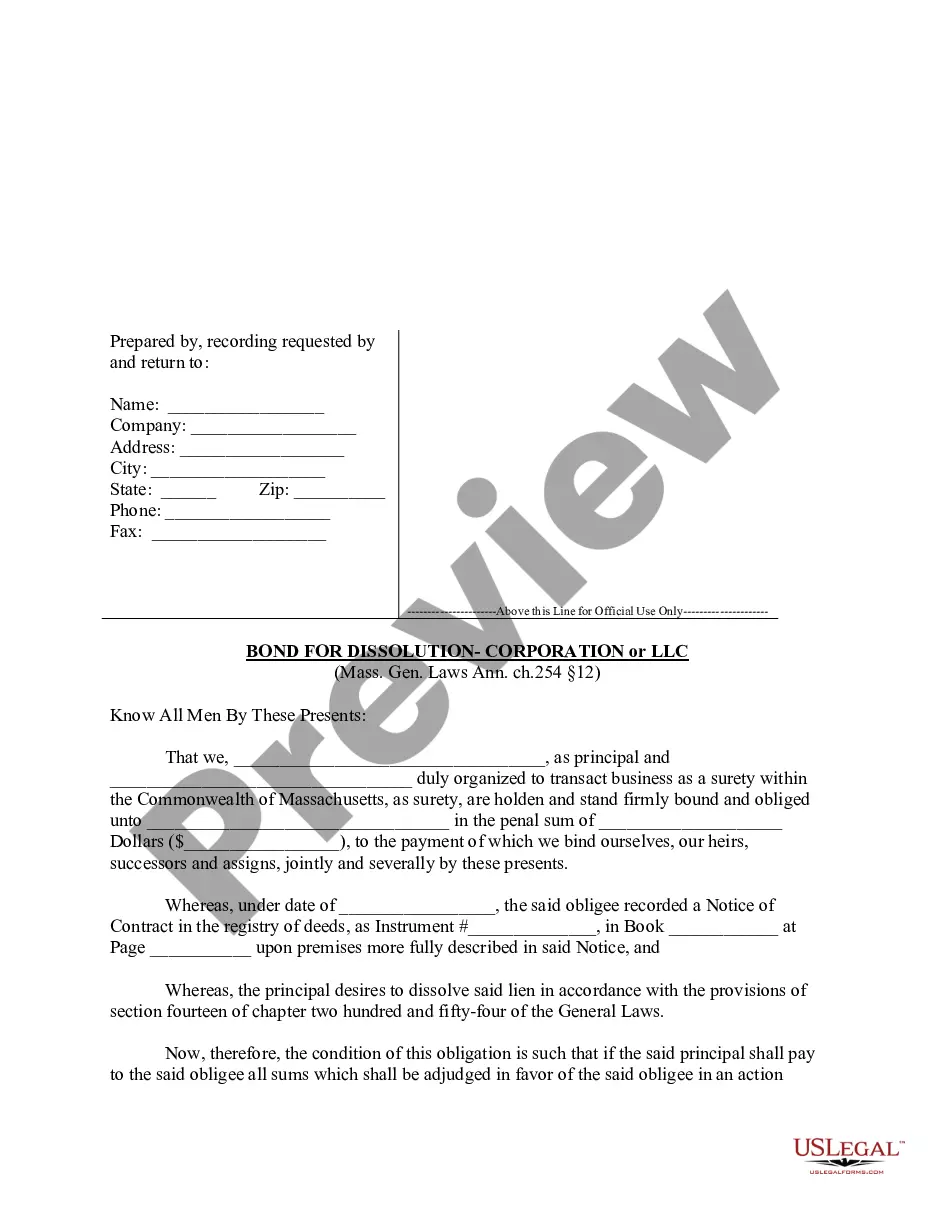

Massachusetts law provides for a very specific form with which a party with an interest in property may enter a bond equal to the amount of the contract.

Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC

Description

How to fill out Massachusetts Bond For Dissolution Form - Corporation Or LLC?

Finding validated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents catering to both personal and business requirements as well as various real-world situations.

All the files are appropriately categorized by area of usage and jurisdiction, making the search for the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC as straightforward as one, two, three.

Maintaining documents orderly and in compliance with legal criteria is critically important. Take advantage of the US Legal Forms library to always have necessary document templates for any requirements readily available!

- If you are already familiar with our catalog and have used it previously, retrieving the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC can be accomplished in just a few clicks.

- Simply Log In to your account, select the document, and hit Download to save it on your device.

- The procedure will require just a couple of extra steps for new users.

- Follow the instructions below to begin navigating through the largest online form library.

