This is an official form from the Massachusetts Court System, which complies with all applicable laws and statutes. USLF amends and updates these forms as is required by Massachusetts statutes and law.

Lowell Massachusetts Financial Statement Long Form Instructions

Description

How to fill out Massachusetts Financial Statement Long Form Instructions?

If you are looking for a suitable document, it’s hard to find a better source than the US Legal Forms website – likely the largest online collections.

With this collection, you can access thousands of templates for business and personal needs categorized by types and regions, or keywords.

Utilizing our efficient search tool, obtaining the latest Lowell Massachusetts Financial Statement Long Form Instructions is as simple as 1-2-3.

Make adjustments. Fill out, modify, print, and sign the obtained Lowell Massachusetts Financial Statement Long Form Instructions.

Every single document you save in your account has no expiry date and belongs to you indefinitely. You always have the option to access them through the My documents menu, so if you need an additional copy for editing or printing, you can return and download it again whenever you like.

- Ensure you have located the document you desire.

- Review its description and use the Preview option to examine its contents. If it doesn’t satisfy your needs, utilize the Search field at the top of the page to find the appropriate file.

- Confirm your choice. Click the Buy now option. Then, select your desired subscription plan and provide details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the account registration.

- Acquire the document. Choose the format and download it to your device.

Form popularity

FAQ

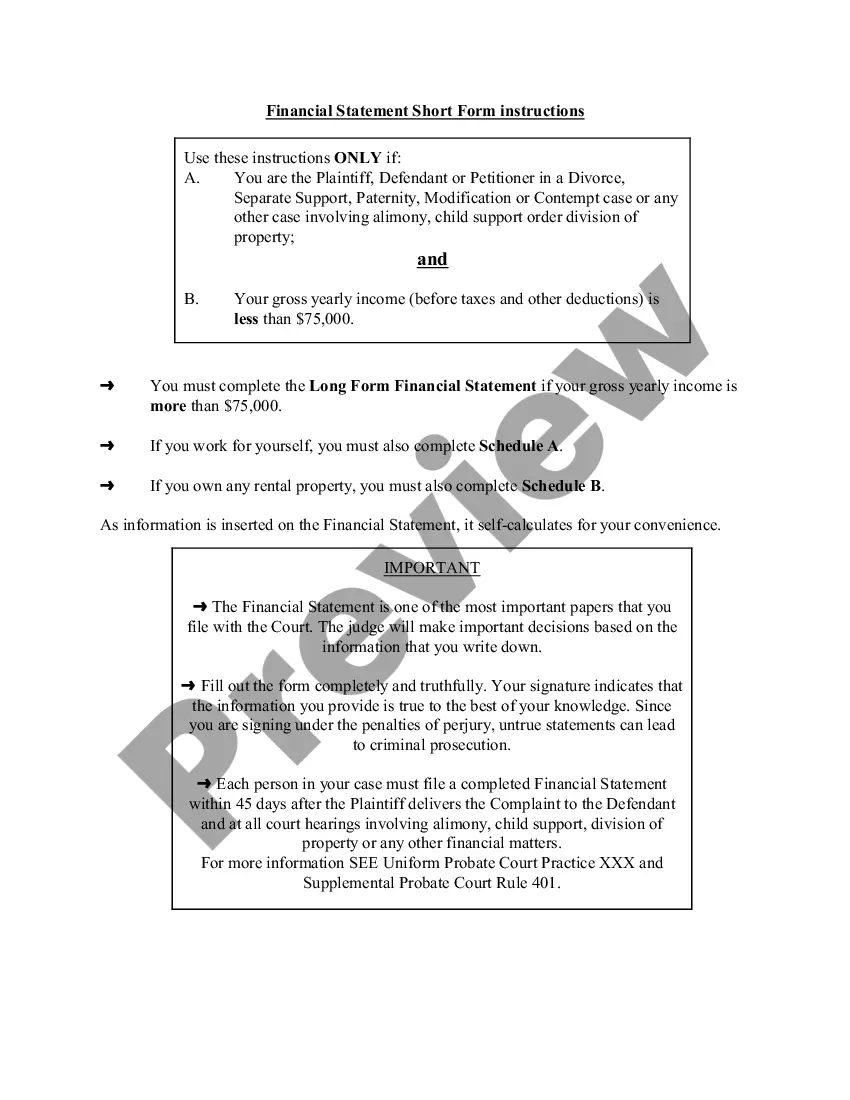

A financial statement form is a document that provides an overview of your financial position at a specific point in time. This form includes details about your income, expenses, assets, and liabilities. For those looking for detailed guidance, the Lowell Massachusetts Financial Statement Long Form Instructions offer a comprehensive approach to filling out this important document correctly. By using these instructions, you can ensure that you complete your financial statement accurately and adhere to local regulations.

Filling out an affidavit of financial information can seem daunting, but the process is straightforward with the right guidelines. First, gather all essential financial documents, such as income statements, bank statements, and any debts you have. Then, follow the Lowell Massachusetts Financial Statement Long Form Instructions carefully to enter the required information accurately. Utilizing a platform like US Legal Forms can streamline this process by providing templates and detailed instructions, ensuring you complete your affidavit correctly and efficiently.

Typically, you should provide at least three to six months of bank statements when preparing for divorce proceedings. This documentation helps capture the financial situation accurately. The Lowell Massachusetts Financial Statement Long Form Instructions will clarify document requirements for your case. Using a service like USLegalForms can help gather and organize these statements effectively.

A long form financial statement provides an exhaustive breakdown of an individual's financial situation, including detailed income, expenses, assets, and liabilities. This format is essential during divorce proceedings to fully understand the financial landscape. Following the Lowell Massachusetts Financial Statement Long Form Instructions ensures you cover all necessary elements. USLegalForms can facilitate this by providing structured formats.

A personal financial statement in a divorce outlines an individual's financial position, detailing assets, debts, income, and expenses. It helps in assessing financial responsibilities during the divorce process. Understanding the Lowell Massachusetts Financial Statement Long Form Instructions will guide you in compiling this document correctly. Consider using USLegalForms to streamline your financial disclosures.

To fill out a divorce financial statement, begin with precise documentation of your assets and debts. Identify your sources of income and monthly expenses accurately. Make sure to follow the Lowell Massachusetts Financial Statement Long Form Instructions for clarity and completeness. Check out USLegalForms for user-friendly templates that simplify this process.

Filing financial statements online typically requires you to create an account with your local court or financial service provider. After logging in, you can complete your statement by filling in the required fields. Ensure you reference the Lowell Massachusetts Financial Statement Long Form Instructions to complete your filing accurately. Platforms like USLegalForms can assist you with seamless electronic filing.

Filling out a financial statement involves compiling your financial details systematically. List your assets, liabilities, income, and expenses clearly. Following the Lowell Massachusetts Financial Statement Long Form Instructions can help ensure you're providing the right information. Using services like USLegalForms makes it easier by offering templates and step-by-step guidance.

To fill out a financial statement for divorce, start by gathering all necessary documents, such as income records and expense statements. Be thorough and accurate when entering your financial details, as inconsistencies can lead to delays. The Lowell Massachusetts Financial Statement Long Form Instructions provide guidance on what to include. You can use platforms like USLegalForms to streamline the process.

The long form financial statement is a comprehensive document that provides an extensive overview of an individual's financial status during divorce proceedings. It typically includes detailed listings of income, expenses, assets, and liabilities. To complete this accurately, use the Lowell Massachusetts Financial Statement Long Form Instructions, available through platforms like USLegalForms to streamline the process.