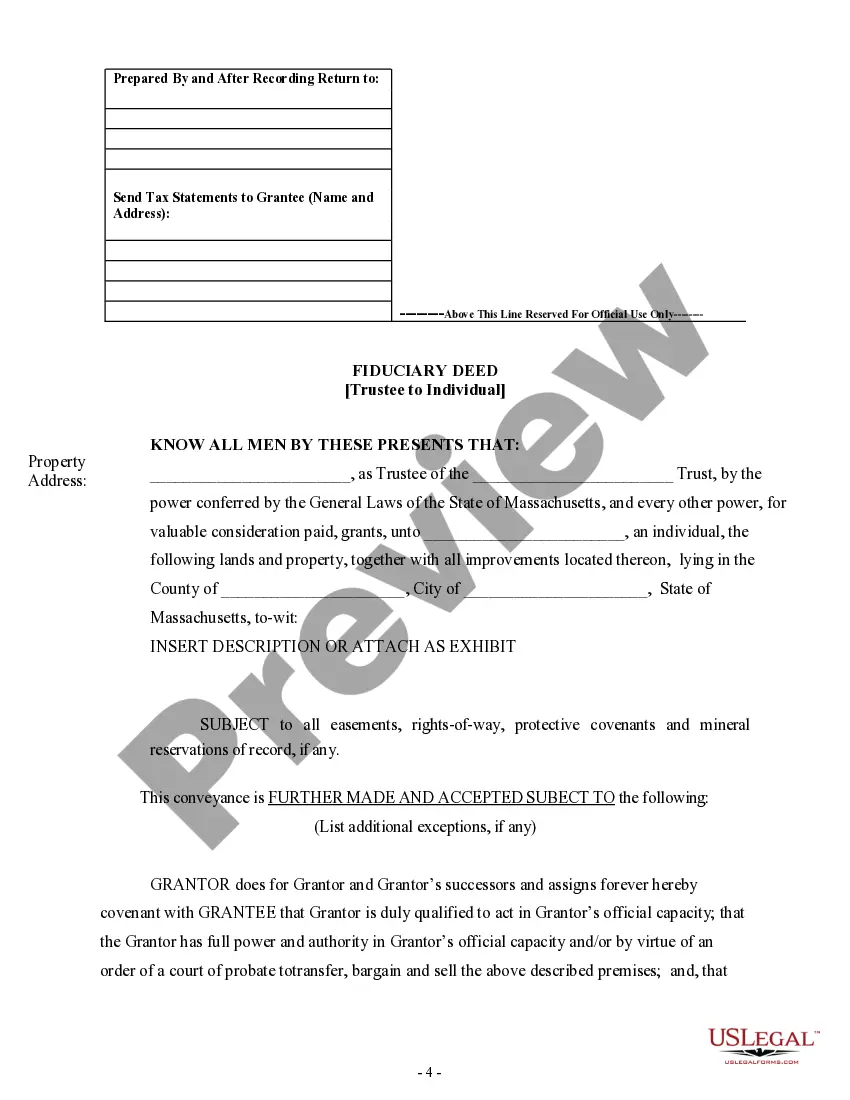

C. 18, §35, Massachusetts now permits the recording of an affidavit by the trustee setting forth the provisions of the estate planning trust relevant to the trustee's power to deal with real estate owned by the trust, in lieu of recording the entire declaration of trust.

To remove a beneficiary from the trust, you must first amend the trust deed. To do so, the trustee must execute a deed of variation (also known as a deed of amendment). This document updates the relevant section of the original trust deed and will amend the trust's beneficiaries.

A Trust Provides More Privacy Than a Will or Intestacy A trust in Massachusetts is a private document that handles your estate without court intervention.