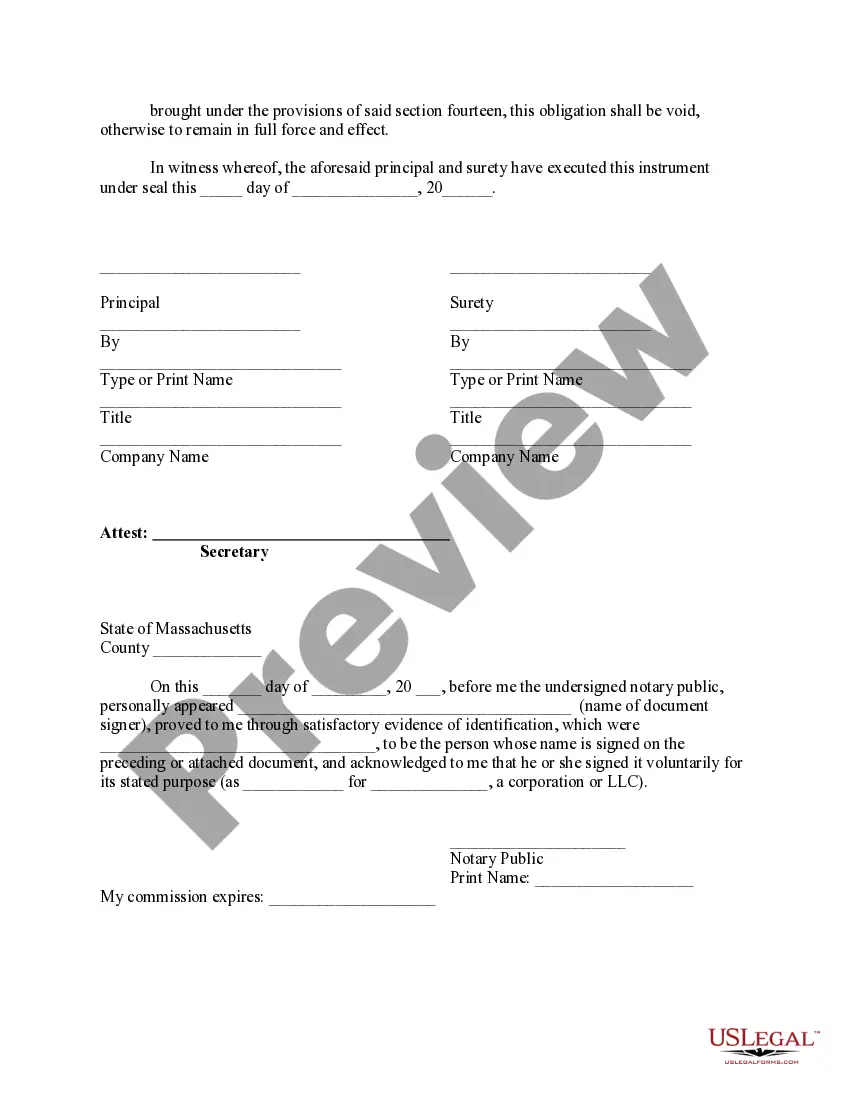

- View the Preview mode and form summary. Ensure that you've selected the correct option that fulfills your requirements and thoroughly aligns with your local jurisdiction regulations.

Form popularity

FAQ

When you dissolve a corporation, any outstanding debts do not simply disappear. You are required to settle all debts before completing your dissolution process using the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC. Creditors retain the right to pursue payment for amounts owed even after dissolution, so it’s crucial to address these financial obligations promptly. Thus, careful planning can help prevent complications during the dissolution.

Dissolving a corporation involves several key steps. First, you must gain approval from your board and, if required, your shareholders. Next, settle any debts and liabilities, complete the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC, and file it with the state. Lastly, make sure to notify the IRS and any other relevant agencies about your corporation's dissolution.

To dissolve a corporation in Massachusetts, you need to file a Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC with the appropriate state authority. Start by holding a meeting with your board to vote on the dissolution. Once you have approved this action, complete the necessary forms and ensure that all financial obligations are settled. Finally, submit your forms to the Secretary of the Commonwealth.

Deciding whether to dissolve your LLC or leave it inactive depends on your future business plans. If you foresee no intention of resuming operations, dissolving your LLC via the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC may be the best choice to avoid ongoing fees and compliance requirements. However, if you plan to reactivate your business in the future, keeping it inactive might be a better option, allowing for potential resumption without starting over.

To dissolve a single member LLC in Massachusetts, you must file a Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC. This form guides you in officially terminating your business entity. Additionally, you should settle all debts, obligations, and taxes associated with the LLC to ensure a clean closure of your business activities.

Canceling a single member from your LLC in Massachusetts involves following specific procedures outlined in your LLC's operating agreement. Generally, you will need to document the removal and file a Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC if the decision leads to the dissolution of the LLC. This ensures that all legal obligations have been addressed and allows the remaining members to continue operating smoothly.

To dissolve a corporation in Massachusetts, you must file a Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC with the Secretary of the Commonwealth. This form initiates the formal dissolution process and requires you to settle any debts or obligations your corporation has. By following the required steps, you can successfully dissolve your corporation and legally wrap up its business affairs.

Yes, you can reinstate a dissolved LLC in Massachusetts. To do this, you will need to file a Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC. This form will help you complete the necessary steps for reinstatement, ensuring that your LLC can continue its business operations. Be mindful of any outstanding fees or taxes that may need to be resolved first.

Writing a dissolution involves drafting a clear document that states the company's intent to dissolve. Include key details, such as the entity's name, reason for dissolution, and any pertinent financial information. If you're unsure how to format this correctly, consider using the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC provided by uslegalforms, which offers templates tailored to your needs.

For a corporation to be voluntarily dissolved, approval from the shareholders is typically required, followed by a filing of the articles of dissolution. All debts and obligations must also be settled before formally ending operations. Ensuring that the Cambridge Massachusetts Bond for Dissolution Form - Corporation or LLC is filed accurately is vital to completing this process successfully.