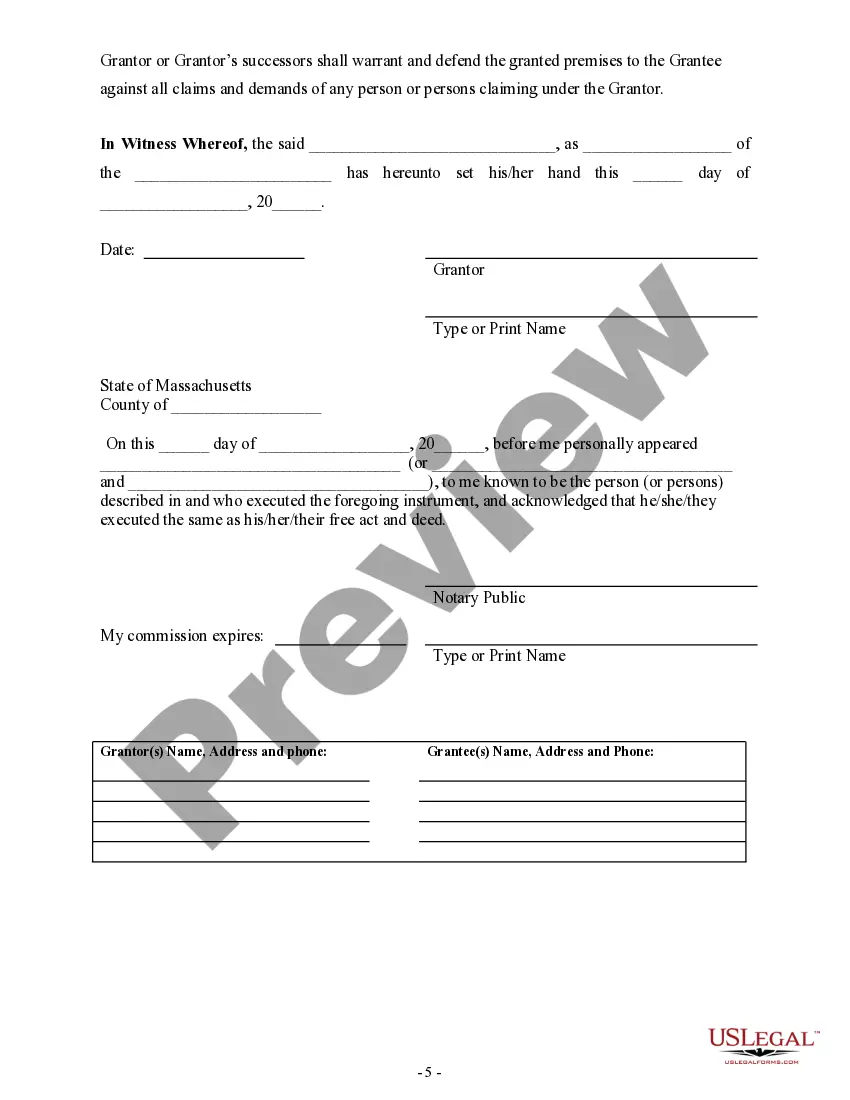

Section 706: Removal of trustee (a) The settlor, a co-trustee or a beneficiary may request the court to remove a trustee or a trustee may be removed by the court on its own initiative.

Start Deed of Trust StateMortgage allowedDeed of trust allowedWashingtonYWest VirginiaYWisconsinYWyomingY47 more rows

Note that many states do in fact allow both....Start Deed of Trust. StateMortgage allowedDeed of trust allowedMassachusettsYMichiganYYMinnesotaYMississippiY47 more rows

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

Although, the court found that the trustees were in accord, it held that ?a trustee will be removed if the court is satisfied that his continuance in office will be prejudicial to the performance of the trust and to the interest of the beneficiaries, or if the trustee has disregarded his duties.? Also, in REMMER v

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

A trustee is required to send a copy of the Trust and its amendments, if there are any amendments, to the beneficiaries of the Trust and heirs of the settlor (i.e., the person who created the Trust), within 60 days of a written request